International Relations

India in US Currency Practices Monitoring List

Why in News

Recently, the United States (US) placed 11 countries, including India in the Currency Practices Monitoring List (Currency Manipulators Watch List).

- India was on the list in the December 2020 report as well. In 2019, the US Treasury Department had removed India from its currency manipulator watch list of major trading partners.

Key Points

- Currency Manipulators:

- This is a label given by the US government to countries it feels are engaging in “unfair currency practices” by deliberately devaluing their currency against the dollar.

- The practice would mean that the country in question is artificially lowering the value of its currency to gain an unfair advantage over others.

- This is because the devaluation would reduce the cost of exports from that country and artificially show a reduction in trade deficits as a result.

- Currency Manipulator Watch List:

- The US Department of Treasury releases the semi-annual report where it has to track developments in international economies and inspect foreign exchange rates.

- It reviews currency practices of the US’ 20 biggest trading partners.

- The US Department of Treasury releases the semi-annual report where it has to track developments in international economies and inspect foreign exchange rates.

- Criteria:

- An economy meeting two of the three criteria in the Trade Facilitation and Trade Enforcement Act of 2015 is placed on the Watch List. This includes:

- A “significant” bilateral trade surplus with the US — one that is at least USD 20 billion over a 12-month period.

- A material current account surplus equivalent to at least 2% of Gross Domestic Product (GDP) over a 12-month period.

- “Persistent”, one-sided intervention — when net purchases of foreign currency totalling at least 2% of the country’s GDP over a 12 month period are conducted repeatedly, in at least six out of 12 months.

- Countries that meet all three of the criteria are labeled as currency manipulators by the Treasury.

- An economy meeting two of the three criteria in the Trade Facilitation and Trade Enforcement Act of 2015 is placed on the Watch List. This includes:

- Current List:

- Countries on the List:

- The other 10 countries on the list with India that merit “close attention to their currency practices” are China, Japan, Korea, Germany, Ireland, Italy, Malaysia, Singapore, Thailand, and Mexico.

- Questionable Chinese Growth:

- The Chinese economic growth in 2020 exceeded that of other large economies but has been driven by the early resumption of manufacturing and increased external demand, especially for medical supplies, personal protection equipment and electronics.

- Questions remain about the continued strength of the Chinese recovery absent a sustained increase in household consumption.

- China's failure to publish foreign exchange intervention and lack of transparency of its exchange rate mechanism and the activities of state-owned banks warrant close monitoring of renminbi (China’s currency) developments going forward.

- Countries on the List:

- India’s Status:

- India met two of the three criteria that is the trade surplus criterion and the “persistent, one-sided intervention” criterion.

- Consequence:

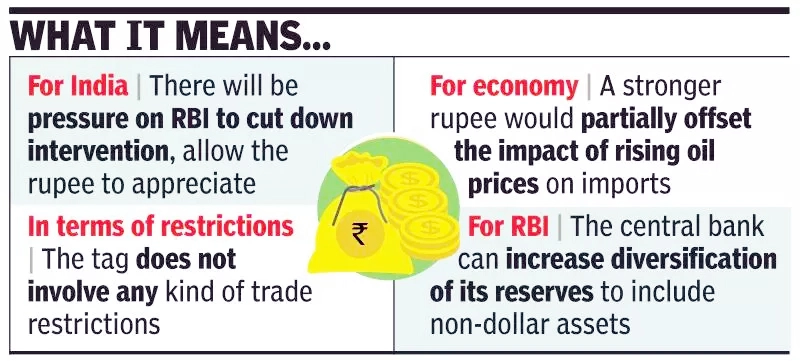

- Inclusion in the list does not subject to any kind of penalty and sanctions but it deteriorates the global financial image of the country in the financial markets in terms of foreign exchange policies including undervaluation of currencies to gain export advantages.

Indian Economy

NEFT & RTGS Direct Membership for Payment System Operators

Why in News

Recently, the Reserve Bank of India (RBI) has proposed to enable, in a phased manner, payment system operators to take direct membership in RTGS and NEFT.

- Real Time Gross Settlement System (RTGS) and National Electronic Fund Transfer (NEFT) are the Centralised Payment Systems (CPSs) of the RBI.

- Non-bank payment system operators, regulated by the RBI, will be allowed to take direct membership in CPSs.

Centralised & Decentralised Payment Systems

- The centralised payment systems will include Real Time Gross Settlement (RTGS) System and National Electronic Fund Transfer (NEFT) system and any other system as may be decided by RBI from time to time.

- RTGS: It enables real-time transfer of funds to a beneficiary’s account and is primarily meant for large-value transactions.

- Real time means the processing of instructions at the time they are received and gross settlement implies that settlement of funds transfer instructions occurs individually.

- NEFT: It is an electronic fund transfer system in which the transactions received up to a particular time are processed in batches.

- It is generally used for fund transfers of up to Rs. 2 lakh.

- The decentralised payment systems will include clearing houses managed by RBI (Cheque Truncation System (CTS) centres) as well as other banks (Express Cheque Clearing System (ECCS) centres) and any other system as decided by RBI from time to time.

- RTGS: It enables real-time transfer of funds to a beneficiary’s account and is primarily meant for large-value transactions.

Key Points

- Direct Membership of NEFT & RTGS to Payment System Operators:

- About:

- This is expected to minimise settlement risk in the financial system and enhance the reach of digital financial services to all user segments.

- These entities will, however, not be eligible for any liquidity facility from RBI to facilitate settlement of their transactions in these Centralised Payment Systems (CPSs).

- This will be subject to an overall limit of Rs. 2 lakh for non-banks.

- Non- Bank Entities becoming the Members of CPS:

- Prepaid Payment Instrument (PPI) issuers, Card Networks, White Label ATM operators, Trade Receivables Discounting System (TReDS) platforms are going to become members of CPS.

- Mobile wallets like Google Pay, Mobikwik, etc. can provide NEFT and RTGS facilities etc to their customers.

- Transfer will be allowed only to KYC (know your customer)-compliant entities.

- About:

- Facility of Cash Withdrawal:

- RBI has also proposed to allow the facility of cash withdrawal, subject to a limit, to non-bank entities — full-KYC PPIs of non-bank PPI issuers.

- Currently, cash withdrawal is allowed only for full-KYC PPIs issued by banks and this facility is available through ATMs and Point of Sale terminals.

- Holders of such PPIs, given the comfort that they can withdraw cash, are less incentivised to carry cash and consequently more likely to perform digital transactions.

- Advantages:

- Increase Digital Transactions:

- Just as use of Unified Payment Interface (UPI) increased over the last 4-5 years since it was opened to third-party aggregators, opening the payment system to non-banks would increase digital payments and transactions significantly.

- It will enable non-banks to go for full KYC compliance and interoperability.

- Better Record of Transactions:

- It will prepare a digital trail of all individuals doing digital transactions on channels outside the banking system, which could help the overall financial system.

- Increase in Market Size:

- Interoperability of the PPI wallet will expand the market size and will be beneficial to the end consumers.

- Financial Inclusion:

- This will open new opportunities for PPI issuers as they will be able to provide RTGS and NEFT services to the wallet users. Overall, this will take financial inclusion deeper in the country.

- Increase Digital Transactions:

- Concerns:

- The opening up of fund transfer and cash withdrawal through non-banks is certainly a sign of a changing banking horizon. Traditional brick-and-mortar banking is slowly disappearing with non-banks entering the space.

- The RBI says India is on the way to becoming Asia’s top FinTech hub with an 87% FinTech adoption rate as against the global average of 64%.

- Fintech (Financial technology) refers to the integration of technology into offerings by financial services companies in order to improve their use and delivery to consumers.

- The FinTech market in India was valued at Rs. 1.9 lakh crore in 2019 and is expected to reach Rs. 6.2 lakh crore by 2025 across diversified fields such as digital payments, digital lending,peer-to-peer (P2P) lending, crowdfunding, block chain technology, distributed ledgers technology, big data, RegTech and SupTech.

Way Forward

- In a world where FinTech companies are leading in terms of the volume of digital transactions and playing a more active role in the banking and finance industry, it is important that commercial banks adapt to the technological changes and work in tandem with these entities so that in future they are part of the ecosystem rather than competing with FinTech companies for business.

Governance

FASTag and Right to Freedom of Movement

Why in News

Recently, the Union government told the Bombay High Court that making FASTag mandatory for all vehicles does not breach a citizen’s fundamental right to freedom of movement in any way.

- A Public Interest Litigation was filed in the Court challenging the government's decision to make FASTag, the electronic toll collection chip, mandatory for all vehicles at toll plazas on national highways.

Key Points

- About FASTag:

- The FASTag is a reloadable tag that allows automatic deduction of toll without having to stop for carrying out the cash transaction.

- The tag uses Radio Frequency Identification (RFID) technology and is fixed on the windscreen of the vehicle once active.

- RFID is the use of radio waves to read and capture information stored on a tag attached to an object.

- A tag can be read from up to several feet away and does not need to be within the direct line-of-sight of the reader to be tracked.

- Government’s Response:

- FASTag ensures seamless traffic movement, cut travel time short, and that all decisions had been taken in accordance with the Central Motor Vehicles (CMV) Rules.

- Section 136A of Motor Vehicles Amendment Act 2019 puts the responsibility on the Central Government to make rules for the electronic monitoring and enforcement of road safety.

- Legislating the establishment of robust electronic enforcement for traffic violations will result in reduction in human intervention and the associated corruption.

- A robust electronic enforcement system including speed cameras, closed-circuit televisions cameras, speed guns and such other technology will ensure violations being captured at a greater scale.

- Provisions had been made at all toll plazas along national highways to fit the chip in vehicles that did not have FASTag.

- In cases where it was not possible to fit vehicles with FASTag on the spot for any reason, the vehicle was permitted to still ply on highways, on extreme left of the FASTag lanes.

- However, such vehicles were required to pay twice the toll amount.

- The double user fees or penalties imposed on vehicles without FASTag on national highways were also in accordance with the National Highway Fee (determination of rates and collection) Rules, 2008.

- Entertaining such petitions would cause "irreparable loss" to the National Highways Authority of India.

- FASTag ensures seamless traffic movement, cut travel time short, and that all decisions had been taken in accordance with the Central Motor Vehicles (CMV) Rules.

Right to Freedom of Movement

- Right to Freedom of movement is guaranteed under Article 19 of the Indian Constitution. It entitles every citizen to move freely throughout the territory of the country.

- This right is protected against only state action and not private individuals. Moreover, it is available only to the citizens and to shareholders of a company but not to foreigners or legal persons like companies or corporations, etc.

- Restrictions on this freedom can only be imposed on two grounds which are mentioned in the Article 19 of the constitution itself, namely, the interests of the general public and the protection of interests of any scheduled tribe.

- The entry of outsiders in tribal areas is restricted to protect the distinctive culture, language, customs and manners of scheduled tribes and to safeguard their traditional vocation and properties against exploitation.

- The Supreme Court held that the freedom of movement of prostitutes can be restricted on the ground of public health and in the interest of public morals.

- The freedom of movement has two dimensions, viz, internal (right to move inside the country) and external (right to move out of the country and right to come back to the country).

- Article 19 protects only the first dimension. The second dimension is dealt by Article 21 (right to life and personal liberty).

Governance

Extradition

Why in News

Recently, the UK’s Home Department has approved the extradition of Nirav Modi, a diamond merchant to India in connection with the Rs. 13,758-crore Punjab National Bank (PNB) fraud.

- India and the UK entered into an extradition treaty in 1992.

Key Points

- About:

- Extradition is the process by which one state, upon the request of another, affects the return of a person for trial for a crime punishable by the laws of the requesting state and committed outside the state of refuge.

- The Supreme Court defined extradition as the delivery on the part of one State to another of those whom it is desired to deal with for crimes of which they have been accused or convicted and are justifiable in the Courts of the other State.

- Extraditable persons include those charged with a crime but not yet tried, those tried and convicted who have escaped custody, and those convicted in absentia.

- Extradition Law in India:

- In India, the extradition of a fugitive criminal is governed under the Indian Extradition Act, 1962.

- This is for both extraditing persons to India and from India to foreign countries.

- The basis of the extradition could be a treaty between India and another country.

- At present India has an Extradition treaty with more than 40 countries and Extradition agreement with 11 countries.

- In India, the extradition of a fugitive criminal is governed under the Indian Extradition Act, 1962.

- Extradition Treaty:

- About:

- Section 2(d) of The Indian Extradition Act 1962 defines an ‘Extradition Treaty’ as a Treaty, Agreement or Arrangement made by India with a Foreign State, relating to the extradition of fugitive criminals which extends to and is binding on India. Extradition treaties are traditionally bilateral in character.

- Principles Followed:

- The extradition applies only to such offences which are mentioned in the treaty.

- It applies the principle of dual criminality which means that the offence sought to be an offence in the national laws of requesting as well as requested country.

- The requested country must be satisfied that there is a prima facie case made against the offender.

- The extradition should be made only for the offence for which extradition was requested.

- The accused must be provided with a fair trial.

- About:

- Nodal Authority:

- Consular, Passport and Visa Division of the Ministry of External Affairs, administers the Extradition Act and it processes incoming and outgoing Extradition Requests.

- Implementation:

- Extradition can be initiated in the case of under-investigation, under-trial and convicted criminals.

- In cases under investigation, abundant precautions have to be exercised by the law enforcement agency to ensure that it is in possession of prima facie evidence to sustain the allegation before the Courts of Law in the Foreign State.

Science & Technology

Whitest Ever Paint Reflects 99% of Sunlight

Why in News

The team of researchers from Purdue University have created an ultra-white paint.

- The newer paint is whiter and keeps the surface areas it is painted on cooler and thus can act as a breakthrough in combating the woes of global warming.

Key Points

- About:

- The new ultrawhite white paint reflects 99% of all light that hits it, remaining significantly cooler than the ambient temperature, even when sitting in full sunlight.

- Typical commercial white paint gets warmer instead of cooler and paints currently available in the market reflect only 80-90% of the sunlight and therefore, they can’t make surfaces cooler than their surroundings.

- Older formulations of white paints were made of calcium carbonate, while the new one is made up of barium sulphate making it more white.

- Barium Sulphate is used to make photo paper and cosmetics white. Different sized particles of this chemical compound, helps in scattering different amounts of light. This allows for light to scatter in a broad range, resulting in the highest reflectance.

- The paint could be the closest equivalent to the blackest black paint Vantablack, which is able to absorb 99.9% of visible light.

- Vantablack has a diverse range of applications including high performance infrared cameras, sensors, satellite borne calibration sources etc.

- Its ability to absorb light energy and convert it to heat is also of relevance in solar power development.

- Reflection or Absorption of a Light by a Color:

- Every object is seen by the eye because of absorption or reflection of light.

- The light is made up of seven different colours (Violet, Indigo, Blue, Green, Yellow, Orange and Red or VIBGYOR). Specifically, light is made up of wavelengths of different colours.

- The colour of any object or thing is determined by the wavelength the molecules are not able to absorb.

- This is dependent on how electrons are arranged in an atom (the building block of life, an atom is made up of electrons, protons and neutrons).

- For example, if an individual is looking at a sofa that is green, this is because the fabric or material it is made up of is able to absorb all the colours except green (reflect the green coloured wavelengths).

- If an object is black, it is because it has absorbed all the wavelengths and therefore no light is reflected from them.

- This is the reason that darker objects, as a result absorbing all wavelengths tend to heat up faster (as during absorption the light energy is converted into heat energy).

- Significance:

- The new paint technology will help buildings covered by this paint to be cooler for longer, eliminating the effects of Urban Heat Island.

- The paint could help in the fight against global warming by reducing our reliance on electrically powered air conditioning.

- As Air conditioning injects heat into Earth's atmosphere in multiple ways, including pushing hot air out of buildings, the heat of running the machines, and the usually fossil fuel-generated electricity that runs them that contributes to carbon dioxide emissions.

- It can not only prevent heat-related deaths and illnesses but also limit water quality depletion that is caused by heated ground.

- India’s Related Initiative:

- India is one of the first countries in the world to develop a comprehensive Cooling Action plan which has a long term vision to address the cooling requirement across sectors and lists out actions which can help reduce the cooling demand.

Way Forward

- With climate change leading to a rise in temperatures and rapid concretisation exacerbating global warming, it has become important to develop adaptation strategies to reduce and combat heat stress.

- Key actions include cooling buildings naturally through better design, improving efficiency of cooling appliances, promoting renewable energy-based energy efficient cold chains and investing in research and development (R&D) of refrigerant gases that do not harm or warm the planet.

- Plant trees and other vegetation, space in urban areas might be limited, but one can easily integrate small green infrastructure practices into grassy or barren areas, vacant lots, and street rights-of-way.

- Greener rooftops, light-coloured concrete, making the road surface greyish or even pinkish can also be used as they absorb less heat and reflect more sunlight.

Social Justice

Global Diabetes Compact: WHO

Why in News

The World Health Organization (WHO) launched a Global Diabetes Compact to better fight the disease while marking the centenary of the discovery of insulin.

- The programme was launched at the Global Diabetes Summit co-hosted by the Government of Canada.

Key Points

- Global Diabetes Compact:

- The Global Diabetes Compact has the vision of reducing the risk of diabetes, and ensuring that all people who are diagnosed with diabetes have access to equitable, comprehensive, affordable and quality treatment and care.

- It will also support the prevention of type 2 diabetes from obesity, unhealthy diet and physical inactivity.

- It will set standards for tackling the diseases in the form of ‘global coverage targets’ for ensuring a wider reach of diabetes care.

- A key aim of the program is to unite key stakeholders from the public and private sectors, and, critically, people who live with diabetes, around a common agenda, to generate new momentum and co-create solutions.

- Diabetes:

- Diabetes is a Non-Communicable Disease (NCD) that occurs either when the pancreas does not produce enough insulin (a hormone that regulates blood sugar, or glucose), or when the body cannot effectively use the insulin it produces.

- It is classified into two types:

- Type 1 Diabetes: It occurs when the pancreas fails to produce sufficient insulin.

- Type 2 Diabetes: Type 2 diabetes is the most common type of diabetes. In this condition the body does not use insulin properly. This is called insulin resistance.The main reason for the occurrence of type 2 diabetes is due to obesity and lack of exercise.

Insulin

- Insulin is a peptide hormone secreted by Pancreas which helps in maintaining normal blood glucose levels by facilitating cellular glucose uptake, regulating carbohydrate, lipid and protein metabolism and promoting cell division and growth through its mitogenic effects.

- It was discovered in 1921 by orthopedic surgeon Dr. Frederick Banting and medical student Charles Best, from the University of Toronto.

- Dr. Banting later won the Nobel Prize for this discovery in 1923 along with Professor McLeod who was a Professor of Carbohydrate Metabolism.

- Global Burden of Diabetes:

- Today, approximately 6% of the world’s population – more than 420 million people – live with either type 1 or type 2 diabetes.

- It is the only major non-communicable disease for which the risk of dying early is going up, rather than down.

- It has emerged as one of the major comorbid conditions linked to severe Covid-19 infections.

- The International Diabetes Foundation Diabetes Atlas, in 2019, placed India among the top 10 countries for people with diabetes.

- Steps Taken by Government of India:

- India’s National Non-Communicable Disease (NCD) Target is to prevent the rise in obesity and diabetes prevalence.

- National Programme for Prevention and Control of Cancers, Diabetes, Cardiovascular Diseases and Stroke (NPCDCS) in 2010, to provide support for diagnosis and cost-effective treatment at various levels of health care.

Important Facts For Prelims

Multisystem Inflammatory Syndrome in Children

Why in News

Recently, doctors in the United States have reported neurological symptoms in children with Multisystem Inflammatory Syndrome in Children (MIS-C).

Key Points

- Multisystem Inflammatory Syndrome in Children (MIS-C):

- MIS-C is a rare but severe hyperinflammatory condition in children and adolescents that typically occurs 2-6 weeks after a Covid-19 infection.

- It is a potentially deadly condition where different body parts can become inflamed, including the heart, lungs, kidneys, brain, skin, eyes, or gastrointestinal organs.

- Children with MIS-C may have a fever and various symptoms, including abdominal (gut) pain, vomiting, diarrhea, neck pain, rash, bloodshot eyes, or feeling extra tired.

- MIS-C with Neurological Complications:

- In a recent study, young people with the MIS-C syndrome have shown neurological issues which were life-threatening such as strokes or severe encephalopathy (any brain disease that alters brain function or structure).

- Neurological symptoms include hallucinations, confusion, speech impairments, and problems with balance and coordination.

- The new findings strengthen the theory that the syndrome is related to a surge of inflammation triggered by an immune response to the virus.

- Causes of MIS-C:

- As the Syndrome is less researched, there are varied theories as to what causes MIS-C.

- While some researchers believe that MIS-C is a delayed response to the coronavirus which in turn causes massive inflammation in the body and as a result damages organs.

- Some believe that it can also be a result of the children’s immune response making antibodies against the virus.

- There may be a genetic component as not every child develops MIS-C and the presenting symptoms are so varied.

- Treatment:

- It involves symptonic relief such as supportive care or use of various medicines to treat inflammation.