Indian Economy

Digital Rupee

- 05 Dec 2020

- 8 min read

This article is based on “Encrypting the rupee” which was published in The Hindu Business line on 01/12/2020. It talks about the prospects of a Central Bank issued Digital Currency in India.

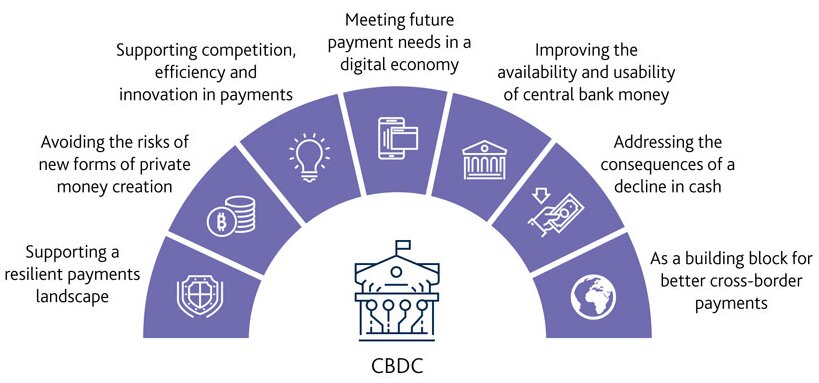

The growing popularity of digital currencies (or cryptocurrency) such as Bitcoin, over the last decade, had made most central banks look seriously at launching a digital currency controlled by them that can address the shortcomings of digital currencies while hastening the shift towards a cashless society.

In this context, the European Central Bank has expressed its intention to evaluate a Central Bank issued Digital Currency (CBDC) for the Euro Zone. The RBI had, in 2018, directed financial institutions against facilitating transactions involving cryptocurrencies, leading to many crypto trading platforms shutting down.

However, recently RBI has indicated that it is conducting a feasibility study of developing a government-backed digital currency. As many countries today explore the prospects of a sovereign digital currency, India should not lag behind in developing Digital Rupee.

Note: Digitalisation of Fiat Currency From Digital Currency.

- In order to understand the importance of a Digital Rupee, it is required to distinguish the digitalisation of fiat currency from digital currency.

- The digitisation of fiat currency stems from the advent of electronic payment and interbank IT systems, allowing commercial banks to more efficiently and independently generate the credit flows that expand the broad money supply.

- By contrast, digital currency, enabled by blockchain technology, affects the base currency allowing the central bank to bypass commercial banks and regain control of currency creation and supply end-to-end.

Need For CBDC in India

- Addressing the Malpractices: The need for a sovereign digital currency arises from the anarchic design of existing cryptocurrencies, wherein their creation, as well as maintenance, are in the hands of the public.

- With no government supervision and ease of cross-border payments, renders them vulnerable to malpractices like tax evasion, terror funding, money laundering, etc.

- By regulating digital currency, the central bank can put a check on their malpractices.

- Addressing Volatility: As the cryptocurrencies are not pegged to any asset or currency, its value is solely determined by speculation (demand and supply). It is due to this, there has been huge volatility in the value of cryptocurrencies like bitcoin.

- As CBDCs will be pegged to any assets (like gold or fiat currency) and hence will not witness the volatility being seen in cryptocurrencies.

- Next Big Thing: In a survey conducted by Bank for International Settlements, around 80 per cent of the 66 responding central banks said they have begun working on central bank-issued digital currency (CBDC) in some form.

- Moreover, China is quietly bringing about a revolutionary change to the currency and payment system by launching its Digital Renminbi.

- Digital Currency Proxy War: India runs the risk of being caught up in the whirlwind of a proxy digital currency war as the US and China battle it out to gain supremacy across other markets by introducing new-age financial products.

- Today, a sovereign Digital Rupee isn’t just a matter of financial innovation but a need to push back against the inevitable proxy war which threatens our national and financial security.

- Reducing Dependency on Dollar: Digital Rupee provides an opportunity for India to establish the dominance of Digital Rupee as a superior currency for trade with its strategic partners, thereby reducing dependency on the dollar.

Digital Proxy War

- For too long, the dollar has been unchallenged as the world’s reserve currency giving the US leverage over the world’s financial system and also enabling it to impose sanctions against countries.

- However, in wake of the recent trade war, China is now pushing for a more advanced financial system using Digital Renminbi.

Advantages of Digital Rupee

- Complete Transmission of Monetary Policy: Digital Rupee will empower the RBI by providing it direct tools to control monetary policy.

- Directly influenced creation and supply flow using a Digital Rupee will immediately reflect the effects of policy changes instead of relying on commercial banks to make those changes when they deem fit.

- Safeguarding the Interest of Deposit Holders: The recent NBFC crisis resulting in the current downturn in the economy and the PMC Bank scandal which has locked out depositors from withdrawing their funds due to high NPAs are a testament to the fragility of our current banking model.

- Officially backed Digital Rupee will empower the regulators to monitor transactions and credit flow across the economy helping them weed out scams and fraud instantly and secure depositors’ money.

- Moreover, it will help distract investors from the current bunch of crypto assets that are highly risky.

- New Paradigm For Banking: Digital Rupee will turn every large technology company into a fintech company without the need for permission or partnership with a bank.

- This will create new incentives for companies to bank the unbanked, while also providing financial services to those who have been at the mercy of banks till date.

- Enabler of Cashless Society: Official digital currencies can play an important role in weaning users away from using cash, which will help control tax evasion.

- Digital Rupee will also make cashback, remittances, loans, insurance, stocks and other financial products a natural extension using programmable smart contracts.

Conclusion

The creation of a Digital Rupee will provide an opportunity for India to empower its citizens and enable them to use it freely in our ever-expanding digital economy and break free from an outdated banking system. Looking into its impact on macroeconomy and liquidity, banking systems and money markets, it is imperative of policymakers to thoroughly consider the prospects of Digital Rupee in India.

|

Drishti Mains Question Discuss the prospects of Central Bank Issued Digital Currency on the money market in India. |

This editorial is based on “Modi govt must get its vaccine talk right” which was published in The Financial Express on December 4th, 2020. Now watch this on our Youtube channel.