Internal Security

Defence Acquisition Procedure 2020

Why in News

Recently, a new Defence Acquisition Procedure (DAP) (erstwhile Defence Procurement Procedure or DPP), 2020 was released by the Ministry of Defence (MoD).

Key Points

- About: The DAP contains policies and procedures for procurement and acquisition from the capital budget of the MoD in order to modernise the Armed Forces including the Coast Guard.

- Background: The first Defence Procurement Procedure (DPP) was promulgated in 2002.

- A committee under the chairmanship of Director General (Acquisition) was constituted to review the Defence Procurement Procedure (DPP) 2016.

- DPP 2016 was released replacing the DPP 2013 based on the recommendations of Dhirendra Singh committee.

- It focussed on indigenously designed, developed and manufactured weapon systems.

- It was facing several issues like lack of transparency (leading to Rafale Scam), inconvenient offset regulations etc.

- A committee under the chairmanship of Director General (Acquisition) was constituted to review the Defence Procurement Procedure (DPP) 2016.

- Objective: Turning India into a global manufacturing hub.

- Aligned with the vision of the Government of Atmanirbhar Bharat and empowering Indian domestic industry through Make in India initiative.

- Salient Features:

- For Ease of Doing Business:

- Time Bound Defence Procurement Process and Faster Decision Making: By setting up a Project Management Unit to support contract management and to streamline the Acquisition process.

- Revised Offset Guidelines: Preference will be given to manufacture of complete defence products over components and various multipliers have been added to give incentivisation in discharge of offsets.

- Further, there will be no offset clause in government-to-government, single vendor and Intergovernmental Agreements (IGA).

- Offsets are a portion of a contracted price with a foreign supplier that must be re-invested in the Indian defence sector, or against which the government can purchase technology.

- Multipliers are credit values earned on offset transactions. A multiplier of 3 means a foreign company can claim credits upto three times of its actual offset investment.

- The offset policy for defence deals was adopted in 2005 for all defence capital imports above Rs. 300 crore under which the foreign vendor is required to invest at least 30% of the value of the contract in India.

- Offset clause was hindering the transfer of technology, according to a recent CAG report.

- Rationalization of Procedures for Trials and Testing: Scope of trials will be restricted to physical evaluation of core operational parameters.

- To Develop India into Global Manufacturing Hub:

- FDI in Defence Manufacturing: Provisions have been incorporated like a new category ‘Buy (Global – Manufacture in India)’, to encourage foreign companies to set up manufacturing through its subsidiary in India.

- To promote Make in India and Atmanirbhar Bharat initiatives:

- Reservation in Categories for Indian Vendors: Some categories like Buy (Indian Indigenously Designed Developed and Manufactured -IDDM), Production Agency in Design & Development etc. will be exclusively reserved for Indian Vendors and FDI of more than 49% is not allowed.

- Ban on Import of Certain Items: With a view to promote domestic and indigenous industry, the MoD will notify a list of weapons/platforms banned for import.

- Indigenisation of Imported Spares: Steps to promote manufacturing of parts in India have been taken. This includes establishment of co-production facilities through Intergovernmental Agreements (IGA) achieving ‘Import Substitution’ and reducing Life Cycle Cost.

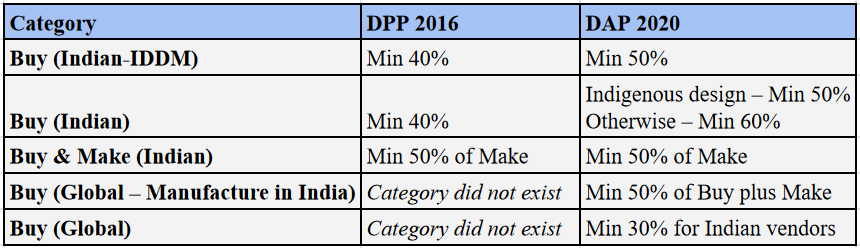

- Overall Enhancement in Indigenous Content (IC): This has been done in all the categories, for products like softwares etc, as follows:

- Other Features

- Cost Cutting : Leasing has been introduced as a new category for acquisition in addition to the existing ‘Buy’ and ‘Make’ categories so that periodical rental payments are made instead of huge capital investment.

- This will be useful for military equipment not used in actual warfare like transport fleets, trainers, simulators, among others.

- For Ease of Doing Business:

- Other Related Initiatives:

- Recently, the Ministry of Defence has formulated a Draft Defence Production and Export Promotion Policy 2020 (DPEPP 2020).

- Innovations for Defence Excellence (iDEX) has been operationalised to provide necessary incubation and infrastructure support to the startups in the defence area.

- iDEX would be further scaled up to engage with 300 more startups and develop 60 new technologies/products during the next five years.

- Mission Raksha Gyan Shakti was launched to promote a greater culture of innovation and technology development and file a higher number of patents in Defence Public Sector Undertakings (DPSUs), Ordnance Factory Board (OFB).

- It would be scaled up for promoting the creation of Intellectual Property in the sector and its commercial utilisation.

Way Forward

- Self-reliance in defence manufacturing is a crucial component of effective defence capability and to maintain national sovereignty and achieve military superiority. The DAP 2020 not only protects the interests of domestic manufacturers by indigenization of technology, but also provides impetus to foreign investment in the country.

- Given the key geostrategic challenges, emanating from the threat of two-front war (against China and Pakistan combinedly), India needs to carry out much-needed defence reforms. DAP 2020 is the one of the many needed defence reforms.

Governance

Sale of Loose Cigarettes and Beedis

Why in News

The Maharashtra government has banned the sale of loose cigarettes and beedis, to reduce the consumption of tobacco and to comply with the Cigarettes and Other Tobacco Products Act (COTPA) 2003.

Key Points

- Other States: Chhattisgarh had banned the sale of loose cigarettes in 2020.

- Karnataka banned the sale of loose cigarettes, beedis and chewing tobacco in 2017.

- Reasons for Ban:

- The government’s aim is to make sure that users are able to see the mandated warnings on cigarette packaging.

- Under COTPA, tobacco products need to be sold with graphic health warnings on their packaging and loose cigarettes do not comply with this rule.

- Section 7 of the Act mentions, no person shall, directly or indirectly, produce, supply or distribute 6 cigarettes or any other tobacco products unless every package of cigarettes or any other tobacco products produced, supplied or distributed by him bears thereon, or on its label.

- The Act also mentions that the warning should be specified on not less than one of the largest panels of the packet in which the cigarettes or any other tobacco products have been packed for distribution, sale and supply.

- Pattern of Tobacco Use in India

- According to the Global Adult Tobacco Survey (GATS) 2016-2017, which was a household survey conducted on over 74,000 people aged 15 years or more.

- Maharashtra has the lowest prevalence of tobacco smoking in the country.

- Over 91% of current smokers in the country believe that smoking causes serious illness.

- Smoke Tobacco- 10.7% of all adults (99.5 million) in India smoke tobacco.

- In either Form- 28.6% of all adults use tobacco either in smoke or smokeless form.

- Average Monthly Expenditure: In India, for a daily cigarette smoker around Rs 1,100 and that for a daily beedi smoker is estimated to be around Rs 284.

- Loose Tobacco Buyers: The survey also showed that 68% of smokers, 17% bidi smokers, and 50% of smokeless tobacco users in India purchase.

- As per the Tobacco Free Union, over 1 million people die from tobacco-related diseases in India every year.

- According to the Global Adult Tobacco Survey (GATS) 2016-2017, which was a household survey conducted on over 74,000 people aged 15 years or more.

- Effectiveness of Bans:

- The effectiveness of bans is not well known and depends on how widespread and stringent the implementation is.

- According to a 2017 study published in the Journal of the Scientific Society, raising tax on tobacco products is one of the key ways of controlling tobacco consumption.

- Caveat: While on one hand making tobacco products dearer may lead to an overall decrease in consumption of tobacco globally, on the other hand, it can lead to an increase in the sale of loose cigarettes.

- Tobacco Control in India

- International Convention:

- Governments adopt and implement the tobacco control provisions of the WHO Framework Convention on Tobacco Control (WHO FCTC).

- It is the first international treaty negotiated under the auspices of the WHO.

- It was adopted by the World Health Assembly on 21 May 2003 and entered into force on 27 February 2005.

- India ratified the WHO FCTC in 2004.

- It was developed in response to the globalization of the tobacco epidemic and is an evidence-based treaty that reaffirms the right of all people to the highest standard of health. The FCTC’s measures to combat tobacco use include:

- Price and tax measures.

- Large, graphic warnings on tobacco packages.

- Keeping plain packaging to minimise the promotion of the products.

- 100% smoke-free public spaces.

- A ban on tobacco marketing.

- Support for smokers who want to quit.

- Prevention of tobacco industry interference.

- Cigarettes and Other Tobacco Products Act (COTPA), 2003: Replaced the Cigarettes Act of 1975 (largely limited to statutory warnings- ‘Cigarette Smoking is Injurious to Health’ to be displayed on cigarette packs and advertisements. It did not include non-cigarettes). The 2003 Act also included cigars, bidis, cheroots, pipe tobacco, hookah, chewing tobacco, pan masala, and gutka.

- National Tobacco Control Programme (NTCP), 2008:

- Objective: To control tobacco consumption and minimize tobacco consumption related deaths

- Activities: Training and capacity building; information, education, and communication (IEC) activities; tobacco control laws; reporting survey and surveillance and tobacco cessation

- Cigarettes and other Tobacco Products (Packaging and Labelling) Amendment Rules, 2020:

- It was mandated that the specified health warning shall cover at least 85% of the principal display area of the package.

- Of this, 60% shall cover pictorial health warning and 25% shall cover textual health warning.

- This shall be positioned on the top edge of the package and in the same direction as the information on the principal display area.

- mCessation Programme:

- It is an initiative using mobile technology for tobacco cessation.

- India launched mCessation using text messages in 2016 as part of the government’s Digital India initiative.

- It uses two-way messaging between the individual seeking to quit tobacco use and programme specialists providing them dynamic support.

- Prevention and Control of Pollution Act of 1981- Recognized smoking as an air pollutant.

- Cable Television Networks Amendment Act of 2000- Prohibited the transmission of advertisements on tobacco and liquor in India.

- The Government of India has issued regulations under the Food Safety and Standards Act 2006 which lay down that tobacco or nicotine cannot be used as ingredients in food products.

- International Convention:

Way Forward

- There is a need for comprehensive tobacco control policy, accessible and affordable cessation services strengthening the implementation of COTPA, alternative opportunities for people engaged in tobacco cultivator, processing and manufacturing.

- The proportion of buying loose cigarettes decreased with increased levels of education and awareness. Enhancing public awareness through campaigns, educational programs in schools, strong and prominent graphic health warnings.

Indian Economy

ESG Funds Becoming Popular in India

Why in News

The ESG funds are increasingly becoming popular in the mutual fund industry in India. Recently, ICICI Prudential Mutual Fund has come out with its ESG fund.

- The first ESG mutual fund was launched by the State Bank of India - SBI Magnum Equity ESG Fund.

Key Points

- ESG Fund:

- ESG is a combination of three words i.e. environment, social and governance.

- It is a kind of mutual fund. Its investing is used synonymously with sustainable investing or socially responsible investing.

- Typically, a mutual fund looks for a good stock of a company that has potential earnings, management quality, cash flows, the business it operates in, competition etc.

- However, while selecting a stock for investment, the ESG fund shortlists companies that score high on environment, social responsibility and corporate governance, and then looks into financial factors.

- Therefore, the key difference between the ESG funds and other funds is 'conscience' i.e the ESG fund focuses on companies with environment-friendly practices, ethical business practices and an employee-friendly record.

- The fund is regulated by Securities and Exchange Board of India (SEBI).

- Reason for Popularity:

- Modern investors are re-evaluating traditional approaches, and look at the impact their investment has on the planet. Thus, investors have started incorporating ESG factors into investment practices.

- The United Nations Principles for Responsible Investment (UN-PRI) (an international organization) works to promote the incorporation of environmental, social, and corporate governance factors into investment decision-making.

- Impact:

- As ESG funds gain momentum in India, companies will be forced to follow better governance, ethical practices, environment-friendly measures and social responsibility.

- Companies that do not follow sustainable business models will find it tough to raise both equity and debt.

- Globally, investors like pension funds, sovereign wealth funds etc. don’t invest in companies that are seen as polluting, don’t follow social responsibility or are tobacco companies.

- The global tobacco industry profits per year come to USD 35 billion, however, it causes nearly 6 million annual deaths and investors are growing sensitive to such realities.

Way Forward

- A significant advantage of ESG compliant companies is that they will be on the safer side when the regulators come up with even more stringent rules.

- The scope for the ESG compliant companies to gain significant market share would be more compared to their non-compliant competitors.

- Being ESG compliant enhances the company’s credibility and reputation several fold and is sure to attract investors due to their sustainability.

Indian Polity

States Planning to Bypass Central Legislation

Why in News

Recently, many states are exploring the possibilities of passing legislation under Article 254(2) of the Constitution, to negate the enforcement of three Farm Acts passed by the Central government under Entry 33 of the Concurrent List.

- Entry 33 of the Concurrent List mentions trade and commerce, production, supply and distribution of domestic and imported products of an industry; foodstuffs, including oilseeds and oils; cattle fodder; raw cotton and jute.

Key Points

- The Article 254(2):

- It enables a State government to pass a law, on any subject in the Concurrent List, that may contradict a Central law, provided it gets the President’s assent.

- In 2014, the Rajasthan government took this Article 254 (2) route to make changes to the central labour laws — the Factories Act, the Industrial Disputes act, and the Contract Labour Act — which subsequently got the President’s assent.

- However, the Parliament is not barred from enacting at any time any law with respect to the same matter including a law adding to, amending, varying or repealing the law so made by the Legislature of the State.

- It enables a State government to pass a law, on any subject in the Concurrent List, that may contradict a Central law, provided it gets the President’s assent.

- Background:

- The three Farm Acts includes:

- Farmers’ Produce Trade and Commerce (Promotion and Facilitation) Act, 2020

- Farmers (Empowerment and Protection) Agreement on Price Assurance and Farm Services Act, 2020

- Essential Commodities (Amendment) Act, 2020.

- In short, the Acts aim to do away with government interference in agricultural trade by creating trading areas free of middlemen and government taxes outside the structure of Agricultural Produce Market Committees (APMCs).

- They also aim to remove restrictions on private stock holding of agricultural produce.

- The three Farm Acts includes:

Distribution of Legislative Subjects

- Article 246 adopts a threefold distribution of legislative power between the Union and the states.

- The subject-wise distribution of this power is given in the three lists of the Seventh Schedule of the constitution:

- List-I- the Union List

- List-II- the State List

- List-III- the Concurrent List

- Union List: Parliament has exclusive powers to make laws with respect to any of the matters enumerated in the Union List.

- It includes the matters of national importance and the matters which require uniformity of legislation nationwide.

- This list includes 98 subjects (originally 97) like defence, banking, foreign affairs, currency, atomic energy, insurance, communication, inter-state trade and commerce, census, audit and so on.

- State List: The state legislature has exclusive powers (not during emergency) to make laws with respect to any of the matters enumerated in the State List.

- It includes the matters of regional and local importance and the matters which permit diversity of interest.

- This list includes 59 subjects (originally 66) like public order, police, public health and sanitation, agriculture, prisons, local government, fisheries, markets, theaters, gambling and so on.

- Concurrent List: Both, the Parliament and state legislature can make laws with respect to any of the matters enumerated in the Concurrent List.

- It includes the matters on which uniformity of legislation throughout the country is desirable but not essential.

- However State legislation operates to the extent that it is not in conflict with the Central legislation. At times, the very presence of a central legislation can negate the state’s ability to legislate.

- This list has at present 52 subjects (originally 47) like criminal law and procedure, civil procedure, marriage and divorce, population control and family planning, electricity, labour welfare,economic and social planning, drugs, newspapers, books and printing press, and others.

- The 42nd Amendment Act of 1976 transferred five subjects to Concurrent List from State List i.e education, forests, weights and measures, protection of wild animals and birds, and administration of justice; constitution and organisation of all courts except the Supreme Court and the High Courts.

- Other Features:

- The power to make laws with respect to residuary subjects i.e. the matters which are not enumerated in any of the three lists, is vested in the Parliament.

- Parliament has power to make laws with respect to any part of the territory of India not included in a state even though that matter is one which is enumerated in the State List.

- This provision is related to the Union Territories or the Acquired Territories (if any).

Biodiversity & Environment

Six Mega Projects in Uttarakhand: Namami Gange Mission

Why in News

The Prime Minister has inaugurated six mega projects in Uttarakhand under the Namami Gange Mission.

Key Points

- Highlights: These six mega projects of Sewage Treatment Plants (STP) are constructed at Haridwar, Rishikesh, Muni ki Reti, Chorpani, and Badrinath.

- Jagjeetpur, Haridwar project also marks the completion of the first sewage project taken up on hybrid annuity mode on public private partnership.

- Hybrid Annuity Model: The Government would provide upfront around 40% of the project cost to the developer to start the work and the remaining 60% would be borne by the private party.

- In Muni ki Reti town, Chandreshwar Nagar STP is the first 4 storied Sewage Treatment Plant in the country where the limitation of land availability was converted into an opportunity.

- Jagjeetpur, Haridwar project also marks the completion of the first sewage project taken up on hybrid annuity mode on public private partnership.

- Significance:

- All 30 STP projects (100%) are now complete in Uttarakhand for taking care of pollution from 17 Ganga towns near river Ganga, which is a landmark achievement.

- The Haridwar-Rishikesh zone contributes about 80% wastewater load into the River Ganga.

- Namami Gange Programme:

- Namami Gange Programme is an Integrated Conservation Mission, approved as a ‘Flagship Programme’ by the Union Government in June 2014 to accomplish the twin objectives of effective abatement of pollution and conservation and rejuvenation of National River Ganga.

- It is being operated under the Department of Water Resources, River Development and Ganga Rejuvenation, Ministry of Jal Shakti.

- The program is being implemented by the National Mission for Clean Ganga (NMCG), and its state counterpart organizations i.e., State Program Management Groups (SPMGs).

- NMCG is the implementation wing of National Ganga Council (set in 2016; which replaced the National Ganga River Basin Authority - NGRBA).

- It has a Rs. 20,000-crore, centrally-funded, non-lapsable corpus and consists of nearly 288 projects.

- The main pillars of the programme are:

- Sewage Treatment Infrastructure & Industrial Effluent Monitoring

- River-Front Development & River-Surface Cleaning

- Bio-Diversity & Afforestation

- Public Awareness

Other Activities at the Event

- Ganga Avalokan: It is the first museum inaugurated for Ganga.

- The museum is dedicated to showcase the culture, biodiversity and rejuvenation activities done in Ganga river.

- The museum is located at Chandi Ghat, Haridwar.

- Rowing down the Ganges: A book co-published by National Mission for Clean Ganga & Wildlife Institute of India is also launched.

- The logo of Jal Jeevan Mission and ‘Margdarshika for Gram Panchayats and Paani Samitis under Jal Jeevan Mission’ is also unveiled during the event.

Way Forward

- The government’s Namami Gange Programme has revitalised India’s efforts in rejuvenating the Ganga.

- It is important to build critical sewage infrastructure at pollution hotspots along the river Ganga and its tributaries as a first step in this direction.

Indian History

Centenary of Discovery of Harappan Civilization

Why in News

To mark the centenary of the discovery of the Harappan civilization at Mohenjo-Daro, the India Study Centre Trust in collaboration with the Directorate of Archaeology and Museums, Maharashtra, will organise a 10-day online lecture series from 5th October 2020.

- The India Study Centre Trust has its core focus in the fields of archaeology, geology and biodiversity.

Key Points

- Harappan civilization is also known as Indus Valley Civilization (IVC) for being situated on and around the banks of the Indus river.

- It flourished around 2,500 BCE in the western part of South Asia, in contemporary Pakistan, western India and parts of Afghanistan.

- It was home to the largest of the four ancient urban civilizations of Egypt, Mesopotamia, India, and China.

- In the 1920s, the Archaeological Survey of India (ASI) carried out excavations in the Indus valley wherein the ruins of the two old cities, viz. Mohenjo-Daro and Harappa were unearthed.

- Both are major sites of IVC and are among the earliest and finest examples of urban civic planning.

- The planned network of roads, houses and drainage systems indicate the planning and engineering skills that developed during those times.

- In 1924, John Marshall, Director-General of the ASI, announced the discovery of a new civilisation in the Indus valley to the world.

- A marked feature of this ancient civilization was the vivid imagination and artistic sensibilities exuded by the numerous sculptures, seals, potteries, pieces of jewellery found at the excavation sites.

- It was a trade based civilization which had overseas trade links with Mesopotamia (region of Western Asia situated within the Tigris–Euphrates river system) attested by the discovery of Harappan seals there and Mesopotamian carnelian beads here.

- IVC’s discovery is one of the most important and characteristic findings in the world because it brought the world’s attention to India and an interest in studying Indian culture, society and past.

- The civilization declined around 1800 BCE but the actual reasons behind its demise are still debated.

- Invasion by Aryans, decline due to natural causes, flooding because of a shift in river courses are among the major theories on its decline.

| Important Sites of IVC | |||

| Site | Excavated by | Location | Important Findings |

| Harappa | Daya Ram Sahni in 1921 | Bank of river Ravi in Montgomery district of Punjab (Pakistan) |

|

| Mohenjo-Daro (Mound of Dead) | R.D. Banerjee in 1922 | Bank of river Indus in Larkana district of Punjab (Pakistan) |

|

| Sutkagendor | Stein in 1929 | In southwestern Balochistan province, Pakistan on Dast river |

|

| Chanhudaro | N.G. Majumdar in 1931 | Sindh on the Indus river |

|

| Amri | N.G. Majumdar in 1935 | On the bank of Indus river |

|

| Kalibangan | Ghose in 1953 | Rajasthan on the bank of Ghaggar river |

|

| Lothal | R. Rao in 1953 | Gujarat on Bhogva river near Gulf of Cambay |

|

| Surkotada | J.P. Joshi in 1964 | Gujarat |

|

| Banawali | R.S. Bisht in 1974 | Hisar district of Haryana |

|

| Dholavira | R.S Bisht in 1985 | Gujarat in Rann of Kachchh |

|

Governance

EPFO’s New Facility on UMANG App

Why in News

Recently, the Employees' Provident Fund Organisation (EPFO) has started a facility on the Unified Mobile Application for New-age Governance (UMANG) App which enables members of the Employees’ Pension Scheme (EPS) 1995 to apply online for Scheme Certificates.

- EPS is a social security scheme that was launched in 1995 and is provided by EPFO.

- It makes provisions for pensions for the employees in the organised sector aft er the retirement at the age of 58 years.

Key Points

- Scheme Certificate:

- It is issued to members who withdraw their Employees' Provident Fund (EPF) contribution but wish to retain their membership with EPFO, to avail pension benefits on the attainment of retirement age.

- Members become eligible for pension only if they have been, cumulatively, a member of the EPS, 1995 for at least 10 years.

- Upon joining a new job, Scheme Certificate ensures that previous pensionable service is added to pensionable service rendered with the new employer thereby, increasing the number of pension benefits.

- Further, Scheme Certificate is also useful for family members to avail family pension, in case of the untimely death of the eligible member.

- Requirements for Online Application:

- For availing the service, an active Universal Account Number (UAN) and a mobile number registered with the EPFO is required.

- Benefits:

- The online application will help members avoid unnecessary hardship of physically applying for it, especially during pandemic times and will also eliminate unnecessary paperwork.

- Role of EPFO in Current Times:

- EPFO was already providing 16 services on the App allowing EPF subscribers to access services during Covid-19 from the comfort of their homes in a hassle-free manner.

- By successfully bringing state-of-the-art technology to the doorstep of its subscribers, EPFO has remained to be a very popular service provider on UMANG App.

- With India witnessing massive growth in digital connectivity through mobile phones, EPFO is making more and more services digitally accessible to members even in remotest locations through the App.

UMANG App

- It is a unified, secure, multi-channel, multi-platform, multi-lingual, multi-service mobile app.

- It is developed by the Ministry of Electronics and Information Technology (MeitY) and National e-Governance Division (NeGD) to drive mobile governance under Digital India.

- It provides a single platform to citizens for accessing pan India e-Government services ranging from central to local government bodies and other citizen-centric services.

- Services Provided: Filing income tax, EPFO services, Aadhar, Pension, ePathshala, e- Land Records, Crop Insurance etc.

Employees’ Provident Fund Organisation

- It is a government organisation that manages the provident fund and pension accounts for the workforce engaged in the organized sector in India.

- It implements the Employees’ Provident Fund and Miscellaneous Provisions Act, 1952.

- The Act provides for the institution of provident funds for employees in factories and other establishments.

- It is administered by the Ministry of Labour and Employment.

- It is one of the world's largest social security organisations in terms of clientele and the volume of financial transactions undertaken.

Biodiversity & Environment

Campaign to Remove Lantana: Rajasthan

Why in News

A special drive to uproot the invasive Lantana bushes in the Sajjangarh Wildlife Sanctuary in Rajasthan’s Udaipur district has been carried out along with the plantation of native species on the cleared patches of land.

- This has helped in ecological restoration of grasslands and saved biodiversity.

Key Points

- Lantana:

- Lantana camara is a small perennial shrub, which forms extensive, dense and impenetrable thickets.

- It is native to Central and South America.

- It is an invasive species which was introduced in tropical regions as an ornamental plant (introduced in India in 1807).

- It is generally deleterious to biodiversity and is an agricultural weed.

- Impact:

- The thickets covered vast tracts of land, stopping the natural light and nutrition for other flora and fauna.

- The toxic substance in its foliage and ripe berries affected the animals.

- With the herbivores not getting sufficient forage, the prey base for carnivorous animals was declining, leading to ecological disturbances in the food chain.

- It has also invaded other wildlife reserves, river banks and the Project Tiger areas.

- In some regions, the plant has invaded pastures and shrunk the cattle grazing areas, affecting the livelihood of villagers.

- Sajjangarh Wildlife Sanctuary:

- Location: Udaipur (Rajasthan)

- History: It is a part of Sajjangarh Palace (also known as Monsoon Palace) built in 1884.

- The Palace derived its name from Maharana Sajjan Singh, one of the rulers of the Mewar dynasty.

- Area: 5.19 sq. Km

- Flora and Fauna: Animals like chitals, panthers, hares, blue bulls (Nilgais), jackals, wild boars, hyenas, and sambhar.

- More than 279 Plant Species.

- Famous for Long-billed vulture, commonly known as the Indian vulture.

- Scientific Name: Gyps indicus

- IUCN Red List Status: Critically Endangered

- CITES Status: Appendix II

- Wild Life (Protection) Act, 1972 Status: Schedule I

Invasive Species

- An invasive species is an organism that is not indigenous, or native, to a particular area and causes harm.

- They are capable of causing extinctions of native plants and animals, reducing biodiversity, competing with native organisms for limited resources, and altering habitats.

- They can be introduced to an area by ship ballast water, accidental release, and most often, by humans.

Important Facts For Prelims

Bharati Script

Why in News

Bharati script is designed to be a common script that can express all the major Indian languages.

- Script refers to a set of letters used for writing a particular language. E.g. Devanagari, Roman, etc.

Key Points

- Developed By: Srinivasa Chakravathy’s team at IIT Madras.

- Features:

- Bharati is a simple and unified script which can be used to write most major Indian languages.

- It is designed using simplest shapes, often borrowing simple characters from various Indian languages/scripts and English.

- Scripts supported are: Hindi/Marathi (Devanagari), Tamil, Telugu, Gujarati, Punjabi (Gurmukhi), Bengali, Oriya, Kannada and Malayalam.

- Use of Technology:

- Optical Character Recognition: The Team has developed a method for reading documents in Bharati script using a multi-lingual Optical Character Recognition (OCR) scheme.

- OCR is a system that provides a full alphanumeric recognition of printed or handwritten characters at electronic speed by simply scanning the form.

- Finger-spelling Method: It can be used to generate a sign language for hearing-impaired persons.

- Related Applications/Tools: Bharati Handwriting Keyboard and Bharati Transliterator.

- Transliteration changes the letters from one alphabet or language into the corresponding, similar-sounding characters of another alphabet.

- It is different from translation which allows words in one language to be understood by those who speak another language. Essentially, translation of a foreign word involves interpreting its meaning.

- Transliteration, on the other hand, makes a language a little more accessible to people who are unfamiliar with that language’s alphabet. Transliteration focuses more on pronunciation than meaning, which is especially useful when discussing foreign people, places, and cultures.

- Optical Character Recognition: The Team has developed a method for reading documents in Bharati script using a multi-lingual Optical Character Recognition (OCR) scheme.

- Significance:

- It is in line with 'One Nation, One Script'.

- The Roman script is used as a common script for many European languages (English, French, German, Italian etc.), which facilitates communication across nations that speak and write those languages. Likewise, a common (Bharati) script for the entire country is hoped to bring down many communication barriers in India.

- It can help the next generation of Indians to easily read in Indian languages.

- It is an ideal script for languages like Konkani or Tulu that don’t have their own script.

- It can serve as a writing system for the innumerable tribal languages of India, and languages of the NorthEast.

- It can act as a link script for migrant Indians who move out of their native state for work

- It can connect the millions of Non Resident Indian (NRI) children back to Indian literature.

- It can lead to a new system of Braille (for blind persons) for Indian languages and even a fingerspelling system for the hearing-impaired.

- It can shorten the duration of adult literacy programs from 6 months to a few weeks, as the script is easy to learn.