Economy

High Crude Oil Prices

- 21 Oct 2021

- 7 min read

Why in News

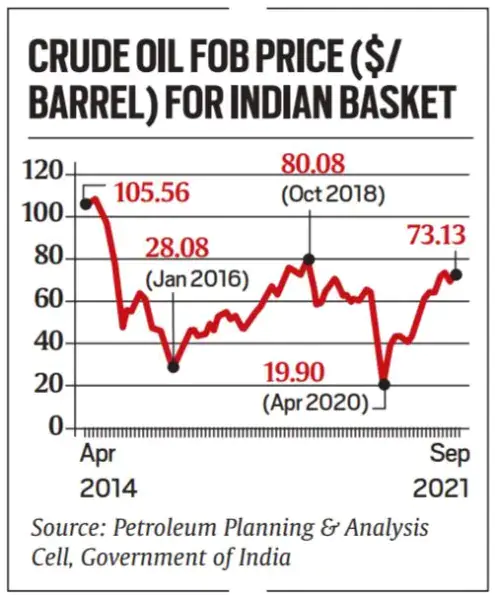

As the global recovery gains strength, the price of crude oil is nearing its highest level since 2018.

- Brent crude oil prices rose to USD 85.89 a barrel, the highest price since October 2018. US West Texas Intermediate (WTI) crude prices climbed to USD 83.40 a barrel, highest since October 2014.

- On the other side the price of natural gas and coal are hitting record highs amid an intensifying energy shortage.

Key Points

- Oil Pricing:

- Generally, the Organization of the Petroleum Exporting Countries (OPEC) used to work as a cartel and fix prices in a favourable band.

- OPEC is led by Saudi Arabia, which is the largest exporter of crude oil in the world (single-handedly exporting 10% of the global demand).

- OPEC has a total of 13 Member Countries viz. Iran, Iraq, Kuwait, United Arab Emirates (UAE), Saudi Arabia, Algeria, Libya, Nigeria, Gabon, Equatorial Guinea, Republic of Congo, Angola, and Venezuela.

- OPEC could bring down prices by increasing oil production and raise prices by cutting production.

- The global oil pricing mainly depends upon the partnership between the global oil exporters instead of a well-functioning competition.

- Cutting oil production or completely shutting down an oil well is a difficult decision, because restarting it is immensely costly and complicated.

- Moreover, if a country cuts production, it risks losing market share if other countries do not follow the suit.

- Recently, OPEC has been working with Russia, as OPEC+ to fix the global prices and supply.

- In 2016, OPEC allied with other top non-OPEC oil-exporting nations to form an even more powerful entity named OPEC+ or OPEC Plus.

- Generally, the Organization of the Petroleum Exporting Countries (OPEC) used to work as a cartel and fix prices in a favourable band.

- Reasons for High Prices:

- Slow Production:

- Key oil producing countries have kept crude oil supplies on a gradually increasing production schedule despite a sharp increase in global crude oil prices.

- OPEC+ had agreed to sharp cuts in supply in 2020 in response to Covid-19 global travel restrictions in 2020 but the organisation has been slow to boost production as demand has recovered.

- Key oil producing countries have kept crude oil supplies on a gradually increasing production schedule despite a sharp increase in global crude oil prices.

- Supply Side Issues:

- Supply side issues in the US including disruptions caused by hurricane Ida and lower than expected natural gas supplies from Russia amid increasing demand in Europe have raised the prospect of natural gas shortages in the winter.

- Slow Production:

- Impact on India:

- Current Account Deficit:

- The increase in oil prices will increase the country’s import bill, and further disturb its current account deficit (excess of imports of goods and services over exports).

- Inflation:

- The increase in crude prices could also further increase inflationary pressures that have been building up over the past few months.

- Fiscal Health:

- If oil prices continue to increase, the government shall be forced to cut taxes on petroleum and diesel which may cause loss of revenue and deteriorate its fiscal balance.

- The growth slowdown in the last two years has already resulted in a precarious fiscal situation because of tax revenue shortfalls.

- The revenue lost will erode the government’s ability to spend or meet its fiscal commitments in the form of budgetary transfers to states, payment of dues and compensation for revenue shortfalls to state governments under the Goods and Services Tax (GST) framework.

- If oil prices continue to increase, the government shall be forced to cut taxes on petroleum and diesel which may cause loss of revenue and deteriorate its fiscal balance.

- Economic Recovery:

- Although the rising prices have impacted the world, India is particularly at a disadvantage as any increase in global prices can affect its import bill, stoke inflation and increase its trade deficit, which in turn will slow its economic recovery.

- India and other oil importing nations have called on OPEC+ to boost oil supply faster, arguing that elevated crude oil prices could undermine the recovery of the global economy.

- Although the rising prices have impacted the world, India is particularly at a disadvantage as any increase in global prices can affect its import bill, stoke inflation and increase its trade deficit, which in turn will slow its economic recovery.

- Natural Gas Price:

- The increase in gas prices has put upward pressure on the price of both Compressed Natural Gas (CNG) used as a transport fuel and Piped Natural Gas (PNG) used as a cooking fuel.

- Current Account Deficit:

Difference between Brent and WTI

- Origin:

- Brent crude oil originates from oil fields in the North Sea between the Shetland Islands and Norway.

- West Texas Intermediate (WTI) is sourced from US oil fields, primarily in Texas, Louisiana, and North Dakota.

- Light and Sweet:

- Both oils are relatively light, but Brent has a slightly higher API gravity, making WTI the lighter of the two.

- American Petroleum Institute (API) gravity is an indicator of the density of crude oil or refined products.

- WTI with a lower sulphur content (0.24%) than Brent (0.37%), is considered "sweeter".

- Both oils are relatively light, but Brent has a slightly higher API gravity, making WTI the lighter of the two.

- Benchmark Prices:

- Brent crude price is the international benchmark price used by OPEC while WTI crude price is a benchmark for US oil prices.

- Since India imports primarily from OPEC countries, Brent is the benchmark for oil prices in India.

- Brent crude price is the international benchmark price used by OPEC while WTI crude price is a benchmark for US oil prices.

- Cost of Shipping:

- Cost of shipping for Brent crude is typically lower, since it is produced near the sea and it can be put on ships immediately.

- Shipping of WTI is priced higher since it is produced in landlocked areas like Cushing, Oklahoma where the storage facilities are limited.