Indian Economy

Renewable Power Generation Costs in 2020: IRENA

Why in News

Recently, the International Renewable Energy Agency (IRENA) released the ‘Renewable Power Generation Costs in 2020’ report.

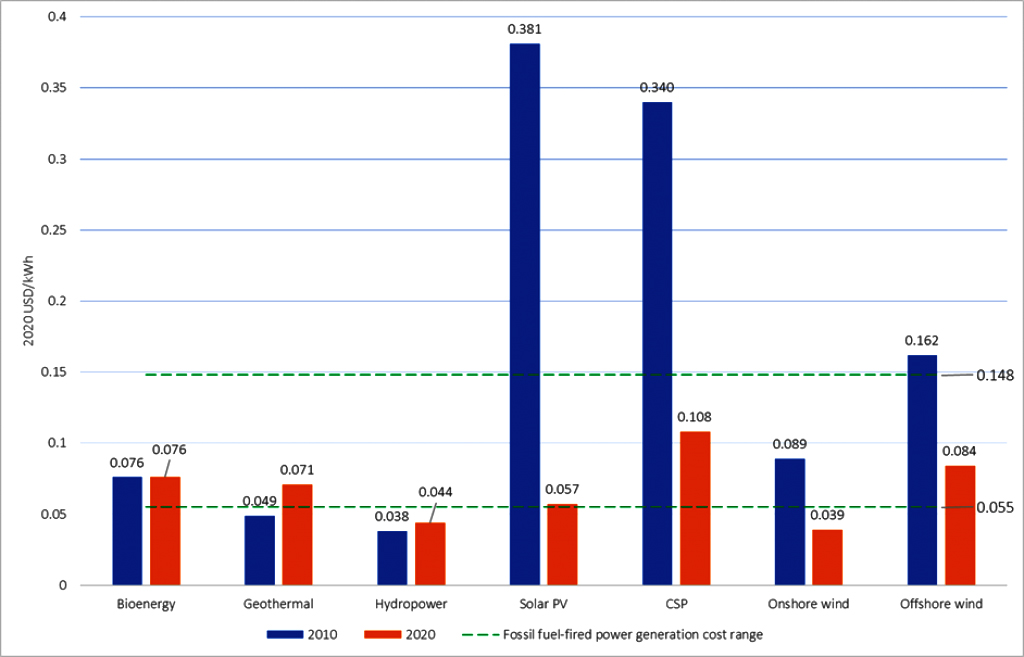

Levelized cost of electricity trends by technology, 2010 and 2020

Key Points

- Replacing Coal with Renewables:

- 810 gigawatts (GW) capacity of the world’s existing coal-fired plants i.e. 38% of the total global energy capacity now have higher operating costs than new utility-scale photovoltaics and onshore wind energy.

- The cost range for generation of fossil fuel-fired power in G20 countries is estimated to be between USD 0.055 per kilowatt-hour (kWh) and USD 0.148/kWh.

- Replacing this expensive coal power with renewables will save operators USD 32 billion a year and reduce annual carbon dioxide emissions by around three billion tonnes.

- Renewable capacities added in 2019 would have saved emerging and developing nations USD 6 billion per annum compared to the same capabilities from conventional sources.

- 810 gigawatts (GW) capacity of the world’s existing coal-fired plants i.e. 38% of the total global energy capacity now have higher operating costs than new utility-scale photovoltaics and onshore wind energy.

- Growth of Renewables in 2020:

- The year 2020 was a record year for renewables deployment despite the Covid-19- pandemic, with 261 GW installed. The addition was almost 50% higher than that made in 2019 and represented 82% of the global new power capacity.

- Around 162 GW or 62% of total renewable power capacity added last year had lower costs than the cheapest new fossil fuel option.

- Supplies from Sources Added in 2020:

- Geothermal > Photovoltaics (PV)> Wind power> Hydropower > Bioenergy> Concentrating solar power.

- Reasons for Growth:

- Between 2000 and 2020, renewables capacity grew more than three times, increasing by 754 GW to 2,799 GW.

- The growth was occasioned by advancements in technologies, consistent fall in component costs, cost-competitive supply distribution channels, learning by using and commercial-scale availability.

- Reducing Cost of Renewables:

- In about 10 years (2010-2020), the cost of power produced from commercial solar PVs fell by 85%, CSP 68%, onshore wind 68% and offshore wind 48%.

- The outlook till 2022 sees global renewable power costs falling further.

- In about 10 years (2010-2020), the cost of power produced from commercial solar PVs fell by 85%, CSP 68%, onshore wind 68% and offshore wind 48%.

- Indian Initiatives for Renewable Energy:

International Renewable Energy Agency

- About:

- It is an intergovernmental organisation, it was officially founded in Bonn, Germany, in January 2009.

- Currently it has 164 members, India is the 77th Founding Member of IRENA.

- It has its headquarters in Abu Dhabi, United Arab Emirates.

- Major Functions:

- It supports countries in their transition to a sustainable energy future, and serves as the principal platform for international cooperation, a centre of excellence, and a repository of policy, technology, resource and financial knowledge on renewable energy.

- It promotes the widespread adoption and sustainable use of all forms of renewable energy, including bioenergy, geothermal, hydropower, ocean, solar and wind energy in the pursuit of sustainable development, energy access, energy security and low-carbon economic growth and prosperity.

Way Forward

- Renewables in all intent and purposes are the most affordable energy sources. Countries should consider deploying these at scale to achieve the Paris Agreement targets and shield their economies from external shocks from fossil fuel markets.

- Right policy incentives and financial incentives to de-risk the sector as well as political support is the need of the hour as most countries have already signaled their commitments towards deploying renewables.

Governance

Fugitive Economic Offenders

Why in News

The Enforcement Directorate has transferred assets worth Rs. 8,441.50 crore to public sector banks that suffered losses to the tune of Rs. 22,585.83 crore due to frauds committed allegedly by Vijay Mallya, Nirav Modi and Mehul Choksi.

- All the three have been declared 'Fugitive Economic Offenders' by PMLA (Prevention of Money Laundering Act) Court in Mumbai.

- Extradition requests to the United Kingdom (UK), Antigua, and Barbuda, have also been filed against all the three accused.

Key Points

- Fugitive Economic Offenders Act, 2018:

- About: It seeks to confiscate properties of economic offenders who have left the country to avoid facing criminal prosecution or refuse to return to the country to face prosecution.

- Fugitive Economic Offender (FEO): A person against whom an arrest warrant has been issued for committing an offence listed in the Act and the value of the offence is at least Rs. 100 crore.

- Some of the offences listed in the act are:

- Counterfeiting government stamps or currency.

- Cheque dishonour.

- Money laundering.

- Transactions defrauding creditors.

- Declaration of a Fugitive Economic Offender:

- After hearing the application, a special court (designated under the PMLA, 2002) may declare an individual as a fugitive economic offender.

- It may confiscate properties which are proceeds of crime, Benami properties and any other property, in India or abroad.

- Upon confiscation, all rights and titles of the property will vest in the central government, free from encumbrances (such as any charges on the property).

- The central government may appoint an administrator to manage and dispose of these properties.

- Bar on Filing or Defending Civil Claims:

- The Act allows any civil court or tribunal to prohibit a declared fugitive economic offender from filing or defending any civil claim.

- Further, any company or limited liability partnership where such a person is a majority shareholder, promoter, or a key managerial person, may also be barred from filing or defending civil claims.

- The authorities may provisionally attach properties of an accused, while the application is pending before the Special Court.

- Powers:

- The authorities under the PMLA, 2002 will exercise powers given to them under the Fugitive Economic Offenders Act.

- These powers will be similar to those of a civil court, including the search of persons in possession of records or proceeds of crime, the search of premises on the belief that a person is an FEO and seizure of documents.

- Prevention of Money Laundering Act (PMLA):

- Money Laundering:

- Money laundering is concealing or disguising the identity of illegally obtained proceeds so that they appear to have originated from legitimate sources. It is frequently a component of other, much more serious, crimes such as drug trafficking, robbery or extortion.

- According to the International Monetary Fund (IMF), global Money Laundering is estimated between 2 to 5% of World GDP.

- Salient Features:

- Punishment for money-laundering:

- Money laundering is punishable with rigorous imprisonment for a minimum of 3 years and a maximum of 7 years and Fine.

- If the crime involves the Narcotic Drugs and Psychotropic Substances Act, 1985, the punishment can go up to 10 years, along with fine.

- Powers of attachment of tainted property:

- The property is believed to be "proceeds of crime" and can be provisionally attached for 180 days. Such an order is required to be confirmed by an independent Adjudicating Authority

- The Enforcement Directorate (ED) is responsible for investigating offences under the PMLA.

- Also, the Financial Intelligence Unit – India (FIU-IND) is the national agency that receives, processes, analyses and disseminates information related to suspect financial transactions.

- Burden of proof: A person, who is accused of having committed the offence of money laundering, has to prove that alleged proceeds of crime are in fact lawful property.

- Punishment for money-laundering:

- Money Laundering:

Enforcement Directorate

- Directorate of Enforcement is a specialized financial investigation agency under the Department of Revenue, Ministry of Finance.

- On 1st May 1956, an ‘Enforcement Unit’ was formed, in the Department of Economic Affairs, for handling Exchange Control Laws violations under Foreign Exchange Regulation Act, 1947.

- In the year 1957, this Unit was renamed as ‘Enforcement Directorate’.

- ED enforces the following laws:

Indian Economy

Gujarat International Maritime Arbitration Centre (GIMAC)

Why in News

Recently, a Memorandum of Understanding (MoU) was signed between the Gujarat Maritime University and International Financial Services Centres Authority in GIFT (Gujarat International Finance Tec-City) City.

- The objective of the MoU is to jointly support the establishment of the Gujarat International Maritime Arbitration Centre (GIMAC).

Key Points

- About GIMAC:

- This will be the first centre of its kind in the country that will manage arbitration and mediation proceedings with disputes related to the maritime and shipping sector.

- The GIMAC will be part of a maritime cluster that the Gujarat Maritime Board (GMB) is setting up in GIFT City at Gandhinagar.

- Need:

- India’s Focus on Arbitration: Recently, the Arbitration and Conciliation (Amendment) Act, 2021 was notified, considered as the landmark step towards making India as the hub of International Commercial Arbitration.

- Arbitration is a kind of dispute resolution method where the disputes arising between the parties are resolved by the arbitrators appointed by them instead of state's legal bodies.

- There are over 35 arbitral institutions in India, however, none focus exclusively on the disputes related to the maritime sector.

- With the state continuing to witness a rapid extension in maritime activities and inching closer to becoming a global maritime hub with the implementation of Gujarat Maritime Cluster project, a strong growing and recurring demand is being generated for a specialized facility for maritime arbitration services.

- The idea is to create a world-class arbitration centre focused on maritime and shipping disputes that can help resolve commercial and financial conflicts between entities having operations in India.

- The arbitration involving Indian players is now heard at the Singapore Arbitration Centre.

- Globally, London is the preferred centre for arbitration for the maritime and shipping sector.

- India’s Focus on Arbitration: Recently, the Arbitration and Conciliation (Amendment) Act, 2021 was notified, considered as the landmark step towards making India as the hub of International Commercial Arbitration.

- Benefits:

- Facilitate faster dispute resolution.

- Enhance the attractiveness of GIFT Special Economic Zone (SEZ) among the International Maritime Community.

- Increase the ease of doing business.

- Reduce burden on courts.

- Gujarat Maritime Cluster:

- It is conceived as a dedicated ecosystem of Ports, Maritime Shipping and Logistics services providers.

- It will host an array of maritime, shipping industry players and service providers, along with relevant Government regulatory agencies, in GIFT City, Gandhinagar – India’s first International Financial Services Centre (IFSC).

- The International Financial Services Centres Authority (IFSCA) is a unified authority for the development and regulation of financial products, financial services and financial institutions in the IFSC in India.

- It will be a one stop solution for all maritime services while attaining economic growth, employment generation and industry – academia confluence in the region.

Indian History

Sant Kabir Das Jayanti

Why in News

Recently, Sant Kabir Das Jayanti was observed on 24th June, 2021 to mark the birth anniversary of Sant Kabirdas.

- Kabirdas Jayanti is celebrated on the Jyeshtha Purnima tithi, as per the Hindu lunar calendar.

Key Points

- About:

- Sant Kabir Das was born in the city of Varanasi, Uttar Pradesh. He was a 15th century mystic poet, saint and social reformer and a proponent of the Bhakti Movement.

- Kabir's legacy is still going on through a sect known as Panth of Kabir, a religious community that considers him as the founder.

- Teacher: His early life was in a Muslim family, but he was strongly influenced by his teacher, the Hindu bhakti leader Ramananda.

- Literature: Kabir Das' writings had a great influence on the Bhakti movement and includes titles like Kabir Granthawali, Anurag Sagar, Bijak, and Sakhi Granth.

- His verses are found in Sikhism's scripture Guru Granth Sahib.

- The major part of his work was collected by the fifth Sikh guru, Guru Arjan Dev.

- He was best known for his two-line couplets, known as 'Kabir Ke Dohe'.

- Language: Kabir's works were written in the Hindi language which was easy to comprehend. He used to write in couplets to enlighten people.

- Sant Kabir Das was born in the city of Varanasi, Uttar Pradesh. He was a 15th century mystic poet, saint and social reformer and a proponent of the Bhakti Movement.

- Bhakti Movement:

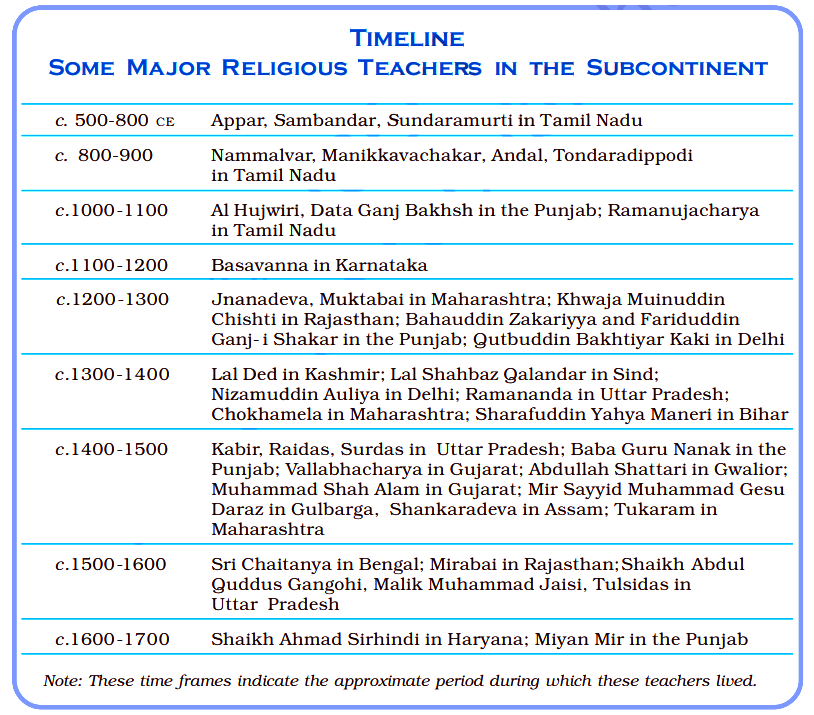

- Beginning: The movement probably began in the Tamil region around the 6th and 7th century AD and achieved a great deal of popularity through the poems of the Alvars (devotees of Vishnu) and Nayanars (devotees of Shiva), the Vaishnavite and Shaivite poets.

- The Alvars and Nayanars travelled from place to place singing hymns in Tamil in praise of their gods.

- The Nalayira Divyaprabandham is a composition by the Alvars. It is frequently described as the Tamil Veda.

- Classification: At a different level, historians of religion often classify bhakti traditions into two broad categories: saguna (with attributes) and nirguna (without attributes).

- The saguna included traditions that focused on the worship of specific deities such as Shiva, Vishnu and his avatars (incarnations) and forms of the goddess or Devi, all often conceptualised in anthropomorphic forms.

- Nirguna bhakti on the other hand was worship of an abstract form of god.

- Social Order:

- This movement was responsible for many rites and rituals associated with the worship of God by Hindus, Muslims and Sikhs of Indian subcontinent. For example, Kirtan at a Hindu Temple, Qawaali at a Dargah (by Muslims), and singing of Gurbani at a Gurdwara.

- They were often opposed to the establishment and all authoritarian monastic order.

- They also strongly criticized all sectarian zealotry and caste discrimination in society.

- Hailing from both high and low castes, these poets created a formidable body of literature that firmly established itself in the popular narratives.

- All of them claimed relevance for religion in social life, in the sphere of real human aspirations and social relationships.

- Bhakti poets emphasized surrender to god.

- The movement's major achievement was its abolition of idol worship.

- Role of Women:

- Andal was a woman Alvar and she saw herself as the beloved of Vishnu.

- Karaikkal Ammaiyar was a devotee of Shiva and she adopted the path of extreme asceticism in order to attain her goal. Her compositions were preserved within the Nayanar tradition.

- Important Personalities:

- Kannada Region: In this region, the movement began by Basavanna (1105-68) in the 12th century.

- Maharashtra: The Bhakti movement began in the late 13th century. Its proponents were known as the Varkaris.

- Among its most popular figures were Jnanadev (1275- 96), Namdev (1270-50) and Tukaram (1608-50).

- Assam: Srimanta Sankardeva (a Vaishnava saint born in 1449 AD in Nagaon district of Assam. He started the neo-Vaishnavite movement).

- Bengal: Chaitanya was a renowned saint and reformer of Bengal who popularised the Krishna cult.

- Northern India: From the 13th to the 17th centuries, a large number of poets flourished who were all Bhakti figures of considerable importance.

- While Kabir, Ravi Dass and Guru Nanak spoke of the formless god (nirgun bhakti), Meerabai (1498-1546) from Rajasthan composed and sung devotional verses in praise of Krishna.

- Surdas, Narasimha Mehta and Tulsidas also made priceless contributions to the canon of Bhakti literature and enhanced its glorious legacy.

- Beginning: The movement probably began in the Tamil region around the 6th and 7th century AD and achieved a great deal of popularity through the poems of the Alvars (devotees of Vishnu) and Nayanars (devotees of Shiva), the Vaishnavite and Shaivite poets.

Indian Economy

Guidelines for Other Service Providers (OSPs)

Why in News

Recently, the Department of Telecommunications (DoT) has eased the norms for Other Service Providers (OSPs).

- The OSP guidelines were earlier liberalised in November 2020 in order to encourage the BPO (Business Process Outsourcing) industry in India. The new guidelines have been simplified even further, offering greater ease of business and regulatory clarity.

Key Points

- Business process outsourcing (BPO):

- BPO is a business practice in which an organization contracts with an external service provider to perform an essential business task.

- BPO offers several benefits, such as lower costs, global expansion, and higher efficiency, while some of the drawbacks include security issues, hidden costs, and overdependence.

- OSPs or Other Service Providers are companies or firms which provide secondary or tertiary services such as telemarketing, telebanking or telemedicine for various companies, banks or hospital chains, respectively.

- The Indian Information Technology (IT) - BPO industry was worth $37.6 billion in 2019-2020, and has the potential to rise to $55.5 billion over the next four to five years.

- BPO is a business practice in which an organization contracts with an external service provider to perform an essential business task.

- Important Features of New Policy:

- Distinction between Domestic and International OSPs has been removed. A BPO centre with common Telecom resources will now be able to serve customers located worldwide including in India.

- Now, the interconnectivity between all types of OSP centres is permitted.

- The Electronic Private Automatic Branch Exchange (EPABX) of OSPs can now be located anywhere in the world.

- Removed the requirement of OSPs submitting their reports to the DoT on a period basis.

- Such service providers will have to self-regulate and maintain a call data record, a usage data record and a system log for all customer calls for a certain time period.

- They will also have to abide by the data security norms prescribed by the Centre.

- Other Provisions:

- Exempted OSPs from requirement of any registration.

- No Bank Guarantees were to be furnished.

- Work from Home and Work from Anywhere was also permitted.

- Penalties for violations were removed altogether reaffirming the trust the Government has in business.

- Distinction between Domestic and International OSPs has been removed. A BPO centre with common Telecom resources will now be able to serve customers located worldwide including in India.

- Expected Benefits:

- The guidelines will make it easier for BPOs and ITes firms in cutting down on the cost of location, rent for premises and other ancillary costs such as electricity and internet bills.

- The companies will no longer have to carry the additional compliance burden of providing the details of OSP employees to the DoT, as they are recognised as extended or remote agents.

- The doing away of registration norms will also mean that there will be no renewal of such licenses. This will invite foreign companies to set up or expand their other service providing units in India.

- It will allow employees to opt for freelancing for more than one company while working from home, thereby attracting more workers in the sector.

- Other Steps Taken to Promote BPO Industry:

Note: A Virtual Network Operator (VNO) License is a smaller subset of the Internet Service Provider (ISP) license. ISPs who wish to do ISP business only in a particular district or state can opt for a VNO license instead of an ISP license due to the cost effectiveness of VNO compared to an ISP license.

Science & Technology

Covid-19 Delta Plus Variant

Why in News

Recently, the Union Ministry of Health and Family Welfare (MoHFW), has warned people against the new Covid-19 strain ‘Delta Plus’ (DP).

- There is fear that this new variant may spark the third wave of Covid-19.

Key Points

- About:

- Delta plus (B.1.617.2.1/(AY.1) is a new variant of the SARS-CoV-2 coronavirus formed due to a mutation in the Delta strain of the virus (B.1.617.2 variant). It is technically the next generation of SARS-COV-2.

- This mutant of Delta was first detected in Europe in March 2021.

- The Delta variant that was first detected in India (in February 2021) eventually became a huge problem for the whole world. However, the Delta Plus variant, at present, is limited to smaller areas in the country.

- It is resistant to monoclonal antibodies cocktail. Since it’s a new variant, its severity is still unknown.

- People reported symptoms like headaches, sore throats, runny noses, and fever.

- The World Health Organisation (WHO) is tracking this variant as part of the Delta variant, it is doing so for other Variants of Concern with additional mutations.

- Transmissibility:

- It has acquired the spike protein mutation called K417N which is also found in the Beta variant first identified in South Africa.

- The spike protein is used by SARS-CoV-2, the virus which causes Covid-19, to enter the host cells.

- Some scientists fear that the mutation combined with other existing features of the Delta variant could make it more transmissible.

- It has acquired the spike protein mutation called K417N which is also found in the Beta variant first identified in South Africa.

- Major Concerns:

- Multiple studies are ongoing in India and globally to test the effectiveness of vaccines against the Delta plus Covid-19 mutation.

- India's health ministry warned that regions where it has been found "may need to enhance their public health response by focusing on surveillance, enhanced testing, quick contact-tracing, and priority vaccination."

- There are worries Delta Plus would inflict another wave of infections on India after it emerged from the world’s worst surge in cases only recently.

- Just over 4% of Indians are fully vaccinated and about 18% have received one dose so far.

Virus Variant

- Variants of a virus have one or more mutations that differentiate it from the other variants that are in circulation. While most mutations are deleterious for the virus, some make it easier for the virus to survive.

- The SARS-CoV-2 (Corona) virus is evolving fast because of the scale at which it has infected people around the world. High levels of circulation mean it is easier for the virus to change as it is able to replicate faster.

- The original pandemic virus (founder variant) was Wu.Hu.1 (Wuhan virus). In a few months, variant D614G emerged and became globally dominant.

- Indian SARS-CoV-2 Consortium on Genomics (INSACOG) is a multi-laboratory, multi-agency, pan-India network to monitor genomic variations in the SARS-CoV-2.

- Global Initiative on Sharing All Influenza Data (GISAID) is a public platform started by the World Health Organization (WHO) in 2008 for countries to share genome sequences.

- The GISAID Initiative promotes the international sharing of all influenza virus sequences, related clinical and epidemiological data associated with human viruses, and geographical as well as species-specific data associated with avian and other animal viruses.

Indian Economy

Toycathon 2021

Why in News

Recently, the Prime Minister of India urged people to be “vocal for local toys”, while interacting with the participants at the Toycathon 2021.

Key Points

- Ministry:

- It was a joint initiative by the Ministry of Education, WCD (Women and Child Development) Ministry, Ministry of Micro, Small and Medium Enterprises, Textile Ministry, Ministry of Information and Broadcasting and All India Council for Technical Education.

- It was launched on 5th January 2021 to crowd-source innovative toys and games ideas.

- Aim:

- To conceptualize innovative toys based on the Indian value system which will inculcate positive behaviour and good value among the children.

- To promote India as a global toy manufacturing hub (Atmanirbhar Bharat).

- Features:

- Based on: Indian culture and ethos, local folklore and heroes, and Indian value systems.

- Themes: Nine themes, including fitness and sport and rediscovering traditional Indian toys.

- Participants: Students, teachers, start-ups and toy experts.

- Prize: Participants can get prizes upto Rs. 50 lakhs.

- Significance:

- Toys can play a big role in highlighting India’s capabilities, art and culture and society to the world.

- Toycathon can prove to be effective in making India a Production Hub of Toys and hence can be the creation of ‘Toyoconomy’.

- Toys can be an excellent medium to further the spirit of ‘Ek Bharat, Shreshtha Bharat’.

- It will help reduce imports.

- Status of Toy Market:

- Global toy market is worth nearly $100 billion.

- Of which, India contributes only around $1.5 billion.

- India imports around 80% of toys from abroad. Which means crores of rupees of the country are going abroad on them.

Way Forward

- Toy industry has its own small-scale industry, artisans comprising rural population, dalits, poor people and tribal population. In order to take the benefits to these segments, we need to be vocal for local toys.

- There is a need for new ideas to be incubated, new start-ups promoted, taking new technology to traditional toy makers and creating new market demand.

- The 75th anniversary of India’s Independence is a huge opportunity for the innovators and creators of the toy industry. Many incidents, stories of our freedom fighters and their valour and leadership can be created into gaming concepts.

- There is a need to create interesting and interactive games that ‘engage, entertain and educate’.

Important Facts For Prelims

Black Sea

Why in News

In a recent event, Russia alleged that the British warship had breached its territorial waters in Black Sea which Britain and most of the world say belong to Ukraine.

- Russia seized and annexed the Crimea peninsula from Ukraine in 2014 and considers areas around its coast to be Russian waters.

Key Points

- Geographical Location of Black Sea:

- The Black Sea, also known as the Euxine Sea, is one of the major water bodies and a famous inland sea of the world.

- This marginal sea of the Atlantic Ocean, located between Eastern Europe and Western Asia.

- It is surrounded by the Pontic, Caucasus, and Crimean Mountains in the south, east and north respectively.

- The Turkish straits system - the Dardanelles, Bosporus and Marmara Sea - forms a transitional zone between the Mediterranean and the Black Sea.

- The Black Sea is also connected to the Sea of Azov by the Strait of Kerch.

- The bordering countries of Black Sea are: Russia, Ukraine, Georgia, Turkey, Bulgaria and Romania.

- Anoxic Water:

- There is a significant absence of oxygen in the water.

- The Black Sea happens to be the largest water body with a meromictic basin, which means the movement of water between the lower and upper layers of the sea is a rare phenomenon to find anywhere in the world.

- The anoxic condition is also caused due to the presence of the process of Eutrophication in the sea.

Anoxic Waters

- Anoxic waters are areas of sea water, fresh water, or groundwater that are depleted of dissolved oxygen and are a more severe condition of hypoxia.

- This condition is generally found in areas that have restricted water exchange.

- International Rules of Passage through Sea:

- Under international law of the sea (United Nations Convention on the Law of the Sea (UNCLOS) 1982), innocent passage permits a vessel to pass through another state’s territorial waters so long as this does not affect its security.

Important Facts For Prelims

Tax Inspectors Without Borders Programme

Why in News

Recently, the Tax Inspectors Without Borders (TIWB), a joint initiative of the United Nations Development Programme (UNDP) and the Organisation for Economic Cooperation and Development (OECD), launched its programme in Bhutan.

- India was chosen as the Partner Jurisdiction and has provided the Tax Expert for this programme.

Key Points

- About:

- This programme is expected to be of about 24 months’ duration.

- It aims to aid Bhutan in strengthening its tax administration by transferring technical know-how and skills to its tax auditors, and through sharing of best audit practices. The focus of the programme will be in the area of International Taxation and Transfer Pricing.

- Transfer price, also known as transfer cost, is the price at which related parties transact with each other, such as during the trade of supplies or labor between departments. Multinational companies can manipulate transfer prices in order to shift profits to low tax regions.

- This programme is another milestone in the continued cooperation between India and Bhutan and India’s continued and active support for South-South cooperation.

- Tax Inspectors Without Borders:

- TIWB is a capacity-building programme.

- It is a joint OECD/UNDP initiative launched in July 2015 to strengthen developing countries' auditing capacity and multinationals' compliance worldwide.

- It deploys qualified experts in developing countries across Africa, Asia, Eastern Europe, Latin America and the Caribbean to help build tax capacity in the areas of audit, criminal tax investigations and the effective use of automatically exchanged information.

- TIWB assistance has led to increased domestic resource mobilisation in some of the least developed countries in the world.

.png)