Indian Economy

Sahamati

- 26 Jul 2019

- 4 min read

Sahamati is a new framework developed by Aadhar architect Nandan Nilekani which aims to make bank account operations paperless.

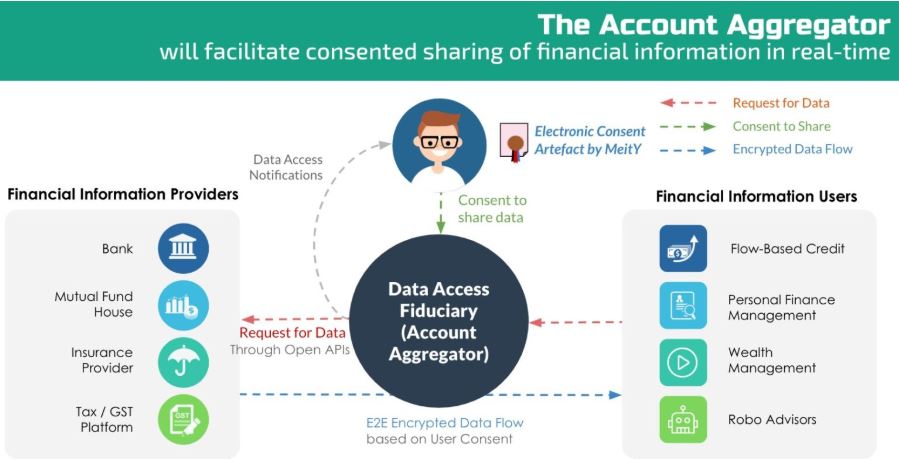

- Sahamati is a Collective of Account Aggregator (AA) ecosystem being set up as a non-Government, private limited company. AA is a process by which information from all of an individual's or household’s accounts are collected in one place.

- The architecture of AA is based on the Data Empowerment and Protection Architecture (DEPA) framework.

Data Empowerment and Protection Architecture (DEPA) Framework

- Data Empowerment and Protection Architecture (DEPA) is a new approach, a paradigm shift in personal data management and processing that transforms the current organization centric system to human-centric system.

- By giving people the power to decide how their data can be used, DEPA enables the collection and use of personal data in ways that empower people to access better financial, healthcare, and other socio-economically important services in real-time while preserving the safety, security and privacy of the user.

Background

- The RBI in 2016 approved Account Aggregator as a new class of NBFC, whose primary responsibility is to facilitate the transfer of user’s financial data with their explicit consent.

- However, currently no such mechanism exists, even if the user wishes to share data.

- Therefore this AA ecosystem will allow for the seamless sharing of data between financial bodies of all kinds centered around user consent (i.e ‘Sahamati’).

- The main responsibilities of the account aggregator is to provide services based on the explicit consent of individual clients.

- Account Aggregator (AA) is the construct/ framework that provides a digital platform for easy sharing and consumption of data from various entities with user consent. This primarily includes transfer, but not storing, of a client’s data.

- An AA is ‘data-blind’ as the data that flows through an AA is encrypted. Also, an AA does not and cannot store any user’s data – thus, the potential for leakage and misuse of user’s data is prevented.

- RBI and other Financial Services Regulators (FSRs) are providing the required regulatory support and guidance for the rollout of AA.

- The scope of Shamati can be expanded to accommodate other domains such as healthcare and telecom in future.

Need

- Currently, an individual’s data is spread across silos and islands in banks, telcos, healthcare institutions with no framework in place for them to share with their benefactors. This data is essential to help build better products for the individual/entity.

- An individual/entity has to collect, collate and share data themselves either physically or electronically. This is slow, and an expensive exercise.

- There is no framework available to integrate and aggregate them that can provide a full view of an individual/entity’s data.

- Also, there is no framework available that can let an entity access users’ data even with users’ permissions.

- As a result, there is still friction in accessing data and a large amount of data is not effectively leveraged.

- Hence, the transition of ‘data rich society’ to an ‘economic rich society’ is still not happening.