Governance

National Mission for Financial Inclusion

- 29 Aug 2020

- 7 min read

Why in News

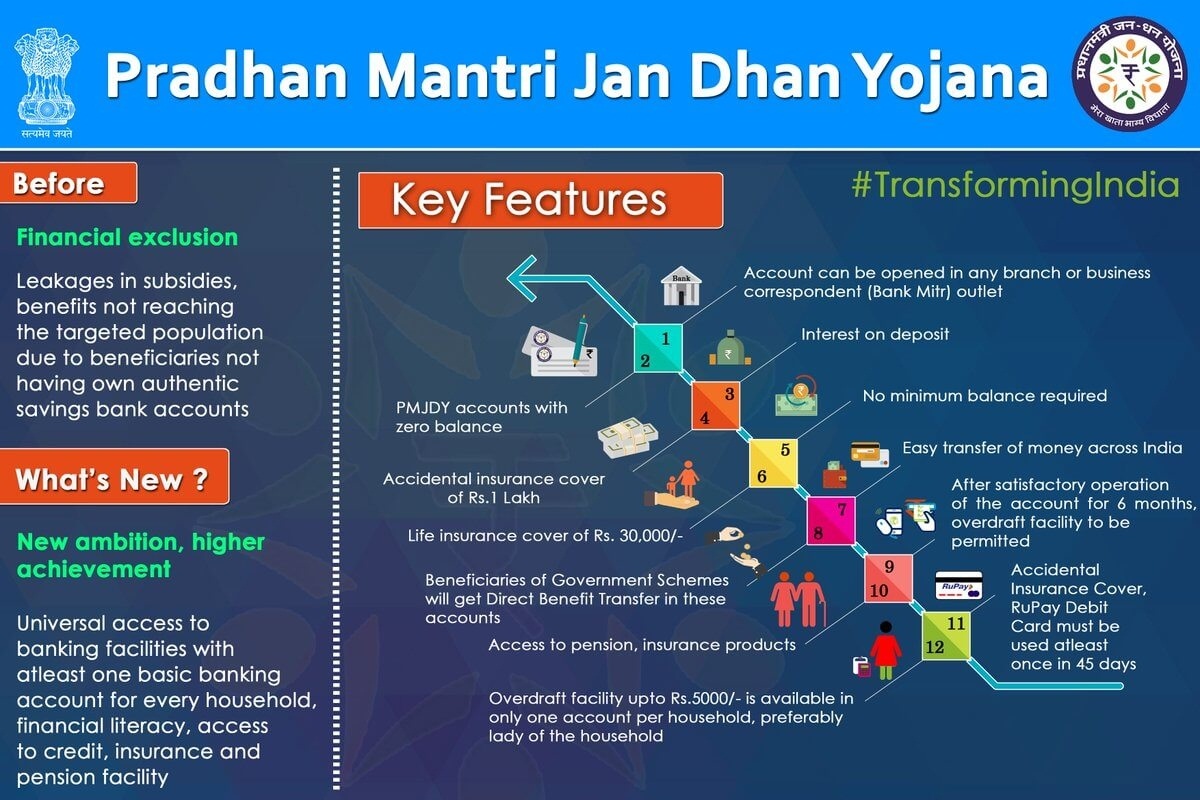

Pradhan Mantri Jan-Dhan Yojana (PMJDY) - National Mission for Financial Inclusion, completed its six years of successful implementation.

Key Points

- While launching the programme on 28th August 2014, the Prime Minister had described the occasion as a festival to celebrate the liberation of the poor from a vicious cycle of poverty.

- A key initiative towards commitment of financial inclusion is the Pradhan Mantri Jan Dhan Yojna (PMJDY).

- Financial inclusion may be defined as the process of ensuring access to financial services and timely and adequate credit where needed by vulnerable groups such as weaker sections and low-income groups at an affordable cost.

- Financial Inclusion is a national priority of the Government as it is an enabler for inclusive growth.

- It is important as it provides an avenue to the poor for bringing their savings into the formal financial system, an avenue to remit money to their families in villages besides taking them out of the clutches of the usurious money lenders.

- Financial inclusion may be defined as the process of ensuring access to financial services and timely and adequate credit where needed by vulnerable groups such as weaker sections and low-income groups at an affordable cost.

- Achievements under PMJDY:

- PMJDY Accounts:

- Total Number of PMJDY Accounts (as on 19th August 2020): 40.35 Crore; Rural PMJDY accounts: 63.6%, Women PMJDY accounts: 55.2%

- During the first year of the scheme 17.90 crore PMJDY accounts were opened.

- Continuous increase in no of accounts under PMJDY.

- Operative PMJDY Accounts:

- As per extant RBI guidelines, a PMJDY account is treated as inoperative if there are no customer induced transactions in the account for over a period of two years.

- Out of total 40.35 crore PMJDY accounts, 34.81 crore (86.3%) are operative.

- Deposits under PMJDY accounts:

- Total deposit balances under PMJDY Accounts stand at Rs. 1.31 lakh crore.

- Deposits have increased about 5.7 times with increase in accounts 2.3 times between 2015 to 2020.

- Rupay Card issued to PMJDY account holders:

- Total RuPay cards issued to PMJDY account holders: 29.75 Crore

- Jan Dhan Darshak App:

- A mobile application was launched to provide a citizen centric platform for locating banking touchpoints such as bank branches, ATMs, Bank Mitras, Post Offices, etc.

- This app is also being used for identifying villages which are not served by banking touchpoints within 5 km. The efforts have resulted in a significant decrease in the number of such villages.

- Pradhan Mantri Garib Kalyan Package (PMGKP) for PMJDY women beneficiaries:

- An amount of Rs. 500/- per month for three months (April’ 20 to June’ 20), was credited to the accounts of women account holders under Pradhan Mantri Jan Dhan Yojana (PMJDY).

- Towards ensuring smooth DBT transactions:

- As informed by banks, about 8 crore PMJDY account holders receive Direct Benefit Transfer (DBT) from the Government under various schemes.

- PMJDY Accounts:

- Important approach adopted in PMJDY based on past experience:

- Extension of PMJDY with New features: From 28th August 2018, the Government extended PMJDY with some modifications:

- Focus shifted from ‘Every Household’ to Every Unbanked Adult’

- RuPay Card Insurance: Free accidental insurance cover on RuPay cards increased from Rs. 1 lakh to Rs. 2 lakh for PMJDY accounts opened after 28.8.2018.

- Enhancement in overdraft facilities: OD limit doubled from Rs 5,000/- to Rs 10,000/-; OD upto Rs 2,000/- (without conditions). Increase in upper age limit for OD from 60 to 65 years.

- Extension of PMJDY with New features: From 28th August 2018, the Government extended PMJDY with some modifications:

Background

- Pradhan Mantri Jan-Dhan Yojana (PMJDY) is National Mission for Financial Inclusion to ensure access to financial services, namely, Banking/Savings & Deposit Accounts, Remittance, Credit, Insurance, Pension in an affordable manner.

- Objectives:

- Ensure access of financial products & services at an affordable cost.

- Use of technology to lower cost & widen reach.

- Basic tenets of the scheme

- Banking the unbanked - Opening of basic savings bank deposit (BSBD) account with minimal paperwork, relaxed KYC, e-KYC, account opening in camp mode, zero balance & zero charges

- Securing the unsecured - Issuance of Indigenous Debit cards for cash withdrawals & payments at merchant locations, with free accident insurance coverage of Rs. 2 lakh

- Funding the unfunded - Other financial products like micro-insurance, overdraft for consumption, micro-pension & micro-credit

- Features

- The scheme was launched based upon the following 6 pillars:

- Universal access to banking services – Branch and Banking Correspondents

- Basic savings bank accounts with overdraft facility of Rs. 10,000/- to every household.

- Financial Literacy Program– Promoting savings, use of ATMs, getting ready for credit, availing insurance and pensions, using basic mobile phones for banking.

- Creation of Credit Guarantee Fund – To provide banks some guarantee against defaults.

- Insurance – Accident cover up to Rs. 1,00,000 and life cover of Rs. 30,000 on account opened between 15 Aug 2014 to 31 January 2015.

- Pension Scheme for Unorganized sector.

- The scheme was launched based upon the following 6 pillars:

Way Forward

- There must be an endeavour to ensure coverage of PMJDY account holders under micro insurance schemes.

- Eligible PMJDY accountholders will be sought to be covered under Pradhan Mantri Jeevan Jyoti Bima Yojana (PMJJBY) and Pradhan Mantri Suraksha Bima Yojana (PMSBY).

- Promotion of digital payments including RuPay debit card usage amongst PMJDY account holders through creation of acceptance infrastructure across India can be taken into account.

- Improving the access of PMJDY account holders to Micro-credit and micro-investment such as Flexi-recurring deposit etc.

- Adding more focus on financial literacy and digital literacy for the common man.