Indian Economy

Indian Aviation Industry

- 11 May 2023

- 11 min read

This editorial is based on The troubles of India’s aviation industry which was published in The Hindu on 11/05/2023. It talks about what does GoFirst’s distress call mean for the aviation sector? Why do airlines struggle to survive? What contributes to the high operating costs? What are the policy and regulatory factors affecting the industry?

For Prelims: Directorate General of Civil Aviation (DGCA), Aviation Turbine Fuel (ATF), Maintenance, Repair and Overhaul (MRO), National Civil Aviation Policy in 2016, Aircraft Act 1934, and Aircraft Rules 1937, Cape Town Convention.

For Mains: Financial, legal, policy oriented and infrastructural issues in the aviation market and services providers, India’s dependency on western nations for importing aviation goods and services.

After low-cost carrier GoFirst’s insolvency filing, the aviation safety regulator Directorate General of Civil Aviation (DGCA), directed the airline to stop selling air tickets immediately.

The DGCA issued GoFirst (rebranded itself two years ago) a showcause notice for its “failure to continue the operation of the service in a safe, efficient and reliable manner”. The Fleet of GoFirst was grounded due to slowed engine manufacturing and high operational costs.

How Big is the Indian Aviation Sector?

- In March 2023, Domestic carriers flew 13 million passengers. As per the Civil Aviation Ministry, India will have more than 140 million passengers in FY2024 alone.

- India to handle over 1.3 billion passengers annually in the next 20 years. There are currently 148 airports in the country, and it is the third-largest domestic market in the world in terms of seat capacity. As of March 2023, IndiGo (domestic market leader) with 56.8% of the market share, followed by Vistara (8.9%) and Air India (8.8%).

Is the Indian Aviation Sector Financially Viable?

- High Competition: Despite being touted as the ‘fastest growing aviation sector’ in the world, airlines in the country have struggled to survive in the highly competitive and unforgiving aviation industry.

- Loss due to Pandemic: In the year 2020-2021, they lost a lot of money (₹15,000 crore) because of the pandemic. In 2019-20, IndiGo was the only airline to make a profit, while all other players posted losses led by then state-run Air India at ₹4,600 crore.

- Financial Difficulties: Seventeen airlines, both domestic and regional, have gone out of business due to financial difficulties. It is mainly led by the liquidity Crunch and low-ticket price.

- Uneven Market Share: The consolidation of four carriers including Air India and Vistara by the Tatas.

- Consolidated Air India and Indigo will capture 75-80% of the market, leaving just about 20% for players like SpiceJet, and the newest entrant Akasa.

What Challenges do Indian Airlines Sector Face?

- Aviation Turbine Fuel (ATF) Cost: India’s airfares are 15% below the break-even point, heavily taxed ATF contributes to the single biggest expenses of carriers, amounting to 40-50% of operational expenses.

- Tax on ATF: Some Indian states charge up to 30% taxes on jet fuel, which makes shorter flight routes unprofitable for smaller airlines. Large airlines like IndiGo offer low fares on these routes and use their size to recoup costs.

- Issue in National Civil Aviation Policy: The policy has not been fair to all players. Until 2016, new airlines had to be in operation for at least five years and have 20 aircraft to fly internationally.

- This changed with the National Civil Aviation Policy in 2016, but still mandated domestic airlines to have at least 20 aircraft for domestic operations.

- High Lease coast: Nearly 80% of India's commercial fleet is leased, and airlines pay annual lease rents of about ₹10,000 crore, making up almost 15% of their revenues.

- Dollar-Rupee Volatility: This adds high costs to operations as the leases are in US dollars, and the Indian rupee's depreciation raises costs further.

- The government's plan to establish leasing companies in India may help reduce costs.

- High Service charge and Low-ticket Price: Airlines have to pay for using airport facilities like runways and terminals and low-ticket prices for the competitive edge in business works against the economic viability. Privatization of airports has raised concerns about fee increases.

- High Training cost of Crew: Training airline crew is expensive and there is a shortage of pilots due to a lack of Flight Training Organizations.

What Steps Government has Taken for the Aviation Sector?

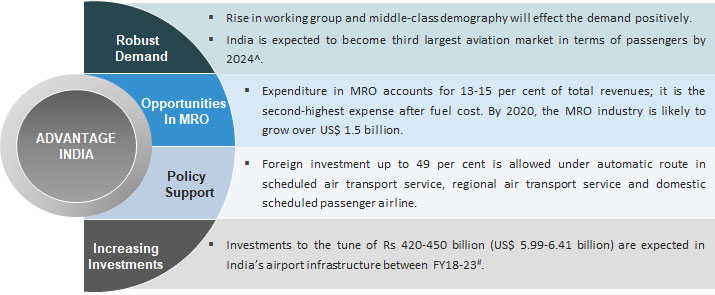

- Goods and Services Tax (GST) rate reduced to 5% from 18% for domestic Maintenance, Repair and Overhaul (MRO) services.

- Benefits under Emergency Credit Line Guarantee Scheme (ECLGS) 3.0 have been extended to the civil aviation sector.

- Operation of Regional Connectivity Scheme (RCS) - UDAN (UdeDeshKaAamNagrik) flights Promoted private investments in existing and new Airports through the PPP route.

- Route rationalisation in the Indian airspace in coordination with Indian Air Force for efficient airspace management, shorter routes and reduced fuel burn.

- RCS-UDAN was launched to Promote air connectivity to unserved and underserved airports in Tier-II and Tier-III cities to stimulate regional growth and provide affordable air travel to the citizens.

What are Opportunities in Indian Aviation Sector?

- Indian carriers are projected to increase their fleet size to 1,100 aircraft by 2027.

- Demand for Maintenance, Repair and Overhaul (MRO) services (MRO) facilities are increasing in India due to consistent double-digit growth in the aviation sector.

- For the development of the aviation industry in the North-East States, AAI plans to develop Guwahati as an inter-regional hub.

- Indian airports are emulating the Special Economic Zone (SEZ) Aerotropolis model to enhance revenues. The model focuses on revenues from retail, advertising, vehicle parking, security equipment and services.

- Three Public Private Partnership (PPP) airports at Delhi, Hyderabad and Bengaluru have undertaken developmental projects to the tune of INR. 30,000 Crores by 2025.

- GOI's vision is to make India one of the top air sports nations by 2030. The mission is to provide a safe, affordable, accessible, enjoyable and sustainable air sports ecosystem in India.

- Noida International Greenfield Airport at Jewar, Uttar Pradesh will bring about all-around development of the industrial infrastructure in the region, increase employment opportunities and encourage manufacturing and export.

What could be the Way forward?

- Enhance Aviation Infrastructure

- There is a need to complete the ongoing projects under the UDAN initiative in a time-bound manner. In addition, the existing capacity of international airports should be augmented under the International UDAN initiative.

- Government intention to make India a global hub for Aircraft Maintenance, Repair and Overhaul (MRO) services will result in saving costs and creating liquidity for airline companies.

- Also, convergence between civil MROs and the defence sector should create economies of scale and long-term benefits.

- Formulation of long-term plans for advanced research in aviation technologies will help in creating a manufacturing ecosystem in the country.

- Address Shortage of Skilled Manpower

- There is a need for promotion of collaboration between original equipment manufacturers (OEMs), industry and educational institutes to assimilate the latest technology and management practices in the aviation industry.

- Augmenting Finances

- Taxation and pricing structure of aviation turbine fuel (ATF) should be aligned to global benchmarks by considering bringing under the ambit of GST.

- Vacant real estate near Airports Authority of India (AAI) airports in all major centres can be monetised to increase non-aeronautical revenues.

- Making India a Transshipment Hub

- India can reap multiple benefits by establishing itself as a transshipment hub in the region. This will augment India’s trading capacity as a service provider, emerging as a foreign exchange earner and enabler for better connectivity in the region.

- This may be done by the development of digital business enablers such as e-contracting, e-transportation multimodality, e-compliances and an e-grievance redressal module.

In this context, the National Civil Aviation Policy 2016 and National Civil Aviation programme 2018 can help India to become a major civil aviation market in the world.

|

Drishti Mains Question: Discuss the current state of the Indian aviation industry and the challenges it faces. What measures can be taken to address these challenges and improve the industry? |

UPSC Civil Services Examination, Previous Year Questions (PYQs)

Mains:

Q. Examine the development of Airports in India through joint ventures under Public–Private Partnership (PPP) model. What are the challenges faced by the authorities in this regard? (2017)