Pakistan's Provincial Status to Gilgit-Baltistan

Why in News

India has strongly rejected Pakistan's move to grant provisional provincial status to Gilgit - Baltistan.

- Gilgit-Baltistan is one of the disputed territories of India.

Key Points

- Gilgit-Baltistan:

- It is a chunk of high-altitude territory located on the north western corner of the Union Territory of Ladakh.

- It is located strategically as it borders Pakistan, Afghanistan and China.

- The region was a part of the erstwhile princely state of Jammu and Kashmir, but has been under Pakistan’s control since 4th November, 1947, following the invasion of Kashmir by tribal militias and the Pakistan army.

- Maharaja Hari Singh, the last Dogra ruler of J&K, had signed the Instrument of Accession with India on 26th October 1947.

- India moved to the United Nations Security Council to raise the issue of Pakistan’s invasion on 1st January 1948.

- The UN Security Council passed a resolution calling for Pakistan to withdraw from all of Jammu and Kashmir and then India had to reduce its forces to the minimum level following which a plebiscite would be held to ascertain people’s wishes.

- However, no withdrawal was ever carried out and it remains a point of contention between two countries.

- Background:

- Recently, Saudi Arabia, a key ally of Pakistan, had removed Pakistan-occupied-Kashmir and Gilgit-Baltistan from the Pakistan map on its new banknote after India asked it to take “urgent corrective steps” about the “gross misrepresentation”.

- On the first anniversary of the revocation of Jammu and Kashmir’s special status, the Pakistan government had released a new “political map” which included Jammu and Kashmir, Ladakh and parts of western Gujarat as part of its territory.

- Describing it as “political absurdity” and a “ridiculous assertion”, India said it “confirms the reality of Pakistan’s obsession with territorial aggrandisement supported by cross-border terrorism”.

- The Gilgit-Baltistan region is at the centre of USD 65 billion China Pakistan Economic Corridor Infrastructure development plan.

- India's Stand:

- India claims that the entire Jammu and Kashmir and Ladakh including Gilgit-Baltistan is an integral part of India by the virtue of legal, complete and irrevocable accession of Jammu and Kashmir to the union of India in 1947.

- Pakistan’s move to name Gilgit-Baltistan as its fifth province is meant to “camouflage its illegal occupation” of the area but it cannot “hide the grave human rights violations, exploitation and denial of freedom” to the people for over seven decades.

Rising GST Revenues

Why in News

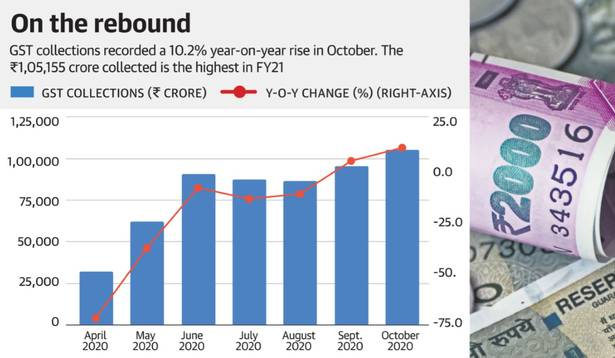

According to the recent data released by the Finance Ministry, the gross Goods and Services Tax (GST) revenue collected in October 2020 was Rs. 1.05 lakh crore.

- It is 10.25% higher than in 2019 and 10.1% more than the revenue garnered in September 2020.

Key Points

- The total revenue earned in October by the Central and State governments stood at Rs. 44,285 crore and Rs. 44,839 crore, respectively.

- GST cess collections, used to compensate the States for switching to the GST regime, rose to Rs. 8,011 crore, which is over 5% more than in 2019 and 12.5% higher than September 2020.

- October’s revenues from import of goods were 9% higher, while domestic transactions (including import of services) yielded 11% higher revenues, on a year-on-year basis.

- Status of the States:

- Andhra Pradesh and Chhattisgarh recorded the highest 26% growth in GST collections in October year-on-year, followed by Jharkhand (23%) and Rajasthan (22%).

- The trend in the more industrially developed States was mixed, with 15% growth in Gujarat, 13% in Tamil Nadu and just 5% in Maharashtra.

- Reasons:

- The surge in October's GST inflows could be attributed to the festive demand and input tax credits as well as other reconciliations that were due for businesses in September.

- Many companies raised sale invoices in September by pushing out their finished products which they had planned in March itself.

- Input Tax Credit: The GST that a merchant pays to procure goods or services (i.e. on inputs) can be set off later against the tax applicable on supply of final goods and services. The set-off tax is called an input tax credit.

- India’s manufacturing sector activities started to show signs of growth in August and September, driven mainly by a pick-up in production along with improvement in customer demand.

- The surge in October's GST inflows could be attributed to the festive demand and input tax credits as well as other reconciliations that were due for businesses in September.

- Implications:

- GST inflows crossing the Rs. 1 lakh crore mark for the first time in the financial year (FY) 2020-21 is a clear sign of a recovery in the economy after its 23.9% contraction in the first quarter of 2020.

- The expected shortfall in GST compensation for the States could be lower than the current estimate of Rs. 2.35 lakh crore if this revenue momentum is maintained through the rest of 2020-21.

- According to the Consortium of Indian Associations, October’s GST inflows must not be considered a return to normalcy for businesses as these revenues normally relate to sales that occurred in September, when a majority of the economy, including public transport, was unlocked.

- The consortium of Indian Associations is an umbrella body of Micro, Small and Medium Enterprises (MSME).

- November and December data has to be awaited before confidently saying that the economy has rebounded to pre-Covid-19 times.

Goods and Services Tax

- It is a comprehensive, multi-stage, destination-based indirect tax that is levied on every value addition.

- The Goods and Service Tax Act was passed in the Parliament on 29th March 2017 and came into effect on 1st July 2017.

- Under the GST Council and 101st constitutional amendment 2017, the tax is levied at every point of sale.

- GST is categorised into Central GST (CGST), State GST (SGST) and Integrated GST (IGST) depending on whether the transaction is intra-State or inter-State.

- Central GST: CGST is a tax levied on intra-State supplies of both goods and services by the Central Government and is governed by the CGST Act.

- State GST: SGST is also levied on the same intra-State supply but will be governed by the State Governments.

- This implies that both the Central and the State governments agree on combining their levies with an appropriate proportion for revenue sharing between them.

- However, it is clearly mentioned in Section 8 of the GST Act that the taxes be levied on all intra-State supplies of goods and/or services but the rate of tax shall not be exceeding 14%, each.

- Integrated GST: IGST is a tax levied on all inter-State supplies of goods and/or services and is governed by the IGST Act.

- It is applicable to any supply of goods and/or services in both cases of import into and export from India.

Provisions For Platform Workers

Why in News

The Code on Social Security, 2020, for the first time in Indian law, attempted to define ‘platform work’ outside of the traditional employment category.

Background

- Labour falls under the Concurrent List of the Constitution. Recently, the Parliament passed three labour codes — on industrial relations; occupational safety, health and working conditions; and social security — proposing to simplify the country’s archaic labour laws and give impetus to economic activity without compromising with the workers’ benefits.

- These labour codes can have a transformative impact on labour relations in India. Along with the ‘Code on Wages Act- 2019’, these can significantly ease the conduct of business by amalgamating a plethora of Central and State laws on labour.

- Code on Social Security , 2020 has the following provisions:

- This will replace nine social security laws, including Maternity Benefit Act, Employees’ Provident Fund Act, Employees’ Pension Scheme, Employees’ Compensation Act, among others.

- The code universalizes social security coverage to those working in the unorganised sector, such as migrant workers, gig workers and platform workers.

- Aggregators, meaning “digital intermediaries or a market place for a buyer or users of a service to connect with the seller or the service provider”, are specifically required to contribute to the social security fund.

- For the first time, provisions of social security will also be extended to agricultural workers also.

- The code also reduces the time limit for receiving gratuity payment from the continuous service of five years to one year for all kinds of employees, including fixed-term employees, contract labour, daily and monthly wage workers.

Key Points

- Platform Work (as defined by the Code): Platform work means a work arrangement outside of a traditional employer-employee relationship in which organisations or individuals use an online platform to access other organisations or individuals to solve specific problems or to provide specific services or any such other activities which may be notified by the Central Government, in exchange for payment.

- Significance of Platform Work:

- Platform work promises workers flexibility and ownership over delivery of work.

- Important for delivery of essential services as seen during pandemic.

- Employment Intensive Sector.

- Potential Sector for growth due to fast pace of Urbanisation.

- Development of rural areas due to remittances sent by platform workers.

- Issues in the sector:

- Though platform work promises workers flexibility and ownership over delivery of work, they are still largely dictated by mechanisms of control wired by the algorithm. This affects pricing per unit of work, allocation of work, and hours.

- Entry into on-such platform work like ride sharing and food delivery requires vehicular assets which an average Indian worker lacks. Thus, to enter the platform economy, workers rely on intensive loan schemes, often facilitated by platform aggregator companies. This results in dependence on platform companies, driven by financial obligations, thus rendering flexibility and ownership.

- Leads to contractualisation of the workforce and promotes the Gig economy.

- Gig Economy is a free market system in which temporary positions are common and organizations hire independent workers for short-term commitments. The term "gig" is a slang word for a job that lasts a specified period of time.

- A company engaging in greater contractualisation often has a higher turnover rate of personnel, creating a disruptive operational environment and leading to higher costs of training and higher incidence in costs of errors.

Way Forward

- Adopting International best practices- Ontario and California have shown a move towards granting employee status to platform workers, thus guaranteeing minimum wage and welfare benefits.

- Further, the government needs to ensure easy availability of credit to platform workers.

Dairy Production in Indus Valley Civilisation

Why in News

Recently, a study by Indian and Canadian archaeologists has found that dairy products were being produced by the Harappans as far back as 2500 BCE. The finding reveals the earliest evidence of dairy production.

- The year 2020 also marks 100 years of discovery of Indus Valley Civilisation.

Key Points

- Milk Production:

- The results of the study are based on molecular chemical analysis of residue in shards of pottery found at the archaeological site of Kotada Bhadli, in Gujarat.

- Traces seen in cooking vessels indicate the presence of milk, which may have been boiled for consumption. There are also remains of a perforated vessel, which indicates processing of milk into different forms.

- Pots are porous and absorb liquid from food. This helps the pots to preserve the molecules of food such as fats and proteins.

- Using techniques like C16 and C18 analysis the source of foods can be identified.

- The large herd indicates that milk was produced in surplus so that it could be exchanged and there could have been some kind of trade between settlements.

- This could have also given rise to an industrial level of dairy production.

- Types of Animals:

- Through a process called stable isotope analysis, the researchers were also able to identify that cattles used for dairy production.

- Most of the cattle and water-buffalo died at an older age, suggesting they could have been raised for milk, whereas the majority of goat/sheep died when they were young, indicating they could have been used for meat.

- Through a process called stable isotope analysis, the researchers were also able to identify that cattles used for dairy production.

- Faceless Civilisation:

- The Indus Valley Civilisation was faceless — no king, no bureaucratic organisations, but there were very close regional interactions between settlements, a symbiotic relationship of give and take that helped the civilisation survive for so long.

- Background:

- Indus Valley Civilisation is known for its metropolitan cities and the big towns, great urban planning, trading systems, jewellery making.

- Earlier, there was no idea how the common people were living during the Harappan times, and how they were contributing to the larger network.

- However, the new study throws fresh light on the rural economy of the Indus Valley Civilisation.

Indus Valley Civilization

- The history of India begins with the birth of the Indus Valley Civilization (IVC), also known as Harappan Civilization.

- It flourished around 2,500 BC, in the western part of South Asia, in contemporary Pakistan and Western India.

- The Indus Valley was home to the largest of the four ancient urban civilizations of Egypt, Mesopotamia, India and China.

- In the 1920s, the Archaeological Department of India carried out excavations in the Indus valley wherein the ruins of the two old cities, viz. Mohenjodaro and Harappa were unearthed.

- In 1924, John Marshall, Director-General of the ASI, announced the discovery of a new civilisation in the Indus valley to the world.

| Important Sites of IVC | |||

| Site | Excavated by | Location | Important Findings |

| Harappa | Daya Ram Sahni in 1921 | Bank of river Ravi in Montgomery district of Punjab (Pakistan) |

|

| Mohenjo-Daro (Mound of Dead) | R.D. Banerjee in 1922 | Bank of river Indus in Larkana district of Punjab (Pakistan) |

|

| Sutkagendor | Stein in 1929 | In southwestern Balochistan province, Pakistan on Dast river |

|

| Chanhudaro | N.G. Majumdar in 1931 | Sindh on the Indus river |

|

| Amri | N.G. Majumdar in 1935 | On the bank of Indus river |

|

| Kalibangan | Ghose in 1953 | Rajasthan on the bank of Ghaggar river |

|

| Lothal | R. Rao in 1953 | Gujarat on Bhogva river near Gulf of Cambay |

|

| Surkotada | J.P. Joshi in 1964 | Gujarat |

|

| Banawali | R.S. Bisht in 1974 | Hisar district of Haryana |

|

| Dholavira | R.S Bisht in 1985 | Gujarat in Rann of Kachchh |

|

Rising Cybercrimes

Why in News

The Ministry of Home Affairs (MHA) has written to all States to examine and register First Information Reports (FIRs) based on the complaints received on National Cybercrime Reporting Portal (www.cybercrime.gov.in).

Key Points

- Low Conversion Rates: As per Ministry of Home Affairs, only 2.5% of total complaints registered on the portal are converted into FIRs.

- Cyber Crime Volunteers: Through the portal, the Government seeks to promote Cyber Crime Volunteers for identifying, reporting and removal of illegal/unlawful online content.

- Increase in Cases: According to the National Crime Records Bureau (NCRB), the number of registered cyber crimes increased by 63.5% in the year 2019 compared to 2018.

- Benefits:

- Help in curbing rising cyber frauds ,cyber bullying,child pornography etc.

- In consonance with the Digital India drive of the government as with rising digital footprint cyber crimes are bound to rise.

- Massive Digitalisation in the post-covid world in the sectors of education , health etc highlights the importance of cyber governance initiatives such as this.

National Cyber Crime Reporting Portal

- Launched in 2019, it is a citizen-centric initiative enabling citizens to report cybercrimes online.

- The portal specifically focuses on crimes against women, children, particularly child pornography, child sex abuse material, online content pertaining to rapes/gang rapes, etc.

- It also focuses on crimes like financial crime and social media related crimes like stalking, cyberbullying, etc.

- It will improve the capacity of law enforcement agencies to investigate the cases after successful completion by improving coordination amongst the law enforcement agencies of different States, districts and police stations.

Budapest Convention

- The Council of Europe’s (CoE) Cybercrime Convention, also known as the Budapest Convention is the sole legally binding international multilateral treaty on cybercrime. It coordinates cybercrime investigations between nation-states and criminalizes certain cybercrime conduct.

- It was open for signature in 2001 and came into force in 2004.

- The Budapest Convention is supplemented by a Protocol on Xenophobia and Racism committed through computer systems.

- India is not a party to it. India recently voted in favour of a Russian-led UN resolution to set up a separate convention. The resolution seeks to set up new cyber norms considered as a counter alternative to the US backed Budapest Accord.

Recent Initiatives to Tackle Cybercrime

- Indian Cyber Crime Coordination Centre (I4C): The I4C will assist in centralising cyber security investigations, prioritise the development of response tools and bring together private companies to contain the menace.

- Draft Personal Data Protection Bill, 2018 (based on the recommendation of Justice BN Srikrishna Committee) to secure citizens data.

- Cyber Swachhta Kendra: The "Cyber Swachhta Kendra" (Botnet Cleaning and Malware Analysis Centre) is a part of the Government of India's Digital India initiative under the Ministry of Electronics and Information Technology (MeitY).

- Indian Computer Emergency Response Team (CERT-IN): It is an organisation of the Ministry of Electronics and Information Technology, Government of India, with the objective of securing Indian cyberspace. It is the nodal agency which deals with cybersecurity threats like hacking and phishing.

Asteroid 16 Psyche

Why in News

A recent study at National Aeronautics and Space Administration (NASA) has found out that asteroid 16 Psyche, which orbits between Mars and Jupiter, could be made entirely of metal and is worth an estimated 10,000 quadrillion US dollars.

Key Points

- About Asteroid 16 Psyche:

- Asteroid 16 Psyche is located 370 million kilometers away from earth between Mars and Jupiter and has a diameter of 140 miles.

- It was discovered in the year 1853 by the Italian astronomer Annibale de Gaspard and was named after the ancient Greek goddess of the soul, Psyche.

- Unlike most asteroids that are made up of rocks or ice, scientists believe that Psyche is a dense and largely metallic object thought to be the core of an earlier planet that failed formation.

- Psyche’s shape is like a potato which takes about five earth years to complete one orbit of the sun but only a bit over 4 hours to rotate once on its axis.

- Latest Findings:

- The latest study through the Hubble Space Telescope and ultraviolet observation gives a clearer picture of Psyche’s composition.

- The Hubble Space Telescope was launched into low Earth orbit in 1990 and remains in operation.

- It was found that Psyche could be a unique asteroid composed of iron and nickel almost completely which is similar to earth's core. The iron alone would be worth more than 10,000 quadrillion US dollars.

- Scientists noted that the manner in which Psyche reflected ultraviolet light was very similar to the way iron reflects sunlight.

- The latest study through the Hubble Space Telescope and ultraviolet observation gives a clearer picture of Psyche’s composition.

- NASA’s Psyche mission:

- The primary target of the Psyche mission to be launched in 2022 by NASA is to study this asteroid completely and confirm the assumptions being made by the scientists.

- Psyche mission will be the first mission to investigate this metallic asteroid. Psyche spacecraft will land on the asteroid in early 2026.

- As the composition of Psyche is very similar to earth’s own core, its study will also give an insight to earth’s violent history of collisions and accretion that created it.

Pre-Matric Scholarship Scheme

Why in News

A recent investigation has found that the money meant for poor students under the Pre-Matric Scholarship Scheme in Jharkhand has been siphoned off and is not reaching the students.

Key Points

- About the Scheme:

- It is a centrally funded scholarship scheme for students in all states, which opens every year and has to be applied between August and November.

- Aim: To help students of minority communities viz. Muslims, Christians, Sikhs, Parsis, Jains and Buddhists from families with annual income below Rs. 1 lakh.

- Eligibility: Students need to score at least 50% in their class exams.

- Structure of the Scholarship: It is given in two tiers every year to:

- Students in class 1 to 5: Rs. 1,000 per year.

- Students of class 6 to 10: Rs. 10,700 if a hosteller or Rs 5,700 if a day scholar.

- Application Process:

- Eligible students need to register at the National Scholarship Portal (NSP) and submit educational documents, bank account details and Aadhaar numbers among other documents.

- The scheme is online and one can apply for a fresh or renewal scholarship on the NSP or through a mobile application of NSP.

- Suggestions for Improvement:

- The government is planning to bring a single national scholarship scheme by merging all the current scholarship schemes.

- The move came after a multi-crore scam was reported in the post-matric scholarship scheme for Scheduled Castes (SC) in Punjab in August 2020.

- The government is planning to bring a single national scholarship scheme by merging all the current scholarship schemes.

National Scholarship Portal

- It is a “one-stop” solution through which various services, starting from student application, application receipt, verification, processing, and disbursal of various scholarships to students are facilitated.

- It is taken as Mission Mode Project (MMP) under Digital India and aims at providing a simplified, accountable, responsive and transparent system for faster and effective disbursal of scholarship to eligible applicants directly into their account through Direct Benefit Transfer (DBT) without any leakages.

Typhoon Goni

Why in News

Recently, Typhoon Goni has made landfall in the eastern Philippines.

- The Philippines is used to powerful storms - it is hit by an average of 20 storms and typhoons a year.

Key Points

- Goni - known as Rolly in the Philippines - is the most powerful storm to hit the country since Typhoon Haiyan killed more than 6,000 people in 2013.

- In fact, Typhoon Goni is the world’s strongest Typhoon in 2020.

- Last week, the Philippines was hit by Typhoon Molave.

- Another storm, Atsani, is gaining strength in the Pacific Ocean as it approaches the Philippines.

- Typhoon is a regionally specific name for a strong "tropical cyclone".

- Tropical cyclones are known as ‘typhoons’ in the northwest pacific ocean, hurricanes in the North Atlantic Ocean, Willy-willies in north-western Australia and Tropical Cyclones in the Indian Ocean Region.

- A tropical cyclone is a generic term used by meteorologists to describe a rotating, organized system of clouds and thunderstorms that originates over tropical or subtropical waters and has closed, low-level circulation.

- Tropical cyclones rotate counterclockwise in the Northern Hemisphere.

- These are measured by the Saffir-Simpson Hurricane Wind Scale.

- Naming of Typhoons: The Regional Specialized Meteorological Centre (RSMC) Tokyo - Typhoon Centre assigns a tropical cyclone a name from the five lists. The name ‘Goni’ is contributed by South Korea.