Indian Economy

Increased Fiscal Deficit

- 01 Aug 2020

- 6 min read

Why in News

As per the official data, the Centre’s fiscal deficit for the first three months of fiscal 2020-21 (April-June) was Rs. 6.62 lakh crore, which is 83% of the budgeted target for the year (Rs. 7.96 lakh crore).

- As per the economists, the fiscal deficit may end up as high as 8% of the Gross Domestic Product (GDP), far exceeding the budget’s goal of 3.5%.

Key Points

- Fall in Income Component:

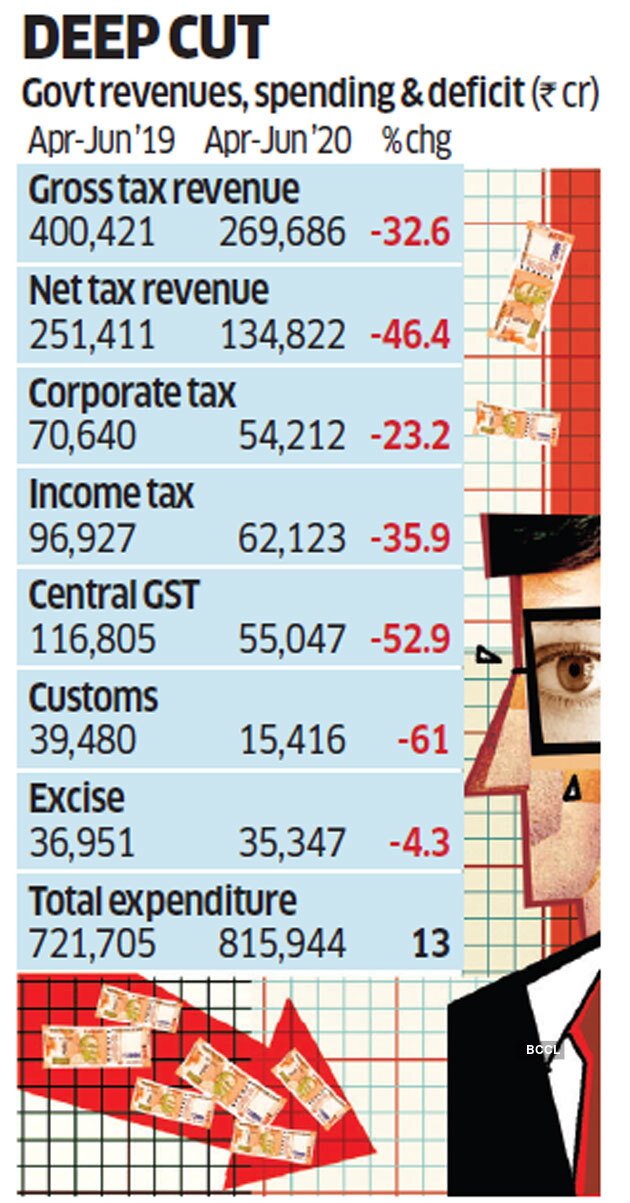

- The Union government has received Rs. 1.53 lakh crore (in terms of tax, non-tax revenue and loan recoveries) from April to June 2020.

- This is less than 7% of budget estimates for the full year.

- When economic activity has been stopped because of the pandemic and lockdown, government revenues are also going to come down.

- The Centre has also transferred Rs. 1.34 lakh crore to States as their share of taxes, which is Rs. 14,588 crore lower than the previous year.

- Increase in Expenditure:

- The Centre’s total expenditure for April-June was Rs. 8.15 lakh crore, almost 27% of budget estimates for the year.

- Due to spending on free food grains and rural job programmes for millions of migrant workers.

- There has been a 40% growth in the first quarter capital expenditure to Rs. 88,273 crore.

- This is historically high (in comparison to data from the last 20 years), in terms of year-on-year percentage growth for the first quarter.

- Increased capital expenditure implies increased spending on creation of assets such as infrastructure.

- The Centre’s total expenditure for April-June was Rs. 8.15 lakh crore, almost 27% of budget estimates for the year.

- Borrowings: The reduced collections have forced the government to raise the amount it’s borrowing this fiscal to a record Rs. 12 lakh crore from earlier estimates of Rs. 7.8 lakh crore to meet spending needs.

Fiscal Deficit

- The government describes fiscal deficit of India as “the excess of total disbursements from the Consolidated Fund of India, excluding repayment of the debt, over total receipts into the Fund (excluding the debt receipts) during a financial year”.

- In simple words, it is a shortfall in a government's income compared with its spending.

- The government that has a fiscal deficit is spending beyond its means.

- It is calculated as a percentage of Gross Domestic Product (GDP), or simply as total money spent in excess of income.

- In either case, the income figure includes only taxes and other revenues and excludes money borrowed to make up the shortfall.

- Formula:

- Fiscal Deficit = Total expenditure of the government (capital and revenue expenditure) – Total income of the government (Revenue receipts + recovery of loans + other receipts).

- Expenditure component: The government in its Budget allocates funds for several works, including payments of salaries, pensions, etc. (revenue expenditure) and creation of assets such as infrastructure, development, etc. (capital expenditure).

- Income component: The income component is made of two variables, revenue generated from taxes levied by the Centre and the income generated from non-tax variables.

- The taxable income consists of the amount generated from corporation tax, income tax, Customs duties, excise duties, GST, among others.

- Meanwhile, the non-taxable income comes from external grants, interest receipts, dividends and profits, receipts from Union Territories, among others.

- It is different from revenue deficit which is only related to revenue expenditure and revenue receipts of the government.

- The government meets the fiscal deficit by borrowing money. In a way, the total borrowing requirements of the government in a financial year is equal to the fiscal deficit in that year.

- A high fiscal deficit can also be good for the economy if the money spent goes into the creation of productive assets like highways, roads, ports and airports that boost economic growth and result in job creation.

- The Fiscal Responsibility and Budget Management Act, 2003 provides that the Centre should take appropriate measures to limit the fiscal deficit upto 3% of the GDP by 31st March, 2021.

- The NK Singh committee (set up in 2016) recommended that the government should target a fiscal deficit of 3% of the GDP in years up to March 31, 2020 cut it to 2.8% in 2020-21 and to 2.5% by 2023.

Way Forward

- Given the level of contraction in the economy, the fiscal deficit is expected to be higher this year. In the current scenario, the most important thing is to bring back confidence among consumers as well as businesses. This will help in fuelling the economic recovery.