Indian Economy

Missed Annual Disinvestment Targets

- 28 Jan 2021

- 5 min read

Why in News

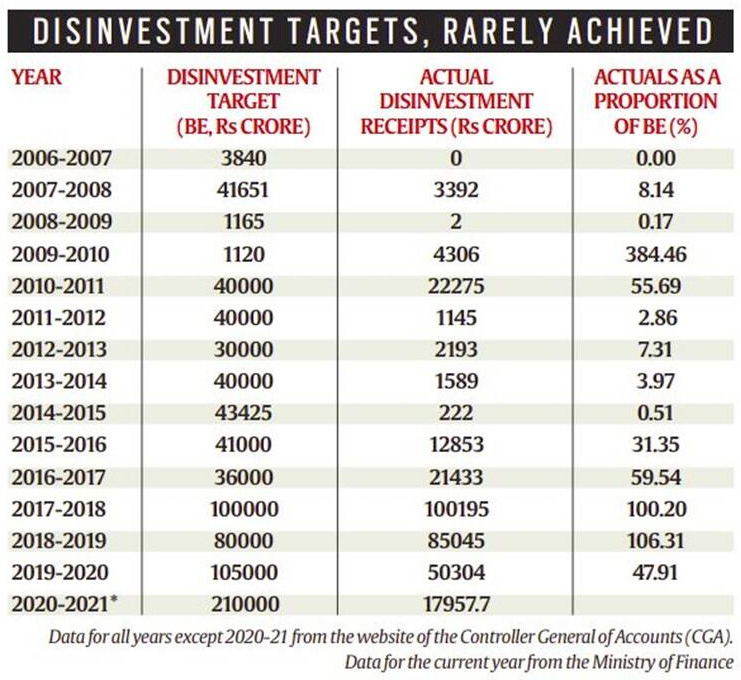

The government has raised less than 3% of budgeted revenues from disinvestment in 2020-21. As a result, the fiscal deficit for the current year is set to worsen.

- The government describes fiscal deficit of India as “the excess of total disbursements from the Consolidated Fund of India, excluding repayment of the debt, over total receipts into the Fund (excluding the debt receipts) during a financial year”.

Key Points

- Disinvestment Targets for 2020-21:

- Presenting the Union Budget of 2020, the Finance Minister had announced a disinvestment target of Rs 2.1 lakh crore. Such ambitious targets were set to keep the fiscal deficit under check.

- However, the total disinvestment receipts from disinvestment so far this year have amounted to Rs. 17.9 thousand crore which is just around 3% of the targeted revenues.

- Reason for Low Revenues:

- Annual targets were set three to four times the usual targeted revenue from disinvestment.

- The slow pace of sales of the public assets marked for disinvestment.

- In the current year, all aspects of the government’s functioning was severely impacted by the Covid-19 pandemic.

- It has been in trend that except in a few years, the government has been unable to raise as much money as it wanted at the start of the year from disinvestment.

- Meaning of Disinvestment:

- Disinvestment means sale or liquidation of assets by the government, usually Central and state public sector enterprises, projects, or other fixed assets.

- The government undertakes disinvestment to reduce the fiscal burden on the exchequer, or to raise money for meeting specific needs, such as to bridge the revenue shortfall from other regular sources.

- For e.g. the Union government invests in several public sector undertakings (PSUs) such as Air India, Bharat Petroleum, Delhi Metro Rail Corporation etc.

- Since it is the majority shareholder (meaning that it owns more than 51% of the shares), the Centre can raise money through the liquidation of its shareholding in these PSUs.

- Types of Disinvestment Methods:

- Minority Disinvestment: This type of disinvestment in PSUs is such that, at the end of it, if the government of India retains a majority stake (typically more than 51%) in the company, it ensures management control.

- For e.g. Reduced government’s share in Life Insurance Corporation in 2020.

- Majority Disinvestment: When disinvestment in PSUs is such that, at the end of it, the government of India retains a minority stake in the company i.e. it sells off a majority stake.

- Complete Disinvestment or Privatization: It is a form of majority disinvestment wherein 100% control of the company is passed on to a buyer i.e government of India completely disinvests from that PSU.

- Like Bharat Aluminium Company, which was sold to the Vedanta group in 2001.

- Minority Disinvestment: This type of disinvestment in PSUs is such that, at the end of it, if the government of India retains a majority stake (typically more than 51%) in the company, it ensures management control.

- Reasons Behind Disinvesting in PSUs.

- Improving the overall efficiency of their functioning.

- Insulating them from political considerations overshadowing economic and corporate interests.

- Especially when PSU transacts with the government — for example when it sells its products and services to the government, the pricing may be influenced by factors other than market factors.

- To make such a PSU more efficient as it would not be accountable to people and entities other than the government.

- Private or corporate ownership could result in more efficient management.

- Plugging budget deficits i.e. filling the gap between its expenditures and tax revenues.

- Making more money available for other sectors like infrastructure and welfare schemes.

- Changed Perspective about Disinvestment:

- Before economic liberalisation, such efforts to monetise government’s assets were criticised as selling the family silver.

- But post-liberalisation, reducing government stake, especially in sectors such as the strategic sectors like defence where government presence is not necessary, disinvestment is welcomed.

- Nodal Agency for Disinvestment:

- Department of Investment and Public Asset Management (DIPAM) under the Ministry of Finance is tasked with managing the Centre’s investments in the PSUs.

- Sale of the Centre’s assets falls within the mandate of DIPAM.