Important Facts For Prelims

PayU Gets Approval as Payment Aggregator

- 29 Apr 2024

- 6 min read

Why in News?

Fintech firm PayU has recently announced that it has received in-principle approval from the Reserve Bank of India (RBI) to operate as a payment aggregator (PA), under the Payment and Settlement Systems(PSS) Act, 2007.

- The in-principle approval from RBI permits PayU to onboard new merchants, yet final approval typically takes six months to a year.

What is a Payment Aggregator?

- About:

- PA acts as an intermediary between businesses and financial institutions, handling payment processing on behalf of merchants.

- A payment aggregator simplifies the process of accepting electronic payments for businesses.

- Payment aggregators streamline the payment acceptance process, allowing businesses to avoid the complexities of establishing direct relationships with financial entities.

- They enable businesses to accept various payment methods, including credit cards, debit cards, e-wallets, and bank transfers, through a single platform.

- Some examples of payment aggregators include Google Pay, Amazon Pay, Phone pe, and PayPal.

- PA acts as an intermediary between businesses and financial institutions, handling payment processing on behalf of merchants.

- Capital Requirements:

- New PAs must have a minimum net worth of Rs 15 crore at the time of application and reach Rs 25 crore by the end of the third financial year post-authorisation.

- Authorisation Process:

- While banks provide PA services as part of their normal banking relationship and do not require separate authorisation, non-bank PAs must obtain authorisation from the RBI under the Payment and Settlement Systems Act, 2007 (PSS).

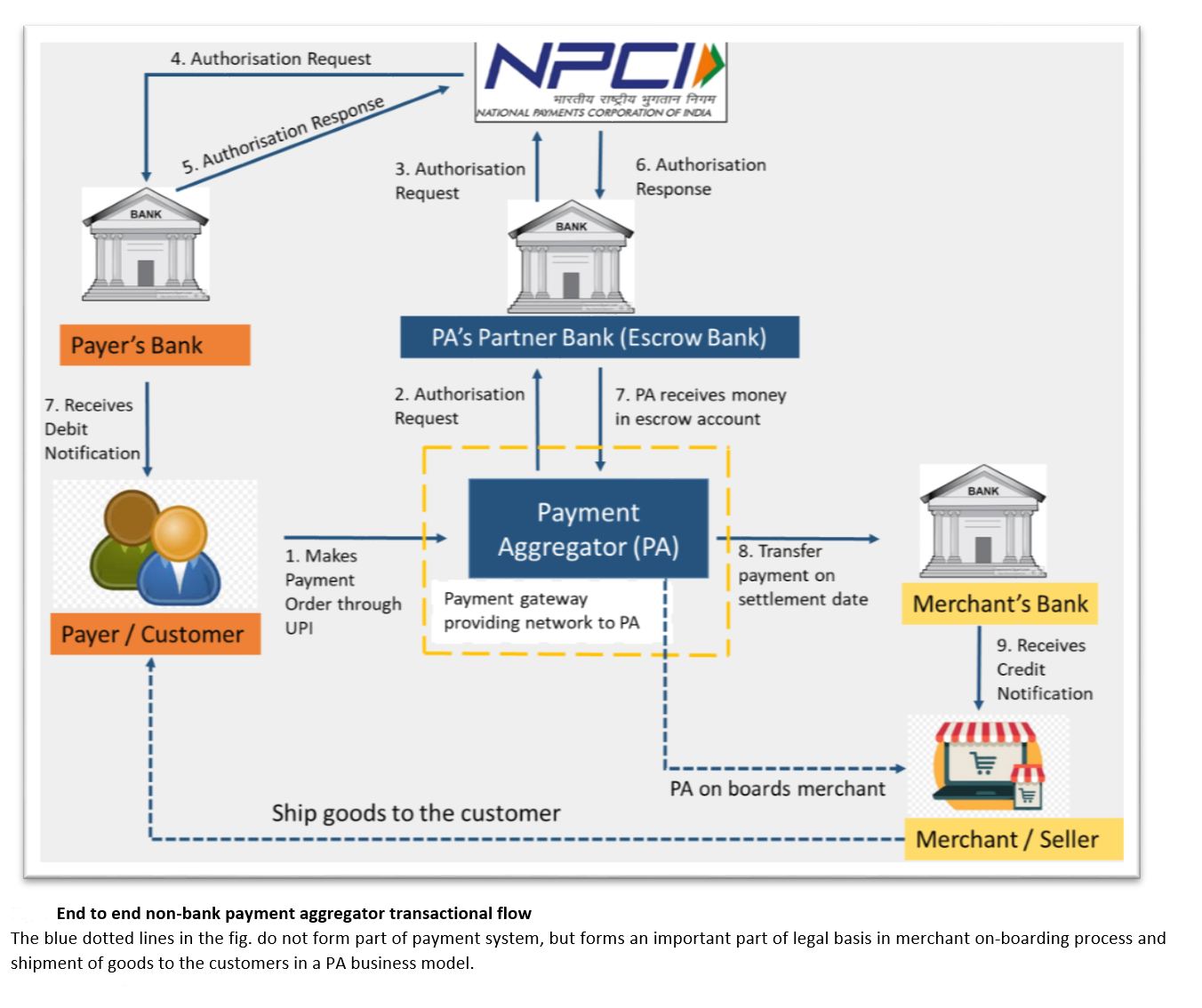

- Settlement and Escrow Account Management:

- Non-bank PAs are mandated to maintain funds collected in an escrow account with a scheduled commercial bank.

- PAs must adhere to specific timelines for settling funds with merchants based on the transaction lifecycle and agreed-upon terms.

- Non-bank PAs are mandated to maintain funds collected in an escrow account with a scheduled commercial bank.

Note:

- Unlike PAs, Payment Gateways (PG) provide technology infrastructure to route and facilitate the processing of online payment transactions without handling funds.

- Payment Aggregators, on the other hand, allow merchants to have multiple payment options on their portal, covering the functionality of a payment gateway.

| Basis of Distinction | Payment Gateway | Payment Aggregator |

| Role | A network bridging the gap between the merchant and the bank. | A solution streamlining end-to-end payment processes. |

| Payment Options | Primarily debit/credit card payments. | Offers multiple options: UPI, debit/credit cards, net banking, etc. |

| Integration | Merchants integrate each payment method or bank separately. | Integration requires partnering with just one service provider. |

| Services Provided | Transaction processing services. | Provides transaction processing along with additional services like access to reports, customer support, etc. |

| Funds Handling | Does not store funds; securely transmits encrypted payment data. | Handles funds through its Merchant Identification Number (MID). Transactions processed through the aggregator's system. |

| Examples | Axis Bank, HDFC Bank, MPGS (Mastercard Payment Gateways). | PhonePe PG, Stripe, Cashfree. |

Payment and Settlement Systems (PSS) Act, 2007

- The PSS Act, 2007, provides for the regulation and supervision of payment systems in India and designates the RBI as the authority for that purpose and all related matters.

- The Reserve Bank is authorised under the Act to constitute a Committee of its Central Board known as the Board for Regulation and Supervision of Payment and Settlement Systems (BPSS), to exercise its powers and perform its functions and discharge its duties under this statute.

- According to Section 4 of the PSS Act, 2007, only the Reserve Bank can authorise the operation of a payment system. Any person wanting to operate a payment system must apply for authorization under Section 5 of the PSS Act, 2007.

- The PSS Act 2007 does not prohibit foreign entities from operating a payment system in India. The Act does not discriminate/differentiate between foreign entities and domestic entities.

- Operating a payment system without authorization, non-compliance with Reserve Bank directions, or violating any provisions of the PSS Act, 2007 can result in criminal prosecution initiated by the Reserve Bank.

UPSC Civil Services Examination, Previous Year Question (PYQ)

Prelims

Q1. With reference to digital payments, consider the following statements: (2018)

- BHIM app allows the user to transfer money to anyone with a UPI-enabled bank account.

- While a chip-pin debit card has four factors of authentication, BHIM app has only two factors of authentication.

Which of the statements given above is/are correct?

(a) 1 only

(b) 2 only

(c) Both 1 and 2

(d) Neither 1 nor 2

Ans: (a)

Q2. Which of the following is a most likely consequence of implementing the ‘Unified Payments Interface (UPI)’? (2017)

(a) Mobile wallets will not be necessary for online payments.

(b) Digital currency will totally replace the physical currency in about two decades.

(c) FDI inflows will drastically increase.

(d) Direct transfer of subsidies to poor people will become very effective.

Ans: (a)

Q3. Consider the following statements: (2017)

- National Payments Corporation of India (NPCI) helps in promoting the financial inclusion in the country.

- NPCI has launched RuPay, a card payment scheme.

Which of the statements given above is/are correct?

(a) 1 only

(b) 2 only

(c) Both 1 and 2

(d) Neither 1 nor 2

Ans: (c)