Social Justice

National Multidimensional Poverty Index: NITI Ayog

Why in News

Recently, NITI Aayog has released the Multidimensional Poverty Index (MPI).

- Earlier, Global Multidimensional Poverty Index 2021 was released by the United Nations Development Programme (UNDP) and the Oxford Poverty & Human Development Initiative (OPHI).

Key Points

- About:

- The MPI seeks to measure poverty across its multiple dimensions and in effect complements existing poverty statistics based on per capita consumption expenditure.

- According to Global MPI 2021, India’s rank is 66 out of 109 countries. The National MPI is aimed at deconstructing the Global MPI and creating a globally aligned and yet customised India MPI for drawing up comprehensive Reform Action Plans with the larger goal of improving India’s position in the Global MPI rankings.

- It has three equally weighted dimensions – health, education, and standard of living.

- These three dimensions are represented by 12 indicators such as nutrition, school attendance, years of schooling, drinking water, sanitation, housing, bank accounts among others.

- Methodology & Data:

- The national MPI measure uses the globally accepted and robust methodology developed by the Oxford Poverty and Human Development Initiative (OPHI) and the UNDP.

- This baseline report of the national MPI measure is based on the reference period of 2015-16 of the National Family Health Survey (NFHS-4).

- NFHS-4 data has been used to derive an idea of baseline multidimensional poverty to know the situation on ground before the full rollout of various central government schemes.

- NFHS-4 precedes the full roll out of (central government’s) flagship schemes on housing, drinking water, sanitation, electricity, cooking fuel, financial inclusion, and other major efforts towards improving school attendance, nutrition, mother and child health, etc.

- However, it has to be noted here that the NFHS-5 data suggests improvement in access to clean cooking fuel, sanitation, and electricity which translates to reduction in deprivation.

- Findings of the Index:

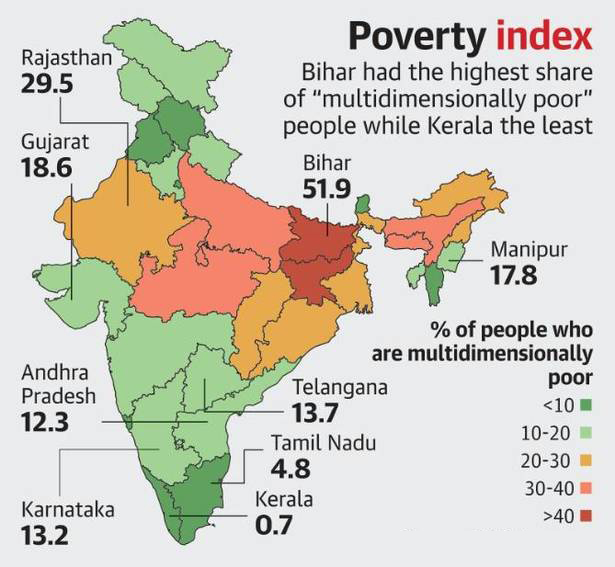

- Poverty Levels:

- Bihar has the highest proportion of people of the state’s population followed by Jharkhand and Uttar Pradesh who are multidimensionally poor.

- Kerala registered the lowest population poverty levels, followed by Puducherry, Lakshadweep, Goa and Sikkim.

- Malnourished People:

- Bihar also has the highest number of malnourished people followed by Jharkhand, Madhya Pradesh, Uttar Pradesh, and Chhattisgarh.

- Poverty Levels:

- Significance of the Index:

- Contribution towards Instituting Public Policy Tool:

- The development of the Index is an important contribution towards instituting a public policy tool which monitors multidimensional poverty, informs evidence-based and focused interventions, thereby ensuring that no one is left behind.

- Presents Overall Picture of Poverty:

- This presents an overall picture of poverty in the country, while also enabling closer and more in-depth analyses of areas of interest such as regions – state or districts, and specific sectors and complements the existing monetary poverty statistics.

- Help Achieving SDGs Goals:

- It is a contribution towards measuring progress towards target 1.2 of the Sustainable Development Goals (SDGs) which aims at reducing “at least by half the proportion of men, women and children of all ages living in poverty in all its dimensions.

- Contribution towards Instituting Public Policy Tool:

- Related Government Initiatives:

- National Rural Livelihood Mission (NRLM)

- The Mahatma Gandhi National Rural Employment Guarantee Act 2005 (MNREGA)

- Pradhan Mantri Awaas Yojana-Gramin (PMAY-G)

- Public Distribution System (PDS)

- Pradhan Mantri Awas Yojana (PMAY)

- Jal Jeevan Mission (JJM)

- Swachh Bharat Mission (SBM)

- Pradhan Mantri Sahaj Bijli Har Ghar Yojana (Saubhagya)

- Pradhan Mantri Ujjwala Yojana (PMUY)

Indian Economy

Corporates Houses & Banking

Why in News

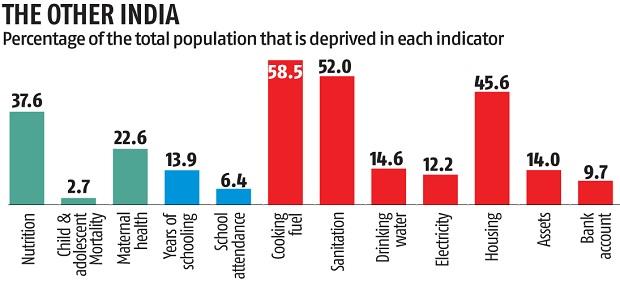

Recently, the Reserve Bank of India (RBI) has put on hold the recommendations from its Internal Working Committee (IWG), that said large corporate and industrial houses may be allowed to promote banks after amendments to the Banking Regulations Act, 1949.

- The RBI has accepted 21 out of 33 recommendations of the IWG on ownership of private banks, but kept silent on giving banking licence to big business groups.

Key Points

- About:

- Corporate Houses (CH) were active in the banking sector till five decades ago when the banks promoted by them were nationalised in the late sixties amid allegations of connected lending and misuse of depositors’ money.

- The Banking sector was opened up again for the CHs Post Liberalisation (1991) with the first round of licensing of private banks that was done in 1993.

- Since then, there were two more rounds of licensing of banks in the private sector – in 2003-04 and 2013-14 – culminating with the on-tap licensing regime of universal banks in 2016.

- However, even some prominent business houses were not considered in 2013-14.

- Pros of Allowing Corporations To Own Bank:

- Plugging Capital Gap:

- Currently, the government keeps picking money from the taxpayers pocket and funding the public sector banks.

- Hence, by allowing the big corporates into the banking sector the capital requirement can be fulfilled.

- Financial Inclusion:

- Even today a significant population do not have access to banking in the country, the corporates’ entry would mean the opening of more branches and subsequently bringing more people into the banking net.

- Improving Competition:

- Privatization of banks has been a long-proposed reform in the Indian banking industry. Allowing corporations into the banking sector will further pressurize Public sector banks to become competitive.

- Plugging Capital Gap:

- Concerns of Allowing Corporates To Own Bank:

- Connected Lending & Moral Hazard:

- There are apprehensions that it would not be easy for supervisors to prevent or detect self-dealing or connected lending as banks could hide connected party or related party lending behind complex company structures and subsidiaries or through lending to suppliers of promoters and their group companies.

- Connected lending involves the controlling owner of a bank giving loans to himself or his related parties and group companies at favourable terms and conditions.

- Big business groups already account for a major chunk of Non-Performing Assets (NPAs) in the banking system even without becoming promoters of a bank.

- In ethical terms, this will erode the bank’s role as an effective financial and create a moral hazard or conflict of interest situation.

- There are apprehensions that it would not be easy for supervisors to prevent or detect self-dealing or connected lending as banks could hide connected party or related party lending behind complex company structures and subsidiaries or through lending to suppliers of promoters and their group companies.

- Circular Lending & Difficulty In Regulation:

- Under circular lending, corporate bank X funding projects of an industry group, which owns corporate bank Y, and corporate bank Y funding projects of an industry group owning bank Z, and finally, corporate bank Z funding projects of industry group owning bank X.

- With available legal structures and the proliferation of shell companies, makes it hard to track such lending on a real-time basis.

- Inequality & Concentration of Wealth:

- Corporations owning banks will add more muscle to big industry groups, which already dominate many important sectors of the economy, including telecom, organised retail, aviation, software and e-commerce.

- This will further accelerate the concentration of wealth and increase inequalities.

- Contradicting the Previous Ruling:

- The banking sector in India has been in trouble for the last few years, keeping that in mind the RBI in 2016 had created new guidelines on the limit of lending to a single company.

- The rationale behind this ruling was that if a bank lends too much to one company only then it risks losing that money if the company sinks.

- Therefore, the recommendation of allowing the entry of industry groups in the banking sector is in contradiction with the above-said ruling in 2016.

- Connected Lending & Moral Hazard:

Way Forward

- Before granting much economic power in the hands of corporations, it is imperative to carry out the long-pending banking reforms and strengthen the functional autonomy of RBI.

- The recent failures on internal and external controls like in the case of PNB leading to an alarming fraud, the failures of bank and NBFCs like Lakshmi Vilas Bank, Yes Bank, etc. where all stakeholders lost money and credibility have given rise to the need of new regulations with a very high degree of supervisory mechanism and corporate governance which has strong Information Technology (IT) and Artificial Intelligence (AI) enabled platform.

- Where a corporate house is a promoter, strict regulations on the use of funds held with the bank and monitoring of related party transactions will be essential.

- Fit and proper criterion needs to be foolproof and the common citizens should become the beneficiaries in the process.

Indian Polity

Gerrymandering & US Democracy

Why in News

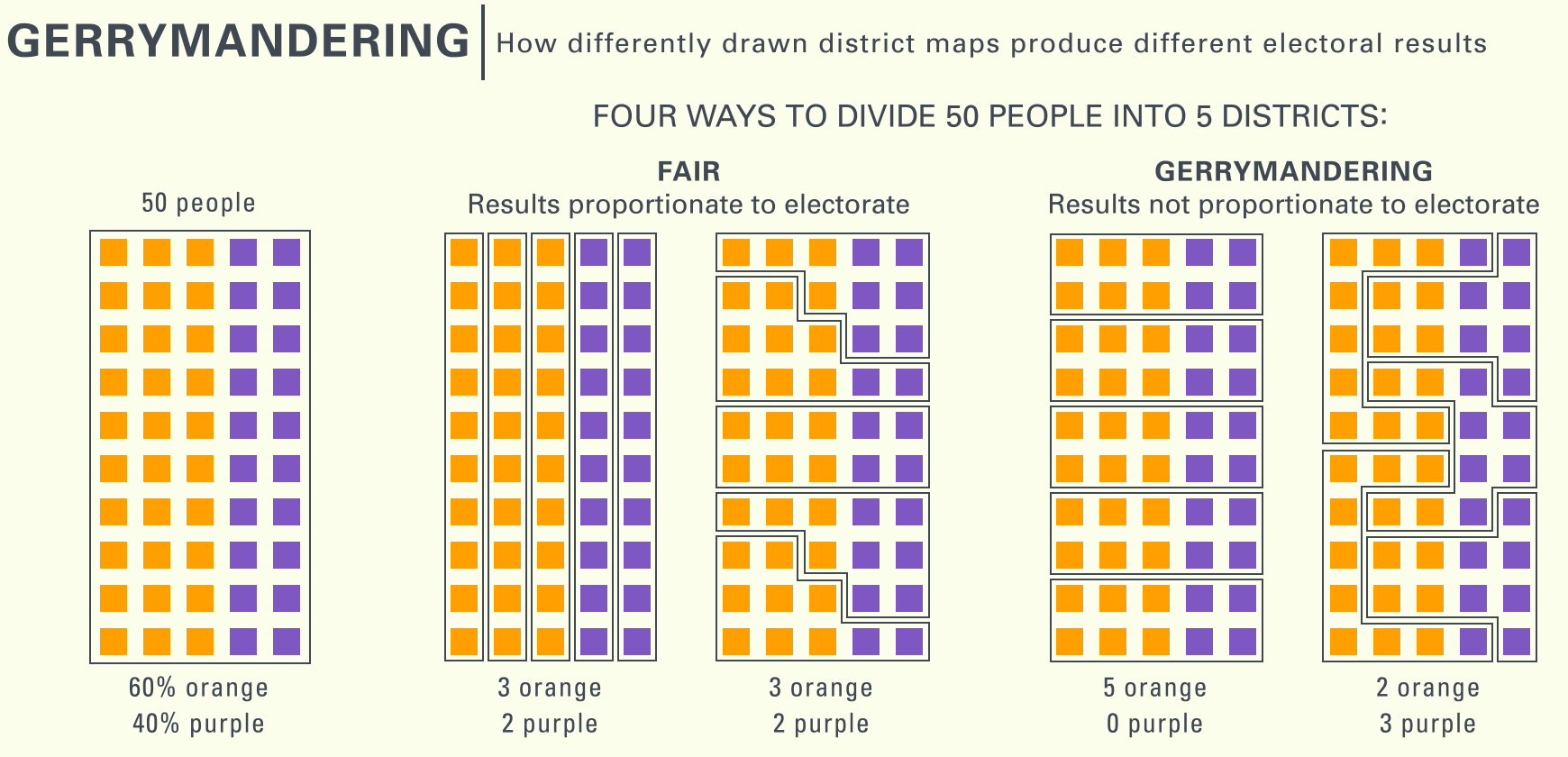

Recently, the 2020 census results of the US population were presented. Following this, the exercise of Gerrymandering has been conducted across the U.S. Congressional and State legislative districts every decade.

- Gerrymandering or redistricting is the process of redrawing electoral boundaries. However, this exercise has been criticised for undermining democracy in the US.

Key Points

- Background: Gerrymandering, the term is derived from the name of Gov. Elbridge Gerry of Massachusetts, whose administration enacted a law in 1812 defining new state senatorial districts.

- Underlying Principle: The principle behind redistricting is to ensure that the election of public officials embodies the ideal of genuine democratic representation, by factoring in changes in the geographic distribution of population.

- Undermining Democracy: A basic objection to gerrymandering of any kind is that it tends to violate two tenets of electoral apportionment—compactness and equality of size of constituencies.

- Issue with US Democracy: In the US, there is a specific long term demographic trend wherein the supporters of Democratic party relatively belong to urban areas, and that of Republican party come from rural areas.

- However, the density of people living in urban areas in the US is more than rural areas.

- In this scenario, the Republican party has Gerrymandered electoral districts to create supermajorities of rural voters.

- In this way, giving one political party an unfair advantage over its rivals or that dilutes the voting power of members of ethnic or linguistic minority groups.

Comparison With India

- Delimitation Commission: In India, political redistricting is handled by the Delimitation Commission of India.

- Delimitation is the act of redrawing boundaries of Lok Sabha and Assembly seats to represent changes in population. In this process, the number of seats allocated to a state may also change.

- Constitutional Provisions: Under Article 82 of Indian Constitution, Delimitation commission is constituted by the Central Government after the Parliament has enacted a Delimitation Act after every census.

- Under Article 170, States also get divided into territorial constituencies as per Delimitation Act after every Census.

- Underlying Principle: To provide equal representation to equal segments of a population.

- Fair division of geographical areas so that one political party doesn’t have an advantage over others in an election.

- To follow the principle of “One Vote One Value”.

- Delimitation Commissions So Far: Delimitation Commissions have been set up four times — 1952, 1963, 1973 and 2002 under the Acts of 1952, 1962, 1972 and 2002.

- The first delimitation exercise was carried out by the President (with the help of the Election Commission) in 1950-51.

- There was no delimitation after the 1981 and 1991 Census.

- The 42nd Amendment Act of 1976 froze the allocation of seats in the Lok Sabha to the states and the division of each State into territorial constituencies till the year 2000 at the 1971 level.

- Further, the 84th Amendment Act of 2001 extended this ban on readjustment for another 25 years (i.e., upto year 2026), without affecting the total number of seats based on the 1971 census.

- The 84th Amendment Act of 2001 also empowered the government to undertake readjustment and rationalisation of territorial constituencies in the states on the basis of the population figures of 1991 census.

- Later, the 87th Amendment Act of 2003 provided for the delimitation of constituencies on the basis of the 2001 census and not 1991 census.

- Hence, the current status of delimitation in India is frozen up to 2026 as per 2001 census.

Delimitation Commission

- About:

- The Delimitation Commission is appointed by the President of India and works in collaboration with the Election Commission of India.

- The Delimitation Commission in India is a high power body whose orders have the force of law and cannot be called in question before any court.

- Composition:

- Retired Supreme Court judge

- Chief Election Commissioner

- Respective State Election Commissioners

- Decision:

- In case of difference of opinion among members of the Commission, the opinion of the majority prevails.

- Functions:

- To determine the number and boundaries of constituencies to make the population of all constituencies nearly equal.

- To identify seats reserved for Scheduled Castes and Scheduled Tribes, wherever their population is relatively large.

Source: TH

Biodiversity & Environment

Depletion of Groundwater

Why in News

Recently, an analysis of water level data done by the Central Ground Water Board (CGWB) indicates that about 33% of the wells monitored have registered decline in ground water levels in the range of 0 – 2 metres.

- Moreover, a decline of more than 4.0 m has also been observed in a few pockets of metro cities like New Delhi, Chennai, Indore, Madurai, Vijayawada, Ghaziabad, Kanpur, and Lucknow, etc.

- CGWB is periodically monitoring the ground water levels throughout the Country including metro cities on a regional scale, through a network of monitoring wells.

Key Points

- About Groundwater Extraction in India:

- The UNESCO World Water Development Report, 2018 states that India is the largest extractor of groundwater in the world.

- The contribution of groundwater to national gross domestic product is never measured.

- According to the CGWB, with 230 billion metre cube of groundwater drawn out each year for irrigating agriculture lands in India, many parts of the country are experiencing rapid depletion of groundwater.

- The total estimated groundwater depletion in India is in the range of 122–199 billion metre cube.

- Reason for Groundwater Extraction:

- Green Revolution: Green Revolution enabled water intensive crops to be grown in drought prone/ water deficit regions, leading to over extraction of groundwater.

- Frequent pumping of water from the ground without waiting for its replenishment leads to quick depletion.

- Further, Subsidies on electricity and high MSP (Minimum Support Price) for water intensive crops.

- Industries Requirement: Water contamination as in the case of pollution by landfills, septic tanks, leaky underground gas tanks, and from overuse of fertilizers and pesticides leading to damage and depletion of groundwater resources.

- Inadequate Regulation: Inadequate regulation of groundwater encourages the exhaustion of groundwater resources without any penalty.

- In India, construction of irrigation wells does not require any clearance and no records are maintained of abandoned wells.

- Several hundred wells are constructed in India every day and even more are abandoned when they run dry.

- Federal Issue: Water being a State subject, initiatives on water management including water conservation and water harvesting and making available adequate drinkable water to citizens in the Country is primarily States’ responsibility.

- However, important measures including funding of various projects are taken by the Central Government.

- Green Revolution: Green Revolution enabled water intensive crops to be grown in drought prone/ water deficit regions, leading to over extraction of groundwater.

Steps taken by the Central Government to Control Groundwater Depletion

- Jal Shakti Abhiyan: Government of India launched Jal Shakti Abhiyan (JSA) in 2019, intended to improve water availability including groundwater conditions in the water stressed blocks of 256 districts in India.

- Master Plan for Artificial Recharge to Groundwater - 2020: CGWB in consultation with the state governments has prepared The Master Plan - 2020.

- It envisages construction of about 1.42 crore Rain water harvesting and artificial recharge structures in the Country to harness 185 Billion Cubic Metre (BCM).

- In addition, the government has also launched the Catch the Rain’ campaign to promote rainwater harvesting.

- National Water Policy (2012): The policy advocates rainwater harvesting and conservation of water and highlights the need for augmenting the availability of water through direct use of rainfall.

- It also advocates conservation of river, river bodies and infrastructure should be undertaken in a scientifically planned manner through community participation.

- Atal Bhujal Yojana: Atal Bhujal Yojana (ABHY) scheme (co-funded by World Bank funding, for sustainable management of ground water with community participation is being taken up in the identified over-exploited and water stressed areas.

- Convergent Approach: Central Government supports construction of water harvesting and conservation works primarily through Mahatma Gandhi National Rural Employment Guarantee Scheme and Pradhan Mantri Krishi Sinchayee Yojana – Watershed Development Component.

- Aquifer Mapping and Management Programme: The CGWB has taken up Aquifer Mapping and Management Programme.

- The program is aimed to delineate aquifer disposition and their characterization for preparation of aquifer/ area specific groundwater management plans with community participation.

- Atal Mission for Rejuvenation and Urban Transformation (AMRUT): The Mission focuses on development of basic urban infrastructure in the AMRUT cities, such as water supply, sewerage & septage management, storm water drainage, green spaces & parks, and non-motorized urban transport.

- Various State Government Initiative: A number of States have done notable work in the field of water conservation/harvesting for sustainable management of water resources. For example,

- Mukhyamantri Jal Swavlamban Abhiyan’ in Rajasthan,

- ‘Jalyukt Shibar’ in Maharashtra,

- ‘Sujalam Sufalam Abhiyan’ in Gujarat,

- ‘Mission Kakatiya’ in Telangana,

- Neeru Chettu’ in Andhra Pradesh,

- Jal Jeevan Hariyali in Bihar,

- ‘Jal Hi Jeevan’ in Haryana

Way Forward

- Concept of Pani Panchayats: The Prime Minister of India has taken a step in the right direction by highlighting the importance of water conservation and the need to adopt appropriate measures to make water conservation a mass movement.

- In this context, decentralizing the water conservation to rural level or strengthening Pani Panchayats can be very effective.

- Restricting Illegal Encroachment of Water Bodies: Encroachment and diversion of water bodies and drainage channels must not be allowed and wherever, it has taken place, it should be restored to the extent feasible and maintained properly.

- Further, the extraction charges collected should be used for restoration of groundwater.

- Micro irrigation: Micro Irrigation techniques like sprinkler or drip irrigation should be encouraged.

- In drip irrigation, water is run through pipes (with holes in them) either buried or lying slightly above the ground next to the crops. Water slowly drips onto the crop roots and stems.

- Unlike spray irrigation, very little is lost to evaporation and the water can be directed only to the plants that need it, cutting back on water waste.

- Artificial Recharge of Groundwater: It is the process of spreading or impounding water on the land to increase the infiltration through the soil and percolation to the aquifer or of injecting water by wells directly into the aquifer.

- Groundwater Management Plants: Installing groundwater management plants at local levels, will help the people in knowing the groundwater availability in their area making them use it wisely.

Indian Economy

Central Bank Digital Currency

Why in News

Recently, the Reserve Bank of India (RBI) has proposed amendments to the Reserve Bank of India Act, 1934, which would enable it to launch a Central Bank Digital Currency (CBDC), thus enhancing the scope of the definition of ‘bank note’ to include currency in digital form.

- The move has come amid the government’s plans to introduce a Bill on cryptocurrencies in the current Parliament session that seeks to prohibit all private cryptocurrencies in India with certain exceptions.

Key Points

- About:

- CBDC is a digital form of Fiat Currency which can be transacted using wallets backed by blockchain and is regulated by the central bank. It is a legal tender issued by a central bank in a digital form.

- Fiat money is a government-issued currency that is not backed by a commodity such as gold. Fiat money gives central banks greater control over the economy because they can control how much money is printed.

- Though the concept of CBDCs was directly inspired by bitcoin, it is different from decentralised virtual currencies and crypto assets, which are not issued by the state and lack the ‘legal tender’ status.

- CBDC is a digital form of Fiat Currency which can be transacted using wallets backed by blockchain and is regulated by the central bank. It is a legal tender issued by a central bank in a digital form.

- Need:

- Addressing the Malpractices:

- The need for a sovereign digital currency arises from the anarchic design of existing cryptocurrencies, wherein their creation, as well as maintenance, are in the hands of the public.

- By regulating digital currency, the central bank can put a check on their malpractices.

- The need for a sovereign digital currency arises from the anarchic design of existing cryptocurrencies, wherein their creation, as well as maintenance, are in the hands of the public.

- Addressing Volatility:

- As the cryptocurrencies are not pegged to any asset or currency, its value is solely determined by speculation (demand and supply).

- Due to this, there has been huge volatility in the value of cryptocurrencies like bitcoin.

- Digital Currency Proxy War:

- India runs the risk of being caught up in the whirlwind of a proxy digital currency war as the US and China battle it out to gain supremacy across other markets by introducing new-age financial products.

- Today, a sovereign Digital Rupee isn’t just a matter of financial innovation but a need to push back against the inevitable proxy war which threatens our national and financial security.

- India runs the risk of being caught up in the whirlwind of a proxy digital currency war as the US and China battle it out to gain supremacy across other markets by introducing new-age financial products.

- Reducing Dependency on Dollar:

- Digital Rupee provides an opportunity for India to establish the dominance of Digital Rupee as a superior currency for trade with its strategic partners, thereby reducing dependency on the dollar.

- Advent of Private Currency:

- If these private currencies gain recognition, national currencies with limited convertibility are likely to come under some kind of threat.

- Addressing the Malpractices:

- Significance:

- It would reduce the cost of currency management while enabling real-time payments without any inter-bank settlement.

- India’s fairly high currency-to-GDP ratio holds out another benefit of CBDC to the extent large cash usage can be replaced by (CBDC), the cost of printing, transporting and storing paper currency can be substantially reduced.

- It will also minimize the damage to the public from the usage of private virtual currencies.

- It will enable the user to conduct both domestic and cross border transactions which do not require a third party or a bank.

- It has the potential to provide significant benefits, such as reduced dependency on cash, higher seigniorage due to lower transaction costs, and reduced settlement risk.

- It would also possibly lead to a more robust, efficient, trusted, regulated and legal tender-based payments option.

- Issues:

- Some key issues under RBI's examination include, the scope of CBDCs, the underlying technology, the validation mechanism and distribution architecture.

- Also, legal changes would be necessary as the current provisions have been made keeping in mind currency in a physical form under the Reserve Bank of India Act.

- Consequential amendments would also be required in the Coinage Act, Foreign Exchange Management Act (FEMA) and Information Technology Act.

- Sudden flight of money from a bank under stress is another point of concern.

- Recent Developments:

- El Salvador, a small coastal country in Central America, has become the first in the world to adopt Bitcoin, as legal tender.

- Britain is also exploring the possibility of creating a Central Bank Digital Currency (Britcoin).

- In 2020, China started testing its official digital currency which is unofficially called “Digital Currency Electronic Payment, DC/EP”.

- In April 2018, RBI banned banks and other regulated entities from supporting crypto transactions after digital currencies were used for frauds. In March 2020, the Supreme Court struck down the ban as unconstitutional.

Way Forward

- The creation of a Digital Rupee will provide an opportunity for India to empower its citizens and enable them to use it freely in our ever-expanding digital economy and break free from an outdated banking system.

- Looking into its impact on macroeconomy and liquidity, banking systems and money markets, it is imperative of policymakers to thoroughly consider the prospects of Digital Rupee in India.

Indian Economy

Zero Defect Zero Effect Scheme

Why in News

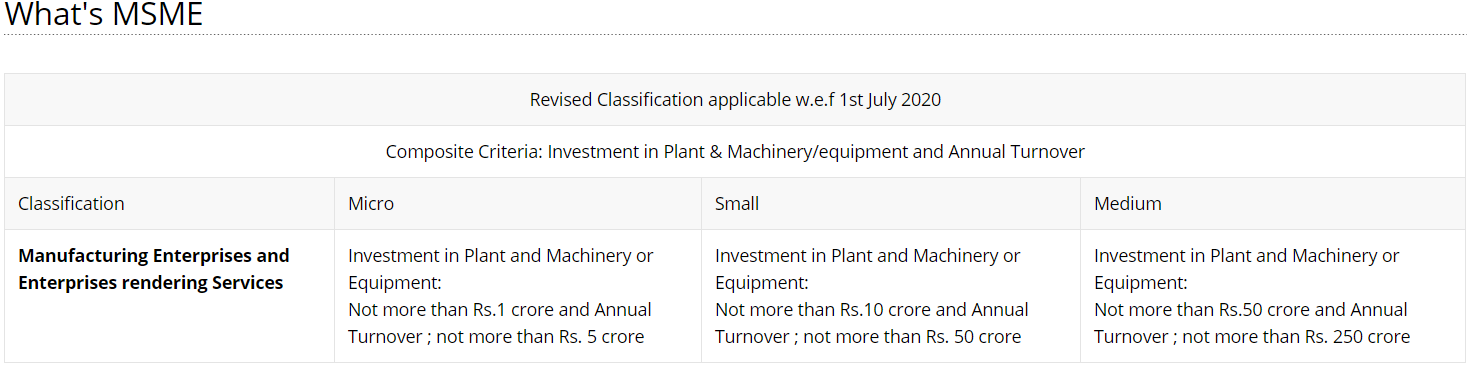

According to the recent data, as many as 23,948 Micro, Small and Medium-sized Enterprises (MSMEs) had registered with intent to adopt the principle of the Zero Defect Zero Effect Scheme (ZED).

Key Points

- About the Scheme:

- Launched in 2016 by the Ministry of MSME, the scheme is an integrated and comprehensive certification system.

- The scheme accounts for productivity, quality, pollution mitigation, energy efficiency, financial status, human resource and technological depth including design and IPR in both products and processes.

- Its mission is to develop and implement the ‘ZED’ culture in India based on the principles of Zero Defect & Zero Effect.

- Zero Defect:

- The Zero defect concept is focusing on the customer.

- Zero non-conformance or non-compliance

- Zero waste

- Zero Effect:

- Zero air pollution, liquid discharge, solid waste

- Zero wastage of natural resources

- ZED Certification\Rating:

- The Rating is a weighted average of the marks obtained on each parameter.

- The MSMEs will be assessed & rated on defined enabler & outcome parameters on operational level indicators and organisational level indicators at the operational level.

- Based on the assessment, the MSME will be ranked as Bronze-Silver-Gold-Diamond-Platinum enterprises.

- There are 50 parameters for ZED rating and additional 25 parameters for ZED Defence rating under ZED Maturity Assessment Model.

- Objective of the Scheme:

- To develop an Ecosystem for Zero Defect Manufacturing in MSMEs.

- To promote adaptation of quality tools/systems and energy efficient manufacturing. Enable MSMEs for manufacturing of quality products.

- To encourage MSMEs to constantly upgrade their quality standards in products and processes.

- To develop professionals in the area of ZED manufacturing and certification.

- To support the 'Make in India' campaign

- Implementation Agency of the Scheme:

- Quality Council of India (QCI) has been appointed as the National Monitoring & Implementing Unit (NMIU) for implementation of ZED.

- The Quality Council of India (QCI) is a non-profit organization registered under the Societies Registration Act of 1860.

- Quality Council of India (QCI) has been appointed as the National Monitoring & Implementing Unit (NMIU) for implementation of ZED.

- Other Initiatives to Promote MSMEs Sector:

- Prime Minister’s Employment Generation programme (PMEGP)

- Scheme of Fund for Regeneration of Traditional Industries (SFURTI)

- A Scheme for Promoting Innovation, Rural Industry & Entrepreneurship (ASPIRE)

- Interest Subvention Scheme for Incremental Credit to MSMEs

- Credit Guarantee Scheme for Micro and Small Enterprises

- CHAMPIONS portal

MSMEs & Indian Economy

- They are the growth accelerators of the Indian economy, contributing about 30% of the country’s Gross Domestic Product (GDP).

- In terms of exports, they are an integral part of the supply chain and contribute about 48% of the overall exports.

- MSMEs also play an important role in employment generation, as they employ about 110 million people across the country.

- Interestingly, MSMEs are intertwined with the rural economy as well, as more than half of the MSMEs operate in rural India.

Governance

India Young Water Professional Programme

Why in News

Recently, the Ministry of Jal Shakti has launched the first edition of the India Young Water Professional Programme.

- Its launch marks a significant milestone in Australia-India Water relationship. This Programme looks to prepare future water leaders.

Key Points

- About:

- This program has been taken up under the National Hydrology Project. It will be implemented by Australia India Water Centre (a consortium of Australian and Indian universities).

- It is focused on Engaged Training and Learning Model. The Program will aim to achieve its objectives through the 70-20-10 framework, which states that three types of experience are required to learn:

- Experience 70% (learn and develop on the job)

- Exposure 20% (learn and develop through others)

- Education 10% (learn and develop through formal training)

- It also focuses on gender equality and diversity, because sustainable water management can only benefit from the views and skills of all members of society.

- It is outcome-driven and the participants will be having certain tools and techniques by the time they are finished with the Programme.

- Based on the success of this edition, a second phase of YWP will be planned in the later half of the year 2022.

- Aim:

- It aims to provide a structured platform for capacity building with strategic and long-term investment to support the water management reforms in India.

- To equip water professionals with the necessary skills, knowledge, behaviours and networks that will better enable them to contribute to the development and management of water resources in India, and to address the competency needs and priorities of the water sector in India.

- Significance:

- It will help in breaking the silos of surface water vs groundwater and participants will learn to take a comprehensive view of water resources management.

- Related Initiatives:

National Hydrology Project

- About

- It was started in 2016 as a Central Sector Scheme by the Ministry of Jal Shakti and is supported by the World Bank.

- Aim:

- To improve the extent, reliability and accessibility of water resources information.

- To strengthen the capacity of targeted water resource management institutions in India.

- To facilitate acquisition of reliable information efficiently which would pave the way for an effective water resource development and management.

- Project Beneficiaries:

- Central and state implementing agencies responsible for surface and/or groundwater planning and management, including river basin organizations.

- Users of the Water Resources Information System (WRIS) across various sectors and around the World.

- WRIS focuses on ensuring increase in public and stakeholders awareness about the present status of water resources and the need for its effective management by attracting their interest in leading towards the holistic goal of water security.