Indian Economy

Panel on Direct Tax Code

- 20 Aug 2019

- 7 min read

Recently, the panel on re-writing the direct tax legislation has submitted its report and a draft of the new proposed version of the Income-tax law to the Government.

- The Income-Tax (I-T) Act, which was drafted almost 60 years ago, needs an overhaul, but at the same time it should be in sync with the economic circumstances of the country.

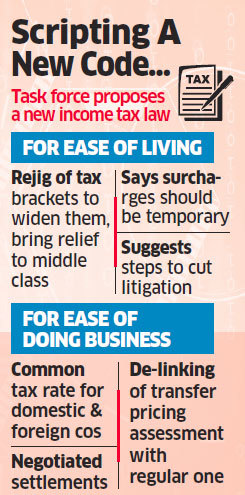

- The panel on the Direct Tax Code (DTC) has suggested a rejig of personal income tax slabs, roadmap of corporate tax rate cut to 25% for companies, provisions to reduce compliance burden by simplification of procedures and litigation management. It has also suggested some changes in Dividend Distribution Tax and Minimum Alternate Tax.

- While the new direct tax law will bring to force new taxation concepts as well as schemes to reduce litigation, the actual tax rate reduction may be executed as part of annual Finance Bills, depending on the revenue buoyancy of the government from time to time.

Minimum Alternate Tax

- At times it may happen that a taxpayer, being a company, may have generated income during the year, but by taking the advantage of various provisions of Income-tax Law (like exemptions, deductions, depreciation, etc.), it may have reduced its tax liability or may not have paid any tax at all.

- Due to an increase in the number of zero tax paying companies, Minimum Alternate Tax (MAT) was introduced by the Finance Act, 1987 with effect from assessment year 1988-89. Later on, it was withdrawn by the Finance Act, 1990 and then reintroduced by Finance Act, 1996.

- MAT is calculated at 18.5% on the book profit (the profit shown in the profit and loss account) or at the usual corporate rates, and whichever is higher is payable as tax.

- All companies in India, whether domestic or foreign, fall under this provision. MAT was later extended to cover non-corporate entities as well.

- MAT is an important tool with which tax avoidance can be prevented.

Background

- The Task Force, initially headed by former CBDT Member (Legislation) Arbind Modi and later on by Akhilesh Ranjan, was constituted in November 2017 in order to review the Income-tax Act and to draft a new Direct Tax Law.

- The proposals in the draft code are aimed at bringing more certainty to taxation of personal and corporate income and capital gains, and at bringing the gist of numerous judicial pronouncements made since 1961, when the current tax law came into force, in one place for easy reference.

- It could improve ease of doing business and reduce the compliance burden as well as tax disputes.

Key Suggestions

- Litigation Management: Amendments in Section 147 and Section 148 of the I-T Act, empowering the tax officer to reopen assessment cases based on predefined criteria.

- The I-T officer can go back up to six years to scrutinise the books of accounts of the assessees.

- Currently, these provisions are prone to the interpretation. 40% of litigation happens because assessees challenge reasons given by officers for reopening cases.

- Increasing the threshold limit for opening cases: Currently it is Rs 1 lakh and above. Also, the pre-defined criteria to select cases for scrutiny will be tightened.

- Reopening cases should be supported by proper reasoning. Often cases are reopened due to information received from banks, financial institutions, and other sources.

- Assessment proceedings should be made faceless, and an option be allowed to the public to seek clarifications on tax matters from CBDT.

- Reduced Burden of Tax Compliance: Tax compliance based on global trends and best practices. This is expected to increase clarity among taxpayers and also expand the tax base.

- Use of Artificial Intelligence (AI) in the tax-compliance and administration process.

- Proposal of introducing collaborative compliance in direct tax administration, which would integrate data from banks, financial institutions and the Goods and Services Tax (GST) network to ensure that the scope of taxable income increases.

- Personal Income Tax: A rejig in rates between 5% to 20%.

- Currently, the personal income tax structure has three categories based on age — for people below the age of 60, for people above the age of 60 but less than 80, and the third for people of 80 years and above.

- The first category has four slabs – nil tax on income up to Rs 2.5 lakh; 5% tax rate for income between Rs 2.50 lakh and Rs 5 lakh, 20% tax rate for income between Rs 5 lakh and Rs 10 lakh and 30% for income above Rs 10 lakh. The second category has the basic slab of Rs 3 lakh while the third category has ‘nil’ rate for income up to Rs 5 lakh.

Corporate Tax to be 25%

- The government will be cutting down the corporate tax rate gradually to 25% for all companies, including the large ones with an annual turnover of over Rs 400 crore.

- The government has, over the last five years, trimmed the rate to 25% from 30% in a phased manner for 99.3% of companies.

- However, the 0.7% large companies that do not enjoy this benefit make up for almost 80% of the total corporate tax collection and are subject to as much as 30%.

- The proposed corporate tax reduction will apply to both large local as well as foreign companies that are present in India without a subsidiary and are taxed at 40%.

- Unlike domestic firms, foreign companies pay a higher corporate tax rate, but do not have to pay dividend distribution tax that is applicable to domestic companies.

- If implemented, the tax rate reduction could prove to be a big fiscal stimulus for the corporate sector reeling under a sharp economic downturn.