Indian Economy

Fiscal Centralisation Concerns in India

- 07 Feb 2024

- 19 min read

This editorial is based on “Union government’s reins on financial transfers to States” which was published in The Hindu on 07/02/2024. The article examines how the Union government’s moves, which reduce the aggregate financial transfers to States, are weakening fiscal-cum-cooperative federalism in the country.

For Prelims: Finance Commission, Goods and Service Tax (GST), GST council, Integrated GST, Vertical and Horizontal devolution, Input tax credit, Article 275, GST compensation

For Mains: Need to rethink measures through which India can strengthen its Fiscal Federalism.

Ever since the beginning of the 14th Finance Commission (FC) award period (2015-16), the Union government has been reducing financial transfers to States. This is particularly strange given that the 14th FC recommended devolving 42% of Union tax revenues to States, which is a clean 10% points increase over the 13th FC’s recommendation.

The 15th Finance Commission retained this recommendation of 41%, excluding the devolution to J&K and Ladakh, which were recategorised as Union Territories. If the shares of J&K and Ladakh are included, it should be 42%. The Union government not only reduced the financial transfers to States but also increased its own total revenue to increase its discretionary expenditure.

What is Fiscal Federalism?

- Fiscal federalism is a term that describes how the financial powers and responsibilities are divided between different levels of government in a country.

- It involves questions such as which functions and services should be provided by the central government or the state governments, how the revenues should be raised and shared among them, and how the transfers or grants should be allocated to ensure efficiency and equity.

What are Different Provisions Related to Centre State Financial Relations?

- Part XII of the Constitution: The Indian Constitution has made elaborate provisions, relating to the distribution of taxes as well as non-tax revenues and the power of borrowing, supplemented by provisions for grants-in-aid by the Union to the States. Article 268 to 293 deals with the provisions of financial relations between Centre and States.

- The grants-in-aid system under Article 275 involves the discretionary transfer of funds from the central government to state governments for specific purposes or schemes.

- The Finance Commission is a constitutional body under Article 280, responsible for recommending the distribution of tax revenues between the central government and the state governments. It also suggests ways to augment the financial resources of states, promote fiscal discipline, and ensure stability in fiscal matters.

- Under Article 280(3) of the Constitution, apart from recommending the devolution of taxes and grants-in-aid to the States, the FC may be asked by the Centre to look into any other issue “in the interest of sound finance”.

- Seventh Schedule of the Constitution: The Constitution divides the taxing powers between the Centre and the States as follows:

- The Parliament has exclusive power to levy taxes on subjects enumerated in the Union List,

- The state legislature has exclusive power to levy taxes on subjects enumerated in the State List,

- Both can levy taxes on the subjects enumerated in Concurrent List whereas residuary power of taxation lies with Parliament only.

What Steps of Union Government Have Reduced Aggregate Financial Transfers to States?

- Increasing Centralisation of Fiscal Powers:

- Over time, the proportion of non-shareable revenue accruing to the central government, such as surcharges and cesses, has risen.

- Consequently, states are advocating for greater fiscal autonomy and a larger share of all taxes collected by the centre.

- Erosion of State Tax Autonomy:

- The ability of states to set tax rates on their own revenue sources has significantly diminished. This erosion occurred following the implementation of value-added tax (VAT) for intra-state trade of goods.

- As a result, states have experienced a loss of autonomy in determining tax policies and revenue generation strategies.

- Constraints on State Expenditure Flexibility:

- States face constraints on their expenditure flexibility due to the increasing prominence of conditional and tied grants.

- These grants, which target items listed in the state list, limit states' discretion in allocating funds according to their unique priorities and local needs.

- Uniform Fiscal Targets Neglecting State Variations:

- Challenges stemming from the Fiscal Responsibility and Budget Management (FRBM) Act, 2003 exacerbate the situation by imposing uniform fiscal targets across states.

- These targets fail to account for the diverse fiscal needs and economic conditions of individual states, further limiting their ability to manage their finances effectively.

- Implementation of Goods and Service Tax (GST):

- The 101st Constitutional Amendment of 2016 giving the Union and states concurrent powers of indirect taxation has been the most far-reaching change from a fiscal standpoint, since the setting up of the 1st FC in 1951.

- The collection of indirect taxes in the state where goods or services are consumed, and not in the state where they are produced, changes both the vertical as well as the horizontal dynamics of federalism.

- The tax burden has been shifted from rich and manufacturing states to consuming states, leading to horizontal imbalances.

- The Integrated GST, for instance, charged during the inter-state supply of goods or services has been transferred to the destination state. This move from the principle of origin to the principle of destination is reconfiguring the balance of power amongst states.

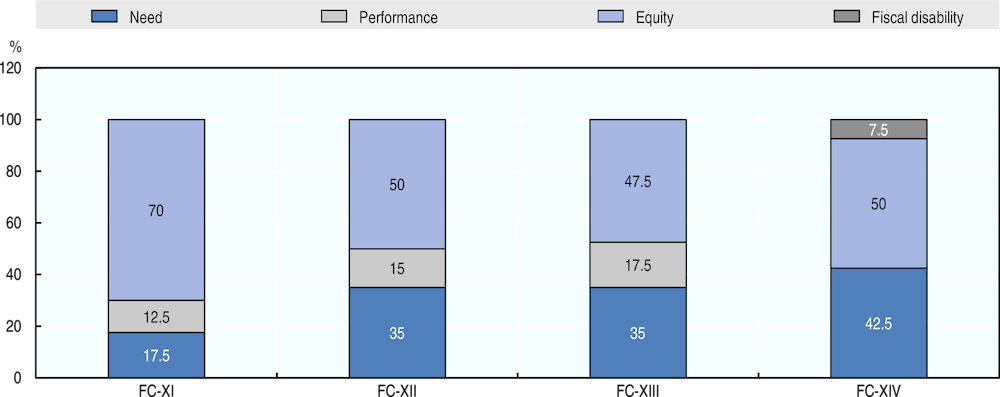

Criteria for the distribution of states’ share in all central taxes, Eleventh to Fourteenth Finance Commissions

What is the Current Scenario of Fiscal Transfers to States?

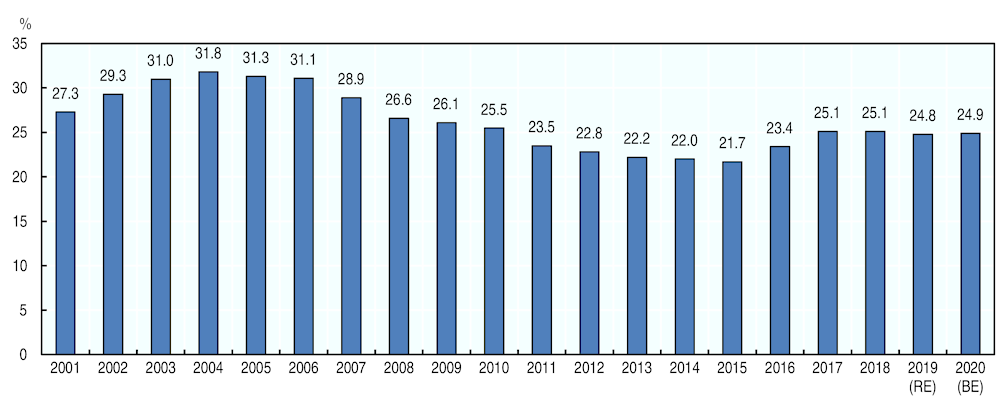

- Declining Share in Gross Tax Revenue:

- Though the 14th and 15th FCs recommended 42% and 41%, respectively, of the net tax revenue to be the shares of States, the share of the gross tax revenue was just 35% in 2015-16 and 30% in 2023-24 (Budget Estimates).

- While the gross tax revenue of the Union government increased from Rs 14.6 lakh crore in 2015-16 to Rs 33.6 lakh crore in 2023-24, the States’ share in the Union tax revenue increased from Rs 5.1 lakh crore to Rs 10.2 lakh crore between these two years.

- Reduction in Grants-in-Aid to States:

- The grants-in-aid to States declined in absolute amount from Rs 1.95 lakh crore in 2015-16 to Rs 1.65 lakh crore in 2023-24. Thus, the combined share of the statutory financial transfers in the gross tax revenue of the Union government declined from 48.2% to 35.32%.

- Increasing Tax Collection Under Cess and Surcharge Categories:

- One of the reasons for the States’ share in gross revenue declining during this period is that the net tax revenue is arrived at after deducting the revenue collections under cess and surcharge, revenue collections from Union Territories, and tax administration expenditure.

- Among the three factors, revenue collection through cess and surcharge is the highest and increasing.

- This calculation is excluding the GST cess that is collected to compensate for the revenue loss of the States due to implementation of GST till June 2022.

- One of the reasons for the States’ share in gross revenue declining during this period is that the net tax revenue is arrived at after deducting the revenue collections under cess and surcharge, revenue collections from Union Territories, and tax administration expenditure.

- Financial Centralisation Concerns:

- The Union government has two other routes of direct financial transfers to States, i.e., Centrally Sponsored Schemes (CSS) and Central Sector Schemes (CS).

- The government influences the priorities of the States through CSS wherein the Union government provides partial funding and another part is to be committed by States. In other words, it proposes the schemes and States implement them, committing the latter’s financial resources as well.

- Between 2015-16 and 2023-24, the allocation for CSS increased from Rs 2.04 lakh crore to Rs 4.76 lakh crore through 59 CSS.

- Thus, the Union government compels the State to commit more or less an equivalent quantum of financial resources.

- The Union government has two other routes of direct financial transfers to States, i.e., Centrally Sponsored Schemes (CSS) and Central Sector Schemes (CS).

- Issues Surrounding Wealthy vs Less Wealthy States:

- An important aspect of CSS shared schemes is that the States that can afford to commit matching finances from the State budgets alone can avail of the matching grants. This creates two different effects in terms of inter-State equity in public finances.

- Wealthy States can afford to commit equivalent finances and leverage Union finances inwards through the implementation of CSS.

- Less wealthy States will have to commit their borrowed finances in these CSS, thus increasing their own liabilities. These differential trajectories of the public finances of States accentuate inter-State inequality in public finances, the major reason being CSS.

- An important aspect of CSS shared schemes is that the States that can afford to commit matching finances from the State budgets alone can avail of the matching grants. This creates two different effects in terms of inter-State equity in public finances.

- Larger Financial Powers of Union Govt with Limited Expenditure Responsibilities:

- Together with statutory grants, the total financial transfers as a proportion to gross tax revenue were only 47.9% in 2023-24.

- In addition to retaining more than 50% of gross tax revenue, the Union government incurs a fiscal deficit to the extent of 5.9% of GDP. Thus, the Union government wields enormous financial powers with limited expenditure responsibilities.

What Steps Should be Taken to Ensure Better Devolution of Finances?

- Re-Examine the Tax-Sharing Principles: The FCs need to be directed to review tax-sharing principles in the context of India's changing fiscal federalism. Their terms of reference should be strictly aligned on the consolidation of the indirect tax base by the Union and the states.

- Redesign the Statutory Sharing of Indirect Taxes: The changes necessitate that the statutory sharing of the indirect taxes, both vertical and horizontal, is re-examined and redesigned.

- Vertical Devolution: To align the principle of vertical sharing with the current system, it is important to start by redefining the divisible pool. For instance, the 16th FC will be required to specify the modalities of making IGST completely a part of the pool.

- Horizontal Devolution: The criteria for the distribution of the divisible pool among states, will have to be revisited. The existing criteria, especially for equalising grants, have evolved into a production-based tax system. This needs to be redesigned for a consumption-based tax system.

- Calculating and Allocating the Cost of Collecting: The new administration of GST, where both the Union and states collect the same taxes, has resulted in a significant increase and wide variation in the cost of tax collection. This cost ranges from 7% to 10%.

- Therefore, the ensuing FCs should be tasked with recommending a method to calculate and allocate the cost of collecting indirect taxes.

- Additionally, they should suggest ways to reduce these taxes and improve their collection efficiency.

- Redesign the Grant Mechanism: The “gap-filling” approach devised by British Banker Otto Niemeyer in 1935 and continued under Article 275, should be redesigned in light of the compensation law brought in by the GST Council.

- With the GST compensation grants extended to March 31, 2026, the fiscal year after that will be the base year for the 16th FC award and will be operative from 2027 to 2032.

- It is very much evident that every state will seek the extension of the compensation scheme. Therefore, it is best to enjoin upon the 16th FC to examine the need for compensation, the raison d’etre for which was to “compensate losses in transition to GST”.

- New Institutional Structure of Federal Finance: In the new federal finance institutional structure, the GST council and the finance commission must have a formal relationship since they decide the size of the divisible pool and distribute it.

- The FCs should investigate how the GST Council can act as the Fiscal Council to oversee the implementation of its award during the period when it is not operational.

Conclusion

The significant reduction in financial transfers to States by the Union government since the initiation of the 14th FC award period is alarming, especially considering the recommended increase in devolution to 42%.

Despite a substantial rise in the Union government's gross tax revenue, the share allocated to States has not proportionately increased. The reliance on CS and CSS further exacerbates inter-State inequality and diminishes State autonomy in financial management.

This scenario not only weakens cooperative federalism but also raises concerns about the equitable distribution of financial resources among States in the future.

|

Drishti Mains Question: Discuss the implications of reduced financial transfers to States by the Union government, analysing its impact on fiscal federalism in India. |

UPSC Civil Services Examination, Previous Year Questions (PYQs)

Q. Which one of the following in Indian polity is an essential feature that indicates that it is federal in character ? (2021)

(a) The independence of judiciary is safeguarded.

(b) The Union Legislature has elected representatives from constituent units.

(c) The Union Cabinet can have elected representatives from regional parties.

(d) The Fundamental Rights are enforceable by Courts of Law.

Ans: (a)

Q. Which one of the following is not a feature of Indian federalism? (2017)

(a) There is an independent judiciary in India.

(b) Powers have been clearly divided between the Centre and the States.

(c) The federating units have been given unequal representation in the Rajya Sabha.

(d) It is the result of an agreement among the federating units.

Ans: (d)

Q. Local self-government can be best explained as an exercise in (2017)

(a) Federalism

(b) Democratic decentralisation

(c) Administrative delegation

(d) Direct democracy

Ans: (b)

Q. Consider the following items: (2018)

- Cereal grains hulled

- Chicken eggs cooked

- Fish processed and canned

- Newspapers containing advertising material

Which of the above items is/are exempted under GST (Good and Services Tax)?

(a) 1 only

(b) 2 and 3 only

(c) 1, 2 and 4 only

(d) 1, 2, 3 and 4

Ans: (c)

Q. What is/are the most likely advantages of implementing ‘Goods and Services Tax (GST)’? (2017)

- It will replace multiple taxes collected by multiple authorities and will thus create a single market in India.

- It will drastically reduce the ‘Current Account Deficit’ of India and will enable it to increase its foreign exchange reserves.

- It will enormously increase the growth and size of economy of India and will enable it to overtake China in the near future.

Select the correct answer using the code given below:

(a) 1 only

(b) 2 and 3 only

(c) 1 and 3 only

(d) 1, 2 and 3

Ans: (a)