Indian Economy

Government Budgeting

- 13 Feb 2020

- 17 min read

Why in News

The Union Minister of Finance recently presented the Budget 2020-21 in the Parliament. The central theme of the Budget- “Ease of living for all citizens” was based on three prominent themes:

- Aspirational India - better standards of living with access to health, education and better jobs for all sections of the society

- Economic Development for all - “Sabka Saath, Sabka Vikas, Sabka Vishwas”.

- Caring Society- both humane and compassionate; Antyodaya as an article of faith.

Budget and Constitutional Provisions

- According to Article 112 of the Indian Constitution, the Union Budget of a year is referred to as the Annual Financial Statement (AFS).

- It is a statement of the estimated receipts and expenditure of the Government in a financial year (which begins on 01 April of the current year and ends on 31 March of the following year). In addition to it, the Budget contains:

- Estimates of revenue and capital receipts,

- Ways and means to raise the revenue,

- Estimates of expenditure,

- Details of the actual receipts and expenditure of the closing financial year and the reasons for any deficit or surplus in that year, and

- The economic and financial policy of the coming year, i.e., taxation proposals, prospects of revenue, spending programme and introduction of new schemes/projects.

- In Parliament, the Budget goes through six stages:

- Presentation of Budget.

- General discussion.

- Scrutiny by Departmental Committees.

- Voting on Demands for Grants.

- Passing of Appropriation Bill.

- Passing of Finance Bill.

- The Budget Division of the Department of Economic Affairs in the Finance Ministry is the nodal body responsible for preparing the Budget.

Changes Introduced in 2017

- Advancement of Budget presentation to February 1 (earlier presented on the last working day of February),

- Merger of Railway Budget with the General Budget, and

- Doing away with plan and non-plan expenditure.

Key Words

- Receipts: It indicates the money received by the government. This includes:

- the money earned by the government

- the money it receives in the form of borrowings or repayment of loans by states.

- Plan Expenditure: All expenditures done in the name of planning (i.e. Five Year Plans) were called plan expenditures. For example expenditure on electricity generation, irrigation and rural developments, construction of roads, bridges, canals, etc.

- Non-plan Expenditure: All expenditures other than plan expenditure were known as non-plan expenditure. For example interest payments, pensions, statutory transfers to States and Union Territories governments, etc.

Objectives of Government Budget

- Reallocation of Resources– It helps to distribute resources keeping in view the social and economic conditions of the country.

- Reducing Inequalities in Income and Wealth– Government aims to bring economic equality by imposing taxes on the elite class and spending the collected money on the welfare of the poor.

- Contributing to Economic Growth– A country’s economic growth is based on the rate of investment and savings. Therefore, the budgetary plan focuses on preparing adequate resources for investing in the public sector and raise the overall rate of investments and savings.

- Bringing Economic Stability– The Budget focuses on avoiding business fluctuations so as to accomplish the aim of financial stability. Policies such as Deficit Budget (during deflation) and Surplus Budget (during inflation) assist in balancing the prices in the economy.

- Managing Public Enterprises– Many public sector industries are built for the social welfare of the people. The Budget is planned to deliver different provisions for operating such business and imparting financial help.

- Reducing Regional Differences– It aims to reduce regional inequalities by promoting the installation of production units in the underdeveloped regions.

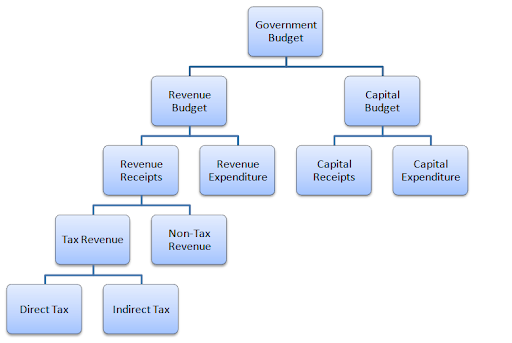

Components of Government Budget

- Revenue Budget– It consists of the Revenue Expenditure and Revenue Receipts.

- Revenue Receipts are receipts which do not have a direct impact on the assets and liabilities of the government. It consists of the money earned by the government through tax (such as excise duty, income tax) and non-tax sources (such as dividend income, profits, interest receipts).

- Revenue Expenditure is the expenditure by the government which does not impact its assets or liabilities. For example, this includes salaries, interest payments, pension, and administrative expenses.

- Capital Budget– It includes the Capital Receipts and Capital Expenditure.

- Capital Receipts indicate the receipts which lead to a decrease in assets or an increase in liabilities of the government. It consists of: (i) the money earned by selling assets (or disinvestment) such as shares of public enterprises, and (ii) the money received in the form of borrowings or repayment of loans by states.

- Capital expenditure is used to create assets or to reduce liabilities. It consists of: (i) the long-term investments by the government on creating assets such as roads and hospitals, and (ii) the money given by the government in the form of loans to states or repayment of its borrowings.

Other Types of Budgets

- Zero Based Budgeting: Zero-based budgeting is a method of budgeting in which all expenses are evaluated each time a Budget is made and expenses must be justified for each new period.

- Zero budgeting starts from the zero base and every function of the government is analysed for its needs and cost. Budget is then made based on the needs

- Outcome Budget: Outcome Budget analyses the progress of each ministry and department and what the respected ministry has done with its Budget outlay. It measures the development outcomes of all government programs. It was first introduced in the year 2005.

- Gender Budgeting: The gender-budgeting is defined as “gender-based assessment of Budgets, incorporating a gender perspective at all levels of the budgetary process and restructuring revenues and expenditures in order to promote gender equality”. It is actually budgeting for gender equity.

- Through Gender Budget, the Government declares an amount to be spent over the development, Welfare, Empowerment schemes and programmes for Females.

Balanced, Surplus and Deficit Budget

- Balanced Budget – A government Budget is assumed to be balanced if the expected expenditure is equal to the anticipated receipts for a fiscal year.

- Surplus Budget – A Budget is said to be surplus when the expected revenues surpass the estimated expenditure for a particular business year. Here, the Budget becomes surplus, when taxes imposed, are higher than the expenses.

- Deficit Budget- A Budget is in deficit if the expenditure surpasses the revenue for a designated year.

Measures of Government Deficit

There are various measures that capture government Deficit:

- Revenue Deficit: It refers to the excess of government’s revenue expenditure over revenue receipts.

- Revenue Deficit = Revenue expenditure – Revenue receipts

- The revenue Deficit includes only such transactions that affect the current income and expenditure of the government.

- When the government incurs a revenue deficit, it implies that the government is dissaving and is using up the savings of the other sectors of the economy to finance a part of its consumption expenditure.

- Fiscal Deficit: It is the gap between the government’s expenditure requirements and its receipts. This equals the money the government needs to borrow during the year. A surplus arises if receipts are more than expenditure.

- Fiscal Deficit = Total expenditure – (Revenue receipts + Non-debt creating capital receipts).

- It indicates the total borrowing requirements of the government from all sources.

- From the financing side: Gross fiscal deficit = Net borrowing at home + Borrowing from RBI + Borrowing from abroad

- The gross fiscal deficit is a key variable in judging the financial health of the public sector and the stability of the economy.

- Primary Deficit: Primary deficit equals fiscal deficit minus interest payments. This indicates the gap between the government’s expenditure requirements and its receipts, not taking into account the expenditure incurred on interest payments on loans taken during the previous years.

- Primary deficit = Fiscal deficit – Interest payments

Fiscal Policy

- Fiscal policy is the use of government revenue collection (mainly taxes but also non-tax revenues such as divestment, loans) and expenditure (spending) to influence the economy.

- Through the fiscal policy, the government of a country controls the flow of tax revenues and public expenditure to navigate the economy. If the government receives more revenue than it spends, it runs a surplus, while if it spends more than the tax and non-tax receipts, it runs a deficit. To meet additional expenditures, the government needs to borrow domestically or from overseas. Alternatively, the government may also choose to draw upon its foreign exchange reserves or print additional money.

- Fiscal policy in India is the guiding force that helps the government decide how much money it should spend to support the economic activity, and how much revenue it must earn from the system, to keep the wheels of the economy running smoothly.

- Attaining rapid economic growth is one of the key goals of fiscal policy formulated by the Government of India. Fiscal policy, along with monetary policy, plays a crucial role in managing a country’s economy.

Main objectives of Fiscal Policy in India

- Economic growth: It helps to maintain the economy’s growth rate so that certain economic goals can be achieved.

- Price stability: It controls the price level in the country so that when the inflation is too high, prices can be regulated.

- Full employment: It aims to achieve full employment, or near full employment, as a tool to recover from low economic activity.

Importance of Fiscal Policy in India

- In a country like India, fiscal policy plays a key role in elevating the rate of capital formation both in the public and private sectors.

- Through taxation, the fiscal policy helps to mobilise a considerable amount of resources for financing its numerous projects.

- Fiscal policy also helps in providing stimulus to elevate the savings rate.

- The fiscal policy gives adequate incentives to the private sector to expand its activities.

- Fiscal policy aims to minimise the imbalance in the dispersal of income and wealth.

Deficit Financing in India

- Deficit financing is defined as “borrowings from the Reserve Bank of India against the issue of Treasury Bills and running down of accumulated cash balances”.

- When the government borrows from the Reserve Bank of India, it merely transfers its securities to the Bank. On the basis of these securities the bank issues more currency and puts them into circulation on behalf of the government. This amounts to the creation of money.

- Rationale for Deficit Financing: sometimes the government fails to mobilise adequate resources. In this situation, the option of deficit financing is required to meet fiscal deficit targets. If the option of deficit financing is not utilized the government ends up compromising on growth targets.

FRBM Act

- The Fiscal Responsibility and Budget Management Act, 2003 (FRBMA) is an Act of the Parliament of India to institutionalize financial discipline, reduce India’s fiscal deficit, improve macroeconomic management and the overall management of the public funds by moving towards a balanced budget.

Objectives

- Reduction of fiscal deficit and revenue deficit;

- To achieve inter-generational equity in fiscal management by reducing the debt burden of the future generation;

- Achieving long-term macroeconomic stability;

- Better coordination between fiscal and monetary policy;

- Transparency in fiscal operations of the Government.

Major Provisions of the FRBM Act, 2003

- The FRBM rule set a target reduction of fiscal deficit to 3% of the GDP by 2008-09. This will be realized with an annual reduction target of 0.3% of GDP per year by the Central government.

- Revenue deficit has to be reduced by 0.5% of the GDP per year with complete elimination by 2008-09.

- Reduction of Public Debt

- The government has to take appropriate measures to reduce the fiscal deficit and revenue deficit so as to eliminate revenue deficit by 2008-09 and thereafter, sizable revenue surplus has to be created.

- It mandated setting annual targets for the reduction of fiscal deficit and revenue deficit, contingent liabilities and total liabilities.

- The government shall end its borrowing from the RBI except for temporary advances.

- The RBI was supposed to not subscribe to the primary issues of the central government securities after 2006.

- The revenue deficit and fiscal deficit may exceed the targets specified in the rules only on grounds of national security, calamity and other exceptional grounds to be specified by the Central government.

- Amendments to FRBM Act: Fiscal Responsibility and Budget Management Act, 2003 was amended in 2012 that mandated the Central Government to lay before the Houses of Parliament, Macro-Economic Framework Statement, Medium Term Fiscal Policy Statement and Fiscal Policy Strategy Statement along with the Annual Financial Statement and Demands for Grants.

- NK Singh committee, that was set up in 2016 to review the FRBM Act, recommended that the government must target a fiscal deficit of 3% of the GDP in the years up to March 31, 2020, subsequently cut it to 2.8% in 2020-21 and to 2.5% by 2023.