PRS Capsule

PRS Capsule June 2020

- 23 Jul 2020

- 33 min read

Key Highlights of PRS

Polity

Insolvency and Bankruptcy Ordinance

- The Insolvency and Bankruptcy Code (Amendment) Ordinance, 2020 was promulgated.

- The Ordinance amends the Insolvency and Bankruptcy Code, 2016.

- The Code provides a time-bound process for resolving insolvency in companies and among individuals.

- The Ordinance exempts certain corporate debtors from being subjected to insolvency proceedings during Covid-19.

Key features of the Ordinance:

- Initiation of insolvency resolution: When a default occurs, creditors of the company (financial or operational) or the company itself may file an application before the National Company Law Tribunal (NCLT) for initiating a corporate insolvency resolution process (CIRP).

- Once the application is accepted, a Committee of Creditors (CoC) consisting of the financial creditors of the company appoints a resolution professional to present a resolution plan to the CoC.

- Once the resolution plan is approved, the resolution process is required to be completed in 180 days (extendable by 90 days).

- The Ordinance exempts certain companies from the provisions on the initiation of CIRP.

- It states that an application for CIRP cannot be filed where a default has arisen during a period of six months (starting from March 2020).

- The central government may extend this period to one year through notification.

- The Ordinance clarifies that no proceedings can ever be initiated for defaults during this period.

- Fraudulent trading: During the resolution, if it is found that the business of the company is being carried out with an intent to defraud its creditors, the NCLT can pass orders against persons involved in such business to make contributions to the assets of the company.

- Further, the resolution professional can apply to the NCLT for an order to direct the director or partner of the company to make such contributions.

- The Ordinance states that for companies exempted from CIRP, the resolution professional cannot file an application to the NCLT for directions against the partners or directors of the company to make contributions to the assets of the company.

Export Policies Revised For Diagnostic Kits, Ppes, Sanitizers, Hydroxychloroquine

The Ministry of Commerce and Industry revised the export policies for the following items used in the prevention, diagnostics, and treatment of Covid-19:

- Alcohol-based sanitizers: Earlier, the export of all types of sanitizers was prohibited. In May 2020, the prohibition was lifted for all types of sanitizers except for alcohol-based hand sanitizers.

- Now, Alcohol-based hand sanitizers have now been made freely exportable, except the ones packaged in containers with a dispenser pump, which remain prohibited.

- Diagnostic kits: The restrictions on the export of diagnostic kits and laboratory reagents imposed in April 2020 have been relaxed and these items can be freely exported.

- However, the export of certain specified diagnostic kits including RNA extraction kits and reagents, and RT-PCR kits and reagents will remain restricted.

- Hydroxychloroquine: In March 2020, the export of Hydroxychloroquine and its formulations was prohibited, except in certain cases. These included export to neighbouring countries which depend on India for the drug and to countries which are severely affected by Covid-19.

- The prohibition on the export of the drug has been removed.

- PPEs: In January, the export of Personal Protection Equipment (PPE) including clothing and mask coveralls were prohibited.

- However, in May, prohibition on export of non-surgical and non-medical masks was lifted.

- All PPEs can now be freely exported except the following specified items which remain prohibited: all types of medical coveralls, medical goggles, all masks other than non-medical and non-surgical masks, nitrile gloves, and face shield.

PM Street Vendor’s AtmaNirbhar Nidhi (PM SVANidhi) Scheme

- The Ministry of Housing and Urban Affairs (MoHUA) launched the PM Street Vendor’s AtmaNirbhar Nidhi (PM SVANidhi) scheme.

- The scheme seeks to provide working capital loans to street vendors whose businesses were impacted by Covid-19.

Key features of the scheme are-

- Eligibility: The scheme is available to states which have notified rules and schemes under the Street Vendors (Protection of Livelihood and Regulation of Street Vending) Act, 2014.

- The Act specifies the rights and obligations of street vendors and regulates their business.

- Under the Act, states are required to establish Town Vending Committees that are responsible for conducting an identification survey of vendors in their zone/ward.

- Loan and interest subvention: Under the scheme, eligible street vendors may apply for collateral-free working capital loans of up to Rs 10,000 with one-year tenure from scheduled commercial banks, regional rural banks, non-banking financial companies, and microfinance institutions.

- Vendors under the scheme will also be eligible to receive an interest subsidy of 7% per annum.

- Credit guarantee: For loans under this scheme, defaults on loans of up to 5% of the total loan portfolio will be fully (100%) guaranteed.

- For default between 5% to 15% of the total loan portfolio, 75% of the default amount will be guaranteed.

- The credit guarantee is subject to a maximum coverage of 15% of the portfolio for the year.

Garib Kalyan Rojgar Abhiyaan Launched

- The Garib Kalyan Rojgar Abhiyaan was launched by the Prime Minister.

- The campaign aims to provide livelihood opportunities to migrant workers who have returned to their villages due to the Covid-19 pandemic.

- It also aims to create public infrastructure and assets in villages related to roads, housing, anganwadis, and community complexes, among others.

- The campaign is being undertaken in 116 districts across six states. These states are Bihar, Uttar Pradesh, Madhya Pradesh, Rajasthan, Jharkhand, and Odisha.

- It will be implemented by 11 ministries of the central government including Road Transport and Highways, Mines, Environment, Railways, Petroleum and Natural Gas, Telecom, and Agriculture.

- The campaign will operate for 125 days (from June 20, 2020) and 25 public infrastructure works have been identified which will be taken up for completion.

Categories of Persons Permitted To Vote By Postal Ballot Expanded

- In India, certain categories of voters are eligible to cast their vote through postal voting. Postal voting is where a voter receives ballot paper from the authority and may return his/her vote through the post.

- The Conduct of Election Rules, 1961 specifies the categories of persons who can vote through postal ballot. These include service voters such as employees of armed forces, voters with disabilities, and senior citizens above 80 years of age.

- The 1961 Rules have been amended to:

- Reduce the age limit for senior citizens from 80 years to 65 years of age, and

- Include Covid-19 suspect or affected persons.

Economy

The Banking Regulation (Amendment) Ordinance, 2020

- The Banking Regulation (Amendment) Ordinance, 2020 was promulgated.

- It amends the Banking Regulation Act, 1949 which regulates the functioning of banks and provides details on various aspects such as licensing, management and operations of banks.

Key features of the Ordinance include:

- Reconstruction or amalgamation without imposing moratorium: Under the Act, the Reserve Bank of India (RBI) may apply to the central government to place a banking company under moratorium.

- During the moratorium, RBI may prepare a scheme for reconstruction or amalgamation of the bank, if it is satisfied that such an order is needed to secure the proper management of the bank, or in the interest of depositors, the general public, or the banking system.

- The Ordinance allows RBI to initiate a scheme for reconstruction or amalgamation without imposing a moratorium.

- Supersession of Board of Directors: The Act states that RBI may supersede the Board of Directors of a multi-state cooperative bank for up to five years under certain conditions.

- These conditions include cases where it is in the public interest for RBI to supersede the Board, and to protect depositors.

- The Ordinance adds that in case of a co-operative bank registered with the Registrar of Co-operative Societies of a state, the RBI will supersede the Board of Directors after consultation with the concerned state government, and within such period as specified by it.

- Exclusions: The Act does not apply to certain cooperative societies, such as primary agricultural credit societies, and cooperative land mortgage banks.

- The Ordinance amends this to exclude: (i) primary agricultural credit societies, and (ii) cooperative societies.

- Power to exempt cooperative banks: The Ordinance states that RBI may exempt a cooperative bank or a class of cooperative banks from certain provisions of the Act through notification.

- These provisions relate to restrictions of certain types of employment, qualifications of the Board of Directors and, the appointment of a chairman.

- The time period and conditions for the exemption will be specified by RBI.

SEBI’s Framework For Regulatory Sandbox

- The Securities and Exchange Board of India (SEBI) introduced a framework for regulatory sandbox.

- A regulatory sandbox provides an environment which allows market participants to test new FinTech solutions (products, services or business models) with customers in a controlled environment.

- All entities registered with SEBI will be eligible for testing in the sandbox.

- Criteria: SEBI will evaluate the applicants based on criteria such as: (i) use of innovative technology, (ii) benefits to investors or markets, (iii) parameters for measurement and mitigation of risk, (iv) clearly defined grievance redressal mechanism, and (v) feasibility of deployment of the solution post-testing.

Working Group To Review Ownership Of Private Sector Banks

- The Reserve Bank of India (RBI) constituted an Internal Working Group to review the guidelines on ownership and corporate structure of Indian private sector banks.

- The Working Group will examine regulatory guidelines relating to ownership, governance and corporate structure in private sector banks, taking into account key developments over the years.

- According to RBI, the review will provide an opportunity to harmonise the norms applicable to banks set up at different time periods.

- The Committee will comprise five members and will be chaired by the Director, Central Board of RBI.

Payments Infrastructure Development Fund

- The RBI announced the creation of a Payments Infrastructure Development Fund to encourage acquirers to deploy point-of-sale (PoS) infrastructure (physical or digital) in tier 3 to 6 centres and north eastern states.

- This will be done to incentivise digitisation of payment systems in these places.

- According to RBI classification, tier-3 centres are areas of the population below 50,000 (according to Census 2011), and tier-6 centres are areas of population of less than 5,000.

- The RBI will make an initial contribution of Rs 250 crores to the Fund. The remaining contribution will be from card-issuing banks and card networks operating in the country.

- The Fund will also receive recurring contributions to cover operational expenses from card-issuing banks and card networks.

- RBI will contribute to yearly shortfalls, if necessary. The Fund will be governed through an advisory council and managed by the RBI.

Agriculture

The Essential Commodities (Amendment) Ordinance, 2020

- The Essential Commodities (Amendment) Ordinance, 2020 was promulgated.

- It amends the Essential Commodities Act, 1955, which empowers the central government to control the production, supply, distribution, trade, and commerce of certain commodities.

- The Ordinance aims to liberalise the regulatory system and increase competition in the agriculture sector.

Key features include:

- Regulation of food items: The Act empowers the central government to designate certain commodities (such as food items, fertilizers, and petroleum products) as essential commodities.

- The Ordinance provides that the central government may regulate the supply of certain food items, including cereals, pulses, potato, onions, and edible oilseeds and oils, only under extraordinary circumstances like war, famine, extraordinary price rise, and natural calamity of grave nature.

- Imposition of stock limit: The Act empowers the central government to regulate the stock of an essential commodity that a person can hold. The Ordinance requires that imposition of any stock limit must be based on price rise.

- A stock limit may be imposed for agricultural produce only if there is: (i) 100% increase in retail price, in case of horticultural produce; and (ii) 50% increase in the retail price, in case of non-perishable agricultural food items.

- The Ordinance provides that any stock limit will not apply to a processor or value chain participant of agricultural produce if the stock held by such person is less than the: the overall ceiling of installed capacity of processing or demand for export in case of an exporter.

- A value chain participant means a person engaged in production, or in value added at any stage of processing, packaging, storage, transport, and distribution of agricultural produce

Regulating Farming Agreements

- The Farmers (Empowerment and Protection) Agreement on Price Assurance and Farm Services Ordinance, 2020 was promulgated.

- It provides for a farming agreement aimed at defining a framework for the protection and empowerment of farmers with reference to the sale and purchase of farm produce.

Key provisions of the Ordinance include:

- Farming agreement: The Ordinance provides for a farming agreement aimed at facilitating farmers in selling farm produce to sponsors. A sponsor includes individuals, partnership firms, companies, and limited liability groups and societies

- The agreement may provide for mutually agreed terms and conditions for supply, quality, standards and price of farming products as well as terms related to supply of farm services.

- These terms and conditions may be subjected to monitoring and certification during the process of cultivation or rearing, or during delivery.

- Duration of agreement: The minimum duration of an agreement will be one crop season or one production cycle of livestock. The maximum period will be five years.

- For a production cycle of more than five years, the maximum period will be mutually decided by the farmer and the sponsor.

- Exemptions from existing laws: Farming produce under a farming agreement will be exempted from all state Acts regulating sale and purchase of farming produce.

- Such produce will also be exempted from the stock limit obligations under the Essential Commodities Act, 1955 or any other law.

- Pricing of farming produce: The Ordinance requires the price of farming produce to be mentioned in the agreement.

- It also provides details regarding the payment and delivery of farming products.

- Dispute settlement: The Ordinance provides for a three-tier system for dispute settlement.

- At first, all disputes must be referred to a Board for resolution.

- If the dispute remains unresolved after thirty days, parties may approach the Sub-Divisional Magistrate for resolution.

- Parties will have a right to appeal to an Appellate Authority against decisions of the Magistrate.

The Farmers’ Produce Trade and Commerce Ordinance, 2020

- The Farmers’ Produce Trade and Commerce (Promotion and Facilitation) Ordinance, 2020 was promulgated.

- It seeks to provide for barrier-free trade of farmers’ produce outside the markets notified under the various state agricultural produce market laws (state APMC Acts).

- The Ordinance will prevail over the state APMC Acts.

Key features include:

- Trade of produce: The Ordinance allows intra-state and inter-state trade of farmers’ produce outside: (i) the physical premises of market yards run by APMCs and (ii) other markets notified under the state APMC acts such as private market yards and market sub-yards, direct marketing collection centres, and private farmer-consumer market yards.

- Electronic trading: The Ordinance permits the electronic trading of farmers’ produce in the specified trade area. An electronic trading and transaction platform may be set up to facilitate the direct and online buying and selling of farmers’ produce.

- No fees to be levied by states: The Ordinance prohibits state governments from levying any market fee, cess or levy on farmers, traders, and electronic trading platforms for any trade under the Ordinance.

Animal Husbandry Infrastructure Development Fund

- The Union Cabinet approved the establishment of the Animal Husbandry Infrastructure Development Fund of Rs 15,000 crore, which was announced under the Aatma Nirbhar Bharat Economic Package.

- The Fund aims to incentivise private investment in infrastructure for dairy and meat processing and value addition. It also covers investment made for the establishment of animal feed plants.

- Private companies, MSMEs, Farmer Producer Organizations, and individuals would be eligible beneficiaries, provided they contribute at lea st 10% of the total investment. Banks will extend loans for the balance of 90% of the investment

- The central government will provide a 3% interest subsidy to eligible beneficiaries on their loans. Further, beneficiaries can repay the principal loan amount over a period of six years, after the completion of the two-year moratorium period.

- The government will also set up a Credit Guarantee Fund of Rs 750 crore, which will be managed by NABARD. The Fund will provide a guarantee for up to 25% of the loan amount for sanctioned projects undertaken by MSMEs.

MSMEs

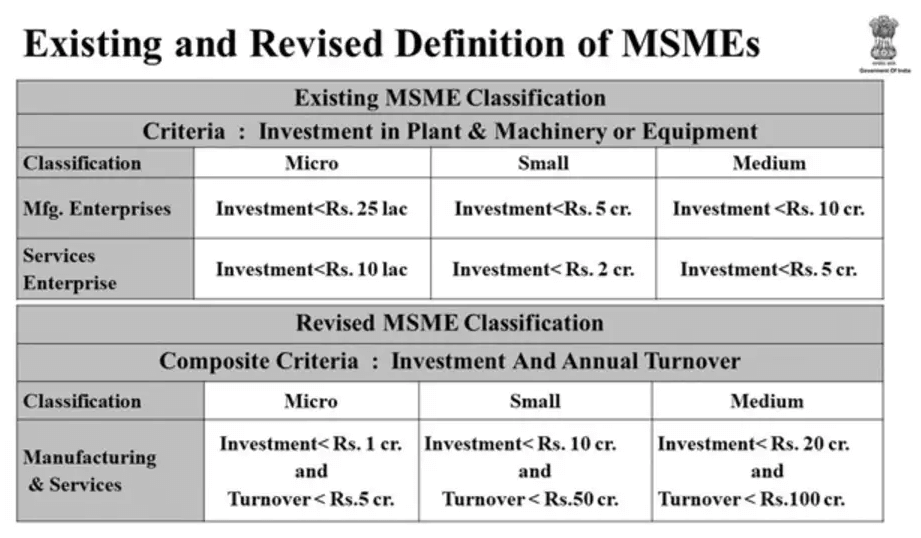

New Classification of Micro, Small and Medium Enterprises

- The government notified a change in the definition of Micro, Small and Medium Enterprises (MSMEs).

- Currently, MSMEs are defined under the Micro, Small and Medium Enterprises Development Act, 2006.

- The Act classifies micro, small and medium enterprises based on: (i) amount of investment in plant and machinery for enterprises engaged in manufacturing or production of goods, and (ii) amount of investment in equipment for enterprises providing services.

- As per the revised definition, the investment limits have been revised upwards and the annual turnover of the enterprise has been used as additional criteria for the classification of MSMEs.

Science and Technology

Global Partnership on Artificial Intelligence (GPAI)

- India co-founded the Global Partnership on Artificial Intelligence (GPAI), an international inter-governmental initiative for responsible development and use of artificial intelligence (AI).

- Other founding member countries of GPAI include USA, UK, European Union, Canada, Japan, and South Korea. GPAI seeks to support research, collaboration and applied activities in AI.

- It seeks to leverage the experience and diversity of participating countries for the development of AI.

- It will also evolve methodologies to showcase how AI can be leveraged to better respond to the present global crisis due to Covid-19. GPAI will have a secretariat in Paris, and centres of expertise in Montreal and Paris.

Promotion of Electronics Manufacturing

- In March 2020, the Union Cabinet had approved certain schemes for the promotion of electronics manufacturing.

- The Ministry of Electronics and Information Technology announced the guidelines for these schemes.

- Production Incentive Scheme for Large Scale Electronics Manufacturing: The scheme proposes production-linked incentive in mobile phone manufacturing and specified electronics components including assembly, testing, marketing, and packing units.

- The objective of the scheme is to promote domestic manufacturing of such electronics items and attract large investments in this area.

- The scheme will provide an incentive of 4% to 6% on incremental sales of goods manufactured in India over the base year.

- The incentive will be available for five years from the base year as may be defined.

- Scheme for promotion of manufacturing of electronic components and semiconductors: The scheme will provide a financial incentive of 25% of capital expenditure for manufacturing of certain specified electronic goods.

- The capital expenditure on plant, machinery, equipment and technology including research and development will be covered under the scheme.

- The segments to be covered under the scheme include (i) mobile, consumer and medical electronics, and (ii) telecom equipment.

- Modified Electronics Manufacturing Clusters (EMC2.0) Scheme: The EMC2.0 scheme will succeed the EMC scheme which was announced in 2012 and was open for application until October 2017.

- The scheme will provide financial assistance for setting up of both Electronics Manufacturing Clusters (EMC) and Common Facility Centres (CFC) and expansion of existing EMCs and CFCs.

- The EMCs and CFCs will provide ready infrastructure along with common facilities and amenities to the electronics systems design and manufacturing sector.

Plastic Waste Management Rules, 2016

- The Ministry of Environment, Forest and Climate Change issued guidelines on the uniform framework for Extended Producer Responsibility (EPR) for plastic waste management.

- The Plastic Waste Management Rules define EPR as the responsibility of a producer for environmentally sound management of a product until the end of its life.

- This framework is based on the premise that producers are responsible for providing financial incentives to the plastic waste collection systems and the recycling industry to collect and process plastic waste to meet the targets set by the government.

A Committee constituted to evaluate the mechanism for the implementation of EPR suggested various models for EPR compliance. These include:

- Fee-based model: This model could be applicable to producers (including importers and brand owners) who use less quantity of plastic (lower than a cut-off decided by the government) for packaging. They shall contribute to the EPR corpus fund at the central level. The amount to be contributed by each of the producers will be decided based on the generation of plastic waste and the efforts required and money spent by the ULB to handle the plastic waste.

- Plastic credit model: Under this model, a producer will not be required to recycle their own packaging, but to ensure that an equivalent amount of packaging waste has been recovered and recycled to meet their obligation. Producers will be mandated to acquire evidence of recycling (plastic credit) from accredited processors or exporters.

- Producer Responsibility Organisations: Producers can join a Producer Responsibility Organization (PRO), which will carry out the legal requirements on behalf of their member companies. PROs will operate as a contractor service to the producers. However, the final responsibility of providing evidence of reprocessing of plastic packaging will be with the producer only.

Pharmacopoeia Commission for Indian Medicine and Homoeopathy

- The Union Cabinet has approved the re-establishment of the Pharmacopoeia Commission for Indian Medicine and Homoeopathy (PCIM&H) as a subordinate office under the Ministry of AYUSH.

- It will be merged with the Pharmacopoeia Laboratory for Indian Medicine and Homoeopathic Pharmacopoeia Laboratory, which are two central laboratories established at Ghaziabad since 1975.

- Prior to the merger, PCIM&H existed as an autonomous organisation under the Ministry of AYUSH. After reconstitution, the PCIM&H will facilitate the uniform development of standards for AYUSH drugs and formulations, prevent duplication of drug standardization work, and promote optimal utilisation of resources, amongst others.

Social Justice and Empowerment

Nasha Mukt Bharat: Annual Action Plan (2020-21)

- The Ministry of Social Justice and Empowerment launched the Nasha Mukt Bharat Annual Action Plan for 2020-21.

- The Plan will focus on the problem of drug abuse in 272 of the most affected districts of the country.

- The Plan will include awareness generation programmes, especially in higher educational institutions, universities, and school.

- Further, it will include identification of dependent populations and treatment in hospital facilities or de-addiction centres.

- The Plan will be implemented by the Ministry and the Narcotics Bureau

Private Sector Participation in Space

- The Union Cabinet approved certain reforms to boost private sector participation in Space.

- An autonomous nodal agency called Indian National Space Promotion and Authorisation Centre will be set up under the Department of Space, as a separate vertical for permitting and regulating the activities of private industry in the space sector.

- The Centre will promote and guide private industries in space activities through encouraging policies and a favourable regulatory environment, with technical expertise from ISRO.

- It will have its own independent directorates for technical, legal, safety and monitoring for assessing the private industry requirements and coordinating the activities.

- The role of New Space India Ltd. (NSIL), a public sector undertaking under the Department of Space, will be re-defined from a supply-driven model to a demand-driven model for space-based services.

- NSIL is the commercial arm of ISRO, currently responsible for the transfer of ISRO’s small satellite technology to industry, among other things.

- Current activities of ISRO in the areas of the launch vehicle, satellite production, launch services and space-based services will be taken up by NSIL.

- It will execute these activities through industry consortiums. These reforms are expected to allow ISRO to allocate more time and resources for research and development.