Important Facts For Prelims

Unified Pension Scheme (UPS)

- 17 Sep 2025

- 5 min read

Why in News?

The government has given central government employees the option to switch to the Unified Pension Scheme (UPS) by 30th September 2025. However, the adoption has been slow, with only 40,000 out of 23.94 lakh eligible employees opting for the UPS so far.

What is the Unified Pension Scheme (UPS)?

- About: The UPS, recommended by the T.V. Somanathan committee (2023) to review the National Pension System (NPS), was announced in August 2024 and came into effect on 1st April 2025 as an optional pension scheme for Central Government employees under the NPS.

- It provides assured, inflation-indexed, and adequate retirement benefits, addressing concerns related to longevity protection and pension predictability.

- UPS is regulated by the Pension Fund Regulatory and Development Authority (PFRDA), and is available to both serving and retired employees, subject to specific conditions.

- Eligibility:

- Central Government employees under NPS as on 1st April 2025.

- New recruits joining Central Government service on or after 1st April 2025.

- Retired NPS subscribers who superannuated or retired on or before 31st March 2025, with at least 10 years of qualifying service, provided retirement was not a penalty under Fundamental Rules (FR) 56(j) (relates to the premature retirement of government servant).

- Legally wedded spouse of a deceased NPS subscriber (who retired before opting for UPS).

- Contributions under UPS

- Employee Contribution: 10% of Basic Pay + Dearness Allowance (DA).

- Government Contribution: Matching 10% of Basic Pay + DA.

- Additional Government Contribution (Pool Corpus): Around 8.5% of Basic Pay + DA, used to ensure assured payouts.

- PRAN (Permanent Retirement Account Number): All contributions and transactions are recorded under the employee’s PRAN account.

- Corpus Contribution under UPS

- Individual Corpus (IC): Actual savings from employee and government contributions.

- Benchmark Corpus (BC): A notional amount calculated assuming regular contributions and no withdrawals.

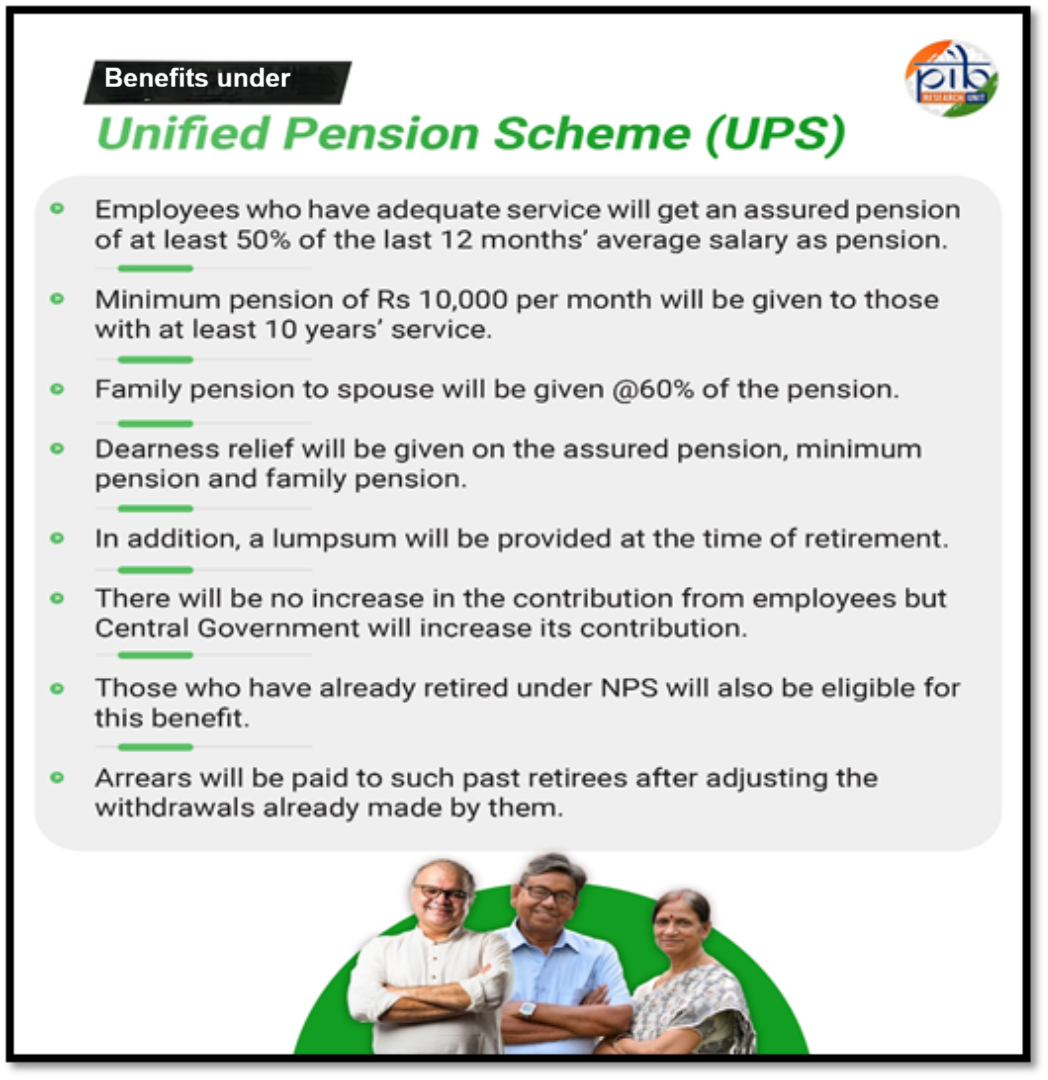

- Benefits under UPS:

NPS vs UPS

|

Parameter |

NPS |

UPS |

|

Nature |

Mandatory for new employees (post-2004) |

Voluntary for eligible employees |

|

Contribution |

10% (Employee) + 14% (Govt.) |

10% (Employee) + 10% (Govt.) + 8.5% (Pool Corpus) |

|

Assured Payout |

No |

Yes (subject to conditions) |

|

Minimum Pension |

No |

₹10,000/month |

|

Dearness Relief |

No |

Yes |

|

Final Withdrawal |

Up to 60% |

Up to 60% |

|

Family Benefits |

Depends on annuity |

60% of subscriber’s payout |

|

Partial Withdrawal |

Yes |

Yes |

Did You Know?

- Central government staff hired before 2004 were under the Old Pension Scheme (OPS) with fixed pensions, while those after 2004 came under the market-linked mandatory NPS.

- Many employees continue to demand a return to the Old Pension Scheme (OPS) as it offers higher security and no employee contribution.

- The Centralized Pension Payments System (CPPS), implemented by the Employees Provident Fund Organisation (EPFO), allows pensioners to access their pension from any bank or branch nationwide. It streamlines payments, removes the need for physical verifications, and ensures immediate credit of pension.

- The Atal Pension Yojana (APY) launched in 2015, with the objective of creating a universal social security system for all Indians, especially the poor, the under-privileged and the workers in the unorganised sector.

UPSC Civil Services Examination, Previous Year Questions (PYQs)

Prelims

Q. Who among the following can join the National Pension System (NPS)? (2017)

(a) Resident Indian citizens only

(b) Persons of age from 21 to 55 only

(c) All State Government employees joining the services after the date of notification by the respective State Governments

(d) All Central Government employees including those of Armed Forces joining the services on or after 1st April, 2004

Ans (c)

Q. Regarding ‘Atal Pension Yojana’, which of the following statements is/are correct? (2016)

- It is a minimum guaranteed pension scheme mainly targeted at unorganised sector workers.

- Only one member of a family can join the scheme.

- Same amount of pension is guaranteed for the spouse for life after the subscriber's death.

Select the correct answer using the code given below:

(a) 1 only

(b) 2 and 3 only

(c) 1 and 3 only

(d) 1, 2 and 3

Ans: (c)