PRS Capsule

PRS Capsule May 2020

- 02 Jul 2020

- 32 min read

Key Highlights of PRS

Polity

Pradhan Mantri Vaya Vandana Yojana

- The Union Cabinet approved the extension of the Pradhan Mantri Vaya Vandana Yojana for a period of three years up to 31st March, 2023.

- The Pradhan Mantri Vaya Vandana Yojana aims to provide social security for persons above 60 years of age to protect them against a future fall in their interest income due to uncertain market conditions.

- Under the scheme, an assured interest return is guaranteed by the insurer. The difference between return generated by the insurer and the assured return is borne by the government of India as subsidy on an annual basis.

- For 2020-21, the assured rate of return will be 7.4%. This will be revised every year.

- The scheme can be purchased at a minimum purchase price of Rs 1,56,658 for a yearly pension of Rs 12,000.

- For monthly pension pay-out option, the minimum purchase price will be Rs 1,62,162 for a monthly pension of Rs 1,000.

PM CARES Fund included in the list of CSR eligible activities

- The Ministry of Corporate Affairs notified the inclusion of Prime Minister’s Citizen Assistance and Relief in emergency Situations (PMCARES) Fund in the list of activities eligible for Corporate Social Responsibility (CSR) under the Companies Act, 2013.

- Under the Act, companies with net worth, turnover or profits above a specified amount are required to spend 2% of their average net profits in the last three financial years towards CSR activities.

- This measure has come into effect retrospectively from March 28, 2020, when the fund was set up.

About the Fund

- The Fund is a public charitable trust with the Prime Minister as its Chairman. Other Members include Defence Minister, Home Minister and Finance Minister.

- The Fund enables micro-donations as a result of which a large number of people will be able to contribute with the smallest of denominations.

- The Fund will strengthen disaster management capacities and encourage research on protecting citizens.

Economy

Partial Credit Guarantee Scheme

- Recently, the Union Cabinet approved modifications to the Partial Credit Guarantee Scheme to expand the coverage of the scheme.

- The Partial Credit Guarantee scheme was announced in the Union Budget 2019-20.

- Under the scheme, a government guarantee (covering initial losses of 10% of the value of the assets or Rs 10,000 crore, whichever is lower) is given to public sector banks (PSBs) for buying high-rated pooled assets from financially sound non-banking financial companies (NBFCs) or housing finance companies (HFCs).

- New changes in the Partial Credit Guarantee Scheme:

- Under the expanded scheme, the government will also provide PSBs with a guarantee for covering upto 20% of first loss for the purchase of Bonds or Commercial Papers issued by NBFCs and Micro Finance Institutions (MFIs).

- The minimum rating for such bonds or commercial papers should be AA or below (including unrated paper with initial maturity of up to one year).

- Benefits:

- The government expects that the guarantee will help NBFCs, MFIs and HFCs continue with capital formation in small and medium enterprises, and help mitigate adverse effects of COVID-19.

- The scheme was originally valid till June, 2020. It will now be valid till March 31, 2021, or till such date by which Rs 10,000 crore worth of guarantees are provided by the government, whichever is earlier

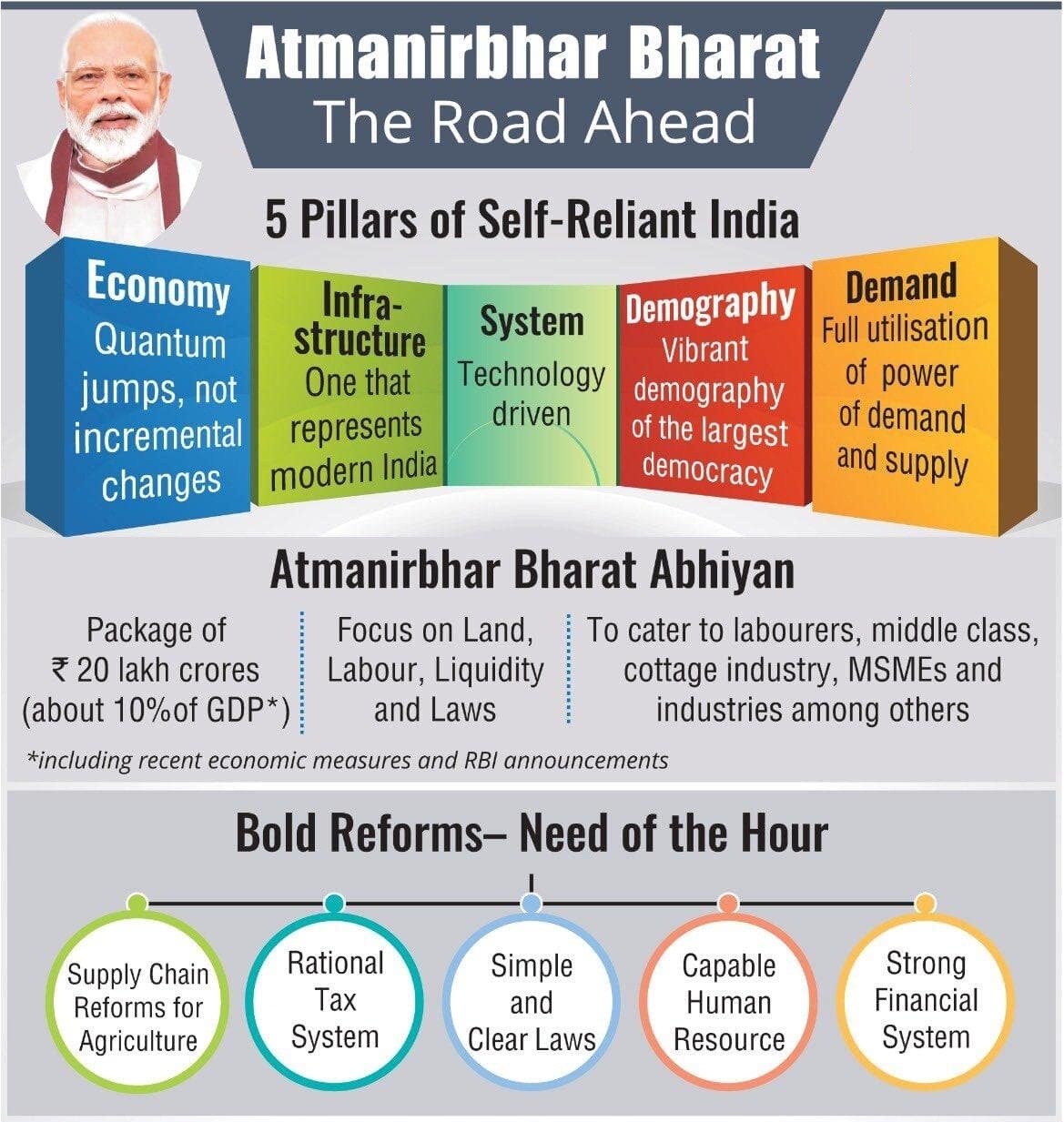

Aatma Nirbhar Bharat Abhiyaan Package

- In light of the COVID-19 pandemic, a special economic package of Rs 20 lakh crore (equivalent to 10% of India’s GDP) was announced by the government.

- The aim of the package is to prepare the country for the tough competition in the global supply chain and to empower the poor, labourers, and migrants who have been adversely affected by the pandemic and the lockdown.

Some key initiatives under various sectors announced under the package are as follows:

Government Reforms

- Increase in borrowing limits: The borrowing limits of state governments will be increased from 3% to 5% of Gross State Domestic Product (GSDP) for the year 2020-21. The increase beyond 3.5% of the GSDP will be conditionally linked to reforms on - universalisation of ‘One Nation One Ration card’, ease of doing business, power distribution, and urban local body revenues.

- Privatisation of Public Sector Enterprises (PSEs): A new PSE policy has been announced. The policy is aimed at privatisation of PSEs, except the ones functioning in certain strategic sectors. A list of strategic sector PSEs will be notified by the government at a later stage. In strategic sectors, at least one PSE will remain, but private sector enterprises will also be allowed.

Business (including MSMEs)

- Collateral free loans: Collateral free loans up to three lakh crore rupees will be provided to all businesses. These loans will be provided through banks and Non-Banking Financial Companies (NBFCs).

- Change in MSME definition: The Micro, Small and Medium Enterprises Development Act, 2006 will be amended to change the MSME definition.

- As per the proposed definition, the investment limit will be increased for MSMEs. A new criteria of annual turnover will be introduced.

- Reduction in tax rates: The rates of Tax Deduction at Source for the non-salaried specified payments made to residents and Tax Collected at Source will be reduced by 25% from the existing rates. This will apply from May 14, 2020 to March 31, 2021.

Agriculture and allied sectors

- Support to farmers and infrastructure: Key initiatives in the sector to support farmers and infrastructural developments include:

- concessional credit worth two lakh crore rupees for 2.5 crore farmers,

- fund of one lakh crore rupees for development of agriculture infrastructure projects, and

- additional fund of Rs 30,000 crore to meet the crop loan demand through NABARD and Rural Banks.

- Amendment to the Essential Commodities Act, 1955: The Essential Commodities Act, 1955 will be amended to deregulate food items including cereals, edible oils, oilseeds, pulses, and onions for attracting investments and enabling competition in the sector.

Migrant Workers

- One nation one card: Under the scheme of One Nation One Card, the migrant workers will be allowed to access the Public Distribution System (Ration) from any Fair Price Shop in India by March 2021.

- Affordable Rental Housing Complexes (ARHC) for Migrant Workers/Urban Poor: The migrant labour/urban poor will be provided living facilities at affordable rent under Pradhan Mantri Awas Yojana.

Civil Aviation

- Efficient airspace management: Restrictions on utilisation of the Indian Air Space will be eased allowing optimal utilisation of airspace, reduction in fuel use, and time to save about Rs 1,000 crore per year for the aviation sector.

- Public Private Partnership (PPP) model for airports: World-class airports will be built through the PPP model to enable private sector investment of around Rs 13,000 crore in 12 airports.

Defence

- Increase in FDI limit: FDI limit in defence manufacturing under automatic route will be increased from 49% to 74%.

- Make in India: A list of weapons/platforms will be released which will be banned for import based on a year wise timeline. Further, the government has planned to improve the autonomy, accountability and efficiency in Ordnance Supplies by corporatisation of Ordnance Factory Board.

Energy

- Liquidity support for distribution companies (discoms): A liquidity support of Rs 90,000 crore will be provided to power discoms in the form of funds from Power Finance Corporation and Rural Electrification Corporation.

- Discoms will also be provided with state government guaranteed loans exclusively for discharging their liabilities to power generation companies. Rs 50,000 crore will be spent on infrastructure development for evacuation of coal.

Housing and Social Sector

- Credit Linked Subsidy Scheme for Middle Income Group (MIG): The Credit Linked Subsidy Scheme for Middle Income Group (annual income between Rs 6 lakh and Rs 18 lakh) will be extended by one year up to March 2021.

- Support to the real estate sector: COVID 19 will be treated as an event of “Force Majeure” under Real Estate Regulatory Authority (RERA) by states/union territories and their Regulatory Authorities.

- An extension of six months will be given on registration and completion dates of all registered projects. This is for projects expiring on or after March 25, 2020 without individual applications.

- Force majeure is a common clause in contracts that essentially frees both parties from liability or obligation when an extraordinary event or circumstance beyond the control of the parties.

- Allocation for MGNREGS: Additional Rs 40,000 crore will be allocated under MGNREGS. This increases the Union Budget allocation for MGNREGS from Rs 61,500 crore to Rs 1,01,500 crore (65% increase) for 2020-21.

Science and Technology

Aarogya Setu App Made Open Source

- The Ministry of Electronics and Information Technology released the Aarogya Setu Data Access and Knowledge Sharing Protocol, 2020 in reference to the Aarogya Setu mobile application (app).

- The app was launched by the central government in April 2020 to enable contact tracing (identification and monitoring of persons who are at a higher risk of being infected by COVID-19) and for users to assess their own risk of getting infected.

- The protocol aims to ensure secure and efficient collection and sharing of data by the application to protect the personal data of individuals.

Key features of the protocol include:

- Data collection: Data collected by the app and the purpose for which it will be used should be clearly specified in the privacy policy of the app.

- Data collection should be minimised to the extent that it is required for formulating or implementing health responses.

- The collected data should be processed in a fair, transparent and non-discriminatory manner.

- Data storage: The app collects data regarding: (i) demographic details of the user, (ii) location of user from time to time, (iii) data of other individuals who have come in proximity with the user, and (iv) self-assessment data.

- Demographic details will be stored with the government for as long as necessary, unless the user requests for deletion of their data.

- Location data and data of other users who have come in proximity will remain on the user's device, but it may be uploaded to the government server (shared with the government) to formulate or implement health responses.

- These data, along with any self-assessment data will not be stored for more than 180 days from the date of collection

- Sharing of personal data: Any data collected by the app can be shared with the health ministry or health department of any state or the national (or state) disaster management authorities for formulating or implementing appropriate health responses.

- Data may be shared with other departments of the central or state government in a de-identified (where personal identifiers are removed or masked from the dataset) format, if required.

- The National Informatics Centre (developer of the app) will maintain a list of agencies with whom such data has been shared. Data may be shared for the purpose of research in an anonymised manner (where it is not possible to identify the user to whom the data pertains to).

- Violation of the protocol may lead to penalties as prescribed under the Disaster Management Act. The protocol is applicable for 6 months and maybe revised, subsequently. Further, the source code of the application has been made open source for review and collaboration for the android version of the application

Coal on Revenue Sharing Basis

- The Union Cabinet approved a new methodology based on revenue sharing for auction of coal and lignite blocks for commercial sale.

- Prior to this, coal and lignite based blocks were awarded on a fixed rupees per tonne basis methodology.

- Under the new methodology, successful bidders will be required to share a percentage of revenue with the government instead of paying a fixed price per tonne of production.

Key features of the methodology are as follows:

- Bid parameter: The bidders will be required to bid for a percentage share of revenue payable to the government. The floor price will be 4% of the revenue share.

- Payment of upfront amount: The successful bidder will be required to pay an upfront amount which will be 0.25% of the value of estimated geological reserves of the mine.

- The upfront amount will not be more than: (i) Rs 100 crore for geological reserves up to 200 million tonnes, and (ii) Rs 500 crore for geological reserves up to 500 million tonnes.

- Monthly payment: The successful bidder will be required to make a monthly payment to the government which will be a product of: (i) percentage of revenue share, (ii) quantity of coal on which statutory royalty is payable during the month, and (iii) notional or actual price, whichever is higher.

- Incentives for early production and clean usage: The successful bidder will be given a rebate in revenue share in events of: (i) early production and (ii) coal consumed or sold for gasification and liquefaction.

- Coal bed methane: The methodology also permits commercial exploitation of the coal bed methane present in the lease area. Coal bed methane is a form of natural gas found near coal deposits.

The Coal Blocks Allocation (Amendment) Rules, 2020 notified

- The Ministry of Coal notified the Coal Blocks Allocation (Amendment) Rules, 2020 to amend the Coal Blocks Allocation Rules, 2017.

- The 2017 Rules issued under the Mines and Minerals (Development and Regulation) Act, 1957 provide for terms and conditions for the auction and allotment of coal blocks.

- The amendments in the 2017 Rules have been notified to give effect to: (i) the provisions of the Mineral Laws (Amendment) Act, 2020 and (ii) auction of coal and lignite blocks for commercial sale on revenue sharing basis. Among other changes, the Act removed the restriction on end-use for certain coal blocks specified under the Coal Mines (Special Provisions) Act, 2015

- Key amendments to the Coal Blocks Allocation Rules, 2017 include:

- Prices for auction or allotment: The 2017 Rules provide for a ceiling price, floor price, and reserve price that the central government could fix for certain types of auctions or allotments.

- This has been amended to provide that these prices could either be specified as a price or a percentage. This seeks to enable the allocation of coal blocks on the revenue sharing model.

- Performance bank guarantee: The 2017 Rules provide that a successful allottee will provide a performance bank guarantee to the central government. It also enables the state government to require a performance bank guarantee from the allottee upon the grant of mining lease.

- This has been amended to provide that the successful allottee will be required to provide an unconditional and irrevocable performance bank guarantee upon the grant of mine opening permission.

- Specified end-use clause: The 2017 Rules provided for allocation of certain coal mines with specified end-use such as power generation and steel production. These provisions have been removed.

- Prospecting license-cum-mining lease: Various provisions regarding allocation order under the 2017 Rules (such as issuance and cancellation) will now also cover the prospecting license-cum-mining lease for a coal block.

- Prices for auction or allotment: The 2017 Rules provide for a ceiling price, floor price, and reserve price that the central government could fix for certain types of auctions or allotments.

National Coal Index

- The Ministry of Coal released the standard operating procedure (SOP) for the National Coal Index. The Index will reflect the market price of coal. Other uses of the Index include:

- use as a base indicator for taxation purpose and

- for future calculation of upfront amount and intrinsic value of mines.

- The SOP provides that the Index will be published once in two months. The Coal Controller’s Organisation will be responsible for:

- collecting data pertaining to coal prices,

- statistical validation of price data, and

- preparation of detailed technical notes on the price movements.

- The Ministry of Coal will be responsible for scrutiny of data and publication of the results.

Removed Mandatory Washing of Coal in Thermal Power Plants

- In January 2014, the Ministry of Environment amended the Environment (Protection) Rules, 1986 to mandate certain coal-based thermal power plants to only use coal with ash content up to 34% (on a quarterly basis).

- These plants included captive plants with capacity of 100 megawatts or above, and all stand-alone plants. This requirement was also based on the distance of the thermal power plant from the coal mine.

- The Ministry of Environment, Forest and Climate Change has amended the 1986 rules to remove this requirement.

- This was done in the light of representations by the Ministry of Power, Ministry of Coal, and Niti Aayog and to stimulate the domestic coal sector during the COVID-19 pandemic.

- The representations included:

- requirement of maintaining average ash content to 34% prompts industries to import coal, leading to outflow of foreign exchange.

- use of washery rejects generates more pollution

- coal washing process involves increased water use and effluent generation, and

- coal washing adversely impacts water drainage patterns, water bodies, and surrounding air quality at a large scale.

The Ministry provided that the use of coal by power plants, shall be permitted without conditions with regards to ash content or distance. However, the following conditions will have to be complied with:

- Setting up technology solutions for emission norms: This includes: (i) complying with specified emission norms for particulate matter, as per instructions of the Central Pollution Control Board, and (ii) installing appropriate technology in washeries to utilise rejects.

- Management of Ash Ponds: This includes:

- complying with fly ash conditions notified by the Ministry, and

- installing appropriate technology solutions to optimise water consumption for ash management.

- Transportation: It should be ensured that a rail siding or conveyor facility is set up at or near the power plant for transportation of coal by rail or conveyor. If transportation by rail or conveyor facility is not available, coal should be transported in covered trucks by road.

Environment

BS VI emission norms for quadricycles notified

- The Ministry of Road Transport and Highways notified the Central Motor Vehicles (Fourth) Amendment, 2020.

- The amendment provides for Bharat Stage -VI (BS-VI) emission standards and testing procedure for quadricycles manufactured on or after April 1, 2020.

- A quadricycle is a four-wheeler, which is smaller and lighter than a passenger car.

- The Bharat Stage Emission Standards are instituted by the central government to regulate air pollutants released from motor vehicles. This notification completes the process of BS-VI for all two and three wheelers, quadricycles, passenger vehicles and commercial vehicles in India.

Bharat Stage (BS)

- The Bharat Stage (BS) are emission standards instituted by the Government of India to regulate the output of air pollutants from motor vehicles.

- The Environment Ministry is responsible for deciding the fuel standard in the country. The Central Pollution Control Board implements these standards.

- The BS regulations are based on the European emission standards.

Coastal Regulation Zone Notification, 2011 Amended

- The Ministry of Environment, Forest and Climate Change amended the Coastal Regulation Zone Notification, 2011.

- The Coastal Regulation Zone Notification declares certain coastal stretches as Coastal Regulation Zone and imposes restrictions on the setting up and expansion of industries, operations and processes in this zone.

- The amendment to the notification provides that certain areas of mangroves will be protected under the notification. These include mangrove areas arising due to saline water access beyond a sluice gate (constructed before February 19 1991).

- Therefore, these mangroves shall not be diverted for any developmental activities

Coastal Regulation Zones

- Coastal stretches of seas, bays, estuaries, creeks, rivers, and backwaters were declared as CRZs under coastal zone regulation notification in 1991.

- CRZs have been classified into 4 zones for the purpose of regulation:

- CRZ-I: includes ecologically sensitive areas, where no construction is allowed except activities for atomic power plants, defense.

- CRZ-II: includes designated urban areas that are substantially built up. Construction activities are allowed on the landward side only.

- CRZ-III: includes relatively undisturbed areas, mainly rural areas. No new construction of buildings allowed in this zone except repairing of the existing ones. However, constructions of dwelling units in the plot area lying between 200-500m of the high tide line is allowed.

- CRZ-IV: includes the water area covered between Low Tide Line and 12 nautical miles seaward. Except for fishing and related activities, all actions impugning on the sea and tidal water will be regulated in this zone.

Guidelines for Swachh Bharat Mission Phase II

- The Ministry of Jal Shakti notified the Operational Guidelines for Swachh Bharat Mission (Grameen) (SBM-G) Phase II.

- The aim of the second phase of the scheme is to sustain the open defecation free status of villages and to improve the levels of cleanliness in rural areas through solid and liquid waste management activities.

- Key features of the guidelines include:

- Components of SBM-G Phase II: All states must develop a detailed implementation strategy based on the following components:

- construction of individual household latrines and community sanitary complexes,

- works for solid waste management (biodegradable and plastic),

- works for liquid waste management and grey water management, and

- faecal sludge management.

- Institutional Mechanism: Committees will be set up at centre, state and village level to help in planning and facilitating the implementation of the mission. An eight-member National Scheme Sanctioning Committee will be constituted to approve state project implementation plans and the annual implementation plan for the scheme.

- Capacity building: Training will be provided for all stakeholders at state, district and village levels. Stakeholders will include functionaries of ASHA, anganwadi workers, self-help group members, masons, and NGOs.

- The training may be on various aspects of the phase, including promoting behavioural change through interpersonal communication, door to door visits, masonry work, plumbing, skills for maintenance of toilets, and other Solid and Liquid Waste Management (SLWM) activities.

- Market linked SLWM activities: The SBM-G Phase II will focus on commercially viable solutions to make the sanitation economy attractive to private businesses. Possible avenues of engagement for engaging private sector in rural sanitation could be:

- providing technical assistance in developing innovative and low-cost models of latrine and SLWM infrastructure,

- developing sustainable business models for operation and maintenance of community and household level sanitation infrastructure,

- raising demand for sanitation value chain products by providing market linkages and financing options to local businesses.

- Components of SBM-G Phase II: All states must develop a detailed implementation strategy based on the following components:

Security

Shekatkar Committee Recommendations

- The government accepted and implemented certain recommendations of the Shekatkar Committee relating to border infrastructure.

- The Shekatkar Committee was set up to enhance combat capability and rebalance defence expenditure.

- Shekatkar Committee was a 11-member committee, appointed by the erstwhile Defence Minister in mid-2016. It was headed by Lt. Gen. D.B. Shekatkar (Retd).

- The Committee had submitted its report in December 2016. However, the report of the Committee has not been released in public domain in the interest of national security.

- The recommendations of the Committee accepted by the government aim to speed up border road construction. These are:

- Road construction work beyond the optimal capacity of the Border Roads Organisation (BRO) will be outsourced. Engineering Procurement Contract (EPC) mode has been made mandatory for execution of all works costing more than Rs 100 crore.

- The Committee recommended that modern construction plants, equipment, and machinery should be introduced for road construction. The government has increased delegation of powers to the BRO for projects upto Rs 100 crore, for speedier procurement of new technologies.

- The Committee recommended that clearances should be obtained before the commencement of the project. Adoption of the EPC mode mandates award of work only after 90% of the statutory clearances, such as forest and environmental clearances, have been obtained.