Biodiversity & Environment

Financial Sector & Climate Change

- 04 May 2021

- 6 min read

Why in News

Recently, the Reserve Bank of India (RBI) joined the Network for Greening the Financial System (NGFS).

- The RBI expects to benefit from the membership of NGFS by learning from and contributing to global efforts on climate finance, which has assumed significance in the context of climate change.

The Network for Greening the Financial System

- It is a global network of central banks and supervisory authorities advocating a more sustainable financial system.

- It aims to analyse the consequences of climate change for the financial system and to redirect global financial flows in order to enable low-carbon economic growth.

- It was created at the Paris One Planet Summit in December 2017 and its secretariat is hosted by the Banque de France.

Climate Finance

- Climate Finance refers to local, national or transnational financing—drawn from public, private and alternative sources of financing.

- It seeks to support mitigation and adaptation actions that will address climate change.

Key Points

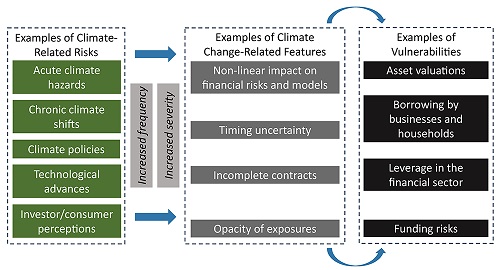

- Risks to Financial Stability due to Climate Change:

- Climate change poses risks to financial stability in the form of:

- Physical risks: Caused by extreme and slow onset weather events.

- Transition risks: Caused by changes in policy, legal and regulatory frameworks, consumer preferences and technological development while transitioning to a low-carbon economy.

- Example:

- Under many climate projections, climate change leads to a further rise in sea levels and increase in storm surge.

- These effects, in turn, lead to increased inundation of coastal land parcels, which could either damage existing structures on those parcels, or require investment and adaptation for their continued productive use.

- As this inundation occurs, the expected value of coastal real estate may decrease—which may, in turn, pose risks to real estate loans, mortgage-backed securities, the profitability of firms using the inundated property, and the finances of state and local governments facing declining property tax revenues and rising remediation costs.

- The World Economic Forum’s (WEF) Global Risks Report 2021 noted climate action failure and infectious diseases as the highest risks (risks with greatest impact and likelihood).

- Climate change poses risks to financial stability in the form of:

- India’s Situation:

- A World Bank report estimates that losses to India’s Gross Domestic Product by 2050 due to climate change could be USD 1,178 billion.

- The RBI has noted the importance of climate-related financial disclosures and private green finance as necessary to generate the enormous amounts of investments required to combat climate change and bring about a transformation towards sustainable and low carbon development.

- A study by non-profit Shakti Foundation found that an assessment of BSE (Bombay Stock Exchange) 100 companies showcases that most of the Indian companies are lagging in the climate change disclosure space due to lack of relevant expertise; limited access to relevant tools and methodologies; and limited subject knowledge.

- Related Initiatives:

- Task Force on Climate-related Financial Disclosures (TFCD):

- TFCD was created in 2015 by the Financial Stability Board (FSB) to develop consistent climate-related financial risk disclosures for use by companies, banks, and investors in providing information to stakeholders.

- To make the private sector contribute to climate positive action and become resilient to climate risks are the recommendations of the TFCD.

- Its recommendations are now widely recognised as the gold standard for global business sustainability reporting frameworks, providing standardised and comprehensive guidelines for corporate climate disclosures.

- About 32 Indian organisations have signed up for TFCD, including the Mahindra Group, Wipro etc.

- Recently, New Zealand became the first country to announce a law that will require financial firms to disclose climate-related risks and opportunities.

- Task Force on Climate-related Financial Disclosures (TFCD):

Way Forward

- The only way forward is to fully integrate climate-aligned structural change with economic recovery needing a fundamental shift in the entire finance system with a massive increase in private finance to get from “billions to trillions”.

- The Indian government needs to introduce guidelines and regulations to standardise and mandate climate-related disclosures in all financial statements and push private companies and financial institutions to manage their exposure to climate risks in their portfolios and operations.

- This would help not only in increasing resilience of Indian companies to face physical and transition risks of climate change but also in facilitating greater climate finance flows while minimising ‘greenwashing’.