Indian Economy

Telangana Industrial Health Clinic

- 30 Dec 2019

- 3 min read

Why in News

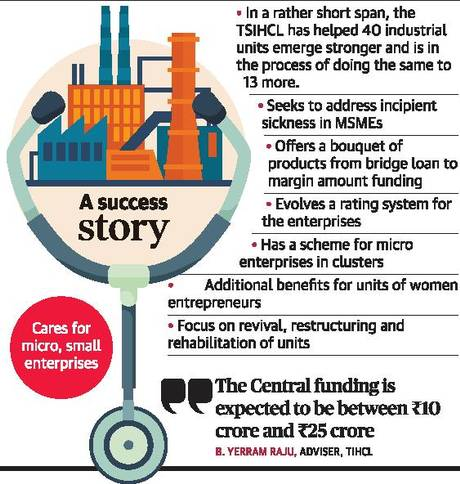

The Telangana Industrial Health Clinic Ltd. (TIHCL), an initiative of the State government to handhold Micro and Small Manufacturing Enterprises (MSMEs) from slipping into sickness, is ready to extend its services at pan India level.

Telangana Industrial Health Clinic Limited

- It was established in 2018 as a fintech Non-Banking Finance Company (NBFC). It is a diagnostic and curative industry initiative for MSMEs.

- It is promoted by the State Government of Telangana and supported by Telangana Industrial Development Corporation (TSIDC).

- Objectives:

- To ensure healthy MSMEs through responsive counselling and responsible consulting and other mentoring services

- To engage MSMEs in strong and consistent financial performance through better compliance standards

- To support & enrich a sustainable working environment that attracts, retains and develops committed team sharing common values

- To play the role of advocacy in assuring prompt payment by the vendees of MSMEs

- To propel potential MSMEs to equity platforms like the National Stock Exchange (NSE) and the Bombay Stock Exchange (BSE).

- Corpus: It has a corpus of Rs.100 Crores, with an initial contribution of Rs.10 Cr. from State Government of Telangana, Rs.50 Cr. from Government of India, and the rest through equity holding from MSMEs, Banks and Financial Institutions, etc.

- The TIHCL has been managing with just one-tenth (contribution made by the State government) of the originally envisaged ₹100 crore corpus fund, making it eligible for Central government funding in order to fulfill the industry demand.

- Investment: In terms of its investment, it is up to ₹25 lakh per unit. Its portfolio of products comprises of bridge loan, stressed assets finance, credit financing and margin amount funding.

- For women entrepreneurs, it offers these services at a concessional rate of interest under NARI scheme. It also provides composite loans with flexible repayments and withdrawals to new micro and small enterprises established by women.