Indian Economy

Financial Stability Report: RBI

Why in News

Recently, the Reserve Bank of India (RBI) released the 23rd issue of its Financial Stability Report (FSR).

- The FSR which is published biannually reflects the collective assessment of the Sub-Committee of the Financial Stability and Development Council (FSDC - headed by the Governor of RBI) on risks to financial stability and the resilience of the financial system.

- The Report also discusses issues relating to development and regulation of the financial sector.

Key Points

- Impact of Covid-19 Second-Wave:

- The impact of the Covid-19 Second-Wave on the balance sheets of Indian banks has been less than what was projected before and capital buffers are reasonably resilient to withstand future shocks.

- A capital buffer is required reserves held by financial institutions put in place by regulators. These are designed to provide banking organizations with the means to support the economy in adverse situations.

- Covid-19 Second-Wave has dented economic activity, but monetary, regulatory and fiscal policy measures have helped curtail the solvency risk of financial entities, stabilise markets, and maintain financial stability.

- Solvency risk is the risk of being unable to absorb losses, generated by all types of risks, with the available capital.

- The impact of the Covid-19 Second-Wave on the balance sheets of Indian banks has been less than what was projected before and capital buffers are reasonably resilient to withstand future shocks.

- Global Recovery:

- Sustained policy support, benign financial conditions and the gathering momentum of vaccinations are nurturing an uneven global recovery.

- Policy support has helped in shoring up financial positions of banks, containing non-performing loans and maintaining solvency and liquidity globally.

- New Risks:

- While the recovery is underway, new risks have emerged which are:

- Nascent and mending state of the upturn (Revival of Economy).

- Economy Vulnerable to shocks and future waves of the pandemic.

- International commodity prices and inflationary pressures.

- Global spillovers amid high uncertainty.

- Rising incidence of data breaches and cyber attacks.

- While the recovery is underway, new risks have emerged which are:

- Gross Non-Performing Asset Ratio:

- The Gross Non-Performing Asset (GNPA) ratio of India’s Scheduled Commercial Banks (SCBs) may climb by the end of 2021-22 to as much as 11.2% under a severe stress scenario, from 7.48% in March 2021.

- The GNPA ratio of SCBs may increase to 9.8% by March 2022 under the baseline scenario.

- While banks’ exposures to better rated large borrowers are declining, there are incipient signs of stress in the Micro, Small and Medium Enterprises (MSMEs) and retail segments.

- The demand for consumer credit across banks and Non-Banking Financial Companies (NBFCs) has decreased, with some deterioration in the risk profile of retail borrowers becoming evident.

- Retail Loans are provided to purchase property, vehicles or other assets such as essential electronics.

- The Gross Non-Performing Asset (GNPA) ratio of India’s Scheduled Commercial Banks (SCBs) may climb by the end of 2021-22 to as much as 11.2% under a severe stress scenario, from 7.48% in March 2021.

- CRAR & PCR:

- Banks have managed to capitalise themselves well during 2020-21 aiding them in maintaining adequate capital adequacy even under stress situations.

- The Capital to Risk-Weighted Assets Ratio (CRAR) of SCBs increased to 16.03% and the Provisioning Coverage Ratio (PCR) stood at 68.86% in March 2021.

- Restructuring of Loans:

- During 2020-21 the RBI had introduced a one-time restructuring scheme to aid borrowers affected by the Covid-19 pandemic.

- The scheme was to be invoked by December 2020 and implemented within 90 days for retail borrowers and 180 days for corporate borrowers.

- By March 2021, 0.9% of total bank advances (loans) were under restructuring.

- MSMEs had the highest restructure ratio at 1.7%.

- Corporate borrowers had a restructured ratio of 0.9% of total advances.

- 0.7% of total retail advances were restructured.

- Suggestions:

- Balance Sheet Stress:

- Banks need to reinforce their capital and liquidity positions to fortify themselves against potential balance sheet stress.

- Policy Support:

- Sustained policy support and simultaneous increased fortification of capital and liquidity buffers by financial entities is important.

- Financial Needs:

- Stronger capital positions, good governance and efficiency in financial intermediation can be the touchstones of this endeavour so that financing needs of productive sectors of the economy are met while the integrity and soundness of banks and financial institutions are secured on an enduring basis.

- Balance Sheet Stress:

Non-Performing Asset

- NPA refers to a classification for loans or advances that are in default or are in arrears on scheduled payments of principal or interest.

- In most cases, debt is classified as non-performing, when the loan payments have not been made for a minimum period of 90 days.

- Gross non-performing assets are the sum of all the loans that have been defaulted by the individuals who have acquired loans from the financial institution.

- Net non-performing assets are the amount that is realized after provision amount has been deducted from the gross non-performing assets.

Capital Adequacy Ratio

- It is the ratio of a bank’s capital in relation to its risk weighted assets and current liabilities. It is also known as Capital-to-Risk Weighted Asset Ratio (CRAR).

- It is decided by central banks to prevent commercial banks from taking excess leverage and becoming insolvent in the process.

Provisioning Coverage Ratio

- It refers to the prescribed percentage of funds to be set aside by the banks for covering the prospective losses due to bad loans.

Indian Economy

Four Years of the GST

Why in News

Recently, the Central Board of Indirect Taxes and Customs (CBIC) decided to felicitate around 54,000 taxpayers to mark the competition of 4 years of Goods and Services Tax (GST).

Key Points

- Achievements of GST:

- Automated Indirect Tax Ecosystem:

- The introduction of e-way bills coupled with the crackdown on fake invoicing has helped in bringing in a substantial portion of GST revenues, which were either being evaded or under-reported.

- E-invoicing system would also usher the taxpayers into a fully automated compliance regime wherein the computation of tax liabilities and matching of input tax credit would become very simple.

- Simplification of Compliance:

- Various initiatives viz. linking the customs portal with GST portal for credit availability on imports, making available proper means for matching input tax credit, increased automation of the refund procedure to seamless operation of the Invoice Registry Portal, helped simplify tax compliance.

- Functioning of GST Council:

- The GST Council made corrections to law, issued clarifications on complex issues, rationalized GST rates and introduced relaxations for dealing with the Covid-19 pandemic, which establishes that the GST Council structure has been very functional and agile.

- Example to the World:

- India has served as an example to the world by successfully implementing one of the most complex tax transformation projects for the country.

- Automated Indirect Tax Ecosystem:

- Challenges:

- Fiscal Federalism:

- This issue became controversial when GST collections fell because of the pandemic.

- Because GST entailed a bigger surrender of taxation powers for the states – states do not levy direct taxes or customs duties – a guaranteed revenue growth of 14% for a period of five years was offered to them by the centre to get them to agree.

- Issues Highlighted by the 15th Finance Commission:

- The 15th Finance Commission has highlighted several areas of concern in the GST regime relating to multiplicity of tax rates, shortfall in GST collections vis-à-vis the forecast, high volatility in GST collections, inconsistency in filing of returns, dependence of States on the compensation from Centre and so on.

- Large Businesses vs Small Businesses:

- The fundamental principles on which the GST law was built viz. seamless flow of input credits and ease of compliance has been impaired by IT glitches.

- Indirect taxes, unlike direct taxes such as income tax, do not differentiate between the rich and the poor and therefore put a bigger burden on the latter.

- Further, small and medium businesses are still grappling to adapt to the tech-enabled regime.

- Fiscal Federalism:

- Suggestions:

- With oil prices sky-rocketing across the country, the policymakers need to contemplate the inclusion of petroleum and related products within the GST net.

- It is vital to finally constitute the GST Appellate Tribunal as it is obvious that all taxpayers do not have the finances or means to approach the High Court for every practical difficulty faced.

- Streamlining of anti-profiteering measures and simplification of compliance procedures also needs to be revisited to ensure that the cost efficiency and reduction in prices envisaged under GST law finally reaches the common man.

Goods And Services Tax

- About:

- The GST is a value-added tax levied on most goods and services sold for domestic consumption.

- The GST is paid by consumers, but it is remitted to the government by the businesses selling the goods and services.

- GST, which subsumed almost all domestic indirect taxes (petroleum, alcoholic beverages and stamp duty are the major exceptions) under one head, is perhaps the biggest tax reform in the history of independent India. It was launched into operation on the midnight of 1st July 2017.

- Features of GST:

- Applicable on Supply Side: GST is applicable on ‘supply’ of goods or services as against the old concept on the manufacture of goods or on sale of goods or on provision of services.

- Destination based Taxation: GST is based on the principle of destination-based consumption taxation as against the principle of origin-based taxation.

- Dual GST: It is a dual GST with the Centre and the States simultaneously levying tax on a common base. The GST to be levied by the Centre is called Central GST (CGST) and that to be levied by the States is called State GST (SGST).

- Import of goods or services would be treated as inter-state supplies and would be subject to Integrated Goods & Services Tax (IGST) in addition to the applicable customs duties.

- GST rates to be mutually decided: CGST, SGST & IGST are levied at rates to be mutually agreed upon by the Centre and the States. The rates are notified on the recommendation of the GST Council.

- Multiple Rates: GST is levied at four rates viz. 5%, 12%, 18% and 28%. The schedule or list of items that would fall under these multiple slabs are worked out by the GST council.

- This is aside from the tax on gold that is kept at 3% and rough precious and semi-precious stones that are placed at a special rate of 0.25% under GST.

- GST Council:

- It is a constitutional body (Article 279A) for making recommendations to the Union and State Government on issues related to GST.

- The GST Council is chaired by the Union Finance Minister and other members are the Union State Minister of Revenue or Finance and Ministers in-charge of Finance or Taxation of all the States.

- It is considered as a federal body where both the centre and the states get due representation.

- Reforms brought about by GST:

- Creation of a common national market: By amalgamating a large number of Central and State taxes into a single tax.

- Mitigation of cascading effect:

- The GST that a merchant pays to procure goods or services (i.e. on inputs) can be set off later against the tax applicable on supply of final goods and services. The set off tax is called input tax credit.

- The GST thus avoids cascading effect or tax on tax which increases the tax burden on the end consumer.

- Reduction in Tax burden: From the consumers’ point of view, the biggest advantage is in terms of reduction in the overall tax burden on goods.

- Making Indian products more competitive: Introduction of GST is making Indian products more competitive in the domestic and international markets owing to the full neutralization of input taxes across the value chain of production.

Way Forward

- The law is still a ‘work-in-progress’ and the process of evolution, in such a complex journey, cannot be eliminated. The Government should continue to take measures to deliver on its promise of a ‘Good & Simple Tax’ in the times to come.

Indian Economy

Forex Reserves

Why in News

According to the recent data from the Reserve Bank of India, India’s Foreign Exchange (Forex) Reserves surged by $ 5 billion to $ 609 billion in the week ended 25th June, 2021.

- Increase in the Foreign Currency Assets (FCA) is the major component of overall reserves.

Key Points

- Changes in forex reserves holdings:

- FCA rose by $ 4.7 billion to $ 566 billion.

- Gold reserves rose by $ 365 million to $ 36.296 billion.

- The special drawing rights (SDRs) with the International Monetary Fund (IMF) remained unchanged at $1.498 billion.

- The country's reserve position with the IMF increased marginally by $ 1 million to $ 4.965 billion in the week.

- Foreign Exchange Reserves:

- Foreign exchange reserves are assets held on reserve by a central bank in foreign currencies, which can include bonds, treasury bills and other government securities.

- It needs to be noted that most foreign exchange reserves are held in US dollars.

- India’s Forex Reserve include:

- Foreign Currency Assets

- Gold reserves

- Special Drawing Rights

- Reserve position with the International Monetary Fund (IMF).

- Foreign exchange reserves are assets held on reserve by a central bank in foreign currencies, which can include bonds, treasury bills and other government securities.

- Objectives of Holding Forex Reserves:

- Supporting and maintaining confidence in the policies for monetary and exchange rate management.

- Provides the capacity to intervene in support of the national or union currency.

- Limits external vulnerability by maintaining foreign currency liquidity to absorb shocks during times of crisis or when access to borrowing is curtailed.

- Significance of rising forex reserves:

- Comfortable Position for the Government: The rising forex reserves give comfort to the government and the RBI in managing India’s external and internal financial issues.

- Managing Crisis: It serves as a cushion in the event of a Balance of Payment (BoP) crisis on the economic front.

- Rupee Appreciation: The rising reserves have also helped the rupee to strengthen against the dollar.

- Confidence in Market: Reserves will provide a level of confidence to markets and investors that a country can meet its external obligations.

Foreign Currency Assets

- FCAs are assets that are valued based on a currency other than the country's own currency.

- FCA is the largest component of the forex reserve. It is expressed in dollar terms.

- The FCAs include the effect of appreciation or depreciation of non-US units like the euro, pound and yen held in the foreign exchange reserves.

Special Drawing Rights

- The SDR is an international reserve asset, created by the IMF in 1969 to supplement its member countries’ official reserves.

- The SDR is neither a currency nor a claim on the IMF. Rather, it is a potential claim on the freely usable currencies of IMF members. SDRs can be exchanged for these currencies.

- The value of the SDR is calculated from a weighted basket of major currencies, including the US dollar, the euro, Japanese yen, Chinese yuan, and British pound.

- The interest rate on SDRs or (SDRi) is the interest paid to members on their SDR holdings.

Reserve Position in the International Monetary Fund

- A reserve tranche position implies a portion of the required quota of currency each member country must provide to the IMF that can be utilized for its own purposes.

- The reserve tranche is basically an emergency account that IMF members can access at any time without agreeing to conditions or paying a service fee.

Social Justice

Trafficking in Persons Report

Why in News

According to the Trafficking in Persons report 2021, released by the US State Department, the Covid-19 pandemic has resulted in an increase in vulnerability to human trafficking and interrupted existing anti-traffic efforts.

- Human trafficking, also called trafficking in persons, form of modern-day slavery involving the illegal transport of individuals by force or deception for the purpose of labour, sexual exploitation, or activities in which others benefit financially.

Key Points

- Findings of the Report:

- While India did not meet the minimum standards to eliminate trafficking, the government was making significant efforts, although these were inadequate, especially when it came to bonded labour.

- Chinese government engaged in widespread forced labour, including through the continued mass arbitrary detention of more than one million Uyghurs, ethnic Kazakhs, ethnic Kyrgyz, and other Muslims.

- Reasons for Increased Trafficking:

- The concurrence of the increased number of individuals at risk, traffickers’ ability to capitalise on competing crises, and the diversion of resources to pandemic response efforts has resulted in an ideal environment for human trafficking to flourish and evolve.

- Categorisation of Countries:

- The categorisation is based not on the magnitude of a country’s trafficking problem but on efforts to meet minimum standards for the elimination of human trafficking.

- The countries are designated on the three-tier system:

- Tier 1 countries are those countries whose governments fully comply with the Trafficking Victims Protection Act (TVPA - US’s law on human trafficking) minimum standards.

- USA, UK, Australia, Bahrain and South Korea are some of the countries in tier 1.

- Tier 2 countries are those countries whose governments do not fully comply with TVPA's minimum standards but are making significant efforts to bring themselves into compliance with those standards.

- Tier 2 watchlist countries are those where the absolute number of victims of severe forms of trafficking is significant or is significantly increasing.

- India is placed in Tier 2 category.

- Tier 3 countries whose governments do not fully comply with the minimum standards and are not making significant efforts to do so.

- Afghanistan, Burma, China, Cuba, Eritrea, North Korea, Iran, Russia, South Sudan, Syria and Turkmenistan are under this tier.

- There are also a few "Special Cases" such as Yemen, where the civil conflict and humanitarian crisis make gaining information difficult.

- Tier 1 countries are those countries whose governments fully comply with the Trafficking Victims Protection Act (TVPA - US’s law on human trafficking) minimum standards.

- Relevant Laws in India:

- Article 23 and 24 of the Constitution of India.

- Article 23 prohibits human trafficking and begar (forced labour without payment).

- Article 24 forbids employment of children below the age of 14 years in dangerous jobs like factories and mines.

- Indian Penal Code (IPC) Section:

- Section 370 and 370A of IPC provide for comprehensive measures to counter the menace of human trafficking including trafficking of children for exploitation in any form including physical exploitation or any form of sexual exploitation, slavery, servitude, or the forced removal of organs.

- Sections 372 and 373 dealing with selling and buying of girls for the purpose of prostitution.

- Other Legislations:

- The Immoral Traffic (Prevention) Act, 1956 (ITPA) is the premier legislation for prevention of trafficking for commercial sexual exploitation.

- There are other specific legislations enacted relating to trafficking in women and children - Prohibition of Child Marriage Act, 2006, Bonded Labour System (Abolition) Act, 1976, Child Labour (Prohibition and Regulation) Act, 1986, Transplantation of Human Organs Act, 1994,

- Protection of Children from Sexual offences (POCSO) Act, 2012, is a special law to protect children from sexual abuse and exploitation.

- State Governments have also enacted specific legislations to deal with the issue (e.g. The Punjab Prevention of Human Smuggling Act, 2012).

- Article 23 and 24 of the Constitution of India.

Other Steps Taken by India

- Anti-Trafficking Nodal Cell was set up in the Ministry of Home Affairs (MHA) in 2006 to act as a focal point for communicating various decisions and follow up on action taken by the State Governments to combat the crime of Human Trafficking.

- Anti Human Trafficking Unit (AHTU): The Ministry of Home Affairs under a Comprehensive Scheme ‘Strengthening Law Enforcement Response in India against Trafficking in Persons’ (2010) has released fund for establishment of AHTU for many districts of the country.

- The primary role of an Anti Human Trafficking Unit (AHTU) is law enforcement and liaising with other concerned agencies for care & rehabilitation of victims.

- UN Convention: India has ratified (in 2011) United Nations Convention on Transnational Organised Crime (UNCTOC) which among others has a Protocol to Prevent, Suppress and Punish Trafficking in Persons, especially Women and Children.

- SAARC Convention: India has ratified the SAARC Convention on Preventing and Combating Trafficking in Women and Children for Prostitution.

- Bilateral Mechanism: A Memorandum of Understanding (MoU) between India and Bangladesh for Prevention of Human Trafficking in Women and Children, Rescue, Recovery, Repatriation and Re-integration of Victims of Trafficking was signed in June, 2015.

- Judicial Colloquium: These are held at the High court level.

- The aim is to sensitize the judicial officers about the various issues concerning human trafficking and to ensure speedy court process.

- Capacity Building: Various Training of Trainers (TOT) workshops on ‘Combating Trafficking in Human Beings’ for Police officers and for Prosecutors at Regional level, State level and District level have been organized by the government throughout the country.

Way Forward

- There is a need to step up technical assistance and strengthen cooperation, to support all countries to protect victims and bring criminals to justice.

- The capacity building of the Police along with that of the NGOs is necessary to tackle the menace of human trafficking.

- There is a need to ensure proper data sharing, internally in an administration or between agencies like the police or the NGOs, or between the different countries as well.

- The Justice Verma Committee, 2012 had recommended a census of the missing children.

- Government needs to take some preventive steps, such as

- Educating children on the crime of trafficking by including the same in their school curriculum.

- Making people aware as a society i.e. if an individual comes across any suspicious activity, s/he should report the same to the concerned authorities.

Governance

Drop in Open Defecation: Wash Report

Why in News

According to a new report by the Wash Institute (a global non-profit organisation), India was responsible for the largest drop in open defecation since 2015, in terms of absolute numbers.

- Universal access to water, sanitation and hygiene (WASH) to achieve the United Nations-mandated Sustainable Development Goal (SDG) 6 was also emphasised.

WASH

- WASH is an acronym that stands for the interrelated areas of Water, Sanitation and Hygiene.

- The World Health Organisation (WHO) WASH Strategy 2018-25 has been developed in response to Member State Resolution (WHA 64.4) and the 2030 Agenda for Sustainable Development (SDG 3: Good Health and Well Being, SDG 6: Clean Water And Sanitation).

- It is a component of WHO’s 13th General Programme of Work 2019–2023 which aims to contribute to the health of three billion through multisectoral actions like better emergency preparedness and response; and one billion with Universal Health Coverage (UHC).

- It also takes on board the need for progressive realization of the human rights to safe drinking-water and sanitation, adopted by the UN General Assembly in July 2010.

Key Points

- Findings of the Report:

- On Open Defecation:

- Within India, open defecation had been highly variable regionally since at least 2006 but by 2016 open defecation had decreased in all states, with the largest drops seen in Himachal Pradesh and Haryana.

- Progress in curbing open defecation in sub-Saharan Africa was slow.

- On SDG 6:

- Between 2016 and 2020, the global population with access to safely managed drinking water at home increased to 74%, from 70%.

- There is an improvement in at-source water resources and onsite sanitation systems.

- At-source water resources include piped water, boreholes or tubewells, protected dug wells, protected springs, rainwater and packaged or delivered water.

- Onsite sanitation system is a system in which excreta and wastewater are collected, stored and/or treated on the plot where they are generated.

- There was an increase in safely managed sanitation services to 54%, from 47% between 2016 and 2020.

- On Open Defecation:

- Challenges:

- In order to ensure long-term sustainability of both centralised and decentralised sanitation, proper funding and investment was required.

- The Report also talked about hygiene, especially in the context of the novel coronavirus disease (Covid-19).

- In June 2020, the World Health Organization and Unicef jointly launched the ‘Hand Hygiene for All’ initiative, which aims to improve access to handwashing infrastructure as well as stimulating changes in handwashing practices where facilities are available.

- Handwashing facilities with soap and water increased to 71%, from 67%.

- However, 3 in 10 people worldwide could not wash their hands with soap and water at home during the Covid-19 pandemic due to lack of water resources.

- Open Defecation:

- It refers to the practise whereby people go out in fields, bushes, forests, open bodies of water, or other open spaces rather than using the toilet to defecate.

- It poses a serious threat to the health of children in India.

- It exposes women to the danger of physical attacks and encounters such as snake bites.

- Poor sanitation also cripples national development, by diverting people’s hard-earned money towards out of pocket expenditure on health (leading cause of dragging people into poverty), rather than productive investment like education.

Some Government Initiatives

- National rural sanitation strategy:

- The Department of Drinking Water and Sanitation (DDWS) under the Ministry of Jal Shakti has launched the 10-year Rural Sanitation Strategy starting from 2019 up to 2029.

- It lays down a framework to guide local governments, policy-makers, implementers and other relevant stakeholders in their planning for Open Defecation Free (ODF) Plus status, where everyone uses a toilet, and every village has access to solid and liquid waste management.

- Swachh Bharat Mission Grameen Phase-II:

- It emphasizes the sustainability of achievements under phase I and to provide adequate facilities for Solid/Liquid & plastic Waste Management (SLWM) in rural India.

- Under the Swachh Bharat Mission (G) Phase-I, more than 10 crore individual toilets have been constructed since the launch of the mission; as a result, rural areas in all the States have declared themselves ODF as on 2nd October, 2019.

Open Defecation Free (ODF), ODF+, ODF++ Status (for Town and Cities)

- ODF: An area can be notified or declared as ODF if at any point of the day, not even a single person is found defecating in the open.

- ODF+: This status is given if at any point of the day, not a single person is found defecating and/or urinating in the open, and all community and public toilets are functional and well maintained.

- ODF++: This status is given if the area is already ODF+ and the faecal sludge/septage and sewage are safely managed and treated, with no discharging or dumping of untreated faecal sludge and sewage into the open drains, water bodies or areas.

Governance

Andhra Pradesh-Telangana Water Dispute

Why in News

Amid escalating tensions, the Police forces were deployed at various hydel power projects in bordering districts of Andhra Pradesh and Telangana.

- Andhra Pradesh has complained to the Krishna River Management Board (KRMB) about the drawing of water from the Srisailam project by Telangana for power generation.

- The KRMB, in its recent orders, had asked Telangana to stop power generation. The tension has emerged over defiance of orders of the KRBM by Telangana Government.

Key Points

- About Dispute:

- Telangana and Andhra Pradesh share stretches of the Krishna and the Godavari and own their tributaries.

- Both states have proposed several new projects without getting clearance from the river boards, the Central Water Commission and the Apex Council, as mandated by the Andhra Pradesh Reorganisation Act, 2014.

- The Andhra Pradesh Reorganisation Act, 2014 mandates for the constitution of an Apex Council by the Central Government for the supervision of the functioning of the Godavari River Management Board and Krishna River Management Board.

- The Apex Council comprises the Union Water Resources Minister and the Chief Ministers of Telangana and Andhra Pradesh.

- The Andhra Pradesh government’s proposal to increase the utilisation of the Krishna water from a section of the river above the Srisailam Reservoir led to the Telangana government filing a complaint against Andhra Pradesh.

- The Srisailam reservoir is constructed across the Krishna River in Andhra Pradesh. It is located in the Nallamala hills.

- The Andhra Pradesh government retaliated with its own complaints saying that Palamuru-Rangareddy, Dindi Lift Irrigation Schemes on the Krishna river and Kaleshwaram, Tupakulagudem schemes and a few barrages proposed across the Godavari are all new projects.

- Inter-State River Water Disputes:

- Article 262 of the Constitution provides for the adjudication of inter-state water disputes.

- Under this, Parliament may by law provide for the adjudication of any dispute or complaint with respect to the use, distribution and control of waters of any inter-state river and river valley.

- Parliament may also provide that neither the Supreme Court nor any other court is to exercise jurisdiction in respect of any such dispute or complaint.

- The Parliament has enacted the two laws, the River Boards Act (1956) and the Inter-State Water Disputes Act (1956).

- The River Boards Act provides for the establishment of river boards by the Central government for the regulation and development of inter-state river and river valleys.

- A River Board is established on the request of state governments concerned to advise them.

- The Inter-State Water Disputes Act empowers the Central government to set up an ad hoc tribunal for the adjudication of a dispute between two or more states in relation to the waters of an inter-state river or river valley.

- The decision of the tribunal is final and binding on the parties to the dispute.

- Neither the Supreme Court nor any other court is to have jurisdiction in respect of any water dispute which may be referred to such a tribunal under this Act.

- Article 262 of the Constitution provides for the adjudication of inter-state water disputes.

Godavari River

- Source: Godavari river rises from Trimbakeshwar near Nasik in Maharashtra and flows for a length of about 1465 km before outfalling into the Bay of Bengal.

- Drainage Basin: The Godavari basin extends over states of Maharashtra, Telangana, Andhra Pradesh, Chhattisgarh and Odisha in addition to smaller parts in Madhya Pradesh, Karnataka and Union territory of Puducherry.

- Tributaries: Pravara, Purna, Manjra, Penganga, Wardha, Wainganga, Pranhita (combined flow of Wainganga, Penganga, Wardha), Indravati, Maner and the Sabri

Krishna River

- Source: It originates near Mahabaleshwar (Satara) in Maharashtra. It is the second biggest river in peninsular India after the Godavari River.

- Drainage: It runs from four states Maharashtra (303 km), North Karnataka (480 km) and the rest of its 1300 km journey in Telangana and Andhra Pradesh before it empties into the Bay of Bengal.

- Tributaries: Tungabhadra, Mallaprabha, Koyna, Bhima, Ghataprabha, Yerla, Warna, Dindi, Musi and Dudhganga.

Biodiversity & Environment

Conservation of Vultures

Why in News

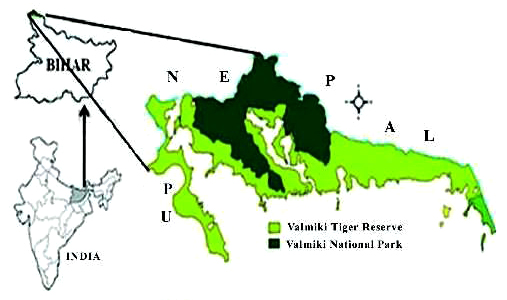

Recently, 150 vultures were seen in the Valmiki Tiger Reserve (VTR), Bihar, which has prompted a vulture conservation plan in the protected region of VTR.

Key Points

- About Vultures:

- It is one of the 22 species of large carrion-eating birds that live predominantly in the tropics and subtropics.

- They act an important function as nature’s garbage collectors and help to keep the environment clean of waste.

- Vultures also play a valuable role in keeping wildlife diseases in check.

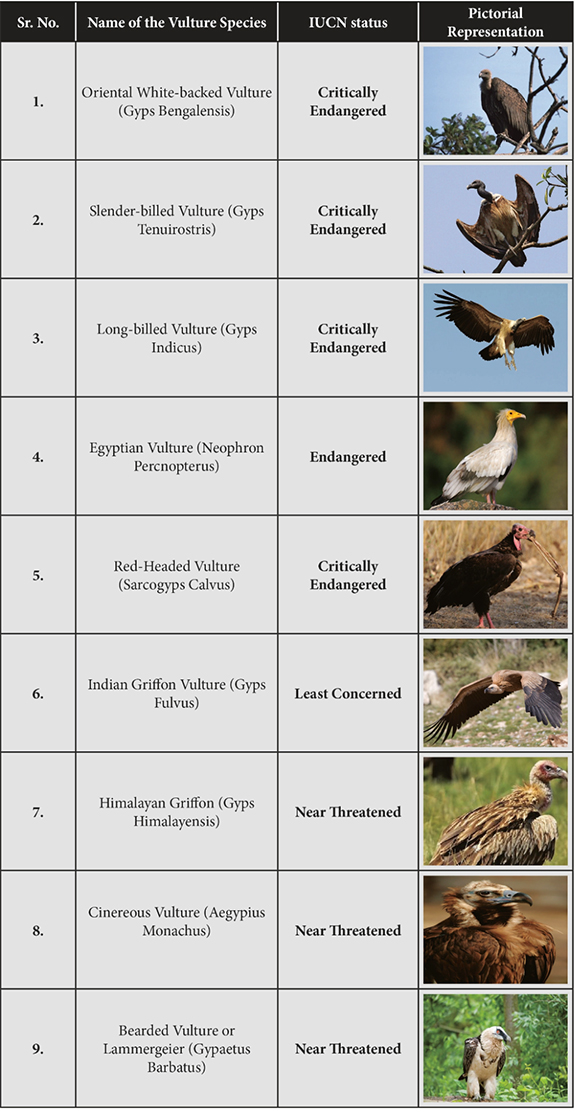

- India is home to 9 species of Vulture namely the Oriental white-backed, Long-billed, Slender-billed, Himalayan, Red-headed, Egyptian, Bearded, Cinereous and the Eurasian Griffon.

- Most of these 9 species face danger of extinction.

- Bearded, Long-billed, Slender-billed, Oriental white-backed are protected in the Schedule-1 of the Wildlife Protection Act 1972. Rest are protected under ‘Schedule IV’.

- IUCN status:

- Threats:

- Poisoning from diclofenac that is used as a medicine for livestock.

- Loss of Natural Habitats due to anthropogenic activities.

- Food Dearth and Contaminated Food.

- Electrocution by Power lines.

- Conservation Efforts:

- Recently, the Ministry for Environment, Forests and Climate Change launched a Vulture Action Plan 2020-25 for the conservation of vultures in the country.

- It will ensure minimum use of Diclofenac and prevent the poisoning of the principal food of vultures, the cattle carcasses.

- The Vulture Safe Zone programme is being implemented at eight different places in the country where there were extant populations of vultures, including two in Uttar Pradesh.

- To upscaling conservation four rescue centres will be opened like Pinjore in the north, Bhopal in central India, Guwahati in Northeast and Hyderabad in South India.

- The ministry has now also launched conservation plans for the red-headed and Egyptian vultures, with breeding programmes for both.

- To study the cause of deaths of vultures in India, a Vulture Care Centre (VCC) was set up at Pinjore, Haryana in 2001.

- Later in 2004, the VCC was upgraded to being the first Vulture Conservation and Breeding Centre (VCBC) in India.

- At present, there are nine Vulture Conservation and Breeding Centres (VCBC) in India, of which three are directly administered by the Bombay Natural History Society (BNHS).

- Recently, the Ministry for Environment, Forests and Climate Change launched a Vulture Action Plan 2020-25 for the conservation of vultures in the country.

Valmiki Tiger Reserve

- Location:

- located at the India-Nepal border in the West Champaran district of Bihar.

- It forms the easternmost limits of the Himalayan Terai forests in India.

- Situated in the Gangetic Plains bio-geographic zone of the country, the forest has a combination of bhabar and terai tracts.

- Establishment:

- This was established in March 1994 under Project Tiger.

- Biodiversity:

- The wildlife found in the forest of National Park are the Bengal tiger, Indian rhinoceros, black bear, Indian sloth bear, otter, Indian leopard, wild dog, buffalo, and boar.

- Also Indian flying foxes can be sighted here.

- The Reserve has rich avifauna diversity. Over 250 species of birds have been reported.

- Tharu’, a scheduled tribe, is the dominant community in the landscape of the Valmiki National Park.

- Other Protected Areas in Bihar:

- Bhimbandh Sanctuary.

- Rajgir Sanctuary.

- Kaimur Sanctuary.

- Kanwar Jheel Bird Sanctuary.

- Vikramshila Gangetic Dolphin.

- Gautambudha Sanctuary.

Important Facts For Prelims

Vembanad Lake: Kerala

Why in News

Kerala houseboats in Vembanad Lake are about to begin soon amid a robust vaccination drive.

- This is the largest lake in Kerala and the longest Lake in India.

Key Points

- Vembanad Lake is also known as Vembanad Kayal, Vembanad Kol, Punnamada Lake (in Kuttanad) and Kochi Lake (in Kochi).

- Spanning several districts of Kerala and covering a territory of more than 2033.02 km2.

- The lake has its source in four rivers, Meenachil, Achankovil, Pampa and Manimala

- It is separated from the Arabian Sea by a narrow barrier island and is a popular backwater stretch in Kerala.

- Vallam Kali (i.e Nehru Trophy Boat Race) is a Snake Boat Race held every year in the month of August in Vembanad Lake.

- In 2002, it was included in the list of wetlands of international importance, as defined by the Ramsar Convention.

- It is the second-largest Ramsar site in India only after the Sundarbans in West Bengal.

- The Government of India has identified the Vembanad wetland under the National Wetlands Conservation Programme.

- The Kumarakom Bird Sanctuary is located on the east coast of the lake.

- In 2019, Willingdon Island, a seaport located in the city of Kochi, was carved out of Vembanad Lake.

- One of the most outstanding features of this lake is the 1252 m long saltwater barrier, Thanneermukkom, which was built to stop saltwater intrusion into Kuttanad.