Indian Economy

Manufacturing Hits Record Low

- 05 May 2020

- 5 min read

Why in News

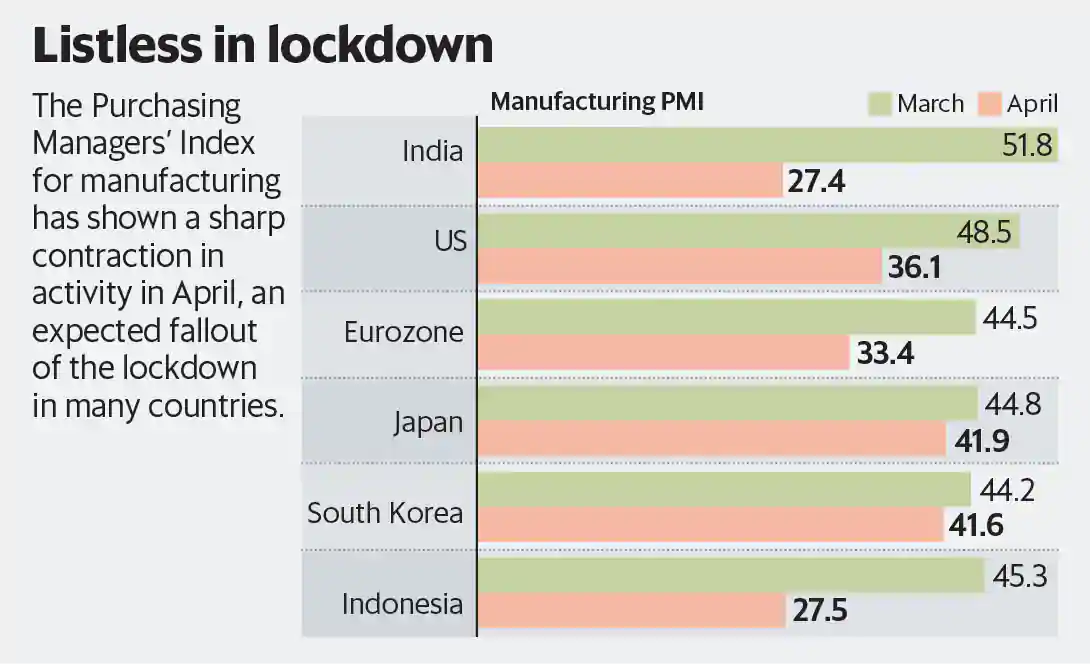

According to a recent IHS Markit India monthly survey, Manufacturing Purchasing Managers’ Index (PMI) fell to 27.4 in April, 2020 from 51.8 in March, 2020.

Key Points

- India’s manufacturing sector activity has witnessed contraction in April, 2020 due to national lockdown restrictions.

- The new business orders have collapsed at a record pace severely hampering the demand.

- This is the sharpest deterioration in business conditions across the manufacturing sector since data collection began over 15 years ago.

- The deteriorating demand conditions has led the manufacturers to drastically cut back staff numbers.

- Export orders have also witnessed a sharp decline.

- There was also evidence of supply-side disruption due to the lockdown.

- The PMI slipped into contraction mode, after remaining in the growth territory for 32 consecutive months.

- In PMI’s language, a reading above 50 means expansion, while a score below that denotes contraction.

- According to the 12-month outlook for production the demand will rebound once the Covid-19 threat is diminished and lockdown restrictions are eased.

- The Index (PMI) is compiled by IHS Markit for more than 40 economies worldwide. IHS Markit is a global leader in information, analytics and solutions for the major industries and markets that drive economies worldwide.

Purchasing Managers' Index

- Purchasing Managers’ Index (PMI) is an indicator of business activity - both in the manufacturing and services sectors.

- It is calculated separately for the manufacturing and services sectors and then a composite index is also constructed.

- The PMI summarizes whether market conditions as viewed by purchasing managers are expanding, neutral, or contracting.

- The purpose of the PMI is to provide information about current and future business conditions to company decision makers, analysts, and investors.

- The PMI is a number from 0 to 100.

- PMI above 50 represents an expansion when compared to the previous month;

- PMI under 50 represents a contraction, and

- A reading at 50 indicates no change.

- The PMI is usually released at the start of every month. It is, therefore, considered a good leading indicator of economic activity.

- It is different from the Index of Industrial Production (IIP), which also gauges the level of activity in the economy.

Index of Industrial Production

- The Index of Industrial Production (IIP) is an index which details out the growth of various sectors in an economy such as mineral mining, electricity, manufacturing, etc.

- It is compiled and published monthly by the National Statistical Organisation (NSO), Ministry of Statistics and Programme Implementation.

- The Base Year of the Index of Eight Core Industries has been revised from the year 2004-05 to 2011-12 from April, 2017.

- The eight core industries comprise 40.27% of the weight of items included in the Index of Industrial Production (IIP).

- The eight Core Industries in decreasing order of their weightage: Refinery Products> Electricity> Steel> Coal> Crude Oil> Natural Gas> Cement> Fertilizers.

Difference between PMI and IIP

- IIP covers the broader industrial sector compared to PMI.

- IIP shows the change in production volume in major industrial sub sectors like manufacturing, mining and electricity.

- Similarly, the IIP also gives use based (capital goods, consumer goods etc) trends in industrial production.

- PMI is more dynamic compared to a standard industrial production index.

- The PMI senses dynamic trends because of the variable it uses for the construction of the index compared to volume based production indicators like the IIP.

- For example, new orders under PMI show growth oriented positive trends and not just volume of past production that can be traced in an ordinary Index of Industrial Production.