Indian Economy

Fiscal Activism

- 03 Feb 2021

- 8 min read

This article is based on “It’s goodbye to fiscal orthodoxy” which was published in The Hindu on 03/02/2021. It talks about government departure from rigid adherence to fiscal consolidation.

Affected by the Covid-19 pandemic, the flailing Indian economy is marked by contracting GDP requiring a push from the government. In this scenario, the government has resorted to Keynesian economics (government’s spending rather than the free hand of the market).

The Budget 2021 is a selective departure from the principles of the free market. The government adheres to market orthodoxy elements, such as privatization and a greater role for foreign direct investment but sought to spend more to spur growth.

This can be reflected by the fact that the Finance Minister’s speech pledges to lower the fiscal deficit to 4.5% of GDP by 2025-26 and promised to introduce an amendment to the FRBM Act to formalize the new targets (the present target as per the FRBM Act is of 3%).

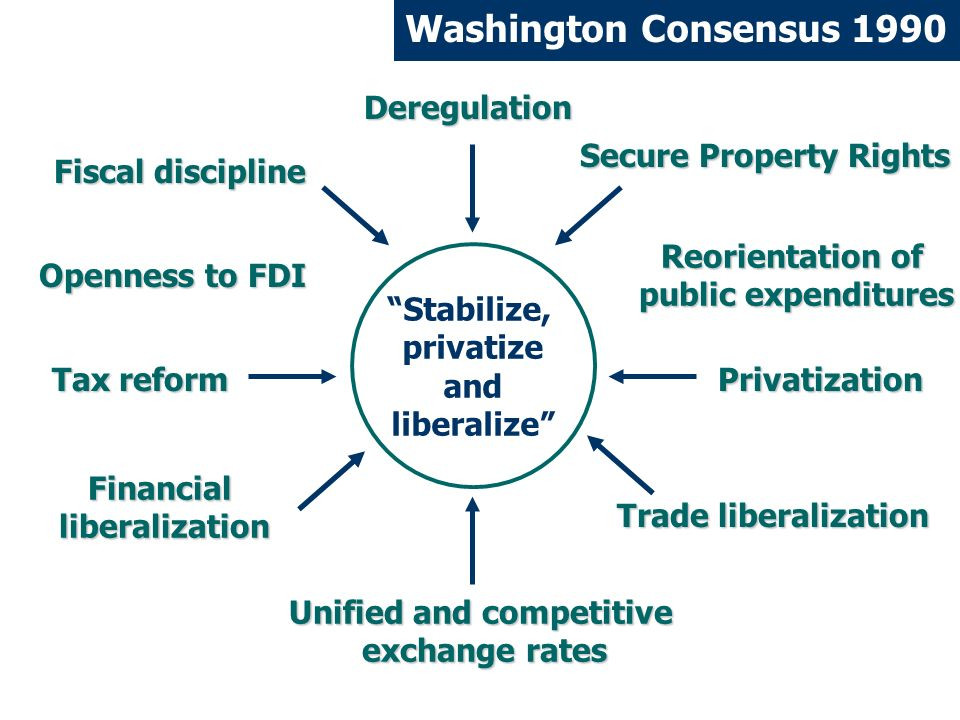

Thus, the Budget marks an important departure from one of the key tenets of the Washington Consensus, the framework for market-oriented economics that has dominated policy-making in most parts of the world. Though this is a step in the right direction, it has some key macroeconomic stability concerns.

Departure From The Principles of Free-Market Economics

- Budget 2021 rests on six pillars: Health and well-being, physical & financial capital and infrastructure, inclusive development for aspirational India, reinvigorating human capital, innovation, and R&D, and minimum government-maximum governance.

- This will require a major increase in funding, not only from the Central Government but also from the states and the private sector. This can be reflected in some of the following highlights of the budget:

- The present budget presents a whopping 34.5% increase in budget allocation — Rs 5.54 lakh crore.

- The Budget has proposed a new bad bank framework to deal with the problem of non-performing assets. Given the magnitude of NPA, a huge amount of capital will be required to finance it.

- The government also announced the setting up of a development finance institution to provide long-term financing for infrastructure projects.

Reasons for Departure From Fiscal Orthodoxy

Departure From Rigid Adherence To Fiscal Consolidation

- The Economic Survey that preceded the Budget laid the groundwork for a departure from rigid adherence to fiscal consolidation.

- It has a quote from economist Olivier Blanchard, “If the interest rate paid by the government is less than the growth rate, then the intertemporal budget constraint facing the government no longer binds.”

- According to the Economic Survey, in the current situation, expansionary fiscal policy will boost growth, and given India’s growth potential, we do not have to worry about debt sustainability until 2030.

Intertemporal Budget Constraint

- The “intertemporal budget constraint” means that any debt outstanding today must be offset by a future source of revenue of income.

- Blanchard was saying that intertemporal budget constraint doesn’t apply if the Interest Rate-Growth Differential (IRGD), the difference between the interest rate and growth rate, becomes negative.

- In the advanced economies, as interest rates have turned negative, Blanchard’s condition has been met. So governments there do not have to worry that deficits will render public debt unsustainable.

Idea Supported By IMF & World Bank

- The International Monetary Fund (IMF) and the World Bank, both flag-bearers of the Washington Consensus, have been urging a departure from fiscal orthodoxy in the wake of the pandemic.

- Both these institutions used to be wary of any increase in the public debt to GDP ratio beyond 100%.

- Today, they are urging the advanced economies to spend more by running up deficits even when the debt to GDP ratio is poised to rise to 125% by the end of 2021.

Key Macroeconomic Stability Issues

- Inflation May Rise: There is a concern that a large fiscal deficit can fuel a rise in inflation.

- Further, it is more than likely that a change in the fiscal consolidation targets will require a change in the inflation target of 4% set for India’s Reserve Bank. However, the Budget makes no mention of such a possibility.

- Low Tax-to GDP Ratio: Another concern is that, with the tax to GDP ratio not rising as expected, the government has to focus on garnering more non-tax revenues through strategic disinvestment, privatization, and monetization of non-core assets.

- However, these measures have their own issues.

- Disinvestment, A High-Risk Strategy: The sale of public assets has become crucial to a reduction in fiscal deficits in the years ahead. However, this is a high-risk strategy.

- For years now, revenues from disinvestment have fallen short of targets. For example, Air India’s sale, which was begun in 2018, is still dragging on.

- Moreover, selling public assets is politically contentious due to public sector unions and job losses.

- Downgrade of Ratings: An important consideration is a fear that the rating agencies would downgrade India if total public debt crossed say, 10%-11% of GDP.

- That is a risk that cannot be wished away unless the rating agencies have decided to toe the IMF-World Bank line on fiscal deficits.

- Conflicting With AtmaNirbharta: Moreover, large-scale privatization almost always involves substantial FDI. Increasing FDI will result in a large rise in foreign presence in the domestic economies.

- However, a rise in FDI may not reconcile with Atmanirbhar Bharat which connotes greater self-reliance and stronger Indian companies.

- Crowding Out Effect: As the government adopts an expansionary fiscal policy stance and increases its spending to boost economic activity.

- This leads to an increase in interest rates. Increased interest rates affect private investment decisions.

- A high magnitude of the crowding-out effect may even lead to lesser income in the economy.

Conclusion

A departure from fiscal orthodoxy is welcome. But the government needs to think of ways to make it more sustainable.

|

Drishti Mains Question Budget 2021 is a departure from a key tenet of the Washington Consensus. Analyze. |

This editorial is based on “Getting back on track: on Union Budget 2021” published in The Hindu on February 2nd, 2020. Now watch this on our Youtube channel.