Important Facts For Prelims

Loan Mela

- 20 Sep 2019

- 1 min read

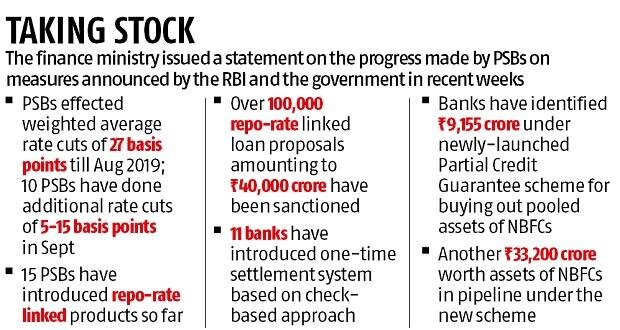

The Finance Ministry in a bid to give impetus to the slowing economy recently announced to organize the loan melas in the 400 districts of the country.

- The reason behind such an initiative was to increase the liquidity in the market.

- Banks despite having the liquidity were not following a standard monetary policy transmission measure.

- This move will now compel the banks to give funds to the Non-Banking Financial Company (NBFCs) (which are the principal channel for providing loans to small businesses in the country) and from there it will pass on to the end customers, through public meetings or popularly called the ‘Shamiana meetings’.

- The banks and the NBFCs will partner with each other to disburse the loans to the customers.

- Public Sector Banks will focus on giving loans to the 'RAM' category, i.e., Retail customers including homebuyers, Agriculture and farmers, and Micro, small and medium enterprises (MSMEs).

- To resolve the MSME stress and recast their debt, the banks will no longer classify the MSME-stressed loan as a Non-Performing Assets (NPAs) until March 31, 2020.