Governance

Progress Report of Commission for Sub-categorisation of OBCs

Why in News

Recently, the Centre has extended the tenure of the Rohini Commission until 31st July, 2021 to submit its report on Sub-categorisation of Other Backward Classes (OBCs).

- The Rohini Commission was constituted in October 2017 under Article 340 of the Constitution. At that time, it was given 12 weeks to submit its report, but has been given several extensions since, the latest one being the 10th.

- Article 340 deals with the appointment of a commission to investigate the conditions of backward classes.

Key Points

- Need for Committee for Sub-categorisation of OBCs:

- Ensuring Equality:

- It had been constituted to complete the task of sub-categorising 5000-odd castes in the central OBC.

- OBCs are granted 27% reservation in jobs and education under the central government.

- The need for sub-categorisation arises out of the perception that only a few affluent communities among the over 2,600 included in the Central List of OBCs have secured a major part of this 27% reservation.

- Sub-categorisation would ensure more equitable distribution of opportunities in central government jobs and educational institutions.

- It had been constituted to complete the task of sub-categorising 5000-odd castes in the central OBC.

- Recommended by NCBC:

- In 2015, the National Commission for Backward Classes (NCBC) had recommended that OBCs should be categorised into extremely backward classes, more backward classes and backward classes.

- The benefits of the reservation in OBCs are being cornered mostly by the dominant OBC groups over the years so there is a need to recognise sub-quotas for the extremely backward classes within the OBCs.

- NCBC has the authority to examine complaints and welfare measures regarding socially and educationally backward classes.

- Ensuring Equality:

- Commission’s Terms of Reference (ToR):

- Examining Inequality: To examine the extent of inequitable distribution of benefits of reservation among the castes or communities included in the broad category of OBCs with reference to such classes included in the Central List.

- Determining Parameters: To work out the mechanism, criteria, norms and parameters in a scientific approach for sub-categorisation within such OBCs.

- Classification: To take up the exercise of identifying the respective castes or communities or sub-castes or synonyms in the Central List of OBCs and classifying them into their respective sub-categories.

- Eliminating Errors: To study the various entries in the Central List of OBCs and recommend correction of any repetitions, ambiguities, inconsistencies and errors of spelling or transcription.

- Challenges Before the Commision:

- Data Deficiency:

- Absence of data for the population of various communities to compare with their representation in jobs and admissions.

- Delaying of Survey:

- It was decided in Census 2021, data of OBCs will also be collected, but no consensus has been reached regarding enumeration of OBCs in the Census.

- Data Deficiency:

- Findings of the Commision Until Now:

- In 2018, the Commission analysed the data of 1.3 lakh central jobs given under OBC quota over the preceding five years.

- It also analysed OBC admissions to central higher education institutions, including universities, IITs, NITs, IIMs and AIIMS, over the preceding three years. The findings were:

- 97% of all jobs and educational seats have gone to just 25% of all sub-castes classified as OBCs.

- 24.95% of these jobs and seats have gone to just 10 OBC communities.

- 983 OBC communities (37% of the total) have zero representation in jobs and educational institutions.

- 994 OBC sub-castes have a total representation of only 2.68% in recruitment and admissions.

- In mid- 2019, the Commission informed that it is ready with the draft report (on sub-categorisation). It is widely understood that the report could have huge political consequences and face a judicial review so it's still not released.

- OBC Recruitment in the Central Government Jobs (as per the Report submitted by the Department of Personnel and Training to NCBC in 2020):

- From the data of 42 ministries/departments, OBC representation in Central government jobs was found out to be:

- 16.51 % in Group-A central government services.

- 13.38 % in Group-B central government services.

- 21.25 % in Group-C (excluding safai karamcharis).

- 17.72 % in Group-C (safai karamcharis).

- Regarding NFS:

- NCBC also found out that a number of posts reserved for OBCs were being filled by people of general category as OBC candidates were declared “NFS” (None Found Suitable).

- From the data of 42 ministries/departments, OBC representation in Central government jobs was found out to be:

- Revision of Creamy Layer:

- Even the revision of the income limit for the creamy layer for the OBCs is under consideration.

Note

- Recently, the Supreme Court of India has reopened a similar legal debate on sub-categorisation of Scheduled Castes and Scheduled Tribes for reservations, what is commonly referred to as “quota within quota” for SCs and STs.

Indian Polity

Right to Privacy & Legitimate State Interest

Why in News

Recently, the Central government has stated that though the right to privacy is held to be a sacred fundamental right, the veil of privacy can be lifted for legitimate State interest.

- The government was responding to a petition seeking permanent halting of the Centre’s surveillance projects- Centralized Monitoring System (CMS), Network Traffic Analysis (NETRA) and National Intelligence Grid (NATGRID).

Centre’s Surveillance Projects

- Centralized Monitoring System:

- The government has set up a Centralised Monitoring System (CMS) for lawful interception and monitoring of mobile phones, landlines and internet traffic through mobile networks.

- Network Traffic Analysis:

- NETRA (or Network Traffic Analysis) is one such effort being taken by the Indian Government to filter suspicious keywords from messages in the network

- National Intelligence Grid:

- First conceptualised in 2009, NATGRID (National intelligence Grid) seeks to become the one-stop destination for security and intelligence agencies to access databases related to immigration entry and exit, banking and telephone details of a suspect on a “secured platform”.

Key Points

- Petitioner's Arguments:

- The government’s surveillance projects enable government authorities to intercept, store, analyse and retain telephone and internet communications data in bulk in violation of the fundamental right to privacy.

- These systems allow the government a 360 degree surveillance of all citizens, including judges.

- It sought creation of a permanent and independent oversight authority - judicial or parliamentary - for authorising and reviewing interception and monitoring orders or warrants issued under the Telegraph Act, 1885 and the IT Act, 2000.

- Government’s Arguments:

- Lawful interception, monitoring or decryption of any messages or information stored in any computer resources is done by authorised agencies after due approval in each case by the competent authority.

- There is no blanket permission to any agency for interception or monitoring or decryption; and permission from the competent authority (Union Home Secretary) is required.

- It contended there is sufficient mechanism of oversight in place in the form of a Review Committee, headed by the Cabinet Secretary at the centre and chief secretary at the state level, which examines if the approval has been given in accordance with the law.

- When the Review Committee is of the opinion that the directions are not in accordance with the provisions, it may set aside the directions and order for destruction of the copies of the intercepted message or class of messages.

- The grave threats to the country from terrorism, radicalization, cross-border terrorism, cybercrime, organized crime, drug cartels cannot be understated or ignored and a strong and robust mechanism for timely and speedy collection of actionable intelligence including digital intelligence, is imperative to counter threats to the national security.

- Lawful interception, monitoring or decryption of any messages or information stored in any computer resources is done by authorised agencies after due approval in each case by the competent authority.

Right to Privacy

- About:

- Generally understood that privacy is synonymous with the right to be let alone.

- The Supreme Court described privacy and its importance in the landmark decision of K.S. Puttaswamy v. Union of India in 2017 that - Right to Privacy is a fundamental and inalienable right and attaches to the person covering all information about that person and the choices that he/ she makes.

- The right to privacy is protected as an intrinsic part of the right to life and personal liberty under Article 21 and as a part of the freedoms guaranteed by Part III of the Constitution.

- Restrictions (as stated in the Judgement):

- The right may be restricted only by state action that passes each of the three tests:

- First, such state action must have a legislative mandate;

- Second, it must be pursuing a legitimate state purpose; and

- Third, it must be proportionate i.e., such state action- both in its nature and extent, must be necessary in a democratic society and the action ought to be the least intrusive of the available alternatives to accomplish the ends.

- The right may be restricted only by state action that passes each of the three tests:

Government Steps to Protect Privacy

- Draft Personal Data Protection Bill 2019:

- The Bill regulates the processing of personal data of individuals (data principals) by government and private entities (data fiduciaries) incorporated in India and abroad. Processing is allowed if the individual gives consent, or in a medical emergency, or by the State for providing benefits.

- B N Srikrishna Committee:

- Government appointed a committee of experts on data protection under the chairmanship of Justice B N Srikrishna that submitted its report in July 2018.

- Information Technology Act, 2000:

- The IT Act provides for safeguard against certain breaches in relation to data from computer systems. It contains provisions to prevent the unauthorized use of computers, computer systems and data stored therein.

Indian Economy

Direct Access to G-Sec Market for Retail Investors: RBI

Why in News

Recently, the Reserve Bank of India has proposed to allow retail investors to open gilt accounts with the central bank to invest in Government securities (G-secs) directly and without the help of intermediaries.

- Retail Investor is a non-professional investor who buys and sells securities or funds that contain a basket of securities such as mutual funds and Exchange Traded Funds (ETFs).

Government Security

- A G-Sec is a tradable instrument issued by the Central Government or the State Governments.

- It acknowledges the Government’s debt obligation. Such securities are short term (usually called treasury bills, with original maturities of less than one year- presently issued in three tenors, namely, 91 day, 182 day and 364 day) or long term (usually called Government bonds or dated securities with original maturity of one year or more).

- In India, the Central Government issues both treasury bills and bonds or dated securities while the State Governments issue only bonds or dated securities, which are called the State Development Loans (SDLs).

- G-Secs carry practically no risk of default and, hence, are called risk-free gilt-edged instruments.

- Gilt-edged securities are high-grade investment bonds offered by governments and large corporations as a means of borrowing funds.

Key Points

- Background:

- The g-sec market is dominated by institutional investors such as banks, mutual funds, and insurance companies. These entities trade in lot sizes of Rs. 5 crore or more.

- So, there is no liquidity in the secondary market for small investors who would want to trade in smaller lot sizes.

- About the Proposal:

- Retail investors will get online access to the government securities market – both primary and secondary – directly through the Reserve Bank.

- The primary market is where securities are created, while the secondary market is where those securities are traded by investors.

- Retail investors will be allowed to open gilt investment accounts directly with RBI. The account will be called RBI retail direct.

- Gilt Account can be compared with a bank account, except that the account is debited or credited with treasury bills or government securities instead of money.

- The direct participation of retail investors in the bidding process will be enabled through the core banking solution of Reserve Bank of India- E-kuber.

- Retail investors will get online access to the government securities market – both primary and secondary – directly through the Reserve Bank.

- Significance:

- Broaden Investor Base:

- Allowing direct retail investment in G-secs will broaden the investor base and provide retail investors with enhanced access to participate in the government securities market.

- Pioneer in Asia:

- This structural reform will place India in the select league of nations such as the USA and Brazil which have such facilities.

- India will possibly be the first in Asia to allow direct retail investment in G-secs to open up an additional investment avenue.

- Facilitate Government Borrowings:

- This measure together with relaxation in mandatory Hold To Maturity (securities that are purchased to be owned until maturity) provisions will facilitate smooth completion of the government borrowing programme in 2021-22.

- Financialise Domestic Savings:

- Allowing direct retail participation in the G-Sec market will promote financialisation of a vast pool of domestic savings and could be a game-changer in India’s investment market.

- Broaden Investor Base:

- Other Measures Taken to Increase Retail Investment in Government Securities:

- Introduction of non-competitive bidding in primary auctions.

- Non-competitive bidding means the bidder would be able to participate in the auctions of dated government securities without having to quote the yield or price in the bid.

- Stock exchanges to act as aggregators and facilitators of retail bids.

- Allowing a specific retail segment in the secondary market.

- Introduction of non-competitive bidding in primary auctions.

Indian Economy

RBI Monetary Policy 2021

Why in News

Recently, the Reserve Bank of India (RBI) has forecasted that real Gross Domestic Product (GDP), hit by the Covid pandemic in 2020-21, is expected to grow by 10.5% in 2021-22.

- RBI had previously introduced a number of measures in its Monetary Policy Report for dealing with the Covid-19 induced economic setback.

Key Points

- GDP Forecast:

- The 10.5% real GDP growth in 2021-22 forecasted by RBI will move in the range of 26.2 to 8.3% in the first half and 6% in the third quarter of 2021.

- Hit by lockdown and closures of industries, GDP had contracted by 23.9% in the June quarter of 2020-21 and fell by 7.5% in the September quarter of 2020-21.

- Real GDP is a measurement of economic output that accounts for the effects of inflation or deflation.

- The difference between nominal GDP and real GDP is the adjustment for inflation. Since nominal GDP is calculated using current prices, it does not require any adjustments for inflation.

- The 10.5% real GDP growth in 2021-22 forecasted by RBI will move in the range of 26.2 to 8.3% in the first half and 6% in the third quarter of 2021.

- Reasons for a Positive Outlook:

- Rural demand is likely to remain resilient on good prospects of agriculture.

- Urban demand and demand for contact-intensive services is expected to strengthen with the substantial fall in Covid-19 cases and the spread of vaccination.

- Consumer confidence is reviving, and business expectations of manufacturing, services and infrastructure remain upbeat.

- The fiscal stimulus under AtmaNirbhar 2.0 and 3.0 schemes of the government will likely accelerate public investment.

- The Union Budget 2021-22, with its thrust on sectors such as health and well-being, infrastructure, innovation and research, etc. should help accelerate the growth momentum.

- Unchanged Policy Rates:

- The RBI has kept the repo rate under the Liquidity Adjustment Facility (LAF) unchanged at 4%.

- The reverse repo rate under the LAF remains unchanged at 3.35% and the Marginal Standing Facility (MSF) rate and the Bank Rate at 4.25%.

- Other Decisions:

- Cash Reserve Ratio (CRR):

- The RBI has decided to restore the CRR in a non-disruptive manner from 3% to 4% in two stages by May 2021.

- Direct Retail Investment in Government Securities (G-Sec):

- The RBI has proposed to allow small investors direct access to the G-Sec platform.

- A G-Sec is a tradable instrument issued by the Central Government or the State Governments and is considered to be the safest form of investment.

- The RBI has proposed to allow small investors direct access to the G-Sec platform.

- Cash Reserve Ratio (CRR):

- Accommodative Stance:

- The Monetary Policy Committee (MPC) of the RBI also decided to continue with the accommodative stance as long as necessary to revive growth on a durable basis and mitigate the impact of Covid-19 on the economy, while ensuring that inflation remains within the target going forward.

- These decisions are in consonance with the objective of achieving the medium-term target for Consumer Price Index (CPI) inflation of 4% within a band of +/- 2 %, while supporting growth.

- The CPI calculates the difference in the price of commodities and services such as food, medical care, education, electronics etc, which Indian consumers buy for use.

- The CPI has several sub-groups including food and beverages, fuel and light, housing and clothing, bedding and footwear.

Monetary Policy Committee

- About:

- The Monetary Policy Committee is a statutory and institutionalized framework under the Reserve Bank of India Act, 1934, for maintaining price stability, while keeping in mind the objective of growth.

- Formation:

- An RBI-appointed committee led by the then deputy governor Urjit Patel in 2014 recommended the establishment of the Monetary Policy Committee.

- Chairman:

- The Governor of RBI is ex-officio Chairman of the committee.

- Members:

- The committee comprises six members (including the Chairman) - three officials of the RBI and three external members nominated by the Government of India.

- Decisions :

- Decisions are taken by majority with the Governor having the casting vote in case of a tie.

- Function:

- The MPC determines the policy interest rate (repo rate) required to achieve the inflation target (4%).

Key Terms

- Repo and Reverse Repo Rate:

- Repo rate is the rate at which the central bank of a country (Reserve Bank of India in case of India) lends money to commercial banks in the event of any shortfall of funds. Here, the central bank purchases the security.

- Reverse repo rate is the rate at which the RBI borrows money from commercial banks within the country.

- Liquidity Adjustment Facility (LAF):

- It is a tool used in monetary policy by the RBI, that allows banks to borrow money through repurchase agreements (repos) or for banks to make loans to the RBI through reverse repo agreements.

- Bank Rate:

- It is the rate charged by the RBI for lending funds to commercial banks.

- Marginal Standing Facility (MSF):

- MSF is a window for scheduled banks to borrow overnight from the RBI in an emergency situation when interbank liquidity dries up completely.

- Under interbank lending, banks lend funds to one another for a specified term.

- MSF is a window for scheduled banks to borrow overnight from the RBI in an emergency situation when interbank liquidity dries up completely.

- Cash Reserve Ratio (CRR):

- Banks are required to hold a certain proportion of their deposits in the form of cash. This minimum ratio (that is the part of the total deposits to be held as cash) is stipulated by the RBI and is known as the CRR.

Science & Technology

Square Kilometre Array Telescope

Why in News

Recently, the Square Kilometre Array Observatory (SKAO) Council held its inaugural meeting and approved the establishment of the world’s largest radio telescope.

- The new venture is being deemed as important following the collapse of one of the most prolific radio telescopes in the world, the Arecibo in Puerto Rico, in December last year.

- SKAO is a new intergovernmental organisation dedicated to radio astronomy and is headquartered in the UK.

- At the moment, organisations from ten countries are a part of the SKAO.

- These include Australia, Canada, China, India, Italy, New Zealand, South Africa, Sweden, the Netherlands and the UK.

Key Points

- Radio Telescopes:

- Radio telescope, astronomical instrument consisting of a radio receiver and an antenna system that is used to detect radio-frequency radiation between wavelengths of about 10 metres (30 megahertz [MHz]) and 1 mm (300 gigahertz [GHz]) emitted by extraterrestrial sources, such as stars, galaxies, and quasars.

- Unlike optical telescopes, radio telescopes can detect invisible gas and, therefore, they can reveal areas of space that may be obscured by cosmic dust.

- Cosmic dust consists of tiny particles of solid material floating around in the space between the stars.

- Since the first radio signals were detected in the 1930s, astronomers have used radio telescopes to detect radio waves emitted by different objects in the universe and explore it.

- According to the National Aeronautics and Space Administration (NASA), the field of radio astronomy evolved after World War II and became one of the most important tools for making astronomical observations.

- The Arecibo Telescope:

- The Arecibo telescope in Puerto Rico, which was the second-largest single-dish radio telescope in the world, collapsed in December 2020.

- China’s Sky Eye is the world's largest single-dish radio telescope.

- The telescope was built in 1963.

- Because of its powerful radar, scientists employed it to observe planets, asteroids and the ionosphere, making several discoveries over the decades, including finding prebiotic molecules in distant galaxies, the first exoplanets, and the first-millisecond pulsar.

- The Arecibo telescope in Puerto Rico, which was the second-largest single-dish radio telescope in the world, collapsed in December 2020.

- Square Kilometer Array (SKA) Telescope:

- Location:

- The telescope, proposed to be the largest radio telescope in the world, will be located in Africa and Australia.

- Development:

- The development of SKA will use the results of various surveys undertaken using another powerful telescope called the Australian Square Kilometre Array Pathfinder (ASKAP).

- ASKAP is developed and operated by the Australia’s science agency Commonwealth Scientific and Industrial Research Organisation (CSIRO).

- This telescope, which has been fully operational since February 2019 mapped over three million galaxies in a record 300 hours during its first all-sky survey conducted late last year.

- ASKAP surveys are designed to map the structure and evolution of the Universe, which it does by observing galaxies and the hydrogen gas that they contain.

- The development of SKA will use the results of various surveys undertaken using another powerful telescope called the Australian Square Kilometre Array Pathfinder (ASKAP).

- Maintenance:

- Its operation, maintenance and construction will be overseen by SKAO.

- Cost and Completion:

- The completion is expected to take nearly a decade at a cost of over 1.8 billion pounds.

- Significance:

- Some of the questions that scientists hope to address using this telescope:

- The beginning of the universe.

- How and when the first stars were born.

- The life-cycle of a galaxy.

- Exploring the possibility of detecting technologically-active civilisations elsewhere in our galaxy.

- Understanding where gravitational waves come from.

- Some of the questions that scientists hope to address using this telescope:

- Function:

- As per NASA, the telescope will accomplish its scientific goals by measuring neutral hydrogen over cosmic time, accurately timing the signals from pulsars in the Milky Way, and detecting millions of galaxies out to high redshifts.

- Location:

Internal Security

Three New Fighter Jets

Why in News

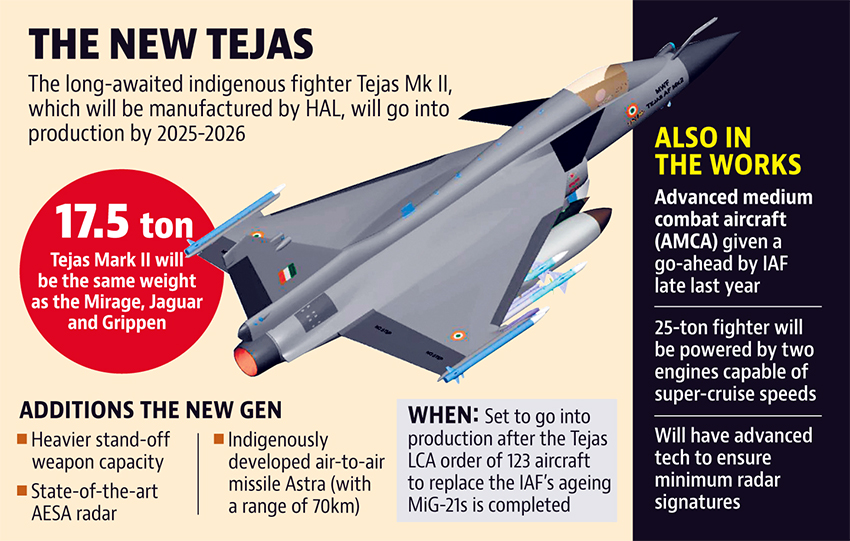

According to the Ministry of Defence, three new fighter jets will be flying by 2026, of which two will be for the Air Force and one for the Navy.

- This includes a new LCA (the Mk-2 version) and AMCA (Advanced Medium Combat Aircraft) for the Air Force and the TEDBF (Twin-Engine Deck-Based Fighter) for the Navy.

- Earlier, the Cabinet Committee on Security (CCS) had cleared a deal worth Rs. 48,000 crore for the acquisition of 83 Tejas Light Combat Aircraft (Mk-1A and Mk-1 versions) for the Indian Air Force.

Key Points

- Light Combat Aircraft (LCA) Mk-2:

- About:

- It is a 4.5 generation aircraft which will be used by the Indian Air Force.

- It is a replacement for the Mirage 2000 class of aircraft.

- It has got a bigger engine and can carry 6.5 tonnes of payload.

- The technology is already developed in Light Combat Aircraft (LCA).

- The Light Combat Aircraft (LCA) programme began in the 1980s to replace India's ageing MiG-21 fighters.

- Following the Mk-1A is the Mk-2 which will provide a high degree of manoeuverability.

- Production:

- The roll-out is planned for 2022 and first flight by 2023 and production of the Mk-2 version by 2026.

- About:

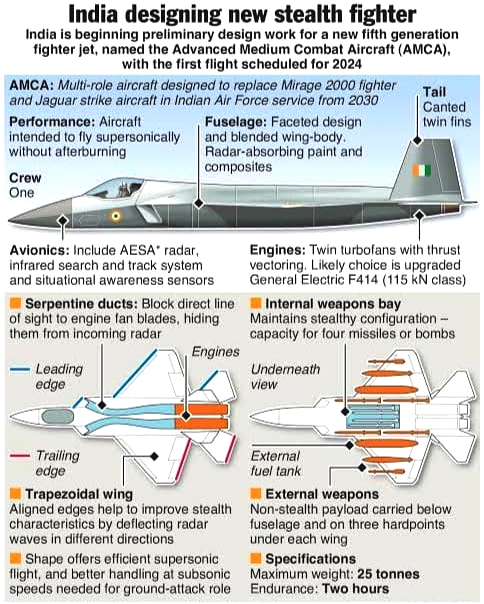

- AMCA (Advanced Medium Combat Aircraft):

- About:

- It is a fifth generation aircraft. And will be used by the Indian Air Force.

- It is a stealth aircraft, i.e. designed for stealth and unlike the LCA, which is designed for maneuverability.

- It has a unique shape to achieve low radar cross-section and has got internal carriage of weapons.

- When the external weapons are removed, this aircraft has enough fuel and weapons inside to do a very capable operational role in stealth mode.

- Range:

- It will have a range from over 1,000 km up to 3,000 km in different modes.

- Variants and Engine:

- It has two variants Mk-1 and Mk-2, While AMCA Mk-1 will have an imported engine, same as LCA Mk-2, the AMCA Mk-2 will have an indigenous engine.

- Production:

- The first flight is expected in 2024-25, followed by trials and tests. It will be in full production by 2029.

- About:

- Twin-Engine Deck-Based Fighter (TEDBF):

- About:

- This fighter will be manufactured for the Navy.

- It will replace the Navy's MiG-29K.

- It will be the first twin engine aircraft project in India that too for dedicated carrier based operations.

- It will operate from the INS Vikramaditya and the upcoming indigenous aircraft carrier.

- Weapons:

- The aircraft will be equipped predominantly with domestic weapons.

- Size and Capacity:

- It will have a maximum mach number of 1.6, service ceiling of 60,000 feet, maximum take off weight of 26 tons, unfolded wing span of 11.2 meters, folded wing span of 7.2 and and a length of 16.3 meters.

- Engine:

- While the engine configuration has not been disclosed, it could well use the same engines that power the LCA Tejas aircraft.

- Induction:

- It will be induced in the Navy by 2030.

- About:

INS Vikramaditya

- INS Vikramaditya is the country’s most powerful aircraft carrier.

- It was built in 1987.

- The Indian navy purchased the vessel in 2004 and commissioned it in November 2013 at Severodvinsk in Russia.

- It was retrofitted with a Barak missile system under joint development with Israel.

Governance

Parivar Pehchan Patra and Privacy Concerns

Why in News

Recently, there has been a privacy concern with respect to Haryana's Parivar Pehchan Patra (PPP) Scheme.

- Although enrollment under the scheme is voluntary, but the precondition of linking it to get the benefit of many essential services has raised serious concerns about the scheme.

Key Points

- Current Issue:

- Contradictory Position: Although the enrollment under the PPP is voluntary, but in case a citizen or a family wishes to apply for a service delivered by the Haryana government, the PPP ID would be required, which leaves very little choice before the residents.

- Data Abuse: In the absence of privacy laws in India, or any indication of data protection Standard Operating Procedures being followed for this exercise, there is strong possibility of potential abuse of the data collected under the PPP.

- Moreover, a lot of data which is being sought is well above and beyond what is required for the delivery of a particular service.

- Parivar Pehchan Patra (PPP) Scheme:

- Background: PPP scheme was formally launched in July 2019 to achieve Haryana government’s vision for ‘paperless’ and ‘faceless’ delivery of schemes, services and benefits offered by the state government.

- Under this, each family is considered a single unit and gets an 8-digit unique identification number, called family ID.

- Family IDs are also linked to independent schemes like scholarships, subsidies and pensions, so as to ensure consistency and reliability.

- It also enables automatic selection of beneficiaries of various schemes, subsidies and pensions.

- Objective: The primary objective of Parivar Pehchan Patra (PPP) is to create authentic, verified and reliable data of all families in Haryana.

- Background: PPP scheme was formally launched in July 2019 to achieve Haryana government’s vision for ‘paperless’ and ‘faceless’ delivery of schemes, services and benefits offered by the state government.

- Benefits of PPP:

- Family as a Unit: Union government’s Aadhaar card contains individual’s details and does not cater to the entire family as a unit.

- Although the ration card system is there, it is not updated and does not contain adequate family records.

- Smooth Service Delivery: Government services and schemes such as social security pensions, ration cards and birth, death, caste and income certificates etc. are being delivered by various departments of the Haryana government through PPP.

- Beneficial for Migrant Workers: Registration IDs are provided to those who live in Haryana but have not completed residency requirements.

- This enables the State government to provide benefits such as rations from fair price shops, benefits of labour schemes, street vendors’ support schemes, etc.

- Family as a Unit: Union government’s Aadhaar card contains individual’s details and does not cater to the entire family as a unit.

PPP vs Aadhaar

- While Aadhaar represents an individual as a unit, a PPP represents a family as a unit and this is where PPP is important because, most of our government schemes are structured around the family, not around an individual.

- For example, ration eligibility is there for the family but the family can split it into various members as long as they are above 18 years and say they are separating entitlements for all individuals.

Way Forward

- The PPP may also be linked to property records in the government database of lands and properties to prevent fraudulent transactions and clarify ownership.

- Besides, the government should start a mass campaign to make people aware about the schemes and its benefits.

- Government should also introduce measures to strengthen the security of data being collected under the Parivar Pehchan Patra (PPP) scheme.

Important Facts For Prelims

Unified Portal of Gobardhan

Why in News

Recently, a Unified Portal of Gobardhan has been launched to ensure smooth implementation of Biogas schemes/initiatives and their real time tracking.

Key Points

- Objectives:

- Ensure close coordination with various Departments/Ministries for smooth implementation of Biogas schemes/initiatives and its real time tracking.

- Coordinated by:

- The Department of Drinking Water and Sanitation under the Swachh Bharat Mission – Grameen (SBMG).

- Benefits:

- Economy: Strengthen the rural economy through a convergent approach for various Biogas projects/models and initiatives.

- ODF Plus Goals: The ODF Plus goals (solid waste management in villages, along with the collection and transportation of biodegradable and non-biodegradable waste) outlined in the Phase 2 of SBMG will depend on the performance of Gobardhan scheme to a great extent.

- Synchronisation with other Schemes: The portal will further help in achieving objectives of SATAT (Sustainable Alternative towards Affordable Transportation) aimed at setting up of Compressed Biogas (CBG) production plants and ensuring market linkage for use of biofuel in automotive fuels.

- Better Environment & Public Health: Rural India generates enormous quantities of bio-waste which can be efficiently utilized and lead to better environment and public health.

- Employment Generation & Savings: Bio-waste processing especially cattle dung into Biogas & organic manure leads to generation of opportunities for employment and household savings.

GOBAR-DHAN Scheme

- Launched By:

- The ministry of Jal Shakti has launched the GOBAR (Galvanizing Organic Bio-Agro Resources) - DHAN scheme.

- Implementation:

- The scheme is being implemented as part of the Swachh Bharat Mission (Gramin).

- Components:

- The Swachh Bharat Mission (Gramin) comprises two main components for creating clean villages – creating open defecation free (ODF) villages and managing solid and liquid waste in villages.

- Aim:

- Keeping villages clean, increasing the income of rural households, and generation of energy from cattle waste.

- The scheme also aims at creating new rural livelihood opportunities and enhancing income for farmers and other rural people.

Important Facts For Prelims

Ratha Saptami

Why in News

This years’ Ratha Saptami festival is being celebrated on 19th February 2021.

Key Points

- Ratha Saptami is an annual Hindu festival that is dedicated to Surya, the sun god.

- It is made of two words- ‘Ratha’ means Chariot and ‘Saptami’ means seventh.

- A one-day Brahmotsavam is held in Tirumala (Andhra Pradesh) on this day.

- Ratha Saptami is also called Surya Jayanti as it marks the birth of Surya and referred as Magha Saptami as it falls on the seventh day (Saptami) of the Hindu month Magha.

- Ratha Saptami also marks the change of season to spring and the start of the harvesting season.