Indian Economy

Increase in Direct Tax Collections

- 23 Jun 2021

- 6 min read

Why in News

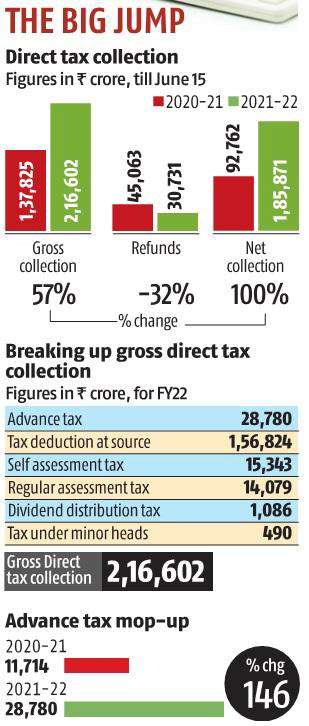

India’s direct tax collections in the first two and a half months (April - June) of 2021-22 stand at nearly Rs. 1.86 lakh crore, which is double the collections over the same period of last year that was affected by the national lockdown.

- The collections last year over the same period were Rs. 92,762 crore.

Key Points

- Surge in Direct Tax Collections:

- It includes Corporation Tax collections of Rs. 74,356 crore and Personal Income Tax inflows, which include the Security Transaction Tax of Rs. 1.11 lakh crore.

- The jump in the direct tax collections reflects healthy exports and a continuation of various industrial and construction activities.

- It is expected that GDP (Gross Domestic Product) will record a double-digit expansion in Quarter 1 of 2021-22.

- Direct Tax:

- A direct tax is a tax that a person or organization pays directly to the entity that imposed it.

- An individual taxpayer, for example, pays direct taxes to the government for various purposes, including income tax, real property tax, personal property tax, or taxes on assets.

- Corporation Tax:

- Corporation tax is a direct tax imposed on the net income or profit that enterprises make from their businesses.

- Companies, both public and privately registered in India under the Companies Act 1956, are liable to pay corporation tax.

- This tax is levied at a specific rate according to the provisions of the Income Tax Act, 1961.

- In September 2019, India slashed corporate tax rates to 22% from 30% for existing companies and to 15% from 25% for new manufacturing companies.

- Including a surcharge and cess, the effective tax rate for existing companies now stands at 25.17%, down from 35%.

- Security Transaction Tax (STT):

- It is a direct tax charged on purchase and sale of securities that are listed on the recognized stock exchanges in India.

- Both purchaser and seller need to pay 0.1% of share value as STT.

- Advance Tax Collections:

- Advance tax is paid by those who have tax liability of Rs. 10,000 or more in a financial year. It is paid by both salaried and businesses, thus including collections from corporate tax and personal income tax.

- Advance tax is paid as and when the money is earned in four instalments rather than at the end of the fiscal year.

- It is considered an indication of economic sentiment.

- The first instalment or 15% of the annual tax is to be paid by 15th June, the second by 15th September (30%), the third by 15th December (30%), and the rest by 15th March.

- Dividend Distribution Tax (DDT):

- Dividend refers to the distribution of profits to shareholders of a company.

- Thus, the dividend distribution tax is a type of tax that is payable on the dividends offered to its shareholders by the corporation.

- In the Union Budget for 2020-2021 the DDT was withdrawn from the tax paid by the dividend payer. Instead, from April 2021 on, dividends would be taxed in the hands of the recipients, i.e. shareholders of the distributing company.

- The proposed rate is 10% for dividends paid to shareholders resident in India and 20% if paid to foreign investors.

- TDS/TCS:

- Tax Deduction at Source: A person (deductor) who is liable to make payment of specified nature to any other person (deductee) shall deduct tax at source and remit the same into the account of the Central Government.

- Tax Collection at Source: It is an additional amount collected as tax by a seller of specified goods from the buyer at the time of sale over and above the sale amount and is remitted to the government account.

- Government Initiatives to Improve Direct Taxes:

- For Personal Income Tax - The Finance Act, 2020 has provided an option to individuals and co-operatives for paying income-tax at concessional rates if they do not avail specified exemption and incentive.

- Vivad se Vishwas: Under Vivad se Vishwas, declarations for settling pending tax disputes are currently being filed.

- This will benefit the Government by generating timely revenue and also to the taxpayers by bringing down mounting litigation costs.

- Expansion of scope of TDS/TCS- For widening the tax base, several new transactions were brought into the ambit of Tax Deduction at Source (TDS) and Tax Collection at Source (TCS).

- These transactions include huge cash withdrawal, foreign remittance, purchase of luxury cars, e-commerce participants, sale of goods, acquisition of immovable property, etc.

- ‘Transparent Taxation - Honoring The Honest’ platform: It is aimed at bringing transparency in income tax systems and empowering taxpayers.