Indian Economy

Black Money

- 15 Dec 2021

- 8 min read

For Prelims: Meaning of terms: Tax Havens, Round tripping, Fugitive Economic Offender, Transfer Pricing, whistleblower, Effects of black money on economy, Sources of black money, Financial Intelligence Unit, Financial Action Task Force

For Mains: Tackling black money in India, Relevance of Panama and Paradise Paper Leaks.

Why in News

Recently, the government has said in the Parliament that Rs 2,476 crore has been collected as tax and penalty under the one-time three months compliance window during 2015.

- It has also been said that there is no official estimation how much worth of black money is lying in foreign accounts over the last five years.

- Total undisclosed credits amounting to Rs 20,353 crore have been detected with respect to 930 India linked entities in the Panama and Paradise Paper Leaks.

Key Points

- Black Money:

- There is no official definition of black money in economic theory, with several different terms such as parallel economy, black money, black incomes, unaccounted economy, illegal economy and irregular economy all being used more or less synonymously.

- The simplest definition of black money could possibly be money that is hidden from tax authorities.

- According to a secret study commissioned by the Finance Ministry concluded in 2014 that about 90% of unaccounted wealth, or black money, was lying within India and not outside.

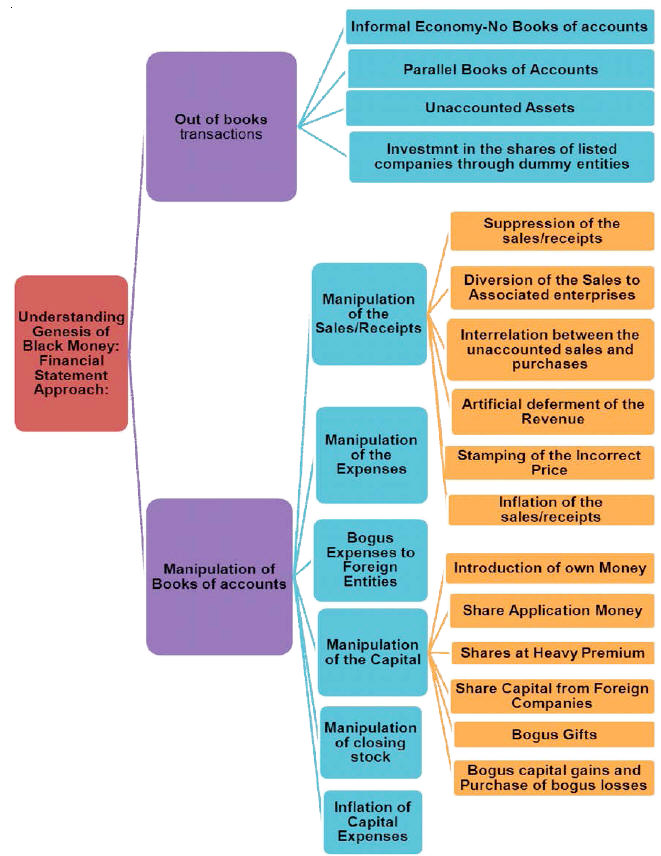

- Source of Black Money:

- It can come from two broad categories:

- Illegal Activity:

- Money that is earned through illegal activity is obviously not reported to the tax authorities, and so is black.

- Legal but Unreported Activity:

- The second category comprises income from legal activity that is not reported to the tax authorities.

- Illegal Activity:

- It can come from two broad categories:

Examples for Sources of Black Money

- Multi-Level Marketing Scheme:

- International debit or credit cards issued by offshore banks are used to create black money.

- Disguised Ownership:

- Increasingly, criminals want to own legitimate businesses. It could be to earn a return or to convert black money into white.

- Mixed Sales:

- Mixing illicit money sources with legit ones is a popular method because it's hard to detect, especially if there is a large cash component in the legal business.

- Smurfing:

- This type of transaction is usually done to evade notice by authorities monitoring transactions above a certain threshold.

- Trade Mispricing:

- Traditionally, goods exported and imported were either priced lower or higher to enable money laundering.

- With current technology, the Organization for Economic Cooperation and Development (OECD) says it's easy to modify invoices or produce fictitious invoices.

- Money Transfers To Benami Entities:

- In a Benami transaction, a property is transferred or held by one person and the consideration for such property is paid by another person for whose benefit such property is held.

- Impacts:

- Loss of Revenue:

- Black money eats up a part of the tax and, thus, the government’s deficit increases.

- The government has to balance this deficit by increasing taxes, decreasing subsidies and increasing borrowings.

- Borrowing leads to a further increase in the government’s debt due to interest burden. If the government is unable to balance the deficit, it has to decrease spending, which affects development.

- Money Circulation:

- People generally tend to keep black money in the form of gold, immovable property and other secret manners.

- Such money does not become part of the main economy and, therefore, remains generally out of circulation.

- The black money keeps circulating among the wealthy and creates more opportunities for them.

- Higher Inflation:

- The infusion of unaccounted black money in the economy leads to higher inflation, which obviously hits the poor the most.

- It also increases the disparity between the rich and the poor.

- Loss of Revenue:

- Government’s Initiatives:

- Legislative Action:

- The Fugitive Economic Offenders Act, 2018

- The Central Goods and Services Tax Act, 2017

- The Benami Transactions (Prohibition) Amendment Act, 2016

- The Black Money (Undisclosed Foreign Income and Assets) and Imposition of Tax Act, 2015

- Prevention of Money Laundering Act, 2002

- Gold Amnesty scheme: This is similar to the Voluntary Income Disclosure scheme to tap black money in income taxes.

- International Cooperation:

- Double Taxation Avoidance Agreements (DTAAs):

- India is proactively engaging with foreign governments with a view to facilitate and enhance the exchange of information under Double Taxation Avoidance Agreements (DTAAs)/Tax Information Exchange Agreements (TIEAs)/Multilateral Conventions.

- Automatic Exchange of Information:

- India has been a leading force in the efforts to forge a multilateral regime for proactive sharing of financial information known as Automatic Exchange of Information which will greatly assist the global efforts to combat tax evasion.

- The Automatic Exchange of Information based on Common Reporting Standard has commenced from 2017 enabling India to receive financial account information of Indian residents in other countries.

- Foreign Account Tax Compliance Act of USA:

- India has entered into an information sharing agreement with the USA under the act.

- Financial Action Task Force (FATF):

- India is a member of the FATF.

- Double Taxation Avoidance Agreements (DTAAs):

- Legislative Action:

Way Forward

- Appropriate legislative framework related to Public Procurement, Prevention of Bribery of foreign officials, citizens grievance redressal, whistleblower protection, UID Aadhar is needed.

- Setting up and strengthening institutions dealing with illicit money: Directorate of Criminal Investigation Cell for Exchange of Information, Income Tax Overseas Units- ITOUs at Mauritius and Singapore have been very useful, Strengthening the Foreign TAX, Tax Research and Investigation Division of the CBDT.

- Electoral Reforms: Appropriate reforms are needed to reduce money power in elections, since elections are one of the biggest channels to utilize the black money.

- Training Personnel: Both domestic and international training to personnel for effective action pertaining to the concerned area can also help.

- For instance, the Financial Intelligence Unit-India makes proactive efforts to regularly upgrade the skills of its employees by providing them opportunities for training on anti-money laundering, terrorist financing, and related economic issues.

- Incentivising Bank Transactions: To curb the menace of black money, industry body Federation of Indian Chambers of Commerce and Industry has suggested incentivisation of transactions through banking channels and a suitable framework for taxation of agricultural income.

- Besides, it suggested reforms in the real estate sector and creation of IT infrastructure to track tax evasion.