Indian Economy

RBI’s COVID-19 Economic Relief Package

- 28 Mar 2020

- 7 min read

Why in News

After the Government’s announcement of Pradhan Mantri Gareeb Kalyan Yojana, the Reserve Bank of India’s Monetary Policy Committee (MPC) has come out with its own measures to help deal with economic fall out of COVID-19 pandemic.

- This was the first time that the MPC met outside its bi-monthly meeting calendar.

Economic Impact of the Pandemic

- According to the International Monetary Fund (IMF) chief Kristalina Georgieva, the world has entered a recession that will be worse than the one in 2009, following the global financial crisis.

- Recession implies significant decline in general economic activity.

- Moody's Investor Service (a rating agency) has reduced its GDP growth forecast for India to 2.5% in 2020 - a sharp drop from an earlier projection of 5.3%, due to the impact of the COVID-19 pandemic and the resultant lockdown.

- At the low growth rate of 2.5% in 2020, India may see a sharp fall in incomes, further weighing on domestic demand and the pace of recovery in 2021.

- The ongoing 21-day lockdown in India has brought business activity in most sectors of the economy to a halt and resulted in thousands of job losses.

- The ratings agency expects the country's economy to recover in 2021, estimating a growth rate of 5.8%, but warned that uncertainty regarding the virus’s spread and containment makes it difficult to fully assess the economic toll of the crisis. India grew at 5% in 2019.

- The G20 countries are likely to see an overall contraction of GDP by 0.5%. G20 GDP growth rate, which was 2.6% in 2019, is likely to recover to 3.2% in 2021.

- The U.S. economy would contract by 2% in 2020, while the Euro area would see a 2.2% contraction. China's economic growth rate is expected to slow to 3.3%, although it is expected to recover to 6% in 2021.

RBI’s Measures

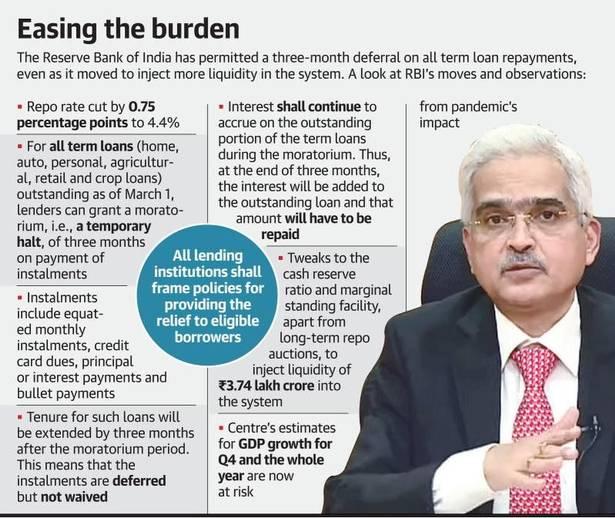

- Cut in Repo Rate

- The repo rate has been cut by 75 basis points (bps) from 5.15% to 4.40%.

- Repo Rate is the rate at which a country’s central bank (RBI) lends money to commercial banks. Ideally, a low repo rate should translate into low-cost loans for general masses.

- The rates have been cut to encourage banks to lend more and to revive growth.

- Cut in Reverse Repo Rate

- The ratio has been cut by 90 bps to 4%.

- Reverse repo rate is the rate at which the central bank of a country (RBI) borrows money from commercial banks within the country.

- The higher reduction in the reverse repo rate was aimed at prompting banks to lend more rather than keeping their excess liquidity with the RBI.

- Macroeconomic Indicators

- The MPC refrained from giving growth and inflation projections, given the uncertainty in the situation.

- Growth outlook will depend on the intensity, speed, and duration of the pandemic. This clearly highlights downside risks to growth from a prolonged lockdown.

- Moratorium on Repayments of Loans

- RBI has also allowed banks to defer payment of Equated Monthly Installments (EMIs) on home, car, personal loans as well as credit card dues for three months till May 31.

- The RBI also allowed lending institutions, banks to defer interest on working capital repayments by 3 months — a move aimed at addressing the distress among firms as production is down.

- A working capital loan is a loan that is taken to finance a company’s everyday operations.

- A moratorium is not a loan waiver and does not offer any discount on interest payout. But it provides stressed customers extra time to repay without their accounts being labelled non-performing assets (NPA) or their credit score being affected - a major worry for small and medium businesses.

- Impact on Banks: For banks and lending institutions, this will affect their cash flows as they may not be getting repayments for three months. But the RBI has reduced their cash reserve ratio (CRR) requirements, providing them additional liquidity.

- Liquidity Infusion of Rs. 3.74 lakh crore - 3.4% of GDP

- Through measures that pertain to Targeted Long-Term Repo Operations (TLTRO) of up to ₹1 trillion, a 100-bps cut in Cash Reserve Ratio (CRR) and easier borrowing requirements under the Marginal Standing Facility (MSF) window.

- TLTRO will provide financing to credit institutions.

- CRR is the amount of money banks need to set aside with RBI as a buffer and do not earn any interest on it. CRR has been cut to 3% from 4%.

- Under the Marginal Standing Facility (MSF) window, banks can borrow funds from the RBI by pledging government securities within the limits of Statutory Liquidity Ratio (SLR). The RBI has increased accommodation under the marginal standing facility from 2%of SLR to 3%.

Way Forward

- There will be more to do as the crisis evolves; governments and regulators are reacting to events, as opposed to being proactive, simply because this is a kind of crisis that they have not dealt with before.

- The priority is to undertake strong and purposeful action in order to minimise the adverse macroeconomic impact of the pandemic.