Indian Economy

Outward Remittance Trend

- 25 May 2022

- 6 min read

For Prelims: Liberalised Remittance Scheme, Remittance, RBI

For Mains: Significance of Liberalised Remittance Scheme

Why in News?

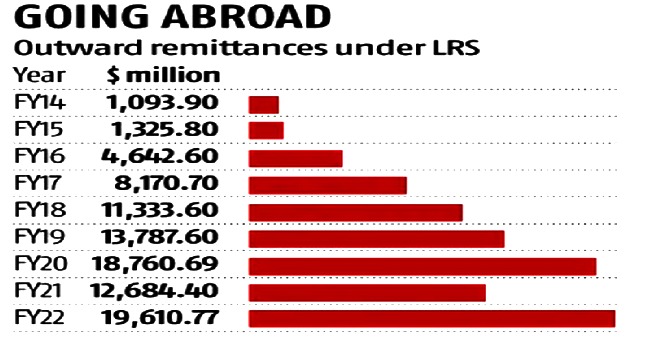

Total outward Remittances, under the RBI’s Liberalised Remittance Scheme, shot up to an all-time high of USD 19.61 billion in the year ended March 2022 as against USD 12.684 billion in March 2021.

- Foreign exchange, including the US dollar and euro, taken out of the country by resident Indians has shot up by 54.60% during the fiscal year ending March 2022.

What are Remittances?

- Remittances are usually understood as financial or in-kind transfers made by migrants to friends and relatives back in their communities of origin.

- These are basically sum of two main components - Personal Transfers in cash or in kind between resident and non-resident households and Compensation of Employees, which refers to the income of workers who work in another country for a limited period of time.

- Remittances help in stimulating economic development in recipient countries, but this can also make such countries over-reliant on them.

What is Outward Remittance?

- Outward remittance is a transfer of funds in the form of foreign exchange by a person from India, to a beneficiary outside India (except for Nepal and Bhutan) for any bonafide purposes as permissible under Foreign Exchange Management Act (FEMA), 1999.

What is the Outward Remittance Trend?

- Total Outward Remittances:

- The total outward remittances were at an all-time high in FY22 as it made a strong comeback from the previous year’s tepid show because of the Disruptions led by Covid-19.

- The comeback has been supported by Indian’s spending more on international travel and overseas education.

- Segments of Outward Remittances:

- International Travel: In FY22, international travel picked up, resulting in India's spending USD 6.91 billion on travel, which is more than double that was spent on travel in FY21.

- In FY20, however, spends on travel by Indians was also almost $6.95 billion.

- Overseas education: Overseas education is important segment that has seen healthy growth in FY22 as Indians remitted over USD 5.17 billion in the year.

- This showed an increase of 35% from FY21, where Indians had remitted USD 3.83 billion.

- In FY20, remittances for overseas education were nearly USD 5 billion.

- Gifts: Indians remitted USD 2.34 billion as gifts in FY22, up 47.28% over FY21.

- In FY20, Indians remitted about USD 1.91 billion as gifts under the LRS scheme.

- International Travel: In FY22, international travel picked up, resulting in India's spending USD 6.91 billion on travel, which is more than double that was spent on travel in FY21.

- Investments in overseas Equity and Debt:

- Investments in overseas equity and debt by Indians also shot up to USD 746.5 million in FY22 as against USD 471.80 million in the previous year.

What is the Liberalised Remittance Scheme?

- This is the scheme of the Reserve Bank of India, introduced in the year 2004.

- Under the scheme, all resident individuals, including minors, are allowed to freely remit up to USD 2,50,000 per financial year (April – March) for any permissible current or capital account transaction or a combination of both.

- The Scheme is not available to corporations, partnership firms, Hindu Undivided Family (HUF), Trusts etc.

- Though there are no restrictions on the frequency of remittances under LRS, once a remittance is made for an amount up to USD 2,50,000 during the financial year, a resident individual would not be eligible to make any further remittances under this scheme.

What are Current and Capital Account Transactions?

- Current Account Transactions: All transactions undertaken by a resident that do not alter his/her assets or liabilities, including contingent liabilities, outside India are current account transactions.

- Example: payment in connection with foreign trade, expenses in connection with foreign travel, education etc.

- Capital Account Transactions: It includes those transactions which are undertaken by a resident of India such that his/her assets or liabilities outside India are altered (either increased or decreased).

- Example: investment in foreign securities, acquisition of immovable property outside India etc.

UPSC Civil Services Examination, Previous Year Questions

Q. Which of the following constitute Capital Account? (2013)

- Foreign Loans

- Foreign Direct Investment

- Private Remittances

- Portfolio Investment

Select the correct answer using the codes given below:

(a) 1, 2 and 3

(b) 1, 2 and 4

(c) 2, 3 and 4

(d) 1, 3 and 4

Ans: (b)

Exp:

- Capital Account is one of two primary components of the balance of payments, the other being the Current Account. Whereas the Current Account reflects a nation’s net income, the Capital Account reflects the net change in ownership of national assets.

- Capital Account includes:

- Foreign Loans, hence, 1 is correct.

- Foreign Direct Investment (FDI), hence, 2 is correct.

- Portfolio Investment, hence, 4 is correct.

- Other Investment,

- Reserve Account.

- Private Remittances come under the Current Account. Hence, 3 is not correct.

- Therefore, option (b) is the correct answer