International Relations

Mission Sagar - II

Why in news

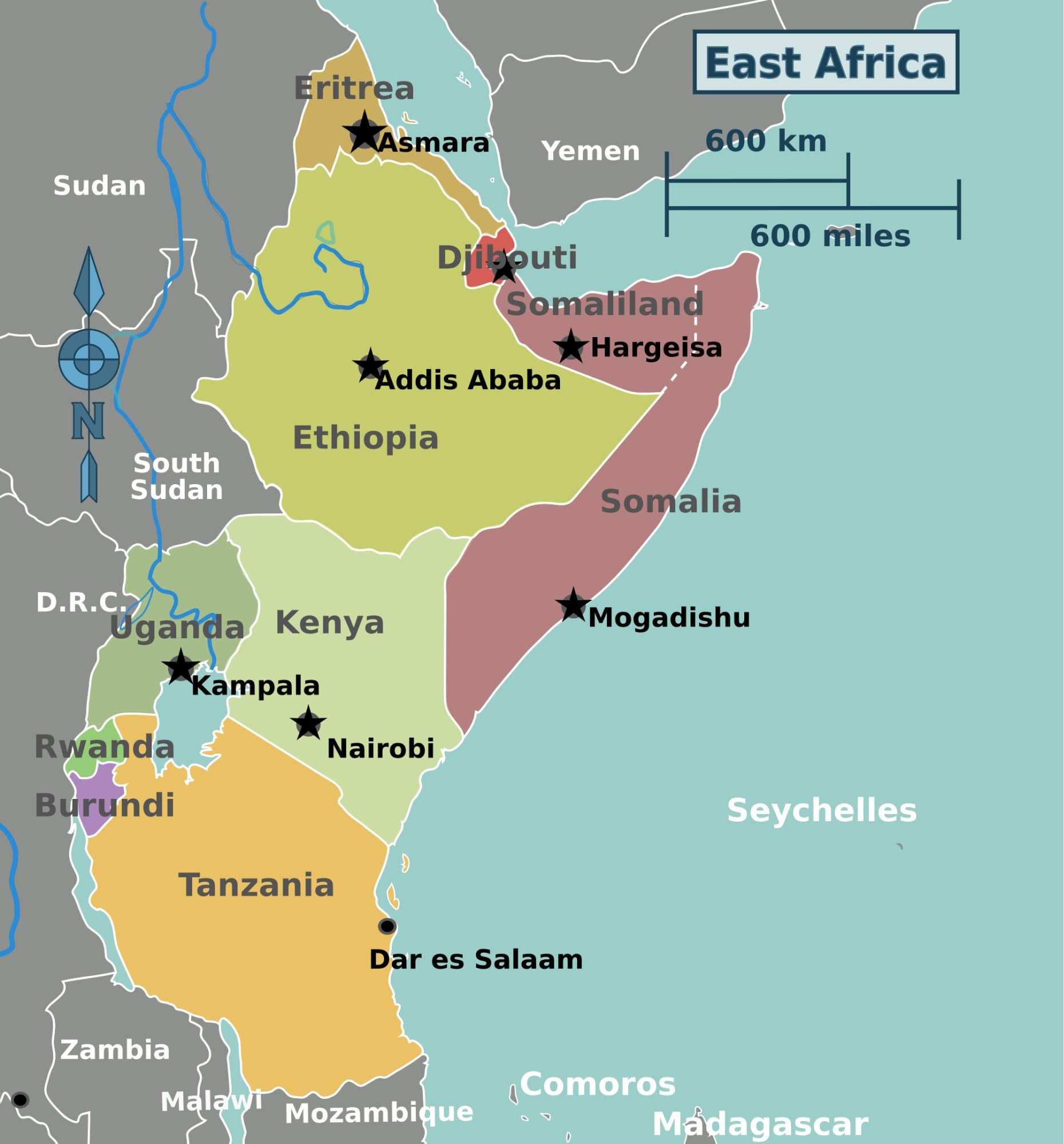

As part of ‘Mission Sagar-II’, the Government of India is providing assistance to Friendly Foreign Countries to overcome natural calamities and Covid-19 pandemic.

- Towards the same INS Airavat is delivering food aid for the people of Sudan.

Key Points

- Mission Sagar-II, follows the first ‘Mission Sagar’ undertaken in 2020.

- As part of Mission Sagar-II, Indian Naval Ship Airavat will deliver food aid to Sudan, South Sudan, Djibouti and Eritrea.

- Mauritius, Madagascar, Comoros and Seychelles along with La Réunion are part of Indian Ocean Commission. India has recently become an observer to the Commission.

- The assistance is in line with India’s role as the first responder in the Indian Ocean region.

- The deployment is also in consonance with the Prime Minister's vision of Security and Growth for All in the Region (SAGAR)

- Earlier, India had sent Indian Naval Ship (INS) Kesari, carrying food items and medical assistance teams, to countries in the southern Indian Ocean to deal with Covid-19 pandemic as part of a "Mission Sagar" initiative.

- Strategic Significance of the Island Countries:

- The strategic importance of these island nations is highlighted by their location along key Sea Lines of Communication (SLOCs).

- These islands are vital and can facilitate a navy’s continuous presence along key international shipping routes, allowing a navy to patrol and secure SLOCs during peace times and an option to interdict and cut off an adversary’s communications during times of conflict.

- Other Related Initiatives:

- India on the 65th anniversary of the landmark Bandung Conference emphasized that members of the Non-Aligned Movement (NAM) must work to reduce the socio-economic impact of the pandemic on the most vulnerable sections of society and promote South-South cooperation.

- In the wake of the global pandemic, the International Solar Alliance (ISA) responded by setting up ISA CARES (like PM-CARES in India), an initiative dedicated to the deployment of solar energy in the healthcare sector.

- With Covid-19 and trade tensions between China and the United States are threatening supply chains, Japan has mooted the Supply Chain Resilience Initiative (SCRI) as a trilateral approach to trade, with India and Australia as the key-partners.

- The Coalition of Epidemic Preparedness for Innovation (CEPI), a global initiative, has named Translational Health Science and Technology Institute (THSTI), Faridabad as one of the six laboratories for assessing Covid-19 vaccine candidates that are under development

- India has contributed 10 million USD to SAARC Covid-19 Emergency Fund and manufactured essential drugs, Covid protection and testing kits, for countries in the SAARC region (Eg. Operation Sanjeevani for Maldives).

SAGAR

- Security and Growth for All in the Region (SAGAR) was launched in 2015. It is India’s strategic vision for the Indian Ocean Region (IOR).

- Through SAGAR, India seeks to deepen economic and security cooperation with its maritime neighbours and assist in building their maritime security capabilities.

- Further, India seeks to safeguard its national interests and ensure Indian Ocean region to become inclusive, collaborative and respect international law.

- The key relevance of SAGAR emerges when seen in conjunction with India’s other policies impacting the maritime domain like Act East Policy, Project Sagarmala, Project Mausam, India as ‘net security provider’, focus on Blue Economy etc.

Other Important Groupings Associated with Indian Ocean Region

- Indian Ocean Rim Association: The Indian Ocean Rim Association (IORA) was established in 1997.

- It is aimed at strengthening regional cooperation and sustainable development within the Indian Ocean region.

- Indian Ocean Naval Symposium: The ‘Indian Ocean Naval Symposium’ (IONS) is a voluntary initiative that seeks to increase maritime cooperation among navies of the littoral states of the Indian Ocean Region by providing an open and inclusive forum for discussion of regionally relevant maritime issues.

- Indian Ocean Commission: Recently, India has been approved as an observer of the Indian Ocean Commission, the inter-governmental organization that coordinates maritime governance in the south-western Indian Ocean.

- Asia Africa Growth Corridor: The idea of Asia Africa Growth Corridor (AAGC) emerged in the joint declaration issued by India and Japan in 2016.

- The AAGC is raised on four pillars of Development and Cooperation Projects, Quality Infrastructure and Institutional Connectivity, Enhancing Capacities and Skills and People-to-People partnership.

Indian Economy

UPI Transactions

Why in News

According to the data released by the National Payments Corporation of India (NPCI), the total number of transactions conducted on the Bharat Interface for Money-Unified Payments Interface (BHIM-UPI), known more simply as the UPI, crossed the 2 billion transactions count in a month in October 2020.

Key Points

- UPI is currently the biggest among the NPCI operated systems including National Automated Clearing House (NACH), Immediate Payment Service (IMPS), Aadhaar enabled Payment System (AePS), Bharat Bill Payment System (BBPS), RuPay etc.

- Digital transactions were already on the rise but the lockdown imposed during the pandemic provided a thrust and the value of UPI transactions crossed the 200 crore-mark.

- The Reserve Bank of India (RBI) had advised to resort to digital payment due to the threat of coronavirus spreading through physical exchange of currency. This resulted in businesses accepting mostly prepaid orders and in turn rise in digital transactions.

- Further, after being able to conveniently pay utility bills and even receive cashback at times, people might now be preferring to transact digitally. So, their habit may have played an important role in this thrust.

- India’s digital payments industry is likely to grow from Rs. 2,153 trillion at 27% Compounded Annual Growth Rate (CAGR) to Rs. 7,092 trillion by 2025.

- The growth is likely to come on the back of strong use cases of merchant payments, government policies including Jan Dhan Yojana, personal data protection bill along with the growth of MSMEs, growth of millennials and high smartphone penetration.

- Challenges:

- The threat of cybercrime on the global banking and financial services industry has increased amid the coronavirus pandemic.

- E.g. Malicious Software Cerberus

- Fraudulent claims, chargebacks, fake buyer accounts, promotion/coupon abuse, account takeover, identity theft, card detail theft and triangulation frauds are emerging as challenges.

- The threat of cybercrime on the global banking and financial services industry has increased amid the coronavirus pandemic.

National Payments Corporation of India

- National Payments Corporation of India (NPCI), an umbrella organisation for operating retail payments and settlement systems in India, is an initiative of Reserve Bank of India (RBI) and Indian Banks’ Association (IBA) under the provisions of the Payment and Settlement Systems Act, 2007.

- It is a “Not for Profit” Company under the provisions of Section 25 of Companies Act 1956 (now Section 8 of Companies Act 2013), with an intention to provide infrastructure to the entire Banking system in India for physical as well as electronic payment and settlement systems.

Various NPCI Operated Systems

- Bharat Interface for Money-Unified Payments Interface (BHIM-UPI):

- It is an initiative to enable fast, secure, reliable cashless payments through the mobile phone. BHIM is based on Unified Payment Interface (UPI) to facilitate e-payments directly through banks. It is an app.

- UPI is an advanced version of Immediate Payment Service (IMPS) - round–the-clock funds transfer service to make cashless payments faster, easier and smoother.

- This is a system that powers multiple bank accounts into a single mobile application (of any participating bank), merging several banking features, seamless fund routing & merchant payments into one hood.

- It also caters to the “Peer to Peer” collect request which can be scheduled and paid as per requirement and convenience.

- Aadhaar enabled Payment System (AePS):

- AePS allows people to carry out financial transactions on a Micro-ATM by furnishing just their Aadhaar number and verifying it with the help of their fingerprint/iris scan.

- This system adds another layer of security to financial transactions as bank details would no longer be required to be furnished while carrying out these transactions.

- National Electronic Toll Collection (NETC):

- It helps in electronic toll collection at toll plazas using FASTag.

- FASTag is a device that employs Radio Frequency Identification (RFID) technology for making toll payments directly while the vehicle is in motion.

- FASTag (RFID Tag) is affixed on the windscreen of the vehicle and enables a customer to make the toll payments directly from the account which is linked to FASTag.

- RFID tagging is a system that uses small radio frequency detection devices for identification and tracking purposes.

- National Automated Clearing House (NACH):

- It is a service offered by NPCI to banks which aims at facilitating interbank high volume, low value debit/credit transactions, which are repetitive and electronic in nature.

- Immediate Payment Service (IMPS):

- It offers an instant 24X7 interbank electronic fund transfer service through mobile phones.

- IMPS is an emphatic tool to transfer money instantly within banks across India through mobile, internet and ATM.

- Bharat Bill Payment System (BBPS):

- Bharat Bill Payment System is a tiered structure for operating a unified bill payment system.

- NPCI functions as the authorised Bharat Bill Payment Central Unit (BBPCU), which is responsible for setting business standards, rules and procedures for technical and business requirements for all the participants.

- Under BBPS, the Bharat Bill Payment Operating Units (BBPOUs) function as entities facilitating collection of repetitive payments for everyday utility services, such as, electricity, water, gas, telephone and Direct-to-Home (DTH).

- RuPay:

- RuPay is the first-of-its-kind domestic card payment network of India, with wide acceptance at ATMs, POS devices and e-commerce websites across India. It is a highly secure network that protects against anti-phishing.

- The name, derived from the words ‘Rupee and ‘Payment’, emphasizes that it is India’s very own initiative for Card payments.

Way Forward

- To further penetrate digital transactions, the government's constant push to digitisation through necessary education, digital rewards and incentives along with intelligent innovations in financial transactions focussed on improving customer experience is necessary.

- Further, there is a need for the convergence of anti-money laundering, fraud and cybersecurity processes in Financial Institutions (FIs). This includes more information sharing, tightening due diligence requirements and investing in maintaining systems to strengthen their defences.

Indian Economy

Growth in Manufacturing: PMI and NIBRI

Why in News

As per the IHS Markit India Purchasing Managers’ Index (PMI), India's manufacturing output showed the strongest growth in 13 years in October 2020 amid robust sales growth.

- The Nomura India Business Resumption Index (NIBRI) has also shown improvement.

Key Points

- Rise in PMI: The headline seasonally adjusted IHS Markit India Manufacturing Purchasing Managers’ Index (PMI) rose from 56.8 in September to 58.9 in October, and pointed to the strongest improvement in the health of the sector in more than a decade (13 years).

- This is a third straight monthly improvement in PMI. In April, the index had slipped into contraction mode (27.4), after remaining in growth territory for 32 consecutive months.

- In PMI parlance, a print above 50 means expansion, while a score below that denotes contraction.

- Improvement in NIBRI:

- NIBRI improved to 82.4 in October, a rise of 2.1 points from 80.3 in September and 73.6 in August.

- It is the Japanese brokerage’s weekly tracker of the pace of normalisation of economic activity.

- Reasons:

- Upturn in Sales: The upturn in sales was the strongest since mid-2008.

- A strong jump in e-way bills (electronic permits for goods movement) has been seen for October, indicating that more goods were shipped within and across states in the month.

- Rise in Export Orders: New export orders rose at a quicker pace, one that was the most pronounced in close to six years.

- Improvement in IIP: The index of industrial production (IIP) shrank 8% in August on a year-on-year basis, marking a marginally improvement compared with July when output contracted 10.8%.

- Upturn in Sales: The upturn in sales was the strongest since mid-2008.

- Concerns: The compliance with government guidelines related to the Covid-19 pandemic caused a further reduction in employment. The fall was the seventh in consecutive months.

Purchasing Managers’ Index

- PMI is an indicator of business activity - both in the manufacturing and services sectors.

- It is calculated separately for the manufacturing and services sectors and then a composite index is also constructed.

- The PMI summarizes whether market conditions as viewed by purchasing managers are expanding, neutral, or contracting.

- The purpose of the PMI is to provide information about current and future business conditions to company decision makers, analysts, and investors.

- The headline PMI is a number from 0 to 100.

- PMI above 50 represents an expansion when compared to the previous month;

- PMI under 50 represents a contraction, and

- A reading at 50 indicates no change.

- The PMI is usually released at the start of every month. It is, therefore, considered a good leading indicator of economic activity.

- PMI is compiled by IHS Markit for more than 40 economies worldwide. IHS Markit is a global leader in information, analytics and solutions for the major industries and markets that drive economies worldwide.

Governance

Ganga Utsav 2020

Why in News

Recently, the Ganga Utsav 2020 has begun which celebrates the glory of the National river Ganga.

- Ganga was declared as the National River of India on 4th November 2008.

Key Points

- Ganga Utsav:

- The National Mission for Clean Ganga (NMCG) celebrates the festival every year.

- NMCG is the implementation wing of National Ganga Council, set up in 2016, which replaced the National Ganga River Basin Authority (NRGBA).

- The three-day festival aims to promote stakeholder engagement and ensure public participation.

- It celebrates mystical and cultural river Ganga through storytelling, folklores, dialogues with eminent personalities, quizzes, displaying traditional art forms, dance and music performance by renowned artists, photo galleries and exhibitions and much more.

- The National Mission for Clean Ganga (NMCG) celebrates the festival every year.

- Programmes Held During the Festival:

- Ganga Task Force (GTF) conducted an afforestation drive with National Cadet Corps (NCC) cadets and educational tour for youth.

- GTF is a unit of battalion of ex-servicemen deployed in the services of the Ganga with the approval of the Ministry of Defence for the period of four years till December 2020.

- It was approved by the Cabinet under the Public Participation component of the Namami Gange Programme and the first battalion was raised in March 2016.

- Mini Ganga Quest, designed to make youth and students aware of environmental issues and explain their role in conservation.

- Ganga Quest is a pan India bilingual quiz to increase public participation in Namami Gange program and encourage the youth.

- Suggestion on the innovative ways in which Namami Gange can engage in activities throughout the year.

- In 2014, Namami Gange Programme was launched to accomplish the twin objectives of effective abatement of pollution and conservation, and rejuvenation of Ganga.

- Ganga Task Force (GTF) conducted an afforestation drive with National Cadet Corps (NCC) cadets and educational tour for youth.

- Government Initiatives on River Ganga:

- Ganga Action Plan: It was the first river action plan which was taken up by the Ministry of Environment, Forest and Climate Change in 1985, to improve the water quality by the interception, diversion and treatment of domestic sewage.

- The National River Conservation Plan is an extension to this plan, which aims at cleaning the Ganga river under Ganga Action Plan phase-2.

- National River Ganga Basin Authority: It was formed by the Government of India in the year 2009 under Section-3 of the Environment Protection Act 1986.

- Clean Ganga Fund: In 2014, it was formed for cleaning up of the Ganga, setting up of waste treatment plants and conservation of biotic diversity of the river.

- Bhuvan-Ganga Web App: It ensures the involvement of the public in the monitoring of pollution entering into the river Ganga.

- Ban on Waste Disposal: In 2017, the National Green Tribunal (NGT) banned the disposal of any waste in the Ganga.

- Ganga Action Plan: It was the first river action plan which was taken up by the Ministry of Environment, Forest and Climate Change in 1985, to improve the water quality by the interception, diversion and treatment of domestic sewage.

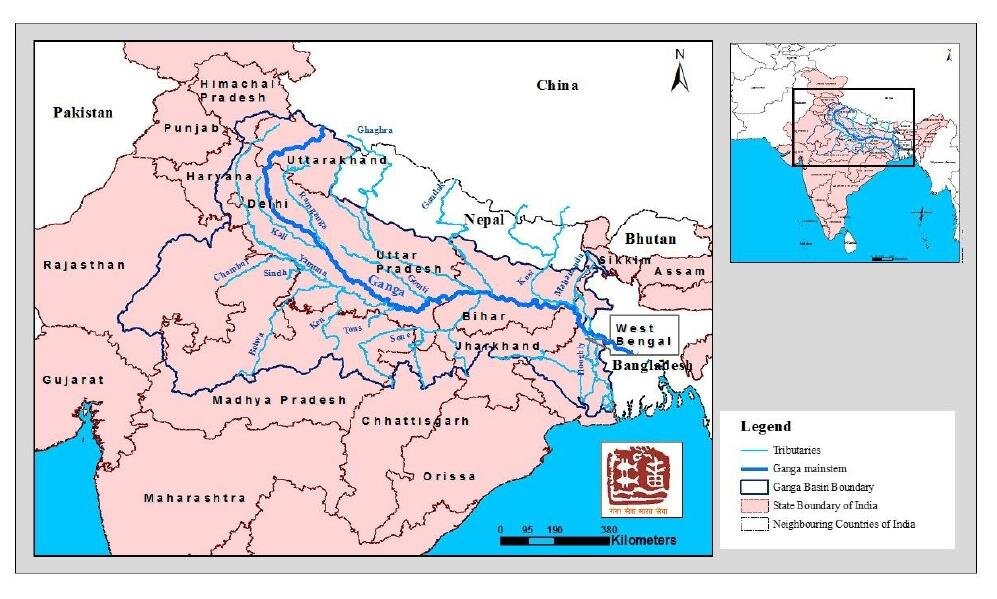

River Ganga

- It is the longest river of India flowing over 2,510 km of mountains, valleys and plains and is revered by Hindus as the most sacred river on earth.

- It originates in the snowfields of the Gangotri Glacier in the Himalayas as the Bhagirathi River and is joined by other rivers such as the Alaknanda, Yamuna, Son, Gumti, Kosi and Ghagra.

- The Ganga river basin is one of the most fertile and densely populated areas of the world and covers an area of 1,000,000 sq. km.

- The Ganges River Dolphin is an endangered animal that specifically habitats this river.

- The Ganga widens out into the Ganges Delta in the Sundarbans swamp of Bangladesh, before it ends its journey by emptying into the Bay of Bengal.

Governance

Initiatives for Good and Vigilant Governance

Why in News

Recently, the Department of Administrative Reforms and Public Grievances (DARPG) has come up with new initiatives for good and vigilant governance on the last day of the Vigilance Awareness Week 2020.

Key Points

- Launches and Initiatives:

- “Ideas Box on Good Governance Practices in a Pandemic” has been launched and operationalised both on the DARPG as well as on the MyGov platform.

- It will crowdsource ideas related to good governance.

- Social media tweets on the “Best Practices in e-governance” have been launched.

- Round table discussion on “Satark Bharat, Samriddh Bharat” (Vigilant India, Prosperous India) was held.

- It focused on key issues of preventive vigilance in the pursuit of “Naitik Bharat” (Ethical India) which includes ethics training in public services, a social audit of ethical practices, development of measurable metrics for corruption and disproportionately high impact of corruption on governance.

- “Ideas Box on Good Governance Practices in a Pandemic” has been launched and operationalised both on the DARPG as well as on the MyGov platform.

- Vigilance Awareness Week:

- The Central Vigilance Commission (CVC) observes the Week every year during the week in which the birthday of Sardar Vallabhbhai Patel (31st October) falls.

- Objective: It affirms India’s commitment to the promotion of integrity and probity in public life through citizen participation and reiterates Government’s resolve to continue the crusade against corruption.

- Theme for 2020: In 2020, it was observed from 27th October to 2nd November with the theme of “Satark Bharat, Samriddh Bharat”.

- Government Initiatives to Prevent and Curb Corruption:

- Amendments in the Prevention of Corruption Act, 1988 to make the processes more equitable and reduce opportunities for corruption.

- Introduction of the Lokpal and Lokayuktas.

- Scaled up disposal of cases by the Central Information Commission (CIC) and the DARPG.

- Level playing field for employment opportunities to lower-level jobs by the National Recruitment Agency (NRA).

- Introduction of e-governance and Direct Benefit Scheme.

- Other Related Legislations: Right to Information Act 2005, Judges (Inquiry) Act 1968, Whistleblower Protection Act, 2014, Prevention of Money Laundering Act 2002, Benami Transactions (Prohibition) Amendment Act 2016, etc.

Central Vigilance Commission

- About:

- It is an independent body which is only responsible to the Parliament.

- It is the apex vigilance institution monitoring all vigilance activity under the Central Government and advising various authorities in Central Government organisations in planning, executing, reviewing and reforming their vigilance work.

- Background:

- It was set up by the Government in February 1964 on the recommendations of the Committee on Prevention of Corruption, headed by K Santhanam.

- The Parliament enacted the Central Vigilance Commission Act, 2003 conferring statutory status on the CVC.

- Composition:

- It is a multi-member commission consisting of a Central Vigilance Commissioner (Chairperson) and not more than 2 Vigilance Commissioners (members).

- They are appointed by the President on the recommendations of a Committee consisting of the Prime Minister (Chairperson), the Minister of Home Affairs (Member) and the Leader of the Opposition in the House of the People (Member).

- Tenure:

- The term of office of the Central Vigilance Commissioner and the Vigilance Commissioners is 4 years from the date on which they enter their office or till they attain the age of 65 years, whichever is earlier.

Indian Economy

Emergency Credit Line Guarantee Scheme

Why in News

The Union Government has extended the Emergency Credit Line Guarantee Scheme (ECLGS) by one month till 30th November, 2020, or till such time that an amount of Rs. 3 lakh crore is sanctioned under the Scheme, whichever is earlier.

- The scheme was launched as part of the Aatmanirbhar Bharat Abhiyan package announced in May 2020 to mitigate the distress caused by coronavirus-induced lockdown, by providing credit to different sectors, especially Micro, Small and Medium Enterprises (MSMEs).

Key Points

- Objective: To provide fully guaranteed and collateral free additional credit to MSMEs, business enterprises, MUDRA borrowers and individual loans for business purposes to the extent of 20% of their credit outstanding as on 29th February, 2020.

- 100% guarantee coverage is being provided by the National Credit Guarantee Trustee Company, whereas Banks and Non Banking Financial Companies (NBFCs) provide loans.

- Eligibility: Borrowers with credit outstanding up to Rs. 50 crore as on 29th February, 2020, and with an annual turnover of up to Rs. 250 crore are eligible under the Scheme.

- On 1st August, the government widened the scope of the Rs. 3 lakh crore-ECLGS scheme by doubling the upper ceiling of loans outstanding and including certain loans given to professionals like doctors, lawyers and chartered accountants for business purposes under its ambit.

- Tenor of loans provided under the Scheme is four years, including a moratorium of one year on principal repayment.

- Interest rates under the Scheme are capped at 9.25% for Banks and Financial Institutions (FIs), and 14% for NBFCs.

- Present Status: As per data uploaded by Member Lending Institutions on the ECLGS portal, an amount of Rs. 2.03 lakh crore has been sanctioned under the Scheme to 60.67 lakh borrowers so far, while an amount of Rs. 1.48 lakh crore has been disbursed.

National Credit Guarantee Trustee Company Ltd

- NCGTC is a private limited company incorporated under the Companies Act, 1956 in 2014, established by the Department of Financial Services, Ministry of Finance, as a wholly owned company of the Government of India, to act as a common trustee company for multiple credit guarantee funds.

- Credit guarantee programmes are designed to share the lending risk of the lenders and in turn, facilitate access to finance for the prospective borrowers.

Important Facts For Prelims

Media Registrations for Aero India 2021

Why in News

Recently, the online media registration for the 13th edition of Aero India has been started, which will be held at Air Force Station, Bengaluru (Karnataka) in February 2021.

Key Points

- Aero India is a biennial international military and civil airshow.

- It is a premier event that draws international and Indian military and civil aircraft makers, their support industries, military brass and government dignitaries and business visitors.

- It provides a unique opportunity for the exchange of information, ideas and new developments in the aviation industry, in addition to giving a fillip to the domestic aviation industry furthering the cause of Make in India.

- The Yelahanka air base, about 30 km from the city centre Bengaluru, has been hosting the air show in February since it was started in 1996.

- In 2019, it was organised by Hindustan Aeronautics Ltd. (HAL) and in 2021, it will be organised by the Defence Exhibition Organisation, Ministry of Defence.

- DEO is an autonomous organisation of the Indian Government established in 1981, to promote the export potential of the Indian defence industry.

- It is responsible for organising international exhibitions such as DefExpo and Indian participation at overseas exhibitions.