Governance

The Big Picture - Operation Clean up

- 11 Oct 2019

- 10 min read

In the run-up to the 2019 general elections, unlike in 2014, the issue of corruption took a back seat; it was overshadowed by the issue of national security. But over the last few months several steps were taken to clean up the system.

In June, the government dismissed from service 12 senior income tax officers, including one of the rank of joint commissioner, on charges of corruption and professional misconduct. A week later twelve Indian Revenue Service (IRS) officers belonging to the Income Tax (I-T) department were dismissed on charges of corruption.

Meanwhile, the government of Uttar Pradesh cracked the whip on 600 government officials of which 200 were forced to go on voluntary retirement and 400 others got strict punitive action in the form of adverse entries in a confidential report. This was the biggest ever action against corruption by any state government.

Background

- The need for cleaning up the system came from a lot of complaints that came in despite the fact that the government in the recent past has been very particular about enforcing the rule of law and compliance to other measures to prevent activities such as money laundering, tax evasion etc.

- Although, the government is taking steps against people who have violated the law, substantial steps have not been taken against the law enforcers themselves.

- There were a lot of complaints, particularly about the income tax officers that these enforcement officials indulge in corruption. The Business and the Industry Community calls the same as ‘Tax Terrorism’.

- This implies that the government has done very little about cleaning up its own law enforcement system.

- The problem is not new. The State Sales Tax (now replaced by GST) Officers were considered as notorious as they followed very draconian and predatory approach i.e. trying to mop up the revenue but at the same time filling up their own pockets.

- Due to such approach, businessmen - big or small, continuously face coercion.

- Therefore, a need was felt to check the ethical behaviour of the enforcement agencies.

Steps Taken by the Government

- The Government took an immediate step of retiring those who were known to be not people of integrity by using the fundamental rule 56.

- The Fundamental Rule 56 of the Central Civil Services (Pension) Rules, 1972 provides for periodical review of performance of government servants with a view to ascertain whether they should be retained in service or retired from service, in the public interest.

- Over time, the legislative framework has been made little more transparent, leading to the rule based decision making process in the country, thus reducing arbitrariness. Also, changes have been made in laws to enable public servants to take bona fide decisions without fear of any harassment.

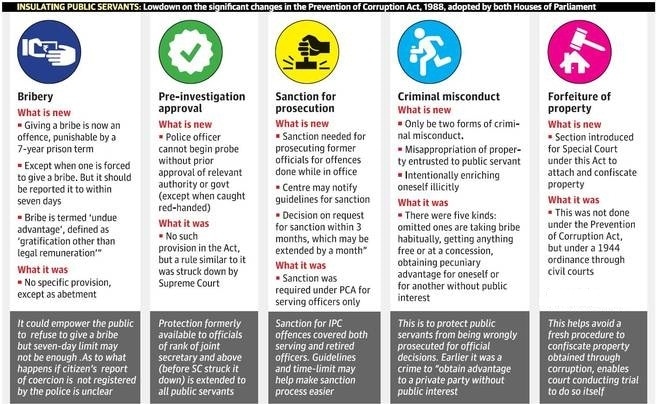

- For e.g. recent amendments made in the Prevention of Corruption Act include some safeguards that ensure that honest officers are not intimidated by false complaints.

- By using the technology, the government has reduced the scope of the misuse of the legislative system by various stakeholders.

- Use of Technology in the Goods and Services Tax (GST) has increased compliance and formalized a large number of transactions which would have otherwise remained under the radar and thus not get tracked.

- Also, after e- tenders became norm in all government offices, the big cases of corruption has come down.

- In a step towards faceless model of governance, Income Tax Department has put in place income tax assessments with anonymity of the payee.

- India has signed several tax agreements with tax havens abroad such as Switzerland, Mauritius, Cyprus, Singapore etc.

- There has been more and more international cooperation (for example G7 summit) on tackling financial aspects of international crime syndicates and terrorism.

Amendments made in the Prevention of Corruption Act

Tackling Corruption in India

- Corruption is the abuse of entrusted power for private gain. It can be classified as grand, petty and political, depending on the amounts of money lost and the sector where it occurs.

- In India, bureaucracy is susceptible to corruption.

- Corruption is widespread and can be tackled at following levels:

- At the cutting edge level.

- At the middle level.

- At the highest level i.e. policy making level.

- The Corruption at the cutting edge level affects a common man the most, i.e. at the Police Station, Municipality etc.

- Though things have improved but there is still a lot of scope for improvement the way one conducts business, whether it is in Police Station or in an electricity office etc.

- The training of civil servants and those who are manning these offices is needed. Also, close supervision of the conduct is required.

- The use of technology can minimize the discretionary powers, thus, reducing the scope of corruption.

- At middle level, the role of professionals like Chartered Accountant and Lawyers, come into play. Such people need to motivate others to follow laws and to not avoid or violate the laws.

- The government has come down heavily on the corruption that happens at the Policy making level. Right to Information is an example.

- Both coercion-led and collusive corruption is prevalent in India. The government needs to tackle both of them.

- In the coercion-led corruption, one is forced to pay bribe.

- In the collusive corruption, the government representative as well as the citizen collude with each other, thus, making the act of corruption voluntary.

Way Forward

- India needs to simplify its tax laws as it has been seen that complexity in laws leads to arbitrariness in bureaucratic system, leaving the scope for corruption.

- Along with simplification, the government also needs to ensure that the rate of taxation remains moderate. This step is required as tax rates on higher side create scope for non-compliance.

- It is expected that the Direct Tax Code would reduce the taxation rate and hence would increase the tax base.

- Governance reforms, which should include Police, Judiciary, Municipalities, etc. from the grass root level to the highest level, is the need of the hour.

- As done by U.K., there is a need to create a Chinese wall between those officers who undertake investigations and those who are responsible for tax collections. The investigation wing of the tax department should function on its own and not be subservient to the revenue collection goals of the government.

- More and more usage of technology is required for ensuring transparency in the governance system. The biggest advantage can be minimised interface with officials.

- The government needs to keep the civil servants or people in the public offices motivated about their work so that they take pride in doing their work. Doing the work properly should be the biggest satisfaction that they should derive. Also, there must be a lot of incentives for honesty.

- With the economy continuously opening up, it should be ensured that the regulator as well as the law enforcers perform their tasks sincerely. In the recent past, incidents of corruption, like the one that happened in PNB, have happened mainly due to non - vigilant regulators.

- Through use of the Fundamental Rule 56, one can only remove people charged with corruption. It should be ensured that such people should be penalized. The country’s judicial system needs to be made more effective and expeditious for the same.

- There is a need for improved accountability standards at the political and administrative level to form a holistic and trustworthy ecosystem.