Indian Economy

Export Promotion Capital Goods Scheme

- 19 Apr 2022

- 6 min read

For Prelims: Customs Duty, Capital Good, Export Related Initiative

For Mains: Government Policies & Interventions, Ease of Doing Business, Government Policies and Interventions

Why in News?

Recently, the Ministry of Commerce and Industry has relaxed various procedures under the Export Promotion Capital Goods (EPCG) scheme in order to reduce compliance requirements and facilitate ease of doing business.

What are Capital Goods?

- Capital goods are physical assets that a company uses in the production process to manufacture products and services that consumers will later use.

- Capital goods include buildings, machinery, equipment, vehicles, and tools.

- Capital goods are not finished goods, instead, they are used to make finished goods.

- The Capital Goods sector has a multiplier effect and has bearing on the growth of the user industries as it provides critical input, i.e., machinery and equipment to the remaining sectors covered under the manufacturing activity.

What is the EPCG Scheme?

- About:

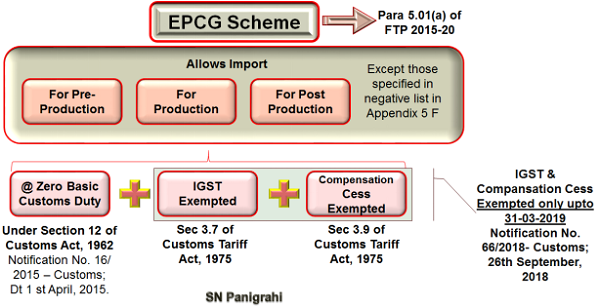

- EPCG Scheme was launched in the 1990s to facilitate import of capital goods with the aim to enhance the production quality of goods and services, thereby, increasing India’s international manufacturing competitiveness.

- Under the scheme, manufacturers can import capital goods for pre-production, production and post-production goods without attracting any customs duty on them.

- Second-hand capital goods may also be imported without any restriction on age under the EPCG Scheme.

- The exemption from paying the obligation of customs duty on the import of capital goods is subject to fulfilment of an export value equivalent to 6 times of duty saved on the importation of such capital goods within 6 years from the date of issuance of the authorization.

- This would mean that the importer (being export-oriented) needs to attract earnings in foreign currency which equals 600% of the customs duty saved in domestic currency, within 6 years of availing benefits of the Scheme.

- Coverage:

- Manufacturer exporters with or without supporting manufacturer(s),

- Merchant exporters tied to supporting manufacturer(s) and,

- Service Providers including Common Service Providers (CSP).

- New Norms:

- Imports of capital goods are allowed duty free, subject to an export obligation.

- The authorisation holder (or exporter) under the scheme has to export finished goods worth six times of the actual duty saved in value terms in six years.

- Requests for export obligation extension should be made within six months of expiry instead of the earlier prescribed period of 90 days. However, applications made after six months and up to six years are subject to a late fee of Rs 10,000 per authorisation.

- According to the changes, requests for block-wise export obligation extension should be made within six months of expiry. However, applications made after six months and up to six years will entail a late fee of Rs 10,000 per authorisation.

- The facility to pay customs duty through scrips MEIS (Merchandise Exports from India Scheme) /Remission of Duties or Taxes On Export Product (RoDTEP) / RoSCTL (Rebate of State and Central Taxes and Levies) for default under EPCG has been withdrawn.

- Benefit from EPCG Scheme:

- EPCG is intended for promoting exports and the Indian Government with the help of this scheme offers incentives and financial support to the exporters.

- Heavy exporters could benefit from this provision. However, it is not advisable to go ahead with this scheme for those who don’t expect to manufacture in quantity or expect to sell the produce entirely within the country, as it could become almost impossible to fulfil the obligations set under this scheme.

What are other Schemes to Promote Export?

- Merchandise Exports from India Scheme:

- MEIS was introduced in the Foreign Trade Policy (FTP) 2015-20, under MEIS, the government provides duty benefits depending on product and country.

- Service Exports from India Scheme:

- It was introduced in April 2015 for 5 Years under the Foreign Trade Policy of India 2015-2020.

- Earlier, this Scheme was named as Served from India Scheme (SFIS Scheme) for Financial Year 2009-2014.

- It was introduced in April 2015 for 5 Years under the Foreign Trade Policy of India 2015-2020.

- Remission of Duties or Taxes on Export Product:

- It is a fully automated route for Input Tax Credit (ITC) in the GST (Goods and Service Tax) to help increase exports in India.

- Rebate of State and Central Taxes and Levies:

- Announced in March, 2019, RoSCTL was offered for embedded state and central duties and taxes that are not refunded through GST.