PRS Capsule - January 2024 | 23 Feb 2024

Key Highlights of PRS

- Governance and Social Justice

- Budget Session 2024 begins

- President’s Address highlights the achievements of the government

- Comments invited on Draft Indian Stamp Bill, 2023

- Guidelines for the regulation of coaching centres released

- Guidelines constituting a Centre for Literacy in each State/UT released

- Cabinet approves a scheme to promote coal/lignite gasification projects

- Mining Rules amendments in relation to the grant of exploration licence notified

- Rules amended to mandate cost reflective tariff and cap open access charges

- Economy

- The Ministry of Finance allows the direct listing of securities by Indian companies on international exchanges

- RBI issues directions for the management of foreign exchange risk

- RBI releases report of the working group on state government guarantees

- RBI issues draft framework for self-regulatory organizations in the fintech sector

- RBI issues draft circular for regulatory framework of housing finance companies

- SEBI seeks comments on recommendations to simplify compliance

- Comments invited on providing flexibility to liquidate investments for certain schemes

- Environment

- Guidelines for solar power for unelectrified households in tribal areas issued

- Cabinet approves overarching scheme PRITHVI for Ministry of Earth Sciences

- Draft rules for the management of end-of-life vehicles released

- Draft amendments to vehicle scrapping Rules released

Governance and Social Justice

Budget Session of Parliament

The Budget Session of Parliament commenced on January 31, 2024, and ended on February 9, 2024. This session had eight sitting days.

- Presidential Address:

- The President addressed both houses of the Parliament on January 31, 2024. She highlighted the achievements of the government and the challenges facing the nation.

- Interim Union Budget 2024-25:

- The interim Union Budget 2024- 25 was presented on February 1, 2024, by the Finance Minister. The budget will outline the estimated receipts and expenditures of the government for the next fiscal year.

- Bills for Introduction, Consideration, and Passing:

- Two Bills have been listed for introduction, consideration and passing:

- The Water (Prevention and Control of Pollution) Amendment Bill, 2024, which aims to strengthen the enforcement and compliance of the water pollution norms and penalties.

- The Public Examination (Prevention of Unfair Means) Bill, 2024, which seeks to prohibit and punish the use of unfair means in public examinations and ensure the credibility and quality of education.

- Two Bills have been listed for introduction, consideration and passing:

President’s Address Highlights Achievements of the Government

The President of India delivered her address to a joint session of both Houses of Parliament on January 31, 2024. She highlighted the achievements of the government in various sectors and the challenges ahead. Some of the key points from her address are:

- Economic Growth and Stability

- India has emerged as the fastest-growing major economy amidst a serious global crisis and has maintained a growth rate of over 7.5% for two consecutive quarters.

- Inflation was over 8% in the 10 years prior to 2014 while in the past decade, it has been at 5%.

- Industrial Development and Ease of Doing Business

- Startups have grown from a few hundred to more than four lakh today.

- More than 40,000 compliances have been removed or simplified to enable ease of doing business.

- Infrastructure and Transport Expansion

- In 10 years, capital expenditure has increased five times to Rs 10 lakh crore.

- National highway length has increased from 90,000 km to 1.46 lakh km. Four-lane highways have increased 2.5 times in length.

- Energy Transition and Climate Action

- In 10 years, non-fossil fuel-based energy capacity has increased from 81 gigawatts to 188 gigawatts.

- India has targeted to achieve 50% installed capacity from non-fossil fuels by 2030.

- Education Quality and Access

- The government is working on more than 14,000 PM SHRI schools to provide quality education. Out of these, about 6,000 have started functioning.

- Space Exploration and Innovation

- India launched the Aditya Mission. The satellite reached 15 lakh km away from Earth.

- India has become the first country to hoist its flag on the southern pole of the Moon.

Comments Invited on Draft Indian Stamp Bill, 2023

The Ministry of Finance issued the draft Indian Stamp Bill, 2023, inviting public feedback, to replace the Indian Stamp Act, of 1899.

- The draft Bill retains several provisions of the Act, including the levy of stamp duty on instruments like affidavits, bills of exchange, and bonds, with key changes introduced.

- Duty for certain instruments to be as per market value: A duty must be paid based on market value for instruments like lease agreements and bonds, as proposed in the draft Bill, extending to transactions like renewing mining leases or transferring interests in estates.

- Exemptions: The Act exempts ship sale and transfer instruments from stamp duty, but the draft Bill extends this exemption to include instruments executed by or for developers or units in Special Economic Zones (SEZs), where developers are individuals or state governments authorized by the central government, and units are established by entrepreneurs within an SEZ.

- The Act exempts stamp duty on beneficial ownership transfers of securities and mutual fund units but the draft Bill removes this exemption, while still exempting registered ownership transfers between a person and a depository and strategic sales or disinvestment of government property to another government.

- Collection of duties by private entities: Private entities, such as stock exchanges, depositories, and authorized clearing corporations, will collect and deduct a percentage of stamp duty as a facilitation charge before transferring it to the state government, as per the draft Bill.

- Undervaluation of instruments: If an instrument is deemed undervalued, the District Collector will set its correct value, with appeals possible to the Chief Controlling Revenue Authority.

Guidelines for the Regulation of Coaching Centres Released

Ministry of Education's guidelines regulates coaching centres with standards for teaching, infrastructure, and registration, sent to states for consideration. Key features of the guidelines include:

- Registration: Coaching centres must register with the state-appointed officer, treating each branch as a separate entity, requiring individual registration renewal before expiry.

- Conditions for registration: Coaching centres must meet criteria, including hiring graduate tutors, not enrolling pre-Class 10 students, and avoiding misleading rank promises, to register, submitting a compliance statement.

- Fees: Fees for each course must be fair, stable, and refundable proportionately if a student leaves mid-course; all fee, facility, and lecture information must be freely provided and prominently displayed.

- Classes: Coaching centres must offer students a weekly day off, breaks for regional festivals, and limit daily classes to five hours without conflicting with school/college schedules.

- Infrastructure: Coaching classes need at least 1 sqm per student per batch, with full electrification, ventilation, and amenities like water and first-aid.

Guidelines Constituting a Centre for Literacy in Each State/UT Released

The Ministry of Education issued guidelines for State Centres for Literacy to set learning outcomes for adult education at State/UT levels, complementing the National Centre for Literacy's work on a national curriculum framework. Key features of the guidelines include:

- Composition: The State Council of Educational Research and Training(SCERT) will establish the State Centre for Literacy (SCL) with ex-officio members including SCERT Director (Chairman), a SCERT Professor (in-charge), and two SCERT faculties, along with members from higher education institutions and local NGOs.

- Curriculum: The State Centre for Literacy to adopt a national curriculum framework for adult education, outlining outcomes for foundational literacy, numeracy, critical life skills, vocational skills, basic education, and continuing education under the New India Literacy Programme.

- The State Centre for Literacy will create training manuals, design teaching material, and develop activity modules aligned with the curriculum.

- Budgetary support: State/UT administration will primarily fund and monitor SCL setup and operations.

Cabinet Approves a Scheme to Promote Coal/Lignite Gasification Projects

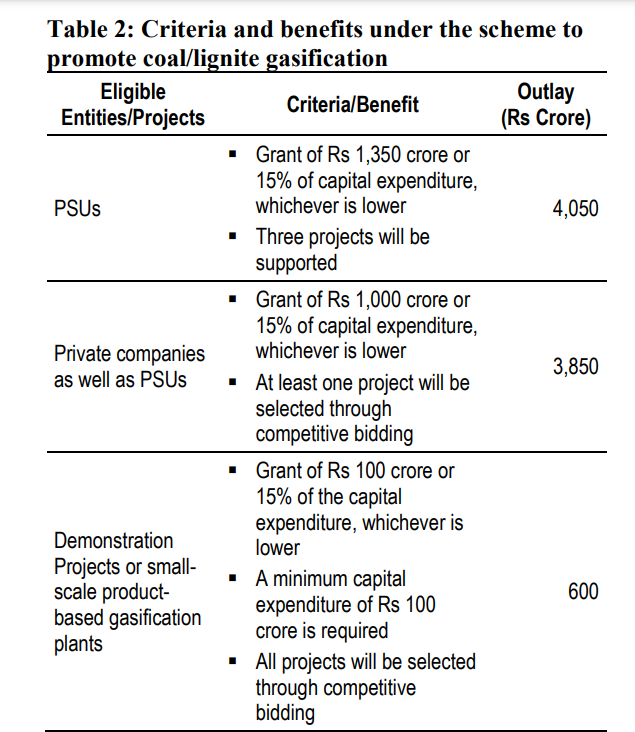

Union Cabinet approved a scheme promoting coal/lignite gasification projects with Rs 8,500 crore outlay, offering grants for three categories.

Mining Rules Amendments to Grant of Exploration Licence Notified

The Ministry of Mines amended the Mineral (Auction) Rules, 2015, framed under the Mines and Minerals (Development and Regulation) Act, 1957, which regulates India's mining sector, specifying the auction procedure for mines. Key features of the amended Rules include:

- Auction of exploration license: The 1957 Act was amended in 2023 to introduce an exploration license for specified minerals, including lithium, cobalt, silver, and gold, allowing reconnaissance or prospecting activities to determine and prove mineral deposits.

- The exploration licensee gets a share in the auction premium from the future lessee of the mining lease for the explored area, payable for up to fifty years or until resource depletion, whichever is sooner.

- The revised rules allow the state government to auction exploration licenses, requiring applicants to submit geoscience data for proposed areas.

- Bidding parameters: State government sets ceiling price for exploration license auction, expressed as a maximum percentage share in auction premium, bidders quote equal or lower price, minimum quoted price wins.

- Performance security: Licensee must provide performance security, which may be used for specified cases: non-adherence to the scheme, non-disclosure of data, data discrepancies, or contravention of rules or conditions.

Rules Amended to Mandate Cost Reflective Tariff and Cap Open Access Charges

The Ministry of Power amended the Electricity Rules, 2005, framed under the Electricity Act, 2003, which regulates the power sector. Key features of the amendments include:

- Tariffs must be cost-reflective: Amended Rules mandate cost-reflective tariffs, allowing lower tariffs only for natural calamities, with a 3% gap limit recoverable in three years and existing gaps in seven years.

- Additional surcharge for open access: Open access users under 2005 Rules may face a surcharge, capped below the discom's per unit fixed cost, to be phased out within four years if they are or were discom consumers.

- Charges on using state network capped: Short-term network access charges for general users are limited to 110% of long-term rates; users <11 months are termed temporary.

- License removed for dedicated transmission lines: Certain entities, including generating companies, captive generating plants, and energy storage systems, will not need a license for dedicated transmission lines connecting them to transmission lines, sub-stations, or generating stations, along with consumers having minimum loads of 25 MW for inter-state and 10 MW for intra-state transmission, as per the amended Rules.

Economy

Direct Listing of Indian Companies on International Exchanges

The Ministry of Finance has enabled public Indian companies to list their securities on foreign exchanges. This is expected to enhance their global visibility and access to capital. The Ministry has issued new rules to regulate this process and ensure compliance with the foreign exchange laws.

- Foreign Exchange Management (Non-debt Instruments) Amendment Rules, 2024: The Ministry has notified the Foreign Exchange Management (Non-debt Instruments) Amendment Rules, 2024, which amend the Foreign Exchange Management (Non-debt Instruments) Rules, 2019. These rules specify the conditions and criteria for direct listing of Indian companies on permitted international exchanges.

- Conditions for Direct Listing: The amendment allows public Indian companies to issue equity shares on international exchanges subject to certain conditions. These include:

- Citizens or entities from countries that share a land border with India can hold shares of such companies only with the approval of the central government.

- Public Indian companies or existing shareholders may issue equity shares on international exchanges based on certain criteria. These include:

- the company, its directors, or directors are not debarred from accessing the capital market,

- the company, promoters, or directors are not wilful defaulters, and

- promoters or directors are not fugitive economic offenders.

- Conditions for Direct Listing: The amendment allows public Indian companies to issue equity shares on international exchanges subject to certain conditions. These include:

RBI Issues Directions for the Management of Foreign Exchange Risk

The Reserve Bank of India (RBI) has issued revised directions for the management of foreign exchange risk:

- A platform for offering hedging products: Foreign exchange contracts available via over-the-counter(OTC) or recognized stock exchanges; OTC transactions occur off-exchange platforms.

- Classification of users: Over-the-counter foreign exchange derivative contract users are categorized as retail and non-retail; the latter includes insurance companies, pension funds, mutual funds, and residents with high net worth or turnover.

- Products offered by stock exchanges: Indian stock exchanges can offer foreign exchange derivatives for hedging rupee exposure, with no restrictions on non-rupee contracts.

RBI Releases Report of the Working Group on State Government Guarantees

Reserve Bank of India (RBI) released a report on state government guarantees, highlighting their fiscal risks. Key recommendations include:

- Definition of guarantees: The working group suggested no distinction in types of guarantees for calculating total extended amounts, encompassing all instruments obligating issuer payments for the borrower, regardless of condition.

- Ceiling on guarantees: The report advised limiting annual incremental guarantees to 5% of revenue receipts or 0.5% of Gross State Domestic Product (GSDP), whichever is lower.

- Guidelines for guarantee policy: State governments must adhere to central government guidelines on guarantee policies, limiting guarantees to principal and interest, excluding external commercial borrowings, capping guarantee amounts at 80% of project loans, and avoiding guarantees for private entities' loans.

- Risk categorization: States should categorize projects as high, medium, or low risk and assign risk weights based on past default records for guarantee extensions.

RBI Issued a Draft for Self-Regulatory Organizations in FinTech

To enhance standards & practices, saving time & costs Reserve Bank of India (RBI) issues a draft framework for self-regulatory organizations in the fintech sector. Key proposals include:

- Features of the SRO: The Self-Regulatory Organizations(SRO), overseen by RBI, should objectively promote sector sustainability, establish compliance plans, ensure broad sector representation, operate independently, arbitrate disputes, and encourage member participation.

- Membership criteria: The SRO should have a diverse membership representing entities of all sizes, stages, and activities, with voluntary participation encouraged by the RBI for FinTechs.

- Functions: SROs should maintain objective, consultative rule-making, set industry benchmarks, deploy surveillance, and establish grievance redressal frameworks.

RBI Issues Draft Circular for Regulatory Framework of Housing Finance Companies

Reserve Bank of India (RBI) issued a draft circular to update regulations for Housing Finance Companies (HFCs), which are Non-Banking Financial Companies (NBFCs) primarily offering housing loans. Key features include the following:

- Maintenance of liquid assets: Deposit-taking HFCs must maintain 13% of liquid assets against public deposits, with the Reserve Bank of India (RBI) proposing an increase to 15% by March 31, 2025.

- Credit rating of HFCs: Housing Finance Companies (HFCs) must maintain an investment grade credit rating to accept public deposits, renewing or accepting new deposits only when this rating is met.

- Finalization of accounts: HFCs need to finalize financial statements by March 31, with RBI requiring balance sheets to be completed within three months of the relevant date, requiring National Housing Bank(NHB) approval for extensions before approaching the Registrar of Companies(RoC).

SEBI Seeks Comments on Recommendations to Simplify Compliance

Securities and Exchange Board of India(SEBI) seeks feedback on the expert group's interim recommendations for simplifying compliance with SEBI Regulations, focusing on ease of doing business. Key recommendations include:

- Calculation of market capitalization: SEBI mandates additional requirements for listed entities with market capitalization beyond a threshold, such as having a female independent director, a Risk Management Committee, and a dividend distribution policy; considering a shift from using March 31 to a six-month average for compliance assessment.

- Committee memberships by directors: Directors are limited to 10 committee memberships and 5 chair positions across listed entities only.

- Minimum promoters’ contribution: Promoters must hold a minimum of 20% of shares post-listing, excluding shares from convertible securities acquired within a year prior to prospectus filing.

- The Committee suggests considering compulsorily convertible securities for minimum holding if held for at least a year before prospectus filing.

Comments Invited on Providing Flexibility to Liquidate Investments for Certain Schemes

The securities and Exchange Board of India(SEBI) consultation paper suggests giving Alternative Investment Funds(AIFs) and Venture Capital Funds(VCFs) have flexibility with unliquidated investments, as they must liquidate investments after their tenure, per SEBI regulations. Issues for consideration include the following:

- Requirement of a liquidation scheme: AIFs can initiate a dissolution process to liquidate investments post their tenure, requiring 75% investor consent, instead of launching a liquidation scheme, to save time and costs.

- Extension of dissolution process to VCFs: VCFs were initially regulated by SEBI in 1996, then brought under AIF Regulations, but existing VCFs remain under old regulations until they migrate to AIF Regulations within six months of notification.

- One-time flexibility scheme: AIFs past the June 15, 2023, liquidation period may get a one-time flexibility for full liquidation, dissolution, or in-specie distribution.

ENVIRONMENT

Guidelines For Solar Power for Unelectrified Households In Tribal Areas Issued

Ministry of New and Renewable Energy issued guidelines for implementing a solar power scheme under PM-JANMAN, providing off-grid solar power and lighting to vulnerable tribal groups in 18 states, with a Rs 515 crore budget over three years, to be implemented by discoms. Key features of the guidelines are as follows:

- Electrification of individual households: Central government to fund off-grid solar power systems with appliances for tribal households, to be operational within three months of tender award by Discoms.

- Mini-grid for a cluster of households: Clustered households may opt for a mini-grid with provided appliances, eligible for power draw and future main grid connection, with a central subsidy of up to Rs 50,000 per household.

- Solarising multi-purpose centers: Electrification of multi-purpose centers via off-grid solar, with central government providing one lakh rupees per center; grids must be operational within nine months of tender award.

- Inspection and monitoring: Implementing agencies conduct inspections for two years, then a third party takes over; Ministries monitor electrification indicators.

Cabinet Approves Overarching Scheme PRITHVI for Ministry of Earth Sciences

The Union Cabinet approved PRITHvi Vigyan (PRITHVI), an umbrella scheme including five sub-schemes for climate research, polar science, seismology, education, and outreach under the Ministry of Earth Sciences.

- The Scheme is to be implemented from 2021 to 2026, at an overall cost of Rs 4,797 crore.

- PRITHVI scheme seeks to:

- to enhance long-term observations of the atmosphere, ocean, and solid earth.

- It seeks to develop model systems for predicting weather and climate hazards.

- The scheme includes exploring polar and high seas regions.

- It focuses on developing technology for sustainable harnessing of oceanic resources.

Draft Rules for the Management of End-Of-Life Vehicles Released

The Ministry of Environment, Forest and Climate Change released the Draft End-of-Life Vehicles (Management) Rules, 2024, outlining responsibilities for consumers and producers under the Environment (Protection) Act, 1986, for vehicles that are no longer registered, declared unfit, or canceled.

- Recycling targets for producers: Vehicle producers must meet set recycling targets by purchasing Extended Producer's Responsibility(EPR) certificates indicating the weight of steel recycled from end-of-life vehicles, with separate targets for private and commercial vehicles for different periods.

- Responsibilities of vehicle owners: End-of-life vehicles must be deposited at a scrapping facility within six months, and owners need a certificate to validate this.

- Responsibilities of bulk consumers: Bulk consumers, owning over 100 vehicles, must ensure their end-of-life vehicles are deposited at registered scrapping facilities, and file annual fleet and end-of-life vehicle returns.

- Responsibilities of testing stations: Automated Testing Stations must declare vehicles as end-of-life if they fail the fitness test, maintaining records linked to a portal managed by the Central Pollution Control Board.

Draft Amendments to Vehicle Scrapping Rules Released

The Ministry of Road Transport and Highways issued draft amendments to the Central Motor Vehicles Rules, 2021 for scrapping end-of-life vehicles under the Motor Vehicles Act, 1988.

- Key features of the Draft Amendments are:

- Obtaining consent to establish: The 2021 Rules require obtaining consent from the state/UT registering authority for a vehicle scrapping facility, while the draft amendment suggests the Pollution Control Board will grant consent instead.

- Obtaining consent to operate: Scrap facilities under 2021 rules need state approval within six months; draft amendment requires consent application at least 60 days prior to operation.

- Transfer of registration: The 2021 Rules prohibit the transfer of scrapping facility registration, but the draft amendment permits it.

- Certificate of deposit: The scrapping facility issues a Certificate of Deposit acknowledging vehicle ownership transfer, mandatory for incentives, electronically tradeable, with extended validity to three years, but excludes government-owned or impounded vehicles, which are not electronically tradeable.