Indian Economy

Steps To Spur Economic Growth

- 16 Sep 2019

- 5 min read

The Finance Minister has announced a number of measures to help reignite the slowing economy.

- The primary reasons for this slowdown include weak consumption (e.g. reduction in auto sales, housing sales etc.) and a deteriorating global environment (US-China trade war, Brexit etc.).

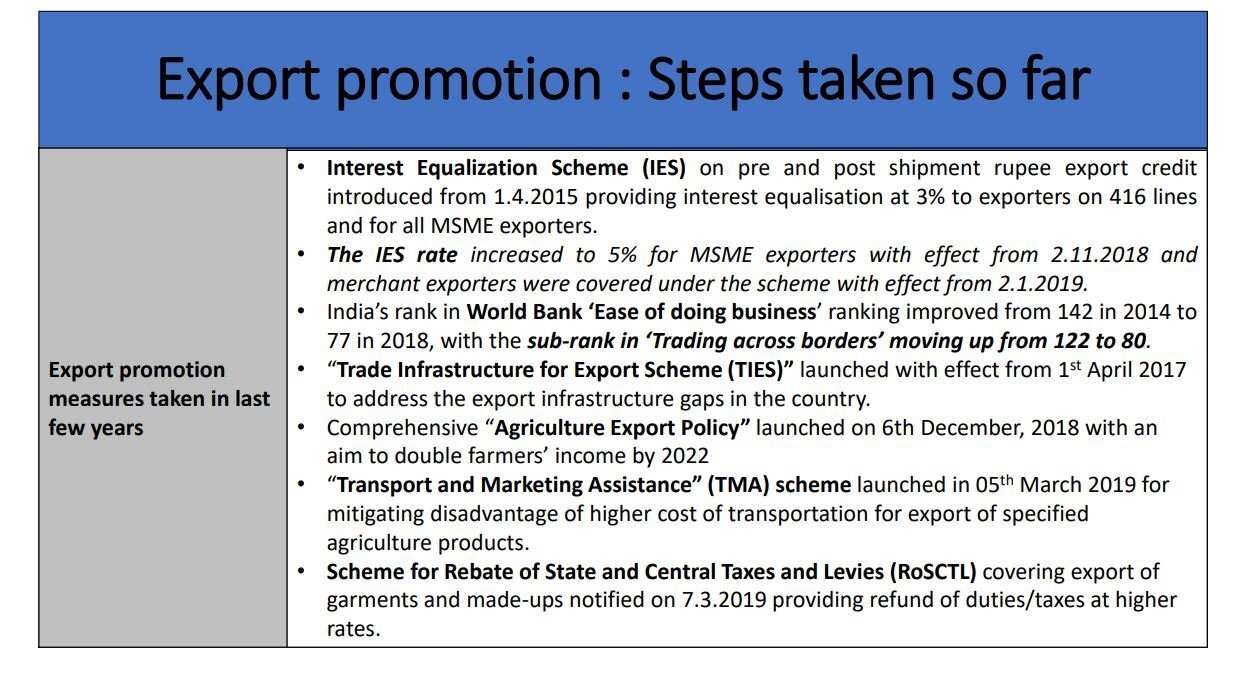

Measures To Boost Export Sector

- Use of Information and Communications Technology (ICT): Number of measures have been announced to leverage technology to promote exports.

- Fully electronic refund module for a quick and automated refund of Input Tax Credits (ITC) will be implemented by end September 2019.

- ITC means deducting the tax paid on inputs from the tax payable on the final output.

- An Online “Origin Management System” for exporters to enable them to obtain Certificates of Origin – CoO will be launched.

- Certificate of Origin is an instrument which establishes evidence on the origin of goods imported into any country. These certificates are essential for exporters to prove where their goods come from and therefore stake their claim to whatever benefits goods of Indian origin may be eligible for in the country of exports.

- Technology will be further leveraged to further reduce "Time to export" - through seamless process digitization of all export clearances (port/airport/customs, etc) and elimination of offline/manual services.

- Fully electronic refund module for a quick and automated refund of Input Tax Credits (ITC) will be implemented by end September 2019.

- Remission of Duties or Taxes on Export Product (RoDTEP): It will replace the Merchandise Exports from India Scheme (MEIS), which is not compliant with world trade rules.

- The new scheme will be implemented from 1st January 2020 and will more than adequately incentivize exporters than existing schemes put together.

- The Merchandise Exports from India Scheme (MEIS) was introduced in the Foreign Trade Policy (FTP) 2015-20 w.e.f. 1st April 2015 with the objective to offset infrastructural inefficiencies and associated costs involved in exporting goods/products which are produced /manufactured in India including products produced/manufactured by MSME Sector.

- Export Financing: To increase bank credit to exporters, the Export Credit Guarantee Corporation (ECGC) will expand the scope of its Export Credit Insurance Scheme (ECIS) to provide a higher insurance cover to banks that are lending working capital for exports.

- Credit flow to exporters has come down by 35%.

- At present banks are covered for 60% of what they lend to exporters for working capital. With the new move, it is expected to be increased to 90%.

- It would also enable a reduction in the overall cost of export credit including interest rates, especially to MSMEs.

- Effective monitoring of export financing will be done by the Department of Commerce.

- Export finance refers to financial assistance extended by banks and other financial institutions to businesses for the shipping of products outside a country or region.

- Priority Sector Lending (PSL) norms for export credit have been examined and enabling guidelines are under consideration of RBI.

- This will release an additional Rs. 36,000 - 68,000 crores as export credit under the priority sector.

- Effective Use of FTAs: Free Trade Agreement (FTA) Utilisation Mission, headed by a Senior officer in the Department of Commerce, will be set up, to work exclusively with export houses to utilise concessional tariffs in each FTA.

- Mega Shopping Festivals: To boost exports, Dubai- like annual mega shopping festivals in India will be organized in 4 places across March 2020. These will focus on four themes: Gems & Jewellery, Handicrafts/Yoga/Tourism, Textiles and Leather.

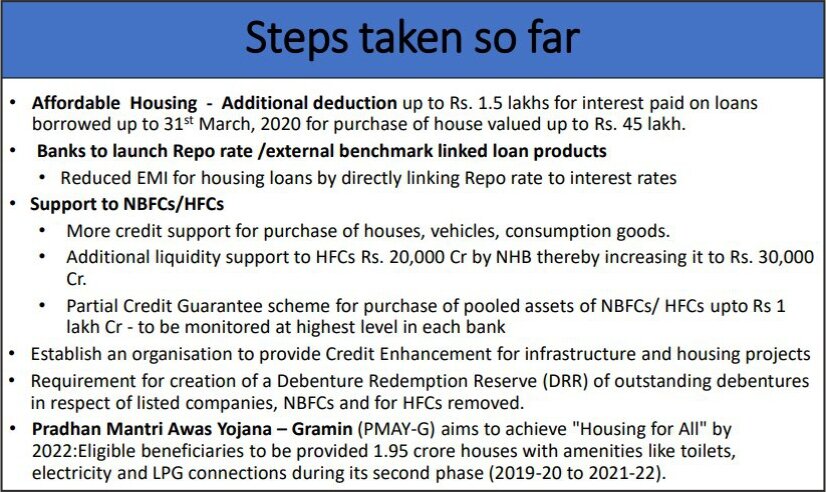

Measures To Boost Housing Sector

- Increasing Bank Credit for Homebuyers:

- The External Commercial Borrowing (ECB) guidelines will be relaxed to facilitate financing for home buyers who are eligible under the Pradhan Mantri Awas Yojana.

- The interest rate on house building advances will be lowered and linked with the 10 Year Government Security yields.

- A Special Window Fund, to provide last mile funding to non-NPA (Non-Performing Assets) and non- NCLT (National Company Law Tribunal) projects in the affordable and middle-income category.

- The government will contribute up to Rs 10,000 crores alongside other investors including LIC and private banks.