Indian Economy

Challenges Faced By RBI

- 04 May 2020

- 8 min read

This article is based on “RBI’s job involves trade-offs, not conflicts” which was published in The Indian Express on 02/05/2020. It talks about challenges faced by the Reserve Bank of India (RBI) in pursuance of its monetary policy.

In the wake of global anthropological shock Covid-19, a sharp slowdown in economic growth and employment prospects is evident in the Indian economy. In this context, Reserve Bank of India’s role in ensuring economic stability, growth and development through effective monetary policy assumes more importance than ever.

RBI’s job involves balancing short-term as well as long-term growth, ensuring economic growth while meeting the inflation targets. However, issues pertaining to the incomplete transmission of monetary policy and inherent weakness of inflation targeting approach, are some of the challenges faced by RBI.

Note:

- Monetary Policy is a macroeconomic policy by RBI, wherein through Repo, OMO, PSL etc. tools it tries to manage the money supply, interest rates, loan distribution, and thereby helping in the Economic Stability, Growth, and Development.

- There are 3 prominent ways of making monetary policy:

- Targeting Exchange rate stability

- Targeting Multiple Indicators

- Targeting Inflation.

- From 2016, RBI has shifted to Inflation Targeting. In pursuance of this, the amendment has been made in the RBI Act, which established a statutory body called “Monetary Policy Committee” (MPC).

- Role of MPC is to decide the repo rate to control inflation between 2-6%

Incomplete Transmission of Monetary Policy

Incomplete Transmission of Monetary Policy means that the cumulative easing in policy rates by RBI has not yet been reflected in the lowering of their lending rates by banks. This can be attributed to the following reasons:

Inflexible Cost of Funds

- In India, customer deposit constitutes the majority of funds to be lent by the banks, whereas the market borrowings through the issuance of debentures/commercial papers is negligible.

- The cost of funds typically remains inflexible as most of these deposits are contracted at fixed rates.

- Further, Interest rates on small savings remained at elevated levels compared to that of banks. This has led to a decline in deposits with the banks.

- The shortfall in the funds has made it virtually impossible for banks to lend at lower deposit rates.

- Until and unless this problem is addressed, banks cannot transmit monetary policy signals at the desired speed and magnitude.

Policy Rates not linked to Market

- Repo rate, being the policy rate, is administered by the Monetary Policy Committee and therefore cannot be treated as a market-determined rate.

- Banks are asked to link their lending rate to repo rate, without any reference to the cost of lending funds.

High Non-Performing Assets (NPAs)

- The accumulation of large NPAs has reduced the profitability of banks. Due to this, banks keep the weighted average lending rate much higher than the marginal lending rate.

Four Balance Sheet Problem

- According to Former chief economic advisor, Arvind Subramanian, the economic slowdown in India is facing a ‘Four balance sheet challenge’.

- This has marred the credit growth in India and thus created hindrance in the greater transmission of monetary policy.

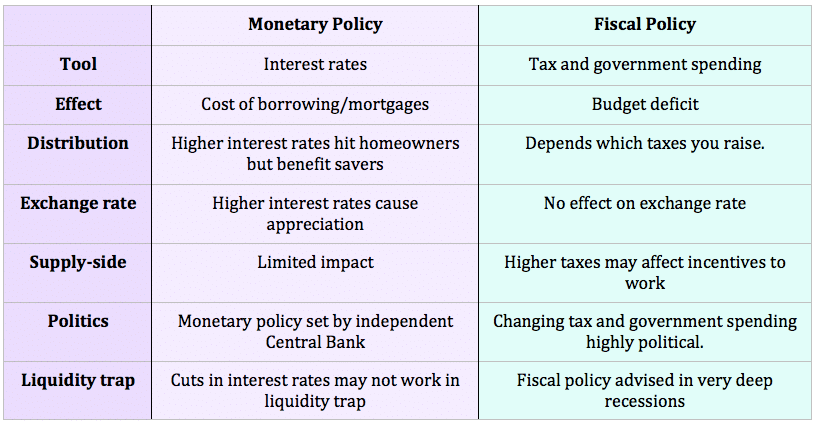

Monetary Policy Vs Fiscal Policy

- High fiscal deficit leads to more market borrowing by the governments. This results in crowding out of the private investment.

- Also, government-determined purchase prices of agri-commodities (through minimum support prices), government subsidy levels on fuels and imperfections in agricultural markets, hinders the functioning of monetary policy. This creates a problem of non-coherence between the two policies.

- New challenges also emanate from the evolution of cryptocurrency.

Issues Pertaining to Inflation Targeting

- Monetary policies can stabilize inflation only caused due to demand shocks and are ineffective against supply shocks.

- Inflation in emerging markets such as India is very sensitive to exogenous shocks like global oil prices, a weaker rupee and a poor monsoon.

- Food inflation, which impacts the common people the most, is prone to supply-side bottlenecks, which are out of the scope of any remedy under the aegis of monetary policy of RBI.

- In order to contain inflation, RBI often undertakes liquidity management through Open Market Operations. This sometimes leads to liquidity shocks in the market.

- Liquidity is also an important factor as these can reinforce or negate the changes in policy rates.

Way Forward

Adoption to Multi-Indicator Approach

- Being the Central bank of the country, RBI has expected to take care of other parameters like economic growth, stable exchange rate and financial stability, and cannot restrict itself to the single objective of inflation.

- In this context, the Government should consider, Multiple Indicator Approach of RBI, where price stability, financial stability and economic growth are considered for decision-making.

- A greater weightage to inflation can be considered in the Multiple Indicator Approach, as it is done by many emerging economies.

Linking Cost of Funds with Market

- In order to make the cost of funds flexible, both deposit and lending rates are linked to external benchmarks like the Mumbai Inter-Bank Offer Rate (MIBOR).

- Linking small savings scheme interest rates to the market would be beneficial.

- An innovative way to make both asset and liability sides of a bank balance sheet flexible is to link both deposit and lending rates to the average inflation rate.

Coordination Between Fiscal Policy and Monetary Policy

- Any of these alone cannot deliver on inflation and growth.

- If the government truly wants to reduce lending rates in India in a meaningful and sustained manner, it would be far better served to focus on bringing down its own fiscal deficit.

- Separating debt management from monetary management in order to make the central bank more independent would be a good move.

Covid-19 has to lead to economic disruption in the Indian economy. However, it also provides an opportunity to carry out much need economic reforms. Establishing synergy between Fiscal and monetary policy can be a right step in pursuit of bringing holistic reforms.

|

Drishti Mains Question Critically analyse the challenges faced by the banks in the transmission of monetary policy. |

This editorial is based on “Ominous contraction: On core sector output” which was published in The Hindu on May 2nd, 2020. Now watch this is on our Youtube channel.