Indian Economy

Securities and Exchange Board of India

- 02 Mar 2022

- 7 min read

For Prelims: Securities and Exchange Board of India, Capital Market.

For Mains: Statutory Bodies, Quasi Judicial Bodies, Capital Market, Issues with SEBI and Way Forward.

Why in News?

Recently, Madhabi Puri Buch, former whole-time member of the Securities and Exchange Board of India (SEBI), has been appointed as its new chairperson — the first woman to head the market regulator. She will hold the position for three years.

- Earlier in January 2022, SEBI launched Saa₹thi – a mobile app on investor education.

What is SEBI?

- About:

- SEBI is a Statutory Body (a Non-Constitutional body which is set up by a Parliament) established on 12th April, 1992 in accordance with the provisions of the Securities and Exchange Board of India Act, 1992.

- The basic functions of SEBI is to protect the interests of investors in securities and to promote and regulate the securities market.

- The headquarters of SEBI is situated in Mumbai. The regional offices of SEBI are located in Ahmedabad, Kolkata, Chennai and Delhi.

- Background:

- Before SEBI came into existence, Controller of Capital Issues was the regulatory authority, it derived authority from the Capital Issues (Control) Act, 1947.

- In April, 1988 the SEBI was constituted as the regulator of capital markets in India under a resolution of the Government of India.

- Initially SEBI was a non statutory body without any statutory power.

- It became autonomous and given statutory powers by SEBI Act 1992.

What is SEBIs Structure?

- SEBI Board consists of a Chairman and several other whole time and part time members.

- SEBI also appoints various committees, whenever required to look into the pressing issues of that time.

- Further, a Securities Appellate Tribunal (SAT) has been constituted to protect the interest of entities that feel aggrieved by SEBI’s decision.

- SAT consists of a Presiding Officer and two other Members.

- It has the same powers as vested in a civil court. Further, if any person feels aggrieved by SAT’s decision or order can appeal to the Supreme Court.

What is SEBIs Power And Functions?

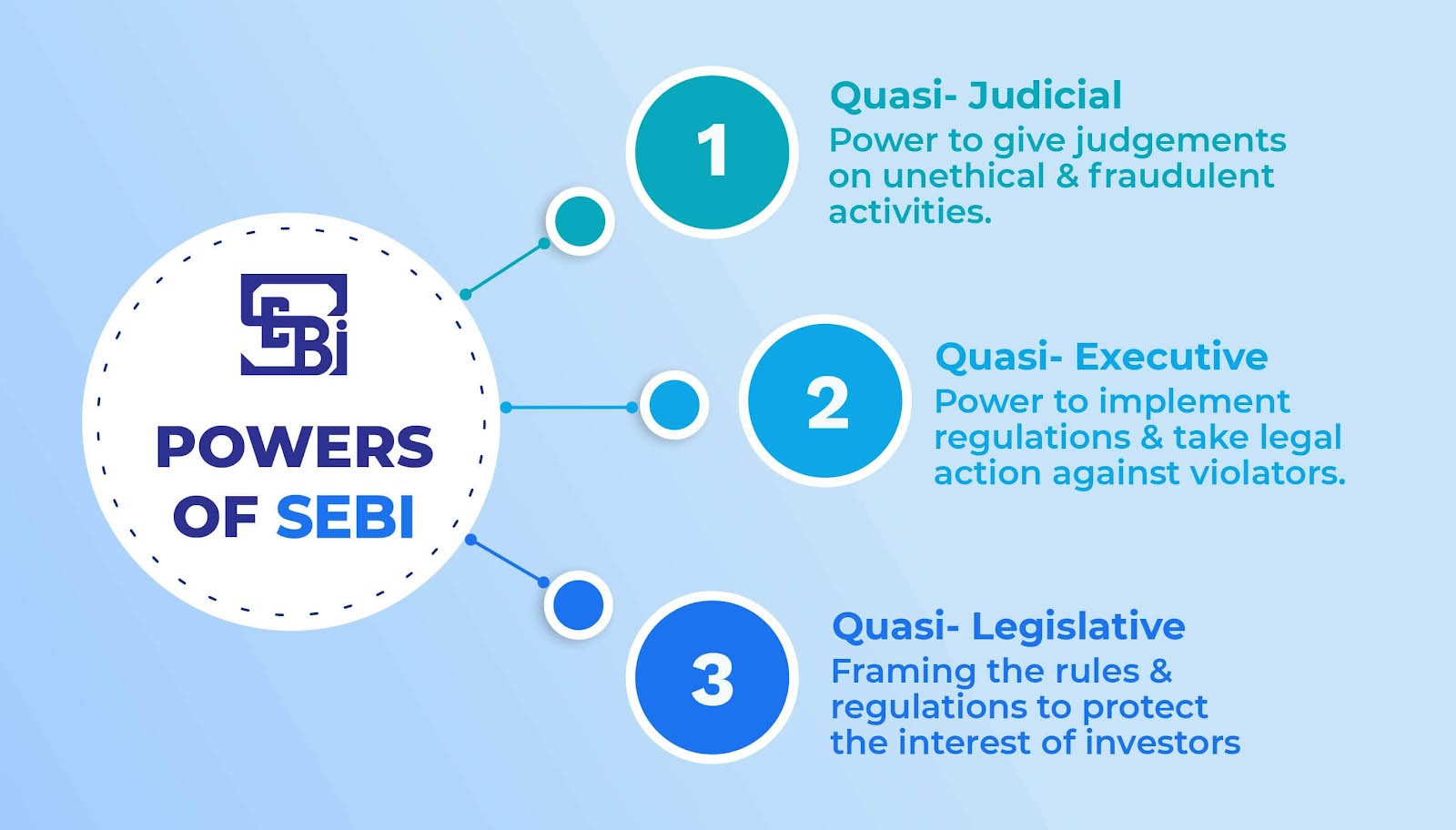

- SEBI is a quasi-legislative and quasi-judicial body which can draft regulations, conduct inquiries, pass rulings and impose penalties.

- It functions to fulfill the requirements of three categories:

- Issuers: By providing a marketplace in which the issuers can increase their finance.

- Investors: By ensuring safety and supply of precise and accurate information.

- Intermediaries: By enabling a competitive professional market for intermediaries.

- By Securities Laws (Amendment) Act, 2014, SEBI is now able to regulate any money pooling scheme worth Rs. 100 cr. or more and attach assets in cases of non-compliance.

- SEBI Chairman has the authority to order "search and seizure operations". SEBI board can also seek information, such as telephone call data records, from any persons or entities in respect to any securities transaction being investigated by it.

- SEBI performs the function of registration and regulation of the working of venture capital funds and collective investment schemes including mutual funds.

- It also works for promoting and regulating self-regulatory organizations and prohibiting fraudulent and unfair trade practices relating to securities markets.

What are the Issues and Related Concerns?

- In recent years SEBI's role became more complex, the capital markets regulator is at a crossroads.

- There is excessive focus on regulation of market conduct and lesser emphasis on prudential regulation.

- SEBI’s statutory enforcement powers are greater than its counterparts in the US and the UK as it is armed with far greater power to inflict serious economic injury.

- It can impose serious restraints on economic activity, this is done based on suspicion, leaving it to those affected to shoulder the burden of disproving the suspicion, somewhat like preventive detention.

- Its legislative powers are near absolute as the SEBI Act grants wide discretion to make subordinate legislation.

- The component of prior consultation with the market and a system of review of regulations to see if they have met the articulated purpose is substantially missing. As a result, the fear of the regulator is widespread.

- Regulation, either rules or enforcement, is far from perfect, particularly in areas like insider trading.

- The Securities offering documents are extraordinarily bulky and have substantially been reduced to formal compliance rather than resulting in substantive disclosures of high quality.

Way Forward

- There is need of an attitudinal change, indeed, hundreds of inputs about the market being full of crooks necessitating a crackdown and severe intervention would be received.

- The foremost objective of SEBI should be cleaning up the policy space in this area of the market.

- SEBI must give special attention to human resources and matters within the organization. SEBI must encourage lateral entry to draw the best talent.

- Alignment and fitment of senior employees upon merger of the Forward Markets Commission into Sebi remains an open area of work.

- Enforcement can be strengthened with continuous monitoring and improving market intelligence.

- India’s financial markets are still segmented. One regulator can’t be blamed for another’s failure when the remit over a financial product overlaps.

- In this context a unified financial regulator makes eminent sense to remove both overlap and excluded boundaries.