Important Facts For Prelims

UPI-PayNow Integration

- 22 Feb 2023

- 5 min read

Why in News?

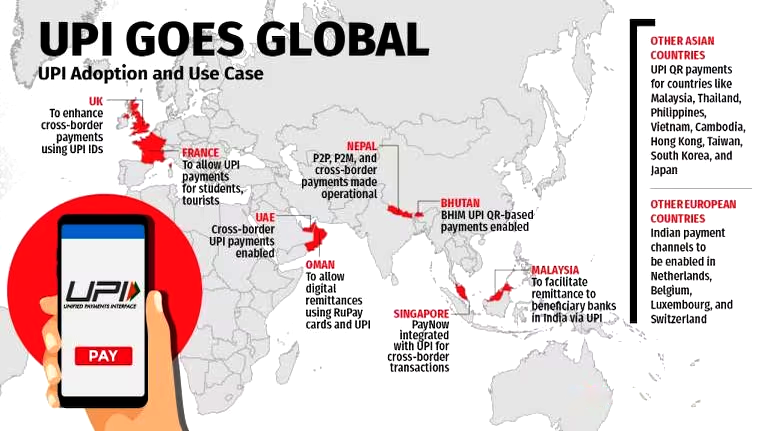

Recently, India’s Unified Payments Interface (UPI) and Singapore’s PayNow have been integrated to enable faster Remittances between the two countries.

- Singapore has become the first country with which cross-border Person to Person (P2P) payment facilities have been launched.

- The UPI-PayNow partnership marks the world’s first to feature cloud-based infrastructure and participation by non-bank financial institutions.

What is UPI and PayNow?

- UPI:

- UPI is India’s mobile-based fast payment system, which facilitates customers to make round-the-clock payments instantly, using a Virtual Payment Address (VPA) created by the customer.

- VPA is a unique identifier assigned to an individual to facilitate the transfer of funds through a digital payments system. It is a user-created identifier that can be used instead of providing sensitive bank account details while making payments.

- It eliminates the risk of sharing bank account details by the remitter. UPI supports both Person-to-Person (P2P) and Person-to-Merchant (P2M) payments and it also enables a user to send or receive money.

- UPI is India’s mobile-based fast payment system, which facilitates customers to make round-the-clock payments instantly, using a Virtual Payment Address (VPA) created by the customer.

- PayNow:

- PayNow is a fast payment system in Singapore. It enables peer-to-peer funds transfer service, available to retail customers through participating banks and Non-Bank Financial Institutions (NFIs) in Singapore.

- It allows users to send and receive instant funds from one bank or e-wallet account to another in Singapore by using just their mobile number, Singapore National Registration Identity Card (NRIC)/Foreign Identification Number (FIN), or VPA.

- Linkage:

- With this facility, funds held in bank accounts or e-wallets can be transferred to /from India using just the UPI ID, mobile number, or VPA.

- This facility will eliminate the need for entering the details of beneficiaries, such as bank account numbers, bank codes etc.

What is the Significance of the Move?

- The project is expected to greatly benefit the Indian diaspora, especially migrant workers and students, in Singapore as it allows faster and cost-efficient funds transfer across both countries without the mandate of getting onboard the other payment system.

- As per the ministry of external affairs (MEA) document Population of Overseas Indians (2022), there are approximately 6.5 lakh Indians, including non-resident Indians and persons of Indian origin, currently residing in Singapore.

- Of the total inward remittances to India in 2020-21, the share of Singapore stood at 5.7%, according to the RBI (Reserve Bank of India) Remittance Survey, 2021.

- Integration of the system will bring down the cost of sending remittances by as much as 10%.

- By reducing the cost and inefficiencies of remittances between Singapore and India, the PayNow-UPI linkage will directly benefit individuals and businesses in Singapore and India that greatly rely on this mode of payment.

UPSC Civil Services Examination, Previous Year Question (PYQ)

Q1. With reference to digital payments, consider the following statements: (2018)

- BHIM app allows the user to transfer money to anyone with a UPI-enabled bank account.

- While a chip-pin debit card has four factors of authentication, BHIM app has only two factors of authentication.

Which of the statements given above is/are correct?

(a) 1 only

(b) 2 only

(c) Both 1 and 2

(d) Neither 1 nor 2

Ans: (a)

Q2. Which of the following is a most likely consequence of implementing the ‘Unified Payments Interface (UPI)’? (2017)

(a) Mobile wallets will not be necessary for online payments.

(b) Digital currency will totally replace the physical currency in about two decades.

(c) FDI inflows will drastically increase.

(d) Direct transfer of subsidies to poor people will become very effective.

Ans: (a)

Q3. Consider the following statements: (2017)

- National Payments Corporation of India (NPCI) helps in promoting the financial inclusion in the country.

- NPCI has launched RuPay, a card payment scheme.

Which of the statements given above is/are correct?

(a) 1 only

(b) 2 only

(c) Both 1 and 2

(d) Neither 1 nor 2

Ans: (c)