Indian Economy

Compound Interest Waiver on Moratorium Loans

- 26 Oct 2020

- 4 min read

Why in News

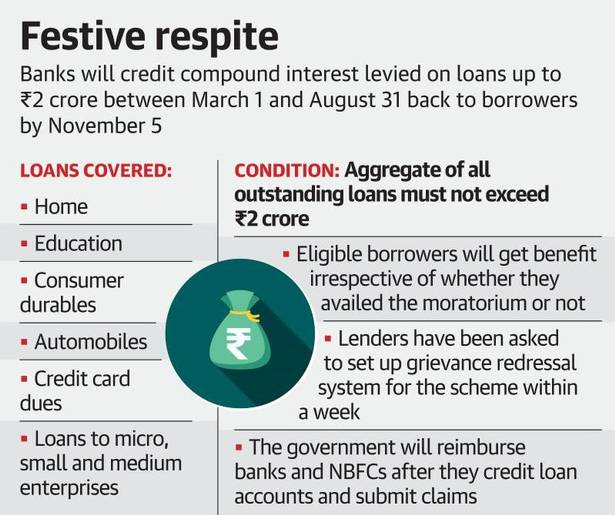

Recently, the Government of India has announced the scheme for the waiver of compound interest that was payable by the borrower who had opted for loan moratorium between 1st March 2020, and 31st August 2020.

- The Reserve Bank of India (RBI) had in March 2020 offered a three-month moratorium on loans, enabling borrowers to defer repayments on EMIs and other loans. This was later extended by another three months, till 31st August 2020.

- The loan moratorium, and waiver of compound interest, was aimed at providing borrowers relief amid the economic impact of the Covid-19 pandemic.

Key Points

- Compound Interest Waiver Scheme:

- Under this, the government will grant eligible borrowers ex-gratia payment of the difference between the compound interest and simple interest for the six-month moratorium period.

- Ex-gratia payment is the money which is paid due to moral obligation and not due to legal obligation.

- Simple interest is levied only on the principal amount of a loan or deposit. In contrast, compound interest is levied on the principal amount and the interest that accumulates on it in every period.

- Under this, the government will grant eligible borrowers ex-gratia payment of the difference between the compound interest and simple interest for the six-month moratorium period.

- Eligibility:

- The scheme shall be applicable for loans availed by Micro, Small and Medium Enterprises (MSMEs) as well as loans to retail customers for education, housing, consumer durables, automobiles, provided a borrower has an aggregate outstanding loan of Rs. 2 crore or less, from all such loans.

- Credit card dues have also been included in the scheme’s ambit.

- The loan interest waiver payment shall be admissible, irrespective of whether the borrower had availed the moratorium partly, fully, or not at all.

- However, this would only be permitted for loan accounts that had not been reported as Non-Performing Assets (NPAs) as on 29th February 2020.

- A loan is recorded as a non-performing asset or NPA, 90 days after repayments become overdue.

- The scheme shall be applicable for loans availed by Micro, Small and Medium Enterprises (MSMEs) as well as loans to retail customers for education, housing, consumer durables, automobiles, provided a borrower has an aggregate outstanding loan of Rs. 2 crore or less, from all such loans.

- Effect:

- The amount saved through loan interest waiver will be very small. This is because only the interest that would have been charged on the interest of the original loan during the six months moratorium period is waived off.

- In other words, the loan repayment will continue and one will still need to pay the simple interest that would have paid if not opted for the loan moratorium.

- It is only the compounding interest that goes off.

- Implementation:

- Lenders have been asked to set up a grievance redressal mechanism for eligible borrowers under the scheme by 30th October 2020.

- A mechanism has also been put in place for lenders to claim the amount back from the government. Lenders have to submit claims for reimbursement by 15th December 2020 through a special cell set up in the State Bank of India (SBI).