Indian Economy

Measures to Boost Consumption Demand and Capex

Why in News

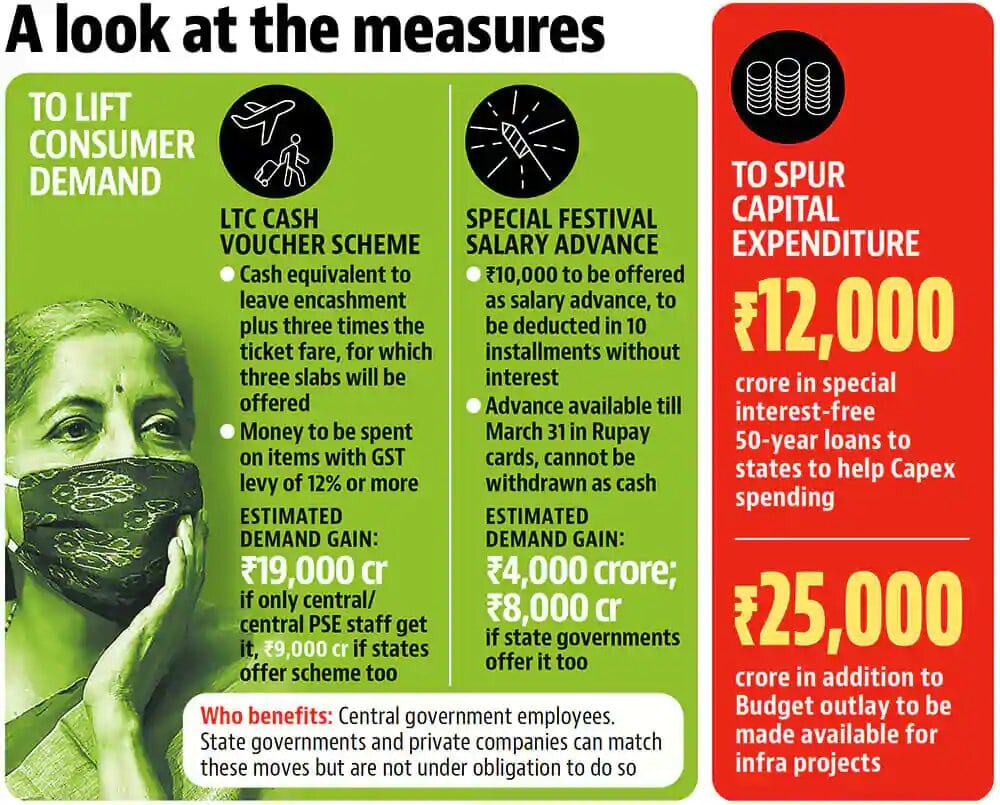

Recently, the government has announced a twin set of measures to boost consumption demand and capital expenditure (Capex), which are estimated to result in quick spending of more than Rs. 1 lakh crore by March 2021.

- These measures are the Leave Travel Concession (LTC) voucher scheme and a festival advance scheme. Also, measures have been announced to step up Capex by the Centre and the states.

Key Points

- Aim:

- Supply constraints in the economy have eased over recent months, but consumer demand remained affected and these measures aim at advancing consumer spending and Capex.

- Capex steps are “directly linked to an increase in economic output given their high multiplier effect”.

- The earlier announced Atmanirbhar Bharat package addressed the requirement of essential goods for needy sections of the society and now these measures aim at promoting consumption of high-value items by those employees whose salaries and jobs have not been affected by Covid-19 pandemic.

- With the participation of the private sector, these will stimulate growth in the economy by advancing the consumption of non-essential, relatively high-value goods and services in the economy.

- Supply constraints in the economy have eased over recent months, but consumer demand remained affected and these measures aim at advancing consumer spending and Capex.

- Leave Travel Concession Voucher Scheme:

- Leave Travel Concession:

- Central government employees get LTC in a block of four years, one each to a destination of choice and home town or two for home town.

- Under this, the air or rail fare is reimbursed as per pay scale/entitlement. Also, a leave encashment of ten days (pay+dearness allowance) is paid.

- However, employees will not be able to avail the LTC in the 2018-21 year block due to the ongoing pandemic and this is where the LTC will benefit government employees.

- In lieu of one LTC during 2018-21, employees will receive cash payment. There will be full payment on leave encashment and fare will be paid as per three slabs depending upon the class of entitlement. Further, there will be no tax on fare payment.

- An employee opting for this scheme will have to buy goods and services worth three times the fare and one time leave encashment, and do so before 31st March 2021.

- The money is to be spent on goods attracting Goods and Services Tax (GST) of 12% or more and only digital payments will be allowed. Also, employees will have to provide the GST invoice.

- If the amount is not spent then the employee will have to pay tax as per the marginal tax rate on the LTC component.

- The same benefits will be available to private-sector employees if the employers decide to offer the scheme to their employees and they decide to avail it.

- Benefits to Economy:

- The government expects a demand generation of Rs. 28,000 crore (Rs. 19,000 crore from central government employees and the rest from states) in the economy.

- While GST collections have been severely impacted in the first half of the fiscal due to Covid-19 pandemic, a consumption boost will lift GST collections in the second half of the year as the scheme calls for expenditure to be done till 31st March 2021.

- If private-sector employees also participate, it may lead to a significant jump in overall consumption and rise in GST collections.

- Since most employees have not been able to travel after the pandemic, the shifting of the LTC benefit is expected to generate demand elsewhere.

- Leave Travel Concession:

- Festival Advance:

- Festival advance, which was abolished in line with recommendations of the 7th Pay Commission, has been restored for one time till 31st March 2021.

- All central government employees will get an interest-free advance of Rs. 10,000 that will be recovered in 10 instalments. It will be given in the form of a pre-loaded RuPay card of the advance value.

- The government expects to disburse Rs. 4,000 crore under the scheme by 31st March 2021 and if all states provide similar advances, another Rs. 8,000 crore is likely to be disbursed.

- This is expected to generate consumer demand ahead of festivals like Diwali.

- Other Measures to Boost Capital Expenditure:

- An additional budget of Rs 25,000 crore for Capex on roads, defence infrastructure, water supply, urban development, and domestically produced capital equipment. This is expected to come through re-allocation of resources.

- Special assistance will be provided to states in the form of interest-free 50-year loans of Rs. 12,000 crore, which can be used only for Capex purposes, with certain conditions.

- Concerns:

- Too Many Restrictions: Provisions like buying goods and services worth three times the fare, only in goods attracting GST of 12% or more through digital mode before 31st March etc. end the freedom of the consumer in decision making.

- Smaller Size: Capex amounts are too small to have any meaningful impact on economic growth.

- With the previous rounds of budgetary fiscal support of around 1% of GDP, current measures take total fiscal support to about 1.2% of GDP, which is small compared with the size of the growth hit and reflects India’s weak fiscal starting position.

- Limited Impact: As the measures are aimed at encouraging spending for government employees rather than private/vulnerable section (where job losses/income losses have been significant), the overall impact will be limited.

- On Tourism: LTC Voucher Scheme may impact the travel and tourism industry negatively if consumers choose to spend through the scheme. Demand in travel and tourism has already fallen significantly after the Covid-19 induced lockdowns and closed borders.

Way Forward

- The government seeks to coincide the schemes with the upcoming festive period to spur overall consumption and is also spending less to not to put additional burden on the exchequer, in the midst of a notable shortfall in tax and divestment revenues.

- The strategic intent behind the schemes is to direct spending towards items for which demand had slumped during the period of lockdowns but this may defeat the larger purpose of reviving demand. Consumption-led growth can arguably lead to a slackening of future growth if it entails growing imbalances due to limits to capacity creation, and rising debt burdens, particularly for households.

Biodiversity & Environment

Human Cost of Disasters 2000-2019: UNDRR

Why in News

In a new report “The Human Cost of Disasters 2000-2019”, the United Nations pointed out that climate change is largely to blame for a near doubling of natural disasters in the past 20 years.

- The report is published by the United Nations Office for Disaster Risk Reduction (UNDRR). The report did not touch on biological hazards and disease-related disasters like the coronavirus pandemic.

- International Day for Disaster Risk Reduction is observed on 13th October every year.

Key Points

- Findings:

- 7,348 major disaster events had occurred between 2000 and 2019, affecting 4.2 billion people and costing the global economy some USD 2.97 trillion.

- The figure is far more than the 4,212 major natural disasters recorded between 1980 and 1999.

- 6,681 climate-linked disasters had been recorded in the period 2000-19, up from 3,656 during the previous 20-year-period.

- Climate-related disasters include disasters categorized as meteorological, climatological, or hydrological.

- There had also been an increase in geophysical events like earthquakes and tsunamis that are not related to climate but are particularly deadly.

- Major floods had more than doubled to 3,254, there had been 2,034 major storms up from 1,457 in 20 years.

- India is the 2nd most affected country by floods after China.

- Extreme heat is proving especially deadly. Heatwaves of 2015 in India resulted in 2,248 deaths.

- The deadliest single disaster in the past 20 years was the 2004 Indian Ocean tsunami, with 2,26,400 deaths, followed by the Haiti earthquake in 2010, which claimed some 2,22,000 lives.

- The data showed that Asia has suffered the highest number of disasters in the past 20 years with 3,068 such events, followed by the Americas with 1,756 and Africa with 1,192.

- In terms of affected countries, China topped the list with 577 events followed by the United States with 467 and India (321 events).

- 7,348 major disaster events had occurred between 2000 and 2019, affecting 4.2 billion people and costing the global economy some USD 2.97 trillion.

- Concern:

- Governments are not doing enough to prevent climate hazards.

- A temperature increase of 3°C of the global climate is estimated to increase the frequency of potentially high impact natural hazard events across the world. This could render current national and local strategies for disaster risk reduction and climate change adaptation obsolete in many countries.

- Shifting rainfall patterns and greater variability in precipitation poses a risk to the 70% of global agriculture that is rain-fed and the 1.3 billion people dependent on degrading agricultural land.

- Recommendations:

- The concentrated impact due to a single disaster in some countries provides an opportunity for a more focused approach on disaster risk reduction. However, Covid-19 demonstrates the need for a systemic, multi hazard approach in an increasingly globalized and interconnected world.

- There is a requirement for strengthening disaster risk governance to manage disaster risk with clear vision, competence, plans, guidelines, funding and coordination across sectors and in a manner, which takes account of the increasingly systemic nature of disaster risk.

- Public and private investment in disaster risk prevention and reduction through structural and non-structural measures needs to be stepped up to create disaster resilient societies.

United Nations Office for Disaster Risk Reduction

- The UNDRR was established in 1999 as a dedicated secretariat to facilitate the implementation of the International Strategy for Disaster Reduction (ISDR).

- It is headquartered in Geneva, Switzerland.

- It is mandated to serve as the focal point in the United Nations system for the coordination of disaster reduction and to ensure synergies among the disaster reduction activities.

- It is an organisational unit of the UN Secretariat and is led by the UN Special Representative of the Secretary General for Disaster Risk Reduction (SRSG).

- UNDRR’s Strategic Framework 2016-2021 has a vision to substantially reduce disaster risk and losses for a sustainable future with the mandate to act as the custodian of the Sendai Framework (India is a signatory).

Indian Scenario

- The National Disaster Management Authority (NDMA) is the apex statutory body for disaster management in India.

- The NDMA was formally constituted in 2006, in accordance with the Disaster Management Act, 2005 with the Prime Minister as its Chairperson.

- National Disaster Management Plan (NDMP) defines the roles and responsibilities of various stakeholders including Central Ministries/ Departments, State Governments, UT Administrations, District Authorities and local self Governments.

- Primary responsibility of disaster management rests with the States.

- The Central Government conducts regular mock drill, community training and awareness programmes to prepare the civilian populations for disasters.

Governance

India in BRICS Ministers’ Meeting

Why in News

Recently, the BRICS Labour and Employment Ministers’ Virtual Meeting was held under the Russian Presidency.

- It aimed to discuss various issues including approaches to creating a safe work culture in BRICS countries.

Key Points

- Emphasis on Health of Workers:

- It was highlighted that health, welfare and improved working conditions are essential for the well-being of the workers. A healthy workforce in the country would be more productive and contribute to economic growth.

- The aspects of occupational safety and health measures to mitigate the impact of Covid-19 have also acquired significance.

- India’s Stand:

- India called for suitable global action especially by BRICS towards effecting a balance between labour and employer which will generate growth and create more jobs and greater labour welfare.

- India also highlighted the importance of digitisation and technological advancements like artificial intelligence (AI) and robotics in reshaping lives and work, with a direct or indirect effect on the labour market.

- Digitisation also offers the opportunity for governments, individuals and businesses to cope with the changing scenarios after the pandemic.

- India underscored that the digital economy is changing the world of work, hence regular studies by the BRICS Network Research Institutes will facilitate a better understanding of the aspects of future of work and supplement policymaking.

- India is committed to eradicate poverty and promote prosperity in a changing world and hence adopted a multi-dimensional strategy to eliminate poverty by covering most of the basic services and fulfil the Sustainable Development Goals of No Poverty (SDG-1).

Initiatives Highlighted by India

- Occupational Safety, Health and Working Conditions Code Bill, 2020:

- Provides a dynamic and effective framework of occupational safety and health at the workplace and covers legal provisions of all sectors.

- Envisages safety standards for different sectors, focusing on the health and working condition of workers, hours of work, leaves, etc.

- Social Security Code Bill, 2020:

- Universalises social security coverage to those working in the unorganised sector, such as migrant workers, gig workers and platform workers.

- Recognises emerging forms of work by defining terms like an aggregator, gig worker and platform worker, and extends social protection to such workers through a separate Social Security Fund wherein the contribution from aggregators would be deposited.

- Provisions of social security will also be extended to agricultural workers.

- Industrial Relations Code Bill, 2020:

- Sets up Grievance Redressal Committees for resolution of disputes arising out of employees’ grievances.

- Also sets up a reskilling fund to help skill retrenched workers.

- Pradhan Mantri Kisan Samman Nidhi:

- Provides direct income support to farmers for easing their liquidity needs to facilitate timely access to inputs.

- Aiding modernisation and makes farmers competitive.

- Atmanirbhar Bharat Abhiyaan:

- Protects the economy from the adverse impact of the Covid-19 crisis.

- Measures include opening a credit line for micro, small and medium enterprises to meet their operational expenses, subsidising the social security contributions of workers, extending unemployment benefit to workers, financial assistance to construction workers, collateral-free working capital loan to approximately 5 million street vendors, etc.

- Other Related Schemes:

Way Forward

All countries need to work together in finding feasible and sustainable solutions to the issues and challenges faced by the future of the labour force in the digital economy so that everyone can get the flexible employment opportunities without compromising the fundamental rights.

Biodiversity & Environment

Anti-pollution Campaign: Delhi

Why in News

The Delhi Government has recently launched a major anti-pollution campaign, Yuddh Pradushan Ke Viruddh, which includes a tree transplantation policy, construction of a smog tower at Connaught Place (Delhi), promoting Electric vehicles and preventing stubble burning.

- This will help in combating the poor air quality of Delhi which deteriorates even more in the winter season.

Key Points

- Tree Transplantation Policy

- Tree transplantation refers to uprooting a tree from a particular spot, lifting it, and planting it at another spot,

- Under this policy, a minimum of 80% of trees affected by any developmental project, will be transplanted. Also, a minimum of 80% of the transplanted trees should survive and ensuring this would be the responsibility of the agencies that will take permission from the government.

- This transplantation will be in addition to the existing compensatory afforestation of planting of 10 saplings for every tree that is cut.

- A panel of the agencies that excel in the task of transplantation and a dedicated Tree Transplantation Cell will also be formed by the government.

- Benefits:

- Planting a new sampling as a substitute for an existing fully grown tree does not adequately counter the adverse environmental effect of cutting the existing tree. Transplantation will ensure the conservation of old trees.

- Also, many old trees have a symbolic or heritage value which needs to be preserved.

- Limitations:

- Low Success Rate: Transplantation is a complicated process with a success rate of around 50%. The survival rate of a transplanted tree depends on soil type as a tree growing on the Delhi ridge is unlikely to survive in the Yamuna floodplain.

- Expensive: It costs around Rs 1 lakh to transplant an average-sized tree.

- Smog Tower:

- A smog tower, which will act as a mega air purifier, will also be installed in Delhi to counter the persistent issue of smog in Delhi as per the November 2019 order of the Supreme Court to the Delhi government and the Central Pollution Control Board.

- The towers to be installed in Delhi will be the result of a collaboration between the IITs at Mumbai and Delhi, and the University of Minnesota.

- Smog towers have been experimented with in recent years in cities in the Netherlands, China, South Korea and Poland. The first such tower was erected in 2015, in Rotterdam, Netherlands, created by Dutch artist Daan Roosegaarde.

- The world’s largest air-purifying tower is in Xi’an, China.

- The Tower will suck the polluted air from above and release clean air from the bottom.

- Limitations:

- Many experts have claimed that due to the large volume of air outdoors, smog towers are not efficient in cleaning the air per se.

- Even in the case of China, there is insufficient data to support the effectiveness of its smog towers.

- An expert panel has estimated that Delhi will need a total of 213 smog towers to battle the pollution crisis which will be very expensive as each tower will cost around 20 crore rupees.

- Electric Vehicles (EVs)

- The government aims to make EVs account for a quarter of the new vehicles registered in the capital by 2024.

- EVs will gain from purchase incentives, scrappage benefits on older vehicles, loans at favourable interest and a waiver of road taxes.

- Recently, the Delhi government notified the Electric Vehicles Policy 2020 which lays the maximum emphasis on replacement of two-wheelers, public transport and shared vehicles and goods-carriers instead of private four-wheelers, with EVs.

- Apart from these steps, the campaign also focuses on cutting the deadly smoke from thermal plants and brick kilns in Delhi as well as on the chemical treatment of stubble burning from nearby States.

Air Pollution in Delhi

- According to air quality data compiled by the World Health Organisation (WHO), Delhi is among the world’s most polluted cities.

- Particulate matter, PM2.5 and PM10 in Delhi, exceed national standards and the more stringent World Health Organization limits.

- Delhi needs a 65% reduction to meet the national standards for PM2.5.

- Delhi’s toxic air also contains high doses of sulphur dioxide and nitrogen oxide.

- The lack of wind worsens the pollutant concentration.

- The Ministry of Earth Sciences published a research paper in October 2018 attributing almost 41% to vehicular emissions, 21.5% to dust and 18% to industries.

- Emission testing of vehicles is only 25%.

- According to the WHO, India has the world's highest death rate from chronic respiratory diseases and asthma. Air pollution also impacts the environment through reduced visibility, acid rain, and formation of ozone at the tropospheric level.

- Reasons for Deteriorating Air Quality of Delhi

- Stubble Burning

- Vehicular Emission

- Weather

- High Population Density

- Lack of Infrastructure

- Construction Activities and Open waste burning

- Thermal Power Plant and Industries

- Firecrackers

- Diesel generators

- Dust Storm from Gulf countries

Way Forward

- Delhi’s long-term solution will depend importantly also on abating emissions from transportation. A three-part action for combating vehicular emissions comprises emissions standards, public transport, and electric vehicles. The Supreme Court’s ruling to increase Delhi’s bus fleet and align it with the Metro network must be carried out.

- Technical solutions need to be underpinned by coordination and transparency across Central, State, and local governments. Citizen participation and the media are vital for sharing the message on pollution and health, using data such as those from the Central Pollution Control Board.

- The need to control becomes ever more important in the Covid-19 pandemic scenario when respiratory ailments due to air pollution can worsen the condition of Covid-19 affected people.

Indian Economy

Nobel Prize in Economic Sciences

Why in News

The Royal Swedish Academy of Sciences awarded Sveriges Riksbank Prize in Economic Sciences, 2020 to Paul Milgrom and Robert Wilson (both from the USA) for their work on commercial auctions.

Key Points

- About:

- Sveriges Riksbank Prize in Economic Sciences, 2020 is given in memory of Alfred Nobel and is popularly (but incorrectly) known as Nobel Prize for Economics.

- As it is not one of the five Nobel prizes that Alfred Nobel established in his will in 1895, it is not a Nobel Prize.

- It was created in 1968 by a donation from Sweden's central bank Sveriges Riksbank to the Nobel Foundation to commemorate the bank's 300th anniversary and includes a 10 million Swedish kronor award money — roughly Rs 8.33 crore.

- It is officially titled the "Sveriges Riksbank Prize in Economic Sciences in Memory of Alfred Nobel”.

- Sveriges Riksbank Prize in Economic Sciences, 2020 is given in memory of Alfred Nobel and is popularly (but incorrectly) known as Nobel Prize for Economics.

- The 2020 Edition:

- Milgrom and Wilson improved the auction theory and invented new auction formats for auctioning off many interrelated objects simultaneously, on behalf of a seller motivated by broad societal benefit rather than maximal revenue.

- Their work will benefit sellers, buyers and taxpayers around the world. It will help in auctioning goods and services, such as radio frequencies, which are difficult to sell in traditional ways.

- Wilson developed the theory for auctions of objects with a common value — a value which is uncertain beforehand but, in the end, is the same for everyone. Examples include the future value of radio frequencies or the volume of minerals in a particular area.

- Wilson’s work showed why rational bidders tend to bid under their own estimate of the worth due to worries over the “winner’s curse”.

- The winner's curse is a tendency for the winning bid in an auction to exceed the intrinsic value or true worth of an item.

- Milgrom came up with a more general theory of auctions, by analysing bidding strategies in different auction forms.

- Auction Theory

- Auction theory studies how auctions are designed, what rules govern them, how bidders behave and what outcomes are achieved.

- The oldest form of auction is the auction of a bankrupt person’s property to pay off his creditors. This simple design of such an auction is the highest open bidder getting the property (or the commodity in question).

- Over time, the format of auctions has widened to include other commodities such as spectrum for radio or telecom use, carbon dioxide emission credits, electricity or the right to collect the local garbage etc.

- Different auction models are needed for depending upon the commodities, purpose of the auction and the entities conducting the auction.

- For e.g. Maximizing the profit may be the motive of a private auction while making a service affordable can be the purpose of auctioning a service by the government. Wrong auction design can lead to a second-hand market where companies trade among themselves with little revenue accruing to the government or little benefit to the public.

- How an auction is designed, has a tremendous impact not just on the buyers and the sellers but also on the broader society.

- Three key variables need to be understood while designing an auction.

- Rules of Auction i.e. closed/sealed bids, single bids versus multiple bids.

- Commodity or service being put up for auction i.e. how does each bidder value an item.

- Uncertainty regarding which bidder has what information about the object, or even the value another bidder associates with the object.

Governance

Sovereign Gold Bond Scheme

Why in News

A seventh tranche of the gold bond scheme - in which the Reserve Bank of India (RBI) issues bonds linked to the market price of gold on behalf of the government - will be available for investment on five days starting 12th October, 2020.

Key Points

- Launch: The Sovereign Gold Bond (SGB) scheme was launched in November 2015 with an objective to reduce the demand for physical gold and shift a part of the domestic savings - used for the purchase of gold - into financial savings.

- Issuance: The Gold Bonds are issued as Government of India Stock under the Government Securities (GS) Act, 2006.

- These are issued by the RBI on behalf of the Government of India.

- Bonds are sold through Commercial banks, Stock Holding Corporation of India Limited (SHCIL), designated post offices (as may be notified) and recognised stock exchanges viz., National Stock Exchange of India Limited and Bombay Stock Exchange, either directly or through agents.

- Eligibility: The bonds are restricted for sale to resident individuals, Hindu Undivided Families (HUFs), trusts, universities and charitable institutions.

- Features:

- Issue Price: The price of the gold bonds is calculated based on the spot price of gold as provided by the Mumbai-based India Bullion and Jewellers Association (IBJA).

- For the seventh tranche, a price of Rs. 5,051 per unit is applicable. Those purchasing the bonds through an online mode - using a digital mode of payment - get a discount of Rs. 50 on each unit.

- Investment Limit: Gold bonds can be purchased in the multiples of one unit, up to certain thresholds for different investors.

- The upper limit for retail (individual) investors and HUFs is 4 kilograms (4,000 units) each per financial year. For trusts and similar entities, an upper limit of 20 kilograms per financial year is applicable.

- Minimum permissible investment is 1 gram of gold.

- Term: The gold bonds come with a maturity period of eight years, with an option to exit the investment after the first five years.

- Interest Rate: A fixed rate of 2.5% per annum is applicable on the scheme, payable semi-annually.

- The interest on Gold Bonds shall be taxable as per the provision of Income Tax Act, 1961.

- Issue Price: The price of the gold bonds is calculated based on the spot price of gold as provided by the Mumbai-based India Bullion and Jewellers Association (IBJA).

- Benefit:

- Bonds can be used as collateral for loans.

- The capital gains tax arising on redemption of SGB to an individual has been exempted.

- Redemption is the act of an issuer repurchasing a bond at or before maturity.

- Capital gain is the profit earned on the sale of an asset like stocks, bonds or real estate. It results in when the selling price of an asset exceeds its purchase price.

Indian History

Dr. Ram Manohar Lohia

Why in News

The Prime Minister of India paid tribute to socialist Dr. Ram Manohar Lohia on his death anniversary.

Key Points

- Birth: 23rd March, 1910 in Akbarpur, Uttar Pradesh

- Brief Profile:

- Indian politician and activist who was a prominent figure in socialist politics and in the movement towards Indian independence.

- Much of his career was devoted to combating injustice through the development of a distinctly Indian version of socialism.

- Socialism refers to a set of political ideas that emerged as a response to the inequalities present in, and reproduced by, the industrial capitalist economy.

- Lohia’s Idea of Socialism:

- Lohia identified five kinds of inequalities that need to be fought against simultaneously: inequality between man and woman, inequality based on skin colour, caste-based inequality, colonial rule of some countries over others, and economic inequality.

- For him struggle against these five inequalities constituted five revolutions. He added two more revolutions to this list: revolution for civil liberties against unjust encroachments on private life and revolution for non-violence, for renunciation of weapons in favour of Satyagraha. These were the seven revolutions or Sapta Kranti which for Lohia was the ideal of socialism.

- Education:

- Bachelor’s degree (1929) from the University of Calcutta and a doctorate (1932) from the University of Berlin, where he studied economics and politics.

- Pre-Independence Role:

- In 1934, he became actively involved in the Congress Socialist Party (CSP), founded that year as a left-wing group within the Indian National Congress.

- A vehement opponent of Indian participation on the side of Great Britain in World War II (1939-45), he was arrested for anti-British remarks in 1939 and again in 1940.

- With the emergence in 1942 of the Quit India movement—a campaign initiated by Mahatma Gandhi to urge the withdrawal of British authorities from India—Lohia and other CSP leaders (such as Jaya Prakash Narayan) mobilized support from the underground. For such resistance activities, he was jailed again in 1944–46.

- Post Independence Role:

- Lohia and other CSP members left the Congress in 1948.

- He became a member of the Praja Socialist Party upon its formation in 1952 and served as general secretary for a brief period, but internal conflicts led to his resignation in 1955.

- He established a new Socialist Party (1955), for which he became chairman as well as the editor of its journal, Mankind.

- He advocated for various socio-political reforms in his capacity as party leader, including the abolition of the caste system, stronger protection of civil liberties, etc.

- In 1963, Lohia was elected to the Lok Sabha, where he was noted for his sharp criticism of government policies.

- Some of his works include: ‘Wheel of History’, ‘Marx, Gandhi and Socialism’, ‘Guilty Men of India’s Partition’, etc.

- Death: 12th October, 1967.

Governance

National Postal Week and World Post Day

Why in News

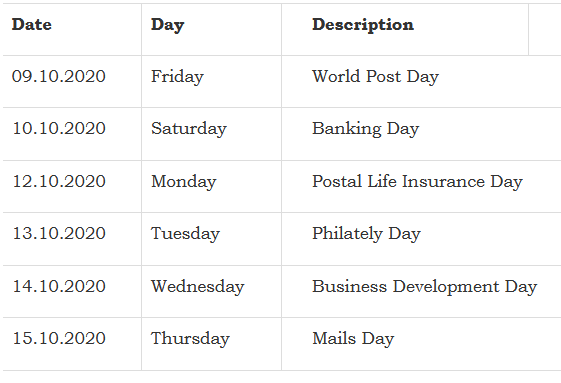

India Post commenced the celebration of the National Postal Week, starting with World Post Day which is celebrated each year on 9th October.

Key Points

- National Postal Week: It is celebrated from 9th to 15th October every year.

- Aim: Generating a broad awareness about India Post’s role and activities among the public and media at the national level

- Activities This Year: Felicitating the valued customers, organizing camps/workshops for Philately, opening accounts, online awareness campaigns etc.

- Philately: The collection and study of postage stamps and postal history.

- In 2018, Deen Dayal SPARSH (Scholarship for Promotion of Aptitude & Research in Stamps as a Hobby) yojana was launched by the Ministry of Communications which gives scholarships to promote philately among school children.

- World Post Day: It is celebrated each year on 9th October, to commemorate the establishment of the Universal Postal Union (UPU) in 1874 in the Swiss capital, Berne.

- It was declared as World Post Day by the UPU Congress held in Tokyo, Japan, in 1969.

- Purpose: To create awareness about the role of the postal sector in the lives of people and business and its contribution to the social and economic development of the country

Universal Postal Union

- The UPU is a specialized agency of the United Nations (UN) that coordinates postal policies among member nations, in addition to the worldwide postal systems.

- Its headquarters are located in Berne, Switzerland.

India Post

- India Post is the trade name for the Department of Posts (DoP), a government-operated postal system in India under the Ministry of Communications.

- With 1, 55,531 Post Offices, the DoP has the most widely distributed postal network in the world.

- Functions:

- Delivering mails, accepting deposits under Small Savings Schemes, providing life insurance cover under Postal Life Insurance (PLI) and Rural Postal Life Insurance (RPLI) and providing retail services like bill collection, sale of forms, etc.

- It also acts as an agent for the Government of India in discharging other services for citizens such as Mahatma Gandhi National Rural Employment Guarantee Scheme (MGNREGS) wage disbursement and old age pension payments.

- Significance

- India Post has been serving the people in an extraordinary way in the difficult situation which has emerged due to Covid-19, by bringing them medicines and financial assistance.

- The Postal Department has been playing a major role in the implementation of Government schemes, leveraging the immense strength of its vast network.

- Postal schemes are known for providing highly secured deposits, they provide a higher return of interest with low risk.

- Related News:

- The Department of Posts (Ministry of Communications) has launched a scheme called Five Star Villages. The scheme seeks to bridge the gaps in public awareness and reach of postal products and services, especially in interior villages.

- The Prime Minister launched India Post Payments Bank (IPPB) on 1st September 2018 aimed at making banking services available at people’s doorstep.

- A Customized My Stamp on India’s First Anti Satellite Missile (A-SAT) launch was released by the Department of Posts on the occasion of Engineers Day on 15th september, 2020.

Important Facts For Prelims

Mount Kilimanjaro

Why in News

Recently, a fire that has broken out on the slopes of Mount Kilimanjaro, the highest peak in Africa.

- The cause of the fire is not clear but strong winds and dry weather have caused it to spread fast.

Key Points

- Located in Tanzania, Mount Kilimanjaro is Africa’s tallest mountain at about 5,895 meters.

- It is also the largest free-standing mountain rise in the world, meaning it is not part of a mountain range.

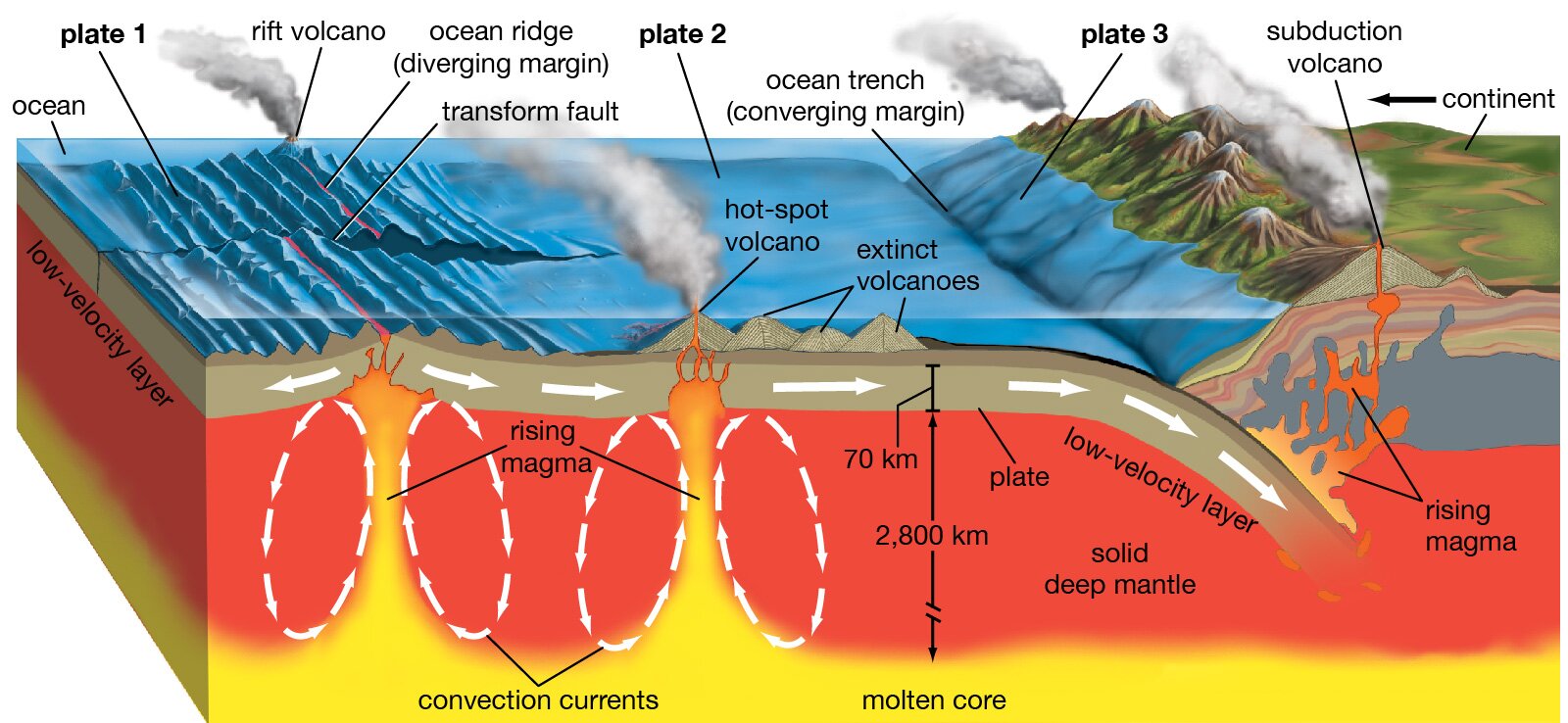

- Kilimanjaro is a stratovolcano or composite volcano (a term for a very large volcano made of layers of ash, lava, and rock) and is made up of three cones: Kibo, Mawenzi, and Shira.

- Kibo is the summit of the mountain and the tallest of the three volcanic formations. While Mawenzi and Shira are extinct, Kibo is dormant and could possibly erupt again.

- Scientists estimate that the last time it erupted was 3,60,000 years ago.

- Kibo is the summit of the mountain and the tallest of the three volcanic formations. While Mawenzi and Shira are extinct, Kibo is dormant and could possibly erupt again.

- The mountain is also known for its snow-capped peak which might disappear within the next 20 years or so as per the warnings by the scientists.

- In 1973, the mountain and its six surrounding forest corridors were named Kilimanjaro National Park in order to protect its unique environment.

- The park was named a United Nations Educational, Scientific and Cultural Organization (UNESCO) World Heritage site in 1987.

- It is a popular tourist destination and tens of thousands of people climb it every year.

Volcano

- A volcano is an opening on the surface of a planet which allows material warmer than its surroundings to escape from its interior.

- When this material escapes, it causes an eruption. An eruption can be explosive, sending material high into the sky. Or it can be calmer, with gentle flows of material.

- On Earth, the erupted material can be liquid rock ("lava" when it's on the surface and "magma" when it's underground), ash, cinders, and/or gas.

Important Facts For Prelims

Completion of Largest Arctic Expedition

Why in News

Year-long MOSAiC Expedition began from Norway and concluded at the port of Bremerhaven, Germany.

- It was a $150 million project organized by the Alfred Wegener Institute, Germany.

Key Points

- The Multidisciplinary Drifting Observatory for the Study of Arctic Climate (MOSAiC) is an international research expedition to study the physical, chemical, and biological processes that coupled the Arctic atmosphere, sea ice, ocean, and ecosystem.

- MOSAiC is the first year-round expedition into the central Arctic exploring the Arctic climate system.

- During the year-round operation of research, the distributed regional network of observational sites were set up on the sea ice surrounding the ship icebreaker RV Polarstern.

- The icebreaker RV Polarstern is a German Research Vessel which is mainly used for research in the Arctic and Antarctica.

- The results of MOSAiC will contribute to enhance understanding of the regional and global consequences of Arctic climate change and sea-ice loss and improve weather and climate predictions.

- Significance:

- The region’s sea ice has been steadily shrinking in recent decades, and summer ice coverage this year was the second lowest since satellite measurements began in 1979.

- Warming has also caused sharp declines in older and thicker ice.

- The information is collected about the ocean, ice, clouds, storms and ecosystems of the Arctic would prove invaluable in helping scientists understand the region, which is warming faster than any other part of the planet.

Important Facts For Prelims

Kerala & Digital Education

Why in News

Kerala has become the first state in the country to have high-tech classrooms or high-tech labs in all government-run and aided schools

Key Points

- As part of this flagship project of the government, high-tech labs have been set up in primary and upper primary schools and 40,000 classrooms in high school and higher secondary schools have been converted into smart classrooms.

- High-speed broadband internet has been ensured in 12,678 schools.

- The high-tech classroom project was implemented by Kerala Infrastructure and Technology for Education (KITE), the nodal agency for ICT education in schools.

- The Kerala government has also started digital classrooms known as ‘First bell’ to impart education to 41 lakh students in the state after schools shut due to the lockdown

- The Kerala State government is also carrying out a unique programme called “Namath Basai”of teaching tribal children in their mother tongue.

- The programme is being implemented by the Samagra Shiksha Kerala (SSK).

- Recently, the Central government has proposed long-term measures to address social inequities in online education, as highlighted by the Covid-19 pandemic.

- However, digital education in India still faces many challenges like lack of internet penetration, economic inequality, lack of trained teachers etc.