Indian Economy

Economic Stimulus-I

Why in News

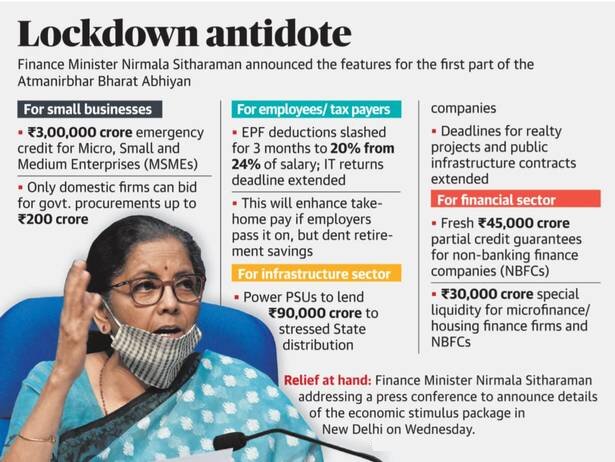

Recently, the Union Finance Minister announced liquidity measures for businesses, especially Micro, Small and Medium enterprises (MSMEs), as part of the first tranche of Atmanirbhar Bharat Abhiyan.

- The announced measures also form a part of the Rs. 20-lakh-crore economic stimulus package to deal with the Covid-19 pandemic.

- This economic stimulus includes both liquidity financing measures and credit guarantees.

Key Points

- Salaried Workers and Taxpayers:

- The deadline for income tax returns for the financial year 2019-20 has been extended, with the due date now pushed to November 30, 2020.

- The rates of Tax Deduction at Source (TDS) and Tax Collection at Source (TCS) have been cut by 25% for the FY 2020-21.

- The statutory Provident Fund (PF) payments have been reduced from 12% to 10% for both employers and employees for the next three months.

- NBFCs, Housing Finance Companies and Microfinance Institutions:

- Many of these institutions serve the MSME sector financially and will be supported through a Rs.30,000 crore investment scheme fully guaranteed by the Centre.

- Further, an expanded partial credit guarantee scheme worth Rs.45,000 crores also has been offered, of which the first 20% of losses will be borne by the Centre.

- For instance, if the government provides a 100% credit guarantee up to an amount of Rs 1 crore to a firm, it means that a bank can lend Rs 1 crore to that firm; in case the firm fails to pay back, the government will repay all of Rs 1 crore. If this guarantee was for the first 20% of the loan, then the government would guarantee to pay back only Rs 20 lakh.

- Power Distribution Companies:

- As these companies are facing an unprecedented cash flow crisis and thus will receive Rs. 90,000 crore liquidity injection.

- Real Estate and Contractors:

- Contractors (those dealing with the construction/ works and goods and services contracts) will get a six month extension for completion of work from all Central agencies, and also get partial bank guarantees to ease their cash flows.

- Registered real estate projects will get a six-month extension for registration and completion of Real Estate Projects under Real Estate (Regulation and Development) Act (RERA) with Covid-19 to be treated as a “force majeure” event.

- A Force Majeure (FM) means extraordinary events or circumstances beyond human control such as an event described as an Act of God (like a natural calamity).

- Global Tenders to be Disallowed:

- Indian MSMEs and other companies have often faced unfair competition from foreign companies and would be difficult to compete in the future due to Covid-19 pandemic.

- Therefore, global tenders will be disallowed in government procurement tenders upto Rs 200 crores.

Liquidity Measures for Medium, Small and Micro Enterprises (MSMEs)

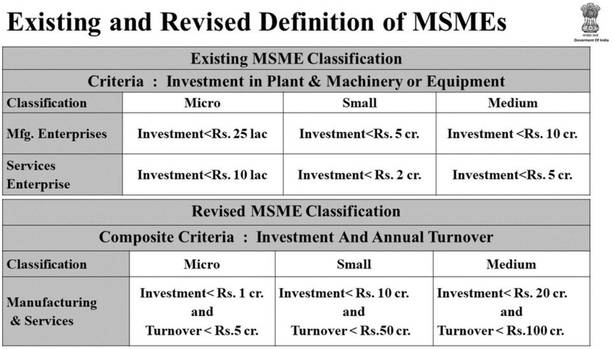

- New Definition of MSMEs:

- The definition of an MSMEs has been expanded to allow for higher investment limits and the introduction of turnover-based criteria.

- Earlier MSMEs were defined on the basis of the limit of investment in machinery or equipment.

- The ‘turnover’ is the more efficient way to identify an MSME as it allows a lot of firms, especially in the services sector like mid-sized hospitals, hotels and diagnostic centres to be eligible for benefits as an MSME.

- There will be no difference between a manufacturing MSME and a services MSMEs.

- The definition of an MSMEs has been expanded to allow for higher investment limits and the introduction of turnover-based criteria.

- Infusion of Liquidity:

- Instead of directly infusing money into the economy or giving it directly to MSMEs,the government will offer credit guarantees for MSMEs.

- Emergency Credit Line: The collateral free loans of worth Rs. 3 lakh crores will be available for MSMEs. It will ensure access to working capital to resume business activity and safeguard jobs for 45 lakh MSMEs.

- The above measure is available for MSMEs that have an already outstanding loan of Rs. 25 crore or those with a turnover less than Rs 100 crore.

- The loans will have a tenure of 4 years and they will have a moratorium of 12 months (that is, the payback starts only after 12 months).

- Subordinate Debt Scheme : The loans of amount Rs 20,000 crore will be provided to MSMEs that were already categorised as “stressed”, or struggling to pay back.

- In this case, the government provides partial guarantee.

- Equity Infusion: Fund of Funds with corpus of Rs 10,000 crores will be set up which will provide equity funding for MSMEs with growth potential and viability.

Credit Guarantees to MSMEs

- Description:

- A Credit Guarantee Schemes (CGS) by the government assures the bank that its loan will be repaid by the government in case the MSME falters.

- Reasons for Introduction of CGS:

- Though, there was an option to pump liquidity via the banks but banks suspect any new loans due to rising Non-Performing Assets (NPAs).

- Thus, the government faced a dual problem where banks had the money but were not willing to lend to the credit-starved sections of the economy, while the government itself did not have enough money to directly help the economy.

- The credit guarantees solve dual issues faced by the government.

- Implications:

- Such CGS creates moral hazards as borrowers remain assured of paying back and the lender remains assured of receiving credit amounts. Subsequently, the government is forced to pay the amount.

Overall Implications of Economic Stimulus

- The measures announced during the first tranche of the economic stimulus focuses majorly on supply side measures, aimed at activating businesses in the MSME, real estate, NBFC sectors.

- In general, stimulus measures are aimed at boosting demand either by government spending on its own account or increasing disposable incomes of households through cash transfers or tax concessions.

- Indian economy needs both supply and demand side measures for the revival.

Internal Security

Army’s Proposal of 3 year Tenure for Civilians

Why in News

Recently, the Army has proposed 3 years of voluntary Tour of Duty (ToD) for civilians on a trial basis.

Key Points

- Proposal:

- The Army plans to take civilians on a three- year ‘Tour of Duty’ (ToD) or ‘Three-year Short Service’ on a trial basis to serve in the force as both officers and Other Ranks (ORs).

- The proposal suggests several measures to incentivise this scheme like a tax-free income for three years and a token lump sum at the end of three years of about Rs.5-6 lakh for officers and Rs.2-3 lakh for ORs.

- However, there will be no severance packages, resettlement courses, professional encashment training leave, ex-Servicemen status, ex-Servicemen Contributory Health Scheme (ECHS) for the ToD officers and other ranks.

- The proposal is a shift from the concept of permanent service/job in the Armed Forces, towards internship/temporary experience for three years.

- If approved it will be a voluntary engagement and there will be no dilution in selection criteria.

- The Army hopes that this would attract individuals from the best colleges, including the Indian Institute of Technology.

- Rationale behind the Proposal:

- There is a "resurgence of nationalism and patriotism" in the country and the proposal attempts to tap the feeling of the youths who do not want to join the Army as a profession but wish to experience military life for a temporary duration.

- Expected Benefits to the Army:

- Reduction of Financial Burden: The cost of a three-year service per officer will be a fraction of the cost incurred on Short Service Commission (SSC) officers,which includes cost of pre-commission training, pay, allowances, gratuity, leave encashment among others.

- Modernisation of Army: The reduced financial burden will shift the focus towards modernisation of the army in terms of training,arms and equipment.

- Expected Benefits to the Youth:

- It will not only provide a job with higher salary but also ensures a placement in corporate sectors after retirement as the corporate sector will prefer to hire such youths rather than fresh graduates.

- It has been seen that corporates favour individuals who have been trained by the military at 26 or 27 years of age.

- Benefits to the Nation:

- It will help to channelise the youth energy into positive utilisation of their potential.

- Rigorous military training and habits inculcation will lead to healthy citizenry.

- The entire nation will benefit from trained, disciplined, confident, diligent and committed young men or women who have done the three-year service.

International Relations

US-Israel Talks on West Bank Annexation

Why in News

Recently, US Secretary of State Mike Pompeo met Israeli Prime Minister Benjamin Netanyahu to discuss Israel's plans to annex parts of the West Bank.

- Pompeo’s visit was exempted from Israel’s mandatory two-week quarantine for arrivals and shut borders due to the Covid-19 pandemic.

- For Israel, this visit was an indication of the strength of its alliance with the USA and the talks focused on discussions on annexation, shared concerns about Iran, the battle against the coronavirus, Israel’s incoming government and threats from Israel’s ties with China.

- Israel-China Ties: The US has reportedly been pressuring Israel to rethink a bid by a Hong Kong company to build a massive desalination facility.

Key Points

- Plans for Annexation of West Bank

- Israeli hard-liners are eager to unilaterally redraw the Mideast map before November’s US Presidential Election.

- The presumptive Democratic nominee, Joe Biden, is in the opposition of unilateral annexation plans by Israel.

- Annexation would give Donald Trump an accomplishment to shore up his pro-Israel base, particularly politically influential pro-Israel evangelical (of or according to the teaching of the gospel or the Christianity) Christian voters.

- These voters believe in the notion that God promised the land to Jews and it should be returned to them.

- Background

- The Israel-Palestine Conflict can be traced back to 1917.

- Mideast War, 1967: It is also known as the six-day war or Third Arab-Israeli war. Israel captured the West Bank, east Jerusalem and Gaza Strip in the war. The Palestinians seek these territories for a future independent state. In the decades since, Israel has built settlements in the West Bank and east Jerusalem that now house nearly 700,000 Israelis. Most of the international communities consider these settlements a violation of international law and obstacles to peace.

- Mideast Plan or Middle East Peace Plan: It was unveiled by Trump in January, 2020. Under it, the Palestinians would have a limited statehood contingent on a list of stringent requirements while Israel would annex some 30% of the West Bank.

- The Palestinians rejected the plan and threatened to withdraw from key provisions of the Oslo Peace Accords, which are a series of agreements between Israel and the Palestinians signed in the 1990s.

- The Trump administration believes that Israel’s West Bank settlements are consistent with international law and supports the annexation of West Bank territory, as long as Israel agrees to enter peace talks with the Palestinians.

- Criticism

- The annexation will trigger widespread international condemnation because it will crush already faint Palestinian hopes of establishing a viable state on the lands captured by Israel in the Mideast war.

- The Arab League has mentioned the annexation as a war crime.

- The European Union (EU) and other individual member states, have warned of tough consequences if Israel moves forward in the annexation process.

- India’s Stand

- India was one of the few countries to oppose the United Nations’ partition plan in November 1947, echoing its own experience during independence a few months earlier.

- India recognised Israel in 1950 but it is also the first non-Arab country to recognise Palestine Liberation Organisation (PLO) as the sole representative of the Palestinians. India is also one of the first countries to recognise the statehood of Palestine in 1988.

- In 2014, India favored the United Nations Human Rights Council’s (UNHRC) resolution to probe Israel’s human rights violations in Gaza. Despite supporting the probe, India abstained from voting against Israel in UNHRC in 2015.

- As a part of Link West Policy, India has de-hyphenated its relationship with Israel and Palestine in 2018 to treat both the countries mutually independent and exclusive.

- In June 2019, India voted in favor of a decision introduced by Israel in the UN Economic and Social Council (ECOSOC) that objected to granting consultative status to a Palestinian non-governmental organization.

Biodiversity & Environment

Energy Transition Index: WEF

Why in News

Recently, the World Economic Forum (WEF) has released the annual rankings of the global Energy Transition Index.

- The index benchmarks 115 economies on the current performance of their energy systems across economic development and growth, environmental sustainability and energy security and access indicators and their readiness for transition to secure, sustainable, affordable and inclusive energy systems.

Key Points

- Data Analysis:

- Sweden has topped the Index for the third consecutive year and is followed by Switzerland and Finland in the top three.

- France (8th) and the UK (7th) are the only G20 countries in the top ten.

- Only 11 out of 115 countries have made steady improvements in ETI scores since 2015. Argentina, China, India and Italy are among the major countries with consistent annual improvements.

- In China (78th), problems of air pollution have resulted in policies to control emissions, electrify vehicles and develop the world’s largest capacity for solar photovoltaic (SPV) and onshore wind power plants.

- Scores for the US, Canada, Brazil and Australia were either stagnant or declining.

- The US ranks outside the top 25% for the first time, primarily due to the uncertain regulatory outlook for energy transition.

- Performance Analysis:

- The results for 2020 show that 75% of countries have improved their environmental sustainability.

- It is a result of multifaceted, incremental approaches, including pricing carbon, retiring coal plants ahead of schedule and redesigning electricity markets to integrate renewable energy sources.

- Its study measuring readiness for clean energy transition in 115 economies showed that 94 have made progress since 2015.

- The greatest overall progress is observed among emerging economies.

- The results for 2020 show that 75% of countries have improved their environmental sustainability.

- India’s Ranking and Reasons:

- India has moved up two positions to rank 74th with improvements in all three dimensions of the energy triangle namely:

- Economic development and growth.

- Energy access and security.

- Environmental sustainability.

- For India, gains have come from a government-mandated renewable energy expansion programme i.e. to add 275 GW by 2027.

- India has also made significant strides in energy efficiency through bulk procurement of LED bulbs, smart meters and programs for labelling of appliances. Similar measures are being experimented to drive down the costs of electric vehicles (EVs).

- It indicates a strong positive trajectory, driven by strong political commitment and an enabling policy environment.

- India has moved up two positions to rank 74th with improvements in all three dimensions of the energy triangle namely:

- Impact of Covid-19

- Covid-19 risks cancelling out recent progress in transitioning to clean energy, with unprecedented falls in demand, price volatility and pressure to quickly mitigate socioeconomic costs placing the near-term trajectory of the transition in doubt.

- Suggestions

- Policies, roadmaps and governance frameworks for energy transition at national, regional and global levels need to be more robust and resilient against external shocks.

- The pandemic offers an opportunity to consider unorthodox intervention in the energy markets and global collaboration to support a recovery that accelerates the energy transition once the crisis subsides.

- The economic recovery packages (like the announcement of the Pradhan Mantri Gareeb Kalyan Yojana by India), introduced by the governments can accelerate the transition to clean energy, by helping countries scale their efforts towards sustainable and inclusive energy systems, if implemented with long-term strategies.

World Economic Forum

- It is a Swiss nonprofit foundation established in 1971, based in Geneva, Switzerland.

- Recognized by the Swiss authorities as the international institution for public-private cooperation, its mission is cited as, "committed to improving the state of the world by engaging business, political, academic, and other leaders of society to shape global, regional, and industry agendas".

- Major reports published by WEF:

- Global Competitiveness Report

- Global IT Report

- Global Gender Gap Report

- Global Risk Report

- Global Travel and Tourism Report

Indian Economy

Revenue Loss to States

Why in News

According to estimates from the India Ratings and Research (a credit rating agency), the Covid-19 lockdown has caused 21 major States to suffer a collective revenue loss of about Rs. 97,100 crore for the month of April.

Key Points

- The lockdown caused disruptions to production, supply-chains, trade and the total washout of activities in aviation, tourism, hotels and hospitality.

- The disruption caused has taken place with such a speed and scale that even if the lockdown is lifted, economic activity is unlikely to normalise in near future.

- Although, during the lockdown, nearly 40% of the economy was functional as economic activities defined as essentials were allowed to operate.

- This means that despite the lockdown some amount of revenue did accrue to the states. But despite this, the states faced significant revenue loss in April.

- The lockdown has a more paralyzing impact on the states, which have a high share of own revenue in the total revenue mix.

- For example, for Goa, Gujarat, Haryana, Karnataka, Kerala, Maharashtra, Tamil Nadu and Telangana 65%-76% of their revenue comes from their own sources.

- Both Union government and State governments are struggling due to the dried-up cash inflow.

- But the problems of the States are more precarious because of the actual battle against the Covid-19 and the associated expenditure being incurred by them.

- Under the current circumstance, there is a fair amount of uncertainty regarding the quantum and timings of the states' receivables from the Centre. Their own sources of revenue have also fallen to abysmally low levels.

- This is pushing states to adopt austerity measures and combine it with exploring new/more ways of generating revenues.

- Austerity measures include action by a government to reduce the amount of money it spends.

- Conclusion

- The situation may improve somewhat in May 2020 due to the easing of some restrictions–

- Allowing the liquor sale.

- Raising the excise duty on liquor.

- Some states have raised VAT on petrol and diesel.

- The situation may improve somewhat in May 2020 due to the easing of some restrictions–

Note

- Sources of State government revenue:

- States’ Own Tax Revenue (SOTR),

- Share in central taxes,

- States’ Own Non-Tax Revenue (SONTR)

- Grants from the Centre.

- States’ own revenue mainly comes from seven heads–

- State Goods and Services Tax (SGST), State Value Added Tax (VAT)- mostly on petroleum products, State excise-mostly on liquor, stamps and registration fees, vehicle tax, tax and duty on electricity, and own non-tax revenue.

Agriculture

Direct Seeding of Rice

Why in News

Due to labour shortage in two granary states of Punjab and Haryana, farmers are now being encouraged to adopt ‘Direct Seeding of Rice’ (DSR) in place of conventional transplanting.

- Covid-19 pandemic has led the labourers to reverse migrate to their villages, which has created a shortage of labourers.

Key Points

- Normal Transplanting of Paddy vs Direct Seeding of Rice

- Transplanting Paddy:

- In transplanting paddy, farmers prepare nurseries where the paddy seeds are first sown and raised into young plants.

- The nursery seed bed is 5-10% of the area to be transplanted.

- These seedlings are then uprooted and replanted 25-35 days later in the puddled field.

- Direct Seeding of Rice (DSR):

- In DSR, the pre-germinated seeds are directly drilled into the field by a tractor-powered machine.

- There is no nursery preparation or transplantation involved in this method.

- Farmers have to only level their land and give one pre-sowing irrigation.

- Transplanting Paddy:

- Protection against the weeds

- Transplanting Method: In transplanting for the first three weeks or so, the plants have to be irrigated almost daily to maintain a water depth of 4-5 cm.

- Water prevents growth of weeds by denying them oxygen in the submerged stage, whereas the soft ‘aerenchyma tissues’ in paddy plants allow air to penetrate through their roots. Water, thus, acts as a herbicide for paddy.

- DSR Method: In DSR as flooding of fields is not done during sowing, chemical herbicides are used to kill weeds.

- Transplanting Method: In transplanting for the first three weeks or so, the plants have to be irrigated almost daily to maintain a water depth of 4-5 cm.

- Advantage with Direct Seeding of Rice

- Water savings.

- Less numbers of labourers required.

- Saves labour cost.

- Reduce methane emissions due to a shorter flooding period and decreased soil disturbance compared to transplanting rice seedlings.

- Drawbacks of Direct Seeding of Rice

- Non-availability of herbicides.

- The seed requirement for DSR is also high, 8-10 kg/acre, compared to 4-5 kg/acre in transplanting.

- Further, laser land levelling is compulsory in DSR. This is not so in transplanting.

- The sowing needs to be done timely so that the plants have come out properly before the monsoon rains arrive.

Rice

- Rice is a staple food for the overwhelming majority of the population in India.

- It is a kharif crop which requires high temperature, (above 25°C) and high humidity with annual rainfall above 100 cm.

- In the areas of less rainfall, it is grown with the help of irrigation.

- In southern states and West Bengal the climatic conditions allow the cultivation of two or three crops of rice in an agricultural year.

- In West Bengal farmers grow three crops of rice called ‘aus’, ‘aman’ and ‘boro’.

- About one-fourth of the total cropped area in India is under rice cultivation.

- Leading producer states: West Bengal, Uttar Pradesh, and Punjab.

- High Yielding States: Punjab, Tamil Nadu, Haryana, Andhra Pradesh, Telangana, West Bengal and Kerala.

- Punjab and Haryana are not traditional rice growing areas.

- Rice Cultivation in the irrigated areas of Punjab and Haryana was introduced in the 1970s following the Green Revolution.

- Almost the entire land under rice cultivation in Punjab and Haryana is irrigated.

- India contributes 21.6% of rice production in the world and ranked second after China in 2016.

Social Justice

Devices for Disabled and Elderly

Why in News

The Department of Science and Technology has helped in developing various assistive tools, devices and technological solutions to mitigate the impact of Covid-19 among Divyangjan and Elderly through a programme on Technology Interventions for Disabled and Elderly (TIDE).

Key Points

- Technology Interventions for Disabled and Elderly (TIDE):

- It is the Department of Science and Technology’s (DST) focused initiative on Science and Technology (S&T) interventions for the benefit of elderly and also the differently-abled Divyangjan persons in the country.

- In addition to improving the quality-of-life of the target population with appropriate and/or innovative scientific technological interventions, TIDE also aims at giving them autonomy, and independence through holistic development by creating requisite enabling environments for their empowerment.

- Proposals on Research and Development for technological solutions with multidisciplinary approach to improve the quality of life of Elderly population and Divyangjan and in making them self sufficient are considered for financial assistance under this programme.

- Latest Tools and Devices to tackle Covid-19:

- e-Tool:

- It has been developed by Rajalakshmi Engineering College, Chennai. It aims to create awareness and impart health and hygiene related information along with education and entertainment through tablets and mobiles.

- It is expected to overcome loneliness of the persons with intellectual disabilities, due to Covid-19 pandemic.

- Wearable sensor device:

- It is a band which has been developed by PSG College of Technology, Coimbatore to remotely monitor the activities of Elderly and Divyangjan staying alone or those who happen to be under quarantine or isolation wards.

- The device will help the elderly to get outcomes regarding the improvement in muscle strength, flexibility and endurance without physical interventions from doctors and physiotherapists.

- e-Tool:

Important Facts For Prelims

Integrated Battle Groups

Why in News

Recently, the Army chief said that a comprehensive testing of the Integrated Battle Groups (IBGs) has concluded but its roll out has been delayed due to the coronavirus pandemic.

Key Points

- IBGs are brigade sized agile self-sufficient combat formations which can swiftly launch strikes against adversaries.

- IBGs can be mobilised within 12-48 hours based on the location.

- Each IBG would be organised on the basis of Threat, Terrain and Task and resources to each battle group will be allocated on the basis of 3Ts.

- For example, the composition of every IBG would differ on the basis of the terrain where it is located i.e. an IBG operating in a desert needs to be constituted differently from one operating in the mountains.

- Each IBG will be headed by a Major General.

- The integrated units for the border will be all-encompassing, with artillery, armoured, combat engineers and signal units.

- IBGs have been classified into- Defensive and Offensive.

- Defensive IBGs would hold ground at vulnerable points or where enemy action is expected.

- Offensive IBGs have the ability to quickly mobilise and make thrust into enemy territory for strikes.

- After years of deliberations, the Army decided to raise the IBGs along the borders with China and Pakistan that will help it carry out swift strikes in case of a war.

Important Facts For Prelims

River Nila

Why in News

Recently, the Ministry of Tourism organised a webinar- ‘Exploring River Nila’ as a part of the Dekho Apna Desh Webinar series.

Key Points

- River Nila is also known as Bharathapuzha and Ponnani.

- Origin: Amaravathipuzha originating from Thrimoorthy Hills of Anamalais in Tamil Nadu joins with Kalpathipuzha at Parali in Palakkad District and forms Nila.

- Drainage Area: Kerala and Tamil Nadu.

- It flows westward through Palakkad Gap (most prominent discontinuity in the western ghats) and drains into the Arabian Sea.

- Main Tributaries: Kannadipuzha (Chitturpuzha), Kalpathipuzha (Korapuzha), Gayathripuzha and Thuthapuzha

- Malampuzha dam is the largest among the reservoirs built across Bharathapuzha.

Important Facts For Prelims

National Biomedical Resource Indigenization Consortium

Why in News

Recently, the Department of Biotechnology (DBT) has launched a National Biomedical Resource Indigenization Consortium (NBRIC) to drive indigenous innovation focused on developing reagents (used in chemical reactions), diagnostics, vaccines and therapeutics for Covid-19.

- It is a Public Private Partnership (PPP) hosted and led by the Centre for Cellular and Molecular Platforms (C-CAMP).

Key Points

- It is a ‘Make in India’ initiative for biomedical research and innovative products, towards promoting import substitution and exports.

- It aims to establish a nation-wide collaborative platform for convergence of research, product resources and services towards developing reagents, diagnostics, vaccines, and therapeutics across India.

- It identifies providers/manufacturing enterprises of crucial bio-medical resources and connects them with policy makers as well as with other stakeholders from public and private sectors.

Centre for Cellular and Molecular Platforms

- Centre for Cellular and Molecular Platforms (C-CAMP) is one of the centers for technology-based innovation and entrepreneurship in the field of life sciences under the Department of Biotechnology (DBT).

- It intends to develop state-of-the-art technologies and to provide training on these technologies to academia and industry.