Indian Economy

Amalgamation of National Banks

- 31 Aug 2019

- 6 min read

The Finance Minister has announced the biggest consolidation plan of Public sector Banks (PSBs)- merging 10 of them into just 4.

New Banks After the Merger

| Sr. No. | Amalgamated Banks | Anchor Banks |

| 1 | Punjab National Bank (PNB), Oriental Bank of Commerce (OBC), and United Bank of India | PNB |

| 2 | Canara Bank and Syndicate Bank | Canara Bank |

| 3 | Union Bank of India, Andhra Bank, and Corporation Bank | Union Bank of India |

| 4 | Indian Bank and Allahabad Bank | Indian Bank |

- Now, the total number of PSBs after consolidation has come down to 12 from 27 in 2017. The earlier mergers were:

- Vijaya Bank and Dena Bank with Bank of Baroda (BoB) – effective from April 01, 2019.

- State Bank of India absorbed five of its associates and the Bharatiya Mahila Bank in 2017.

Current Scenario of PSBs

- After entire merger exercises, the next-generation PSBs of India can now be ranked according to their business size, as follows:

| Sr. No. | Bank Name | PSB Rank by size |

| 1 | State Bank of India | Largest |

| 2 | Punjab National Bank | 2nd largest |

| 3 | Bank of Baroda | 3rd largest |

| 4 | Canara Bank | 4th largest |

| 5 | Union Bank of India | 5th largest |

| 6 | Bank of India | 6th largest |

| 7 | Indian Bank | 7th largest |

| 8 | Central Bank of India | 8th largest |

| 9 | Indian Overseas Bank | 9th largest |

| 10 | UCO Bank | 10th largest |

| 11 | Bank of Maharashtra | 11th largest |

| 12 | Punjab & Sind Bank | 12th largest |

Benefits of Merger

- Competetive: The consolidation of PSBs helps in strengthening its presence globally, nationally and regionally.

- Capital and Governance: The government's intention is not just to give capital but also give good governance. Hence, post-consolidation, boards will be given the flexibility to introduce the chief general manager level as per business needs. They will also recruit chief risk officer at market-linked compensation to attract the best talent.

- Efficiency: It has the potential to reduce operational costs due to the presence of shared overlapping networks. And this enhanced operational efficiency will reduce the lending costs of the banks.

- Technological Synergy: All merged banks in a particular bucket share common Core Banking Solutions (CBS) platform synergizing them technologically.

Core Banking Solutions

- Core Banking Solutions (CBS) can be defined as a solution that enables banks to offer a multitude of customer-centric services on a 24x7 basis from a single location, supporting retail as well as corporate banking activities.

- The centralisation thus makes a “one-stop” shop for financial services a reality. Using CBS, customers can access their accounts from any branch, anywhere, irrespective of where they have physically opened their accounts. The customer is no more the customer of a Branch. He becomes the Bank’s Customer.

- Self-Sufficiency: Larger banks have a better ability to raise resources from the market rather than relying on State exchequer.

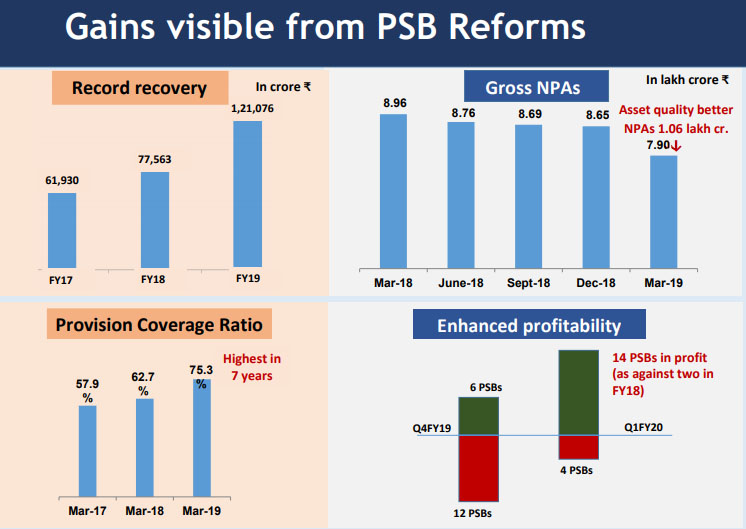

- Recovery: The loan tracking mechanism in PSU banks is being improved for the benefit of customers.

- Monitoring: With the number of PSBs coming down after the process of merger – capital allocation, performance milestones, and monitoring would become easier for the government.

Challenges

- Decision Making: The banks that are getting merged are expected to see a slowdown in decision making at the top level as senior officials of such banks would put all the decisions on the back-burner and it will lead to a drop in credit delivery in the system.

- Geographical Synergy: During the process of merger, the geographical synergy between the merged banks is somewhat missing. In three of the four merger cases, the merged banks serve only one specific region of the country.

- However, the merger of Allahabad Bank (having a presence in East & North region) with the Indian Bank (having a presence in South) increases its geographical spread.

- Slowdown in Economy: The move is a good one but the timings are not just apt. There is already a slowdown in the economy, and private consumption and investments are on a declining trend. Hence, there is a need to lift the economy and increase the credit flow in the short-term, & this decision will block that credit in the short-term.

- Weak Banks: A complex merger with a weaker and under-capitalized PSB would stall the bank’s recovery efforts as the weaknesses of one bank may get transferred and the merged entity may become weak.