Science & Technology

6G Technology

Why in News

Recently, the government has asked the Centre for Development of Telematics (C-DOT) to begin developing 6G and other futuristic technologies to catch up with the global market in time.

- The next generation telecom technology (6G) is said to be 50 times faster than 5G and is expected to be commercially launched between 2028-2030.

Key Points

- About:

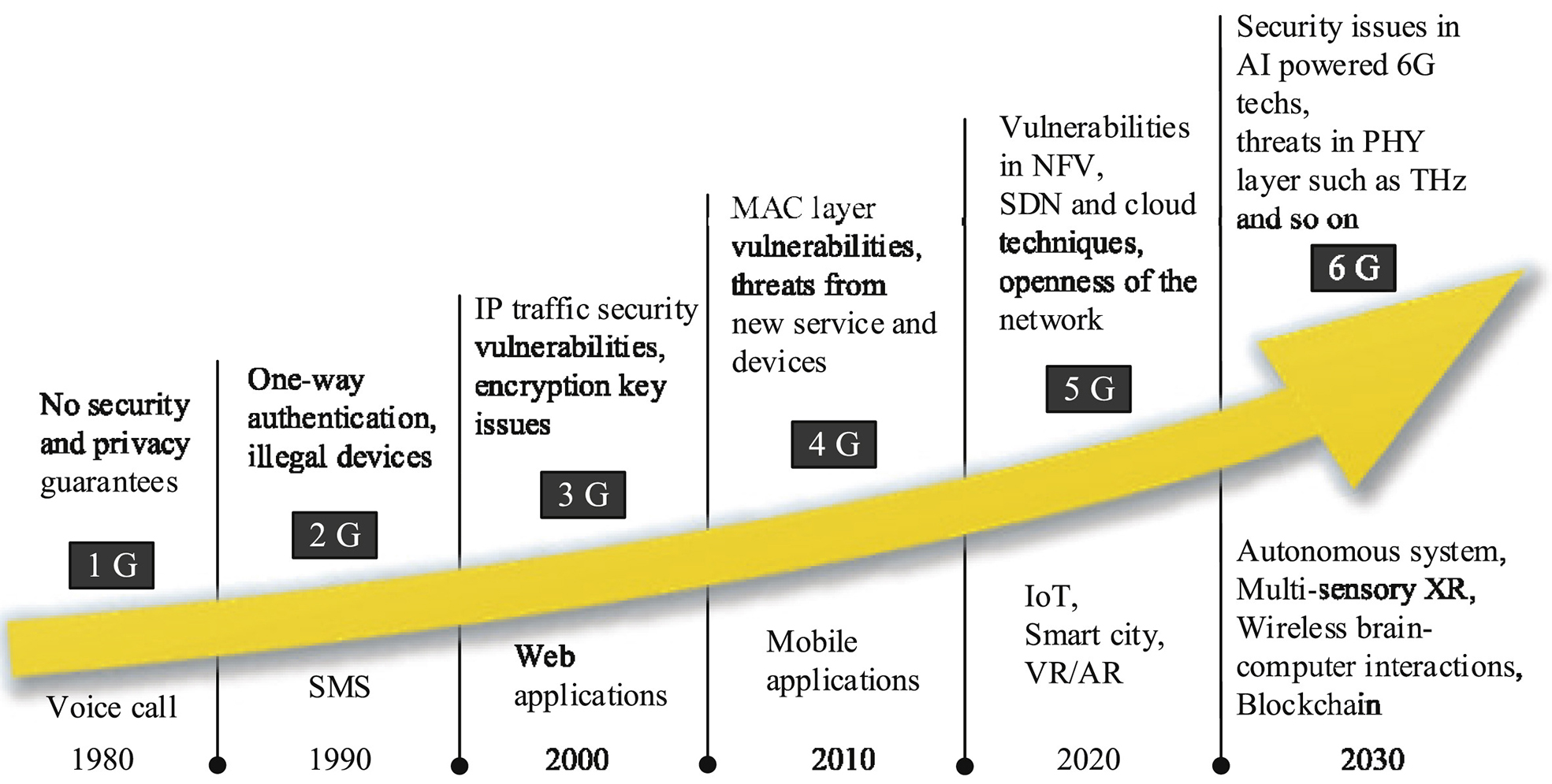

- 6G (sixth-generation wireless) is the successor to 5G cellular technology.

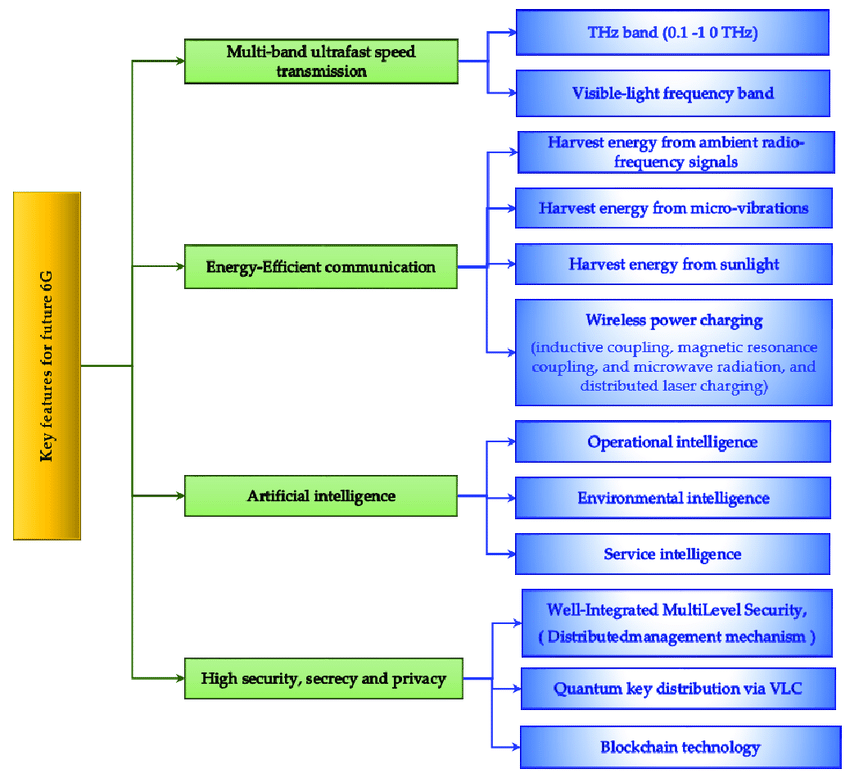

- It will be able to use higher frequencies than 5G networks and provide substantially higher capacity and much lower latency (delay).

- One of the goals of 6G internet will be to support one microsecond-latency communication (delay of one-microsecond in communication).

- This is 1,000 times faster - or 1/1000th the latency - than one millisecond throughput.

- It seeks to utilize the terahertz band of frequency which is currently unutilized.

- Terahertz waves fall between infrared waves and microwaves on the electromagnetic spectrum.

- These waves are extremely tiny and fragile, but there's a huge amount of free spectrum up there that would allow for spectacular data rates.

- Significance:

- More facilitation:

- The 6G technology market is expected to facilitate large improvements in imaging, presence technology and location awareness.

- 6G's higher frequencies will enable much faster sampling rates, in addition to providing significantly better throughput and higher data rates.

- Advancement in Wireless sensing technology:

- The combination of sub-mm waves (e.g., wavelengths smaller than one millimeter) and frequency selectivity to determine relative electromagnetic absorption rates could potentially lead to significant advances in wireless sensing technology.

- Emergence of Digital Capabilities:

- It will see the emergence of simple, easy-to-wear-and-carry devices with a huge set of digital capabilities.

- This will help the paramedics, educators and agro-technicians to jumpstart the village ecosystems with little or limited need for on-site presence of doctors, professors and agro-experts.

- Optimising mass public transportation:

- For India, such an enabling set of technologies will bring manifold utilisation of scarce rail, air and road networks and make mass transportation far more efficient; Artificial Intelligence (AI) and massively parallel computing architectures will help solve transportation and scheduling operations research problems.

- More facilitation:

- Challenges:

- Maintaining Protection Mechanisms:

- The key technical challenges are energy efficiency, avoiding signal attenuation due to obstructions and water droplets in the air, and, of course, maintaining end-to-end trust through robust cyber security and data protection mechanisms.

- Adoption of New Models:

- Need innovations in antenna design, miniaturisation, edge cloud and distributed AI models. In addition, we need to ensure end-to-end security and privacy by design, instead of as an afterthought.

- Availability of Semiconductor:

- We don't have semiconducting materials that can use multi-THz frequencies. Getting any kind of range out of those frequencies may require enormous arrays of extremely tiny antennas.

- Complex Design for Carrier Wave:

- Water vapor in the atmosphere blocks and reflects THz waves, so mathematicians will have to design models that allow data to take very complex routes to its destination.

- Maintaining Protection Mechanisms:

Centre for Development of Telematics (C-DOT)

- It was established in 1984. It is an autonomous Telecom R&D (Research and Development) centre of DoT (Department of Telecom), Ministry of Communications.

- It is a registered society under the Societies Registration Act,1860.

- It is a registered public-funded research institution with the Department of Scientific and Industrial Research (DSIR), Ministry of Science &Technology.

- Currently, C-DOT is working towards realising the objective of various flagship programmes of Govt. of India which include Digital India, BharatNet, Smart Cities etc.

Way Forward

- Government should indicate the intention for pursuit of 6G by announcing a long-term vision, a multi-year (multi-decade) plan, strong investments, and minimal bureaucracy.

- Government needs to execute the new electronics manufacturing policy as stated in the India Trillion Dollar Digital Opportunity document (2019) of the Ministry of Electronics and IT.

- Not just providing leadership for the Googles and Microsofts of the world, but creating them in our own Indian innovation eco system based on the strong foundation of ‘Talent, Technology and Trust’, is imperative.

- India needs to replicate the space and nuclear technologies mission experience which achieved self-reliance and self-confidence or Atmanirbharta. Technology leadership for a better world should be our gift to the world and to ourselves. Leadership in 6G may be the best way to celebrate 2047, our centenary of Independence.

Indian Economy

Global Minimum Tax Deal

Why in News

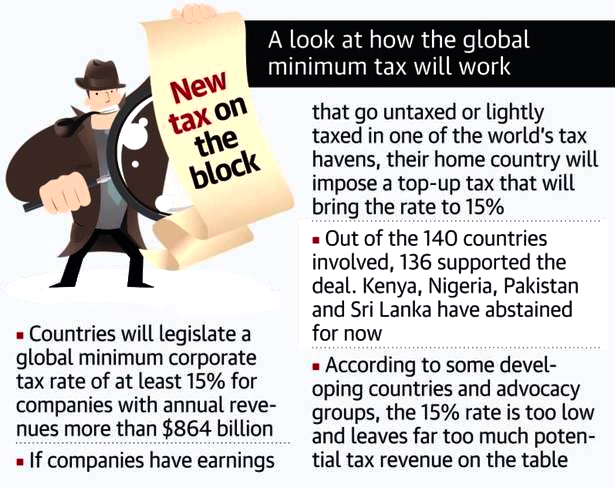

Recently, the Organisation for Economic Cooperation and Development (OECD) has announced that a global deal to ensure big companies pay a Global Minimum Tax (GMT) rate of 15% has been agreed by 136 countries (including India).

- The countries behind the accord together accounted for over 90% of the global economy.

Key Points

Key Points

- About GMT:

- Objective: GMT is tailored to address the low effective rates of tax shelled out by some of the world’s biggest corporations, including Big Tech majors such as Apple, Alphabet and Facebook.

- These companies typically rely on complex webs of subsidiaries to hoover profits out of major markets into low-tax countries or Tax Havens such as Ireland, the British Virgin Islands, the Bahamas, or Panama.

- GMT aimed at squeezing the opportunities for MultiNational Enterprises (MNEs) to indulge in profit shifting, ensuring they pay at least some of their taxes where they do business.

- Proposed Two Pillar Solution: The global minimum tax rate would apply to overseas profits of multinational firms with $868 million in sales globally.

- Pillar 1 (Minimum tax and subject to tax rules): Governments could still set whatever local corporate tax rate they want, but if companies pay lower rates in a particular country, their home governments could “top up” their taxes to the 15% minimum, eliminating the advantage of shifting profits.

- Pillar 2 (Reallocation of additional share of profit to the market jurisdictions): Allows countries where revenues are earned to tax 25% of the largest multinationals’ so-called excess profit – defined as profit in excess of 10% of revenue.

- Timeline: The agreement calls for countries to bring it into law in 2022 so that it can take effect by 2023.

- Countries that have in recent years created national digital services taxes (For example, equalization levy by the Indian Government) will have to repeal them.

- Impact: The minimum tax and other provisions aim to put an end to decades of tax competition between governments to attract foreign investment.

- The economists expect that the deal will encourage multinationals to repatriate capital to their country of headquarters, giving a boost to those economies.

- Objective: GMT is tailored to address the low effective rates of tax shelled out by some of the world’s biggest corporations, including Big Tech majors such as Apple, Alphabet and Facebook.

- Need for GMT:

- Stopping Financial Diversion to Tax Havens: Increasingly, income from intangible sources such as drug patents, software and royalties on intellectual property has migrated to Tax Havens, allowing companies to avoid paying higher taxes in their traditional home countries.

- Mobilising Financial Resources: With budgets strained after the Covid-19 crisis, many governments want more than ever to discourage multinationals from shifting profits – and tax revenues – to low-tax countries regardless of where their sales are made.

- The OECD has estimated that the minimum tax will generate $150 billion in additional global tax revenues annually.

- Global Tax Reforms: Since the inception of the Base Erosion and Profit Shifting (BEPS) programme, the proposal for GMT is another positive step towards global taxation reforms.

- BEPS refers to tax avoidance strategies that exploit gaps and mismatches in tax rules to artificially shift profits to low or no-tax locations. OECD has issued 15 Action Items to address this.

- Associated Challenges:

- Impending Sovereignty: It impinges on the right of the sovereign to decide a nation’s tax policy.

- A global minimum rate would essentially take away a tool countries use to push policies that suit them.

- Tight Timeline: Also, bringing in laws by next year so that it can take effect from 2023 is a tough task.

- Question of Effectiveness: The deal has also been criticised for lacking teeth: Groups such as Oxfam said the deal would not put an end to tax havens.

- Impending Sovereignty: It impinges on the right of the sovereign to decide a nation’s tax policy.

Organisation for Economic Cooperation and Development

- The OECD is an intergovernmental economic organisation, founded to stimulate economic progress and world trade.

- Founded: 1961.

- Headquarters: Paris, France.

- Total Members: 36.

- India is not a member, but a key economic partner.

Economy

Tax Havens in the United States

Why in News

Recently, a report informed how world leaders and some of the world’s wealthiest people hide their riches in the United States (US).

- The information on the report has drawn new scrutiny to the growth of tax havens.

- The release of the Pandora Papers has shed light on the financial dealings of the elite and the corrupt and how they have used offshore accounts and tax havens to shield trillions of dollars in assets.

Key Points

- About:

- Along with the familiar offshore havens, the report also disclosed secret accounts in trusts scattered throughout the United States, including 81 in South Dakota, 37 in Florida and 35 in Delaware..

- Reasons for US’ States Becoming Tax Havens:

- No Rule against Perpetuity:

- Lawmakers in these states have abolished the rule against perpetuities which has allowed the establishment of so-called dynasty trusts, in which wealth can be passed from generation to generation while avoiding federal estate taxes.

- A perpetuity is a type of annuity that lasts forever. The stream of cash flows continues for an infinite amount of time.

- Lawmakers in these states have abolished the rule against perpetuities which has allowed the establishment of so-called dynasty trusts, in which wealth can be passed from generation to generation while avoiding federal estate taxes.

- Asset Protection Trusts:

- Some states also allow asset protection trusts, which protect wealth from claims against creditors. Such trusts can be attractive to wealthy lawyers and doctors as a way to shield their assets from malpractice claims.

- Trusts not Taxed:

- Tax avoidance is another big draw. While most states levy a tax on trust income, trusts established in Delaware are not subject to state income tax if the beneficiaries are not Delaware residents.

- South Dakota does not tax personal income, corporate income or capital gains.

- Privacy Protection:

- South Dakota provides extensive privacy protections for assets held in trusts, including the sealing of trust-related court documents and court proceedings.

- Delaware is a popular venue for registering Limited Liability Companies (LLC), which can include shell companies set up specifically to hide assets or financial transactions. Delaware law does not require the public disclosure of the names of LLC owners or members.

- No Rule against Perpetuity:

- Benefits of States:

- The trust industry can be lucrative, not just for wealthy people and the companies that help them shield assets, but also for government reserves. The state governments are earning high franchise taxes paid by trust companies.

- A franchise tax is a state tax levied on certain businesses for the right to exist as a legal entity and to do business within a particular jurisdiction.

- The trust industry can be lucrative, not just for wealthy people and the companies that help them shield assets, but also for government reserves. The state governments are earning high franchise taxes paid by trust companies.

- Steps Taken:

- While some in the US Congress are calling for tighter scrutiny of trust companies working with foreign clients, the response to the Pandora Papers in Delaware has thus far been muted.

- Federal officials, meanwhile, have taken aim at some privacy protections with enactment earlier this year of the Corporate Transparency Act.

- It is aimed at banning anonymous shell companies that criminals and foreign officials have used to hide financial dealings and launder money, but it includes exemptions and exceptions.

Tax Havens

- About:

- A tax haven is generally an offshore country that offers foreign individuals and businesses little or no tax liability in a politically and economically static environment.

- Characteristics of tax haven countries generally include no or low-income taxes, minimal reporting of information, lack of transparency obligations, lack of local presence requirements, and marketing of tax haven vehicles.

- Generally, tax havens do not require residency or business presence for individuals and businesses to benefit from their tax policies.

- Individuals and corporations can potentially benefit from low or no taxes charged on income in foreign countries where loopholes, credits, or other special tax considerations may be allowed in accordance with the law.

- Popular Tax Havens:

- A list of some of the most popular tax haven countries includes Andorra, the Bahamas, Bermuda, the British Virgin Islands, the Cayman Islands, the Channel Islands, the Cook Islands, Hong Kong, Mauritius, Lichtenstein, Monaco, Panama, British Virgin Islands, and the Cayman Islands.

- Regulatory Oversight:

- Worldwide, there are some programs in place to increase the enforcement of offshore investment reporting.

- The Automatic Exchange of Financial Information is one example, overseen by the Organization for Economic Co-operation and Development (OECD).

Social Justice

Ecological Threat Report 2021

Why in News

Recently, the Institute of Economics and Peace (IEP), an international think tank released the Ecological Threat Report (ETR) 2021: Understanding ecological threats, resilience and peace.

- This is the second edition of the ETR, which covers 178 independent states and territories.

- The ETR includes the most recent and respected scientific research on population growth, water stress, food insecurity, droughts, floods, cyclones, and rising temperature.

Key Points

- Conflict and Ecological Threats:

- Around 1.26 billion people across 30 countries are suffering from both extreme ecological risk and low levels of resilience.

- These countries are least likely to be able to mitigate and adapt to new ecological threats, leading to mass displacement.

- As many as 13 countries faced extremely high and 34 others faced high ecological threats.

- The most vulnerable countries are clustered in the Middle East and North Africa, sub-Saharan Africa and South Asia.

- Ecological degradation and conflict work in a vicious circle, whereby one degradation of resources leads to conflict and vice versa.

- Climate change will have an amplifying effect, causing further ecological degradation and pushing some countries through violent tipping points

- Around 1.26 billion people across 30 countries are suffering from both extreme ecological risk and low levels of resilience.

- Food Risk:

- Global food insecurity has increased by 44% since 2014, affecting 30.4 % of the world's population in 2020, and is likely to rise further.

- As a region, south Asia is the worst-placed, with water and food risks driving the average ETR score in the region.

- Covid-19 has amplified food insecurity further and will likely have a long-lasting negative impact on world hunger due to stagnant economic growth.

- Water Risk:

- By 2040 over 5.4 billion people will live in countries facing extreme water stress.

- Lebanon and Jordan are the countries most at risk.

- Sub-Saharan Africa has the most countries with the lowest levels of social resilience combined with the highest population growth.

- 70% of its population suffer from inadequate access to safely managed water, which will be compounded by high population growth.

- By 2040 over 5.4 billion people will live in countries facing extreme water stress.

- Rapid Population Growth:

- Eleven countries are projected to double their population between 2021 and 2050. They are all in sub-Saharan Africa.

- The three countries with the largest projected increases in population are Niger, Angola and Somalia, where the populations will increase by 161, 128 and 113% respectively.

- Temperature Anomalies and Natural Disasters:

- From 1990 to 2020, a total of 10,320 natural disasters occurred globally. Flooding has been the most common natural disaster, accounting for 42% of the total disaster count.

- In 2020, 177 countries and territories recorded a warmer average temperature compared to their historical average temperatures.

- Recommendations:

- The report recommended a policy to combine health, food, water, refugee relief, finance, agricultural and business development into one integrated agency in high-risk areas and empowering local communities.

Internal Displacement in India

- According to report titled The 'Lost at Home' published last year by the United Nation Children's Fund (UNICEF), more than five million people were internally displaced in India due to natural disasters, conflict and violence in 2019, constituting the highest number of new internal displacements in the world during the period followed by the Philippines, Bangladesh and China.

- Almost 33 million new displacements were recorded in 2019 - around 25 million were due to natural disasters and 8.5 million as consequence of conflict and violence.

Geography

A Spatial Shift of Heatwaves in India

Why in News

Recently, a study has found a spatial shift of heatwaves in India, now occurring in new regions in the country.

- It also added that the eastern and western coasts, which are currently unaffected by heatwaves, wil be severely impacted in the future.

- It assessed the monthly, seasonal, decadal and long-term trends in heatwaves in the country from 1951-2016.

Key Points

- Findings:

- A warming pattern was found over northwestern and southern India, while a progressive cooling phase over northeastern and southwest regions of the country.

- A “spatio-temporal shift” is revealed in the occurrence of heatwave events, with a significantly increasing trend in three prominent heatwave prone regions- northwestern, central, and south-central India, with the highest being in west Madhya Pradesh (0.80 events/year).

- Heatwaves have been traditionally associated with UP, Bihar, Delhi and northern parts of Madhya Pradesh.

- Heatwaves were found in southern Madhya Pradesh, Andhra Pradesh, Karnataka and Tamil Nadu, where they would traditionally not take place.

- Increases in heatwaves in Karnataka and Tamil Nadu are particularly significant, and point to increased events in the future.

- A significant decrease in heatwaves over the eastern region, that is Gangetic West Bengal (−0.13 events/year).

- An increasing trend of heatwave days and severe heatwave days was observed in the decade of 2001–2010 as compared to previous decades.

- Factors:

- Two elements that have exacerbated the heatwave conditions in the country are the increase in night time temperatures, which disallows heat discharge at night, and increasing humidity levels.

- Heatwaves:

- About:

- A heatwave is a period of abnormally high temperatures, more than the normal maximum temperature that occurs during the summer season in the North-Western and South Central parts of India.

- Heatwaves typically occur between March and June, and in some rare cases even extend till July.

- India Meteorological Department (IMD) classifies heatwaves according to regions and their temperature ranges.

- Criteria for Heatwaves:

- The heatwave is considered when the maximum temperature of a station reaches at least 40°C for Plains and at least 30°C for Hilly regions.

- If the normal maximum temperature of a station is less than or equal to 40°C, then an increase of 5°C to 6°C from the normal temperature is considered to be heat wave condition.

- Further, an increase of 7°C or more from the normal temperature is considered a severe heat wave condition.

- If the normal maximum temperature of a station is more than 40°C, then an increase of 4°C to 5°C from the normal temperature is considered to be heat wave condition. Further, an increase of 6°C or more is considered a severe heat wave condition.

- Additionally, if the actual maximum temperature remains 45°C or more irrespective of normal maximum temperature, a heat wave is declared.

- Impact:

- Heat Stress:

- The presence of humidity in the environment prevents the thermoregulatory mechanism of evaporative cooling of the body through the process of perspiration, which can cause heat stress.

- Increase in Heat-Related Mortality

- An increase of 0.5 degrees Celsius in mean summer temperatures can cause an increase of heat-related mortality from 2.5 to 32%, and an increase in the duration of a heatwave from 6 to 8 days and result in an increase in the probability of mortality by 78%.

- Heat Strokes:

- The very high temperatures or humid conditions pose an elevated risk of heat stroke or heat exhaustion.

- Older people avnd people with chronic illness such as heart disease, respiratory disease, and diabetes are more susceptible to heatstroke, as the body’s ability to regulate heat deteriorates with age.

- Increased Energy Demands:

- The sweltering heatwave also leads to rise in energy demand, especially electricity, leading to pushing up rates.

- Lessens Workers’ Productivity:

- Extreme heat also lessens worker productivity, especially among the more than 1 billion workers who are exposed to high heat on a regular basis.

- These workers often report reduced work output due to heat stress.

- Heat Stress:

- About:

Science & Technology

Katol Meteorite

Why in News

Recently, some researchers studied a meteorite from Katol, Maharashtra which was from the meteor shower of 2012.

- A meteorite is a solid piece of debris from an object, such as a comet, asteroid, or meteoroid, that originates in outer space and survives its passage through the atmosphere to reach the surface of a planet or moon.

Key Points

- Findings:

- Depth of Olivine:

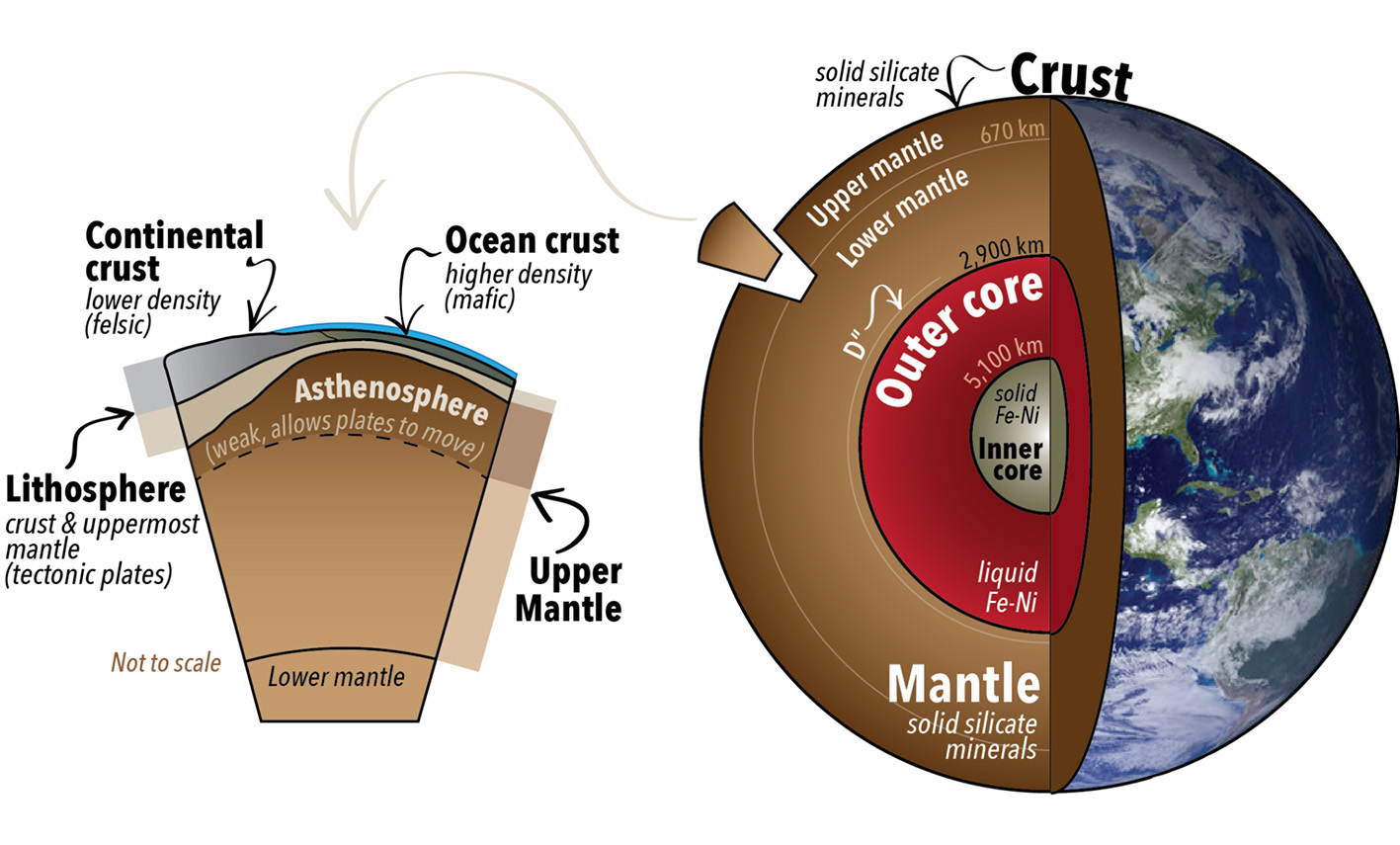

- Initial studies revealed that the host rock was mainly composed of olivine, an olive-green mineral.

- Olivine is the most abundant phase in our Earth’s upper mantle.

- It was believed that we can reach the upper mantle if we drill for about 410 kilometers.

- However, by studying the composition of these meteorite fragments, researchers have unravelled the composition expected to be present in the Earth’s lower mantle which is at about 660 km deep.

- Formation of Bridgmanite:

- Various computational and experimental studies have shown that about 80% of the Earth’s lower mantle is made up of bridgmanite. By studying this meteorite sample, scientists can decode how bridgmanite crystallized during the final stages of our Earth’s formation.

- Bridgmanite is a magnesium-silicate mineral, MgSiO3, the most abundant mineral on earth.

- The mineral was named in 2014 after Prof. Percy W. Bridgman, recipient of the 1946 Nobel Prize in Physics.

- As the bridgmanite of the Katol meteorite sample closely matches with the bridgmanite on Earth.

- Various computational and experimental studies have shown that about 80% of the Earth’s lower mantle is made up of bridgmanite. By studying this meteorite sample, scientists can decode how bridgmanite crystallized during the final stages of our Earth’s formation.

- Depth of Olivine:

- Bridgmanite on Earth vs Meteorite:

- The bridgmanite in the meteorite was found to be formed at pressures of about 23 to 25 gigapascals generated by the shock event.

- The high temperature and pressure in our Earth’s interior have changed over billions of years causing crystallisation, melting, remelting of the different minerals before they reached their current state.

- Significance:

- Studying the meteorite could also tell us more about how our Earth evolved from being a magma ocean to a rocky planet and researchers can unearth more details about the formation of Earth.

- It is important to study these individual minerals to get a thorough idea of how and when the Earth’s layers formed.

- Scientists can also decode how bridgmanite crystallized during the final stages of our Earth’s formation.

Formation of Inner Planets (Earth)

- The inner planets or terrestrial planets or rocky planets Mercury, Venus, Earth, and Mars are formed by accretion or by rocky pieces coming together and forming a planet by increased pressure and high temperature caused by radioactive elements and gravitational forces.

- Earth was an ocean of magma before the elements crystallised and stabilised and the different layers such as core, mantle and crust were formed.

Important Facts For Prelims

Nobel Prize for Economic Sciences, 2021

Why in News

The 2021 Nobel Prize in Economic Sciences has been awarded in one half to Canadian-born David Card and the other half jointly to Israeli-American Joshua D Angrist and Dutch-American Guido W Imbens.

- David Card has been awarded for his empirical contributions to labour economics. Joshua D Angrist and Guido W Imbens won the award “for their methodological contributions to the analysis of causal relationships.”

- The 2020 Nobel Prize in Economic Sciences was awarded to Paul R Milgrom and Robert B Wilson “for improvements to auction theory and inventions of new auction formats”.

Key Points

- About:

- Established: Unlike the other Nobel prizes, the economics award wasn’t established in the will of Alfred Nobel but by the Swedish central bank in his memory in 1968.

- Contributions:

- David Card: He has analysed how minimum wages, immigration and education impact the labour market.

- One of the significant findings of this research was that “increasing the minimum wage does not necessarily lead to fewer jobs”.

- It also led to the understanding that “people who were born in a country can benefit from new immigration, while people who immigrated at an earlier time risk being negatively affected”.

- It also illuminated the role of resources available in school in shaping the future of students in the labour market.

- Joshua Angrist and Guido Imbens: They were rewarded for their “methodological contributions” to the research tool.

- Their work demonstrated “how precise conclusions about cause and effect can be drawn from natural experiments”.

- David Card: He has analysed how minimum wages, immigration and education impact the labour market.

| Nobel Prizes 2021 | ||

| Field | Recipient | Contributions |

| Chemistry | Benjamin List and David W.C. MacMillan | Finding an easier and environmentally cleaner way to build molecules that can be used to make compounds, including medicines and pesticides (organocatalysis). |

| Physics | Syukuro Manabe, Klaus Hasselmann and Giorgio Parisi | Understanding of complex physical systems. |

| Medicine | David Julius and Ardem Patapoutian | For their work in the field of somatosensation, that is the ability of specialised organs such as eyes, ears and skin to see, hear and feel. |

| Peace Prize | Maria Ressa and Dmitry Muratov | For their efforts to safeguard freedom of expression, which is a precondition for democracy and lasting peace. |

| Literature | Abdulrazak Gurnah | For his uncompromising and compassionate penetration of the effects of colonialism and the fate of the refugee in the gulf between cultures and continents. |

| Economics | David Card, Joshua Angrist and Guido Imbens | Research on wages, jobs |

Important Facts For Prelims

Dr Abdul Qadeer Khan

Why in News

Recently, Dr Abdul Qadeer Khan of Pakistan passed away. He is hailed as the man who single-handedly ensured that Pakistan succeeded in making nuclear weapons. This was significant, as this made Pakistan an equal of India in terms of Nuclear Weapon state.

- Due to this, he is revered in Pakistan as the “father” of the country’s “atom bomb” or Nuclear Hero.

- However, the western world criticised him as a nuclear thief or "the greatest nuclear proliferator of all time”.

Key Points

- About Dr Abdul Qadeer Khan:

- In 1975, Khan, then working in Holland in a uranium enrichment facility as a German-Dutch translator, offered his services to then PM Zulfikar Ali Bhutto, who wanted Pakistan to have its own nuclear programme.

- He provided the first blueprints for Pakistan’s centrifuges, setting it on the path to uranium enrichment.

- In 1976, he joined Pakistan Atomic Energy Commission’s nuclear weapons effort.

- He was convicted by a Dutch court for the theft.

- Also, he has smuggled nuclear secrets to states including North Korea, Iran and Libya.

- For this, he was arrested and placed in a house arrest.

- Due to his contribution, by 1998, Pakistan had conducted its first nuclear tests.

- Pakistan honoured him with the titles of Nishan-e-Imtiaz (Order of Excellence, Pakistan’s highest civilian honour) and Mohsin-e-Pakistan (Benefactor of Pakistan).

- In 1975, Khan, then working in Holland in a uranium enrichment facility as a German-Dutch translator, offered his services to then PM Zulfikar Ali Bhutto, who wanted Pakistan to have its own nuclear programme.

- About India’s Nuclear Tests and Nuclear Doctrine:

- In 1965, India with NAM countries proposed some principles to prevent the proliferation of nuclear weapons to the UN Disarmament commission. These are:

- Not to transfer Nuclear technology to others.

- No use of nuclear weapons against non nuclear countries.

- UN security cover to non nuclear States.

- Nuclear disarmament ban on the nuclear test.

- In May 1974, India conducted its first nuclear test in Pokhran with the codename of "Smiling Buddha".

- In 1998, five nuclear tests were conducted as a part of the series of Pokhran-II.

- These tests were collectively called Operation Shakti.

- In 2003, India adopted its Nuclear Doctrine of 'No First Use' i.e. India will use nuclear weapons only in retaliation against a nuclear attack on its Territory.

- India possessed an estimated 156 nuclear warheads at the start of 2021 compared to 150 at the start of last year, while Pakistan had 165 warheads, up from 160 in 2020 (SIPRI Yearbook 2021).

- Pakistan has not stated a “no first use” policy and there is little known about its nuclear doctrine.

- In 1965, India with NAM countries proposed some principles to prevent the proliferation of nuclear weapons to the UN Disarmament commission. These are: