Biodiversity & Environment

Pricing and Taxing Carbon

- 29 Sep 2020

- 8 min read

The article is based on “The benefits of carbon tax” which was published in The Hindu on 28/09/2020. It focuses upon how the Greenhouse Gases (GHGs) are exploiting the planet and how far the pricing and taxing of the carbon contents of domestic production and imports is helpful in mitigation.

After China, the largest GHG emitter, announced that it would balance out its carbon emissions with measures to offset them before 2060, the U.S. and India are next in the list to take actions.

India along with the U.S, China and Japan are some of the countries that are hardest hit by climate impacts. In order to mitigate the condition and reduce the GHG emissions, one smart approach is pricing Carbon.

- The International Monetary Fund (IMF) has endorsed the European Union’s plan for Carbon levying on imports.

- India can be among the world’s first movers in taxing and switching from carbon-intensive fuels.

Carbon Pricing

- It is an instrument that captures the external costs of greenhouse gas (GHG) emissions—the costs of emissions that the public pays for, such as damage to crops, health care costs from heat waves and droughts, and loss of property from flooding and sea level rise—and ties them to their sources through a price, usually in the form of a price on the carbon dioxide (CO2) emitted.

- A price on carbon helps shift the burden for the damage from GHG emissions back to those who are responsible for it and who can avoid it.

Need to Reduce GHG Emissions

- Recorded heat waves in Delhi, water crisis in Tamil Nadu, floods in southwest China, and catastrophic forest fires in California this year are indicative of the existential danger from global warming.

- India ranks fifth in the Global Climate Risk Index 2020.

- Carbon dioxide, the chief culprit in global warming, has already crossed a high mark of 400 parts per million because of past accumulation especially after the Industrial Revolution.

- The Intergovernmental Panel on Climate Change (IPCC) says total global emissions will need to fall by 45% from 2010 levels by 2030 and reach net zero by 2050.

- If these targets are not met, tropical regions of the world, which are densely populated and happen to be mainly concentrated in the global South, are likely to be most negatively affected because of their high vulnerability and pre-existing high temperatures.

Imposing Carbon Levies

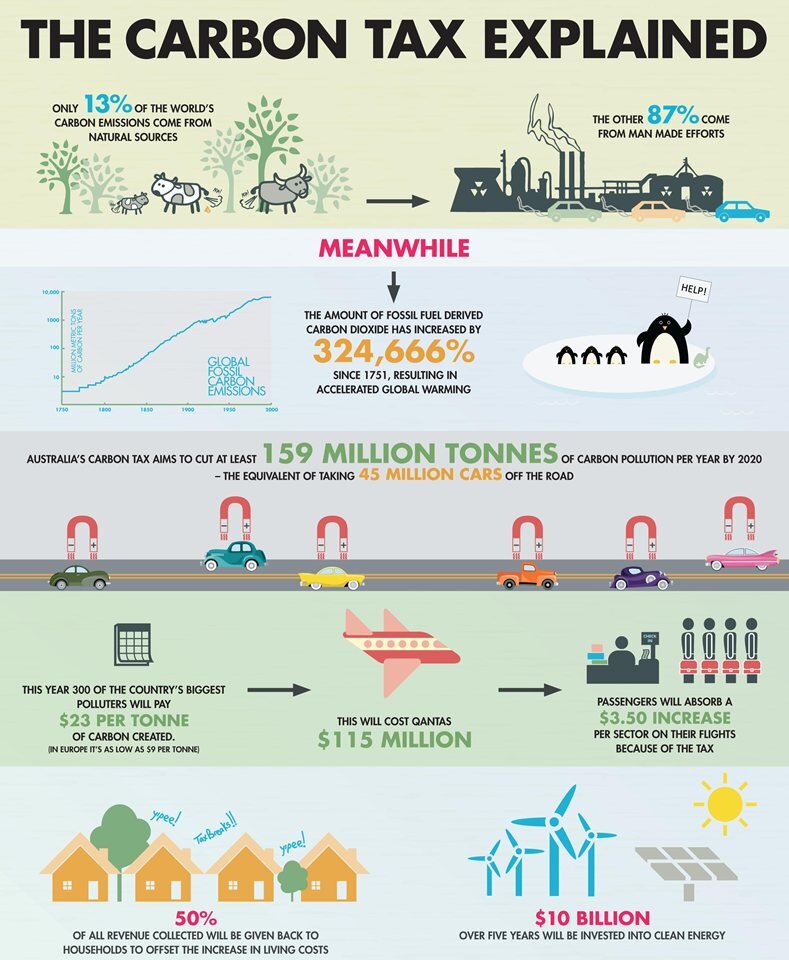

What is a Carbon Tax?

Carbon tax is a fee imposed on the burning of carbon-based fuels (coal, oil, gas). It is viewed as the core policy for reducing and eventually eliminating the use of fossil fuels whose combustion is destabilizing and destroying our climate.

Taxing Carbon

- A smart approach is pricing carbon, building on the small steps taken thus far, such as plans by some 40 large companies to price carbon, government incentives for electric vehicles, and an environmental tax in the 2020-21 budget.

- Another way to price carbon is through emission trading, i.e., setting a maximum amount of allowable effluents from industries, and permitting those with low emissions to sell their extra space.

- Carbon tax can be imposed on economic activities — for example, on the use of fossil fuels like coal, as done in Canada and Sweden.

- Canada imposed a carbon tax at $20 per tonne of CO2 emissions in 2019, eventually rising to $50 per tonne.

- This is estimated to reduce greenhouse gas pollution by between 80 and 90 million tonnes by 2022.

| Pros and Cons of Carbon Tax | |

| Pros | Cons |

|

|

|

|

|

|

|

|

Way Forward

- Big economies like India should also use their global monopsony to impose a carbon tariff as envisaged by the European Union.

- India under the Intended Nationally Determined Contribution has committed to 40% of electricity capacity being from non- fossil fuels by 2030, and lowering the ratio of emissions to GDP by one-third from 2005 levels.

- A carbon tax at $35 per tonne of CO2 emissions in India is estimated to be capable of generating some 2% of GDP through 2030.

- A market-oriented approach to tax and trade carbon domestically and to induce similar action by others through international trade and diplomacy.

Conclusion

- Focusing on trade is vital because reducing the domestic carbon content of production alone would not avert the harm if imports remain carbon-intensive.

- It is in the country’s interest to take stronger action before 2030, leading to no net carbon increase by 2050.

|

Drishti Mains Question “There is growing public support for climate action, but we need solutions that are seen to be in India’s interest.” Discuss in the light of carbon pricing policy. |

This editorial is based on “Salutary lesson: On the Vodafone case” which was published in The Hindu on September 28th, 2020. Now watch this on our Youtube channel.