Carbon Border Adjustment Mechanism

For Prelims: EU, Carbon Trade, Carbon Emission, ETS, Green Energy, Decarbonization.

For Mains: Carbon Border Adjustment Mechanism and its Implication on India.

Why in News?

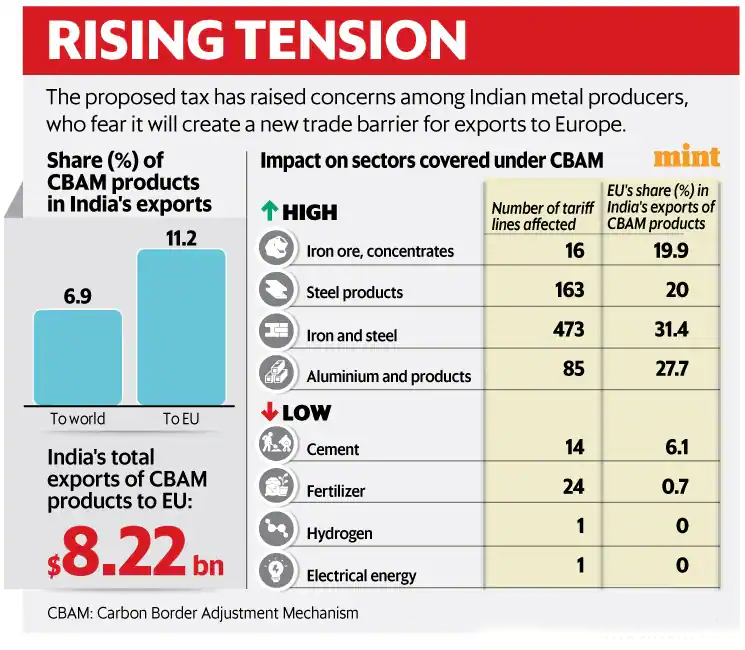

The European Union (EU) has announced that its Carbon Border Adjustment Mechanism (CBAM) will be introduced in its transitional phase from October 2023, which will levy a carbon tax on imports of products made from the processes which are not Environmentally sustainable or non-Green.

- CBAM will translate into a 20-35 % tax on select imports into the EU starting 1st January 2026.

What is CBAM?

- About:

- CBAM is part of the “Fit for 55 in 2030 package", which is the EU’s plan to reduce greenhouse gas emissions by at least 55% by 2030 compared to 1990 levels in line with the European Climate Law.

- The CBAM is a policy tool aimed at reducing Carbon Emissions by ensuring that imported goods are subject to the same carbon costs as products produced within the EU.

- Implementation:

- The CBAM will be implemented by requiring importers to declare the quantity of goods imported into the EU and their embedded Greenhouse Gas (GHG) emissions on an annual basis.

- To offset these emissions, importers will need to surrender a corresponding number of CBAM certificates, the price of which will be based on the weekly average auction price of EU Emission Trading System (ETS) allowances in €/tonne of CO2 emitted.

- Objectives:

- CBAM will ensure its climate objectives are not undermined by carbon-intensive imports and spur cleaner production in the rest of the world.

- Significance:

- It can encourage non-EU countries to adopt more stringent environmental regulations, which would reduce global carbon emissions.

- It can prevent carbon leakage by discouraging companies from relocating to countries with weaker environmental regulations.

- The revenue generated from CBAM will be used to support EU climate policies, which can be learned by other countries to support Green Energy.

How can it Impact India?

- Impact India’s Export:

- It will have an adverse impact on India's exports of metals such as Iron, Steel and aluminum products to the EU, because these will face extra scrutiny under the mechanism.

- India's major exports to the EU, such as iron ore and steel, face a significant threat due to the carbon levies ranging from 19.8% to 52.7%.

- From 1st January 2026, the EU will start collecting the carbon tax on each consignment of steel, aluminum, cement, fertilizer, hydrogen and electricity.

- Carbon Intensity and Higher Tariffs:

- The carbon intensity of Indian products is significantly higher than that of the EU and many other countries because coal dominates the overall energy consumption.

- The proportion of coal-fired power in India is close to 75%, which is much higher than the EU (15%) and the global average (36%).

- Therefore, direct and indirect emissions from iron and steel and aluminium are a major concern for India as higher emissions would translate to higher carbon tariffs to be paid to the EU.

- The carbon intensity of Indian products is significantly higher than that of the EU and many other countries because coal dominates the overall energy consumption.

- Risk to Export Competitiveness:

- It will initially affect a few sectors but may expand to other sectors in the future, such as refined petroleum products, organic chemicals, pharma medicaments, and textiles, which are among the top 20 goods imported from India by the EU.

- Since India has no domestic carbon pricing scheme in place, this poses a greater risk to export competitiveness, as other countries with a carbon pricing system in place might have to pay less carbon tax or get exemptions.

What Measures can India Take to Mitigate the Impact of CBAM?

- Decarbonization Principle:

- On the domestic front, the government has schemes like National Steel Policy, and the Production Linked Incentive (PLI) scheme aims to increase India’s production capacity, but carbon efficiency has been out of the objectives of such schemes.

- The government can complement these schemes with a Decarbonization Principle.

- Decarbonization refers to the process of reducing or eliminating greenhouse gas emissions, especially carbon dioxide (CO2), from human activities such as transportation, power generation, manufacturing, and agriculture.

- Negotiation with EU for Tax Reduction:

- India could negotiate with the EU to recognize its energy taxes as equivalent to a carbon price, which would make its exports less susceptible to CBAM.

- For example, India could argue that its tax on coal is a measure to internalize the costs of carbon emissions, and therefore equivalent to a carbon tax.

- Transfer of Clean Technologies:

- India should negotiate with the EU to transfer clean technologies and financing mechanisms to aid in making India’s production sector more carbon efficient.

- One way to finance this is to propose to the EU to set aside a portion of their CBAM revenue for supporting India’s climate commitments.

- Besides, India should also begin preparing for the new system just as China and Russia are doing by establishing a Carbon Trading System.

- India should negotiate with the EU to transfer clean technologies and financing mechanisms to aid in making India’s production sector more carbon efficient.

- Incentivizing Greener Production:

- India can begin preparations and in fact, seize the opportunity to make production greener and sustainable by incentivizing cleaner production which will benefit India in both remaining competitive in a more carbon-conscious future.

- International economic system and achieving its 2070 Net Zero Targets without compromising on its developmental goals and economic aspirations.

- Take on EU’s Tax Framework:

- India, as the leader of the G-20 2023, should use its position to advocate for other countries and urge them to oppose the EU's carbon tax framework.

- India should not only focus on its own interests but also consider the negative impact that the CBAM will have on poorer countries that heavily rely on mineral resources.

Conclusion

- The CBAM is a policy to reduce carbon emissions from imported goods and create a fair-trade environment.

- It can encourage other countries to have stricter environmental regulations and reduce global carbon emissions.

UPSC Civil Services Examination, Previous Year Question (PYQ)

Q1. Which of the following adopted a law on data protection and privacy for its citizens known as ‘General Data Protection Regulation’ in April, 2016 and started implementation of it from 25th May, 2018? (2019)

(a) Australia

(b) Canada

(c) The European Union

(d) The United States of America

Ans: (c)

Q2. ‘Broad-based Trade and Investment Agreement (BTIA)’ is sometimes seen in the news in the context of negotiations held between India and (2017)

(a) European Union

(b) Gulf Cooperation Council

(c) Organization for Economic Cooperation and Development

(d) Shanghai Cooperation Organization

Ans: (a)

Sludge Management

For Prelims: National Mission for Clean Ganga, Sludge, Arth Ganga project

For Mains: Sludge management in Indian sewage treatment plants, Potential uses of sludge as fertilizer and biofuel.

Why in News?

The sludge found in Indian sewage treatment plants (STPs) plays a significant role in the efforts to treat polluted water from the Ganga River. A recent study of this sludge revealed its potential for use as fertilizer and a potential biofuel.

- The National Mission for Clean Ganga, aimed at preventing pollution and rejuvenating the Ganga River, has introduced an emerging initiative called 'Arth Ganga' (economic value from Ganga).

- This initiative aims to derive livelihood opportunities from the river rejuvenation program and includes measures to monetize and reuse treated wastewater and sludge.

What is Sludge?

- About:

- Sludge is the thick residue generated during the treatment of wastewater or sewage in sewage treatment plants.

- It is the semi-solid material remaining after the liquid portion of the sewage has been separated and treated.

- The composition of sludge can vary depending on the source and treatment processes used.

- It typically contains organic compounds, nutrients (such as nitrogen and phosphorus), and microorganisms.

- However, sludge can also contain contaminants like heavy metals, industrial pollutants, and pathogens.

- Treatment and processing of sludge can yield organic fertilizers, biogas for energy production, or construction materials.

- Contaminants in sludge require careful handling to avoid negative impacts on water bodies and agricultural land.

- Classification of Treated Sludge:

- Sludge can be classified as class A or class B according to the standards of the United States Environment Protection Agency.

- Class A sludge is safe for open disposal and serves as organic fertilizer.

- Class B sludge can be used in restricted agricultural applications, with precautions to avoid exposure of edible parts of crops to sludge-mixed soil and to limit contact with animals and people.

- India does not have established standards for classifying sludge as class A or B.

- Sludge can be classified as class A or class B according to the standards of the United States Environment Protection Agency.

- State of Sludge in Indian STPs:

- Contractors under the Namami Ganga Mission are assigned land for sludge disposal.

- Inadequate treatment of sludge by these contractors leads to its release into rivers and local water sources during rainfall.

- Data on the chemical characteristics of sludge is essential to incentivize private players to treat and dispose of sludge properly.

- This study marks the first of its kind initiative in India, aimed at effectively addressing the issue of sludge disposal.

- Contractors under the Namami Ganga Mission are assigned land for sludge disposal.

What are the Findings from the Study?

- Findings:

- Most of the dried sludge analyzed falls into the class B category.

- Nitrogen and phosphorus levels exceed India's fertilizer standards, while potassium levels are lower than recommended.

- Total organic carbon content is higher than recommended, but heavy metal contamination and pathogen levels surpass fertilizer standards.

- Calorific value of sludge ranges from 1,000-3,500 kcal/kg, lower than that of Indian coal.

- Recommendations for Improving Sludge Quality:

- Storage of sludge for at least three months is recommended to kill pathogens.

- Blending sludge with cattle manure, husk, or local soil can reduce heavy metal content.

- These measures, however, would still categorize sludge as class B.

- Converting sludge into class A would require more extensive treatment.

What is the Arth Ganga Project?

- About:

- ‘Arth Ganga’ implies a sustainable development model with a focus on economic activities related to Ganga.

- Prime Minister of India first introduced the concept during the first National Ganga Council meeting in Kanpur in 2019, where he urged for a shift from Namami Gange to the model of Arth Ganga.

- Under Arth Ganga, the government is working on six verticals:

- The first is Zero Budget Natural Farming, which involves chemical-free farming on 10 km on either side of the river, and the promotion of cow dung as fertilizer through the Gobardhan scheme.

- The Monetization and Reuse of Sludge & Wastewater is the second, which seeks to reuse treated water for irrigation, industries and revenue generation for Urban Local Bodies (ULBs).

- Arth Ganga will also involve Livelihood Generation Opportunities, by creating haats where people can sell local products, medicinal plants and ayurveda.

- The fourth is to increase public participation by increasing synergies between the stakeholders involved with the river.

- The model also wants to promote the cultural heritage and tourism of Ganga and its surroundings, through boat tourism, adventure sports, and by conducting yoga activities.

- Lastly, the model seeks to promote institutional building by empowering local administration for improved water governance.

UPSC Civil Services Examination, Previous Year Questions (PYQs)

Prelims

Q. Which of the following are the key features of ‘National Ganga River Basin Authority (NGRBA)’? (2016)

- River basin is the unit of planning and management.

- It spearheads the river conservation efforts at the national level.

- One of the Chief Ministers of the States through which the Ganga flows becomes the Chairman of NGRBA on rotation basis.

Select the correct answer using the code given below:

(a) 1 and 2 only

(b) 2 and 3 only

(c) 1 and 3 only

(d) 1, 2 and 3

Ans: (a)

Mains

Q. Discuss the Namami Gange and National Mission for Clean Ganga (NMCG) programmes and causes of mixed results from the previous schemes. What quantum leaps can help preserve the river Ganga better than incremental inputs? (2015)

Draft Notification on EPR on Waste Oil

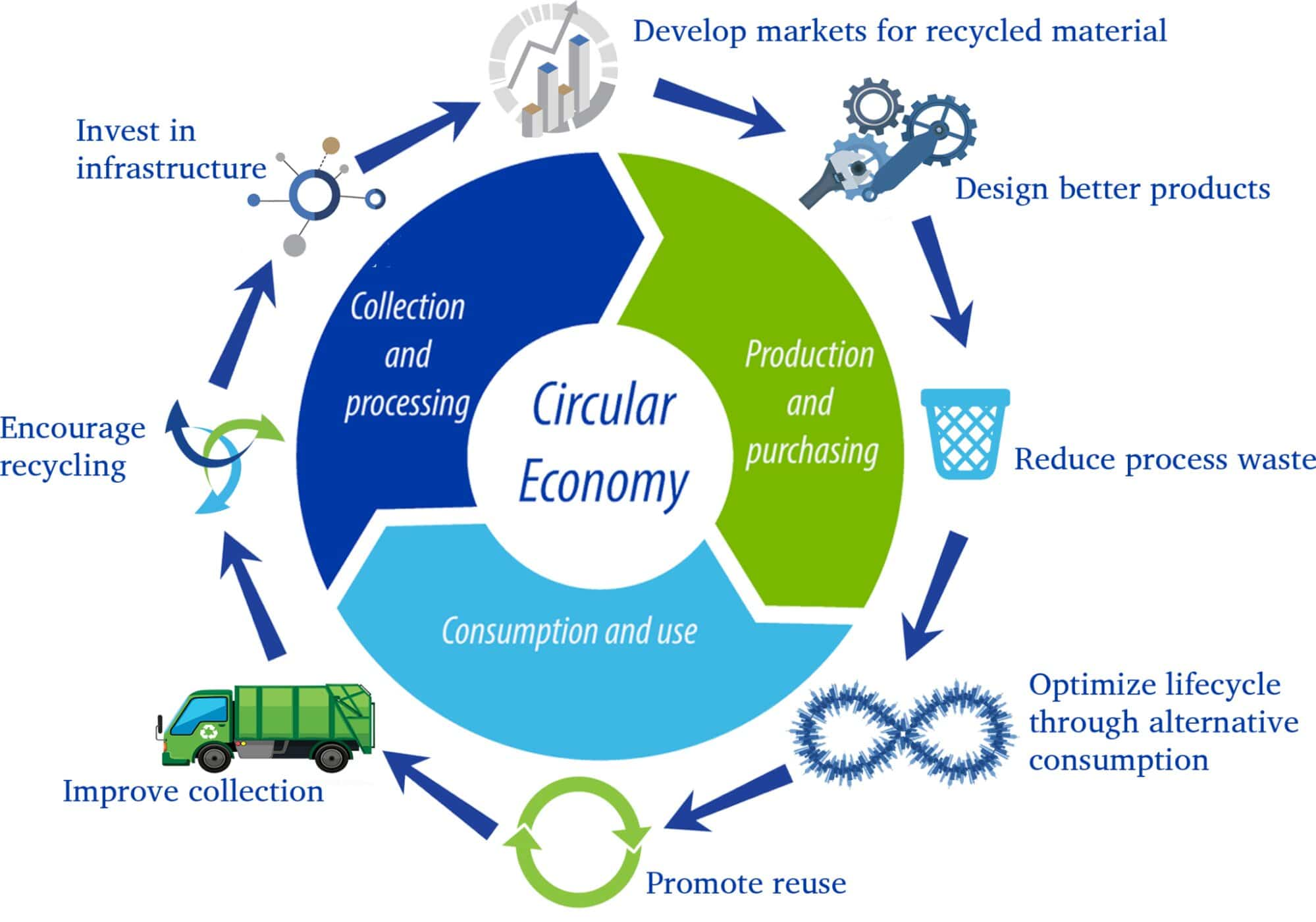

For Prelims: Extended Producer Responsibility, circular economy

For Mains: The importance of waste oil management and the potential impact of EPR, The significance of EPR in the circular economy

Why in News?

Recently, the Ministry of Environment, Forest and Climate Change (MoEFCC) introduced a draft notification on Extended Producer Responsibility (EPR) on waste oil.

- The Union Budget 2023-24 in India emphasizes sustainable development and a circular economy, with a goal of shifting from a linear model to a circular one through the replacement of natural resource usage with valuable waste materials.

What is EPR?

- It makes producers responsible for the environmental impacts of their products throughout their life cycle.

- EPR aims to promote better waste management and reduce the burden on municipalities.

- It integrates environmental costs into product prices and encourages the design of environmentally sound products.

- EPR is applicable to various types of waste, including plastic waste, e-waste, and battery waste.

- The E-Waste (Management and Handling) Rules, 2011 introduced the concept of EPR for the first time in India.

What is the Draft Notification on EPR on Waste Oil?

- About:

- EPR on waste oil is to improve the circularity of waste oil management. Waste oil is a contaminant that contains harmful substances that can pollute freshwater and soil.

- Waste oil can act as a contaminant as it contains benzene, zinc, cadmium and other impurities that have the potential to pollute freshwater.

- EPR on waste oil is to improve the circularity of waste oil management. Waste oil is a contaminant that contains harmful substances that can pollute freshwater and soil.

- Aim:

- Prevent pollution and bring waste oil collection and recycling under the formal sector.

- Recommendation:

- It recommends the registration of stakeholders, including producers, collection agents, recyclers and waste oil importers, on Central Pollution Control Board’s (CPCB) online portal.

- Applicability:

- EPR on waste oil is applicable to producers, and bulk generators (like industry, railways, transport companies, power transmission companies, etc.).

- EPR Targets:

- Gradual increase in waste oil recycling targets, starting from 2024-25.

- Base year target set at 10%, increasing by 10% annually until 2029.

- Future targets based on the quantity of lubrication oil sold or imported annually.

- Provisions and Responsibilities:

- EPR certificate generation, computation of eligible quantity, and transaction details.

- Clear demarcation of responsibilities for producers, importers, agents, recyclers, etc.

- Online portal for registration, filing returns, and tracing oil produced or generated.

- Bureau of Indian Standards is entrusted with setting necessary standards for re-refined oil.

- Challenges:

- Need for monitoring, verification, and auditing mechanisms.

- Overburden on Central Pollution Control Board(CPCB) and State Pollution Control Boards(SPCBs) require additional support.

- Focus on improving waste oil circularity and reducing fresh oil consumption.

- Questions on compliance, third-party audits, and monitoring oversight.

- Expert Opinions:

- Positive reception by non-profit organizations for EPR on waste oil.

- Concerns over implementation, monitoring, oversight, and penalties for defaulters.

What is India’s Progress Towards Circular Economy?

- Notifying various rules and policies for waste management, such as the Plastic Waste Management Rules,2022, e-Waste Management Rules 2022, Battery Waste Management Rules 2022 etc.

- Constituting 11 committees led by the concerned line ministries to prepare comprehensive action plans for transitioning from a linear to a circular economy in 11 focus areas, such as agriculture, mobility, textiles, electronics, etc.

- NITI also organized an international conference on ‘Sustainable Growth through National Recycling’.

- Collaborating with international partners, such as the European Union and the United States, to exchange best practices and learnings on resource efficiency and circular economy.

- Supporting social and environmental innovators who are developing circular economy solutions for waste management, such as the World Institute of Sustainable Energy.

- Encouraging businesses and industries to adopt circular economy principles and practices in their production systems and supply chains.

- India's progress toward a circular economy is still in its early stages and faces many challenges, such as a lack of awareness, data gaps, regulatory barriers, infrastructural constraints, and behavioral inertia.

- However, with concerted efforts from all stakeholders and continuous learning and innovation, India can achieve its vision of a resilient and inclusive circular economy.

What is A Circular Economy?

- About:

- A Circular Economy is the one where products are designed for durability, reuse and recyclability and thus almost everything gets reused, remanufactured, and recycled into a raw material or used as a source of energy.

- It includes 6 R’s - Reduce, Reuse, Recycle, Refurbishment, Recover, and Repairing of materials.

- Need for Circular Economy:

- CE focuses on minimising waste while maximising utilisation and calls for a production model aiming to retain the most value to create a system that promotes sustainability, longevity, reuse, and recycling.

- Though India has always had a culture of recycle and reuse, its rapid economic growth, growing population, impact of climate change and rising environmental pollution, the adoption of a circular economy is more imperative now.

- CE can lead to the emergence of more sustainable production and consumption patterns, thus providing opportunities for developed and developing countries to achieve economic growth and inclusive and sustainable industrial development (ISID) in line with the 2030 Agenda for Sustainable Development.

UPSC Civil Services Examination, Previous Year Questions (PYQs)

Q. In India, ‘extend producer responsibility’ was introduced as an important feature in which of the following? (2019)

(a) The Bio-medical Waste (Management and Handling) Rules, 1998

(b) The Recycled Plastic (Manufacturing and Usage) Rules, 1999

(c) The e-Waste (Management and Handling) Rules, 2011

(d) The Food Safety and Standard Regulations, 2011

Ans: (c)

Eight Years of Jan Suraksha Schemes

For Prelims: Pradhan Mantri Suraksha Bima Yojana, Pradhan Mantri Jeevan Jyoti Bima Yojana, Atal Pension Yojana, Pension Fund Regulatory and Development Authority, National Pension System.

For Mains: Pradhan Mantri Suraksha Bima Yojana (PMSBY), Pradhan Mantri Jeevan Jyoti Bima Yojana (PMJJBY), Atal Pension Yojana (APY), Significances of these schemes, Welfare Schemes.

Why in News?

Recently, the three social security (Jan Suraksha) schemes – Pradhan Mantri Suraksha Bima Yojana (PMSBY), Pradhan Mantri Jeevan Jyoti Bima Yojana (PMJJBY) and Atal Pension Yojana (APY) – completed 8 years of providing social security net.

- PMJJBY and PMSBY were launched to ensure that the people from the unorganised section of the country are financially secure while APY was introduced to cover the exigencies in old age.

What is Pradhan Mantri Suraksha Bima Yojana (PMSBY)?

- About:

- It is a one-year accidental insurance scheme renewable from year to year offering coverage for death or disability due to accident.

- Administered By:

- It is administered by Public Sector General Insurance Companies (PSGICs) or any other general insurance company in partnership with banks / Post offices.

- Eligibility:

- Individuals in the age group of 18-70 years having a savings bank or a post office account are entitled to enroll.

- Benefits:

- Accidental death cum disability cover of Rs. 2 lakhs (Rs. 1 lakh in case of partial disability) for death or disability due to an accident against a premium of Rs.20/- per annum.

- Achievements:

- As of April 2023, the cumulative enrolments under the scheme have been more than 34.18 crore and an amount of Rs. 2,302.26 crore has been paid for 1,15,951 claims.

What is Pradhan Mantri Jeevan Jyoti Bima Yojana (PMJJBY)?

- About:

- It is a one-year life insurance scheme renewable from year to year offering coverage for death due to any reason.

- Administered By:

- It is administered by LIC or any other life insurance company in partnership with banks / Post office.

- Eligibility:

- Individuals in the age group of 18-50 years having a savings bank or a post office account are entitled to enroll under the scheme.

- Benefits:

- Life cover of Rs. 2 Lakhs in case of death due to any reason against a premium of Rs. 436/- per annum.

- Achievements:

- As of April 2023, the cumulative enrolments under the scheme have been more than 16.19 crore and an amount of Rs. 13,290.40 crore has been paid for 6,64,520 claims.

What is Atal Pension Yojana (APY)?

- About:

- It was launched to create a universal social security system for all Indians, especially the poor, the under-privileged and the workers in the unorganised sector.

- It is an initiative of the Government to provide financial security and cover future exigencies for the people in the unorganized sector.

- Administered By:

- Pension Fund Regulatory and Development Authority (PFRDA) through the National Pension System (NPS).

- Eligibility:

- All bank account holders in the age group of 18 to 40 years (the contributions differ, based on the pension amount chosen).

- Benefits:

- Subscribers would receive the guaranteed minimum monthly pension of Rs. 1000 or Rs. 2000 or Rs. 3000 or Rs. 4000 or Rs. 5000 at the age of 60 years, based on the contributions made by them after joining the scheme.

- Payment Frequency:

- Subscribers can make contributions to APY on a monthly/ quarterly / half-yearly basis.

- Withdrawal from the Scheme:

- Subscribers can voluntarily exit from APY subject to certain conditions, on deduction of Government co-contribution and return/interest thereon.

- Achievements:

- As of April 2023, more than 5 crore individuals have subscribed to APY.

What are the Significances of these Schemes?

- These three social security schemes are dedicated to the welfare of the citizens, recognising the need for securing human life from unforeseen risks/losses and financial uncertainties.

- The PMJJBY and PMSBY provide access to low-cost life/accidental insurance cover to the people, the APY provides an opportunity for saving in the present for getting a regular pension in old age.

- The number of people who have enrolled and benefitted from these schemes over the last seven years is a testimony to their success.

- These low-cost insurance schemes and the guaranteed pension scheme are ensuring that financial security, which was available to a select few earlier, is now reaching the last person of the society.

What are the Other Social Security Schemes launched by Govt of India?

- Pradhan Mantri Shram Yogi Maan-Dhan Yojana (PM-SYM) (Old Age Protection)

- National Pension Scheme for Traders and The Self-employed Persons (NPS)

- National Health Mission and Janani Suraksha Yojana

- Pradhan Mantri Matru Vandana Yojana

- Pradhan Mantri Vaya Vandana Yojana (PMVVY)

- National Social Assistance Programme (NSAP) scheme

- PM KISAN

UPSC Civil Services Examination, Previous Year Questions (PYQs)

Prelims:

Q. Regarding ‘Atal Pension Yojana’, which of the following statements is/are correct? (2016)

- It is a minimum guaranteed pension scheme mainly targeted at unorganized sector workers.

- Only one member of a family can join the scheme.

- Same amount of pension is guaranteed for the spouse for life after subscriber’s death.

Select the correct answer using the code given below:

(a) 1 only

(b) 2 and 3 only

(c) 1 and 3 only

(d) 1, 2 and 3

Ans: (c)

India Strengthens PMLA

For Mains: Legal and regulatory framework in India to combat money laundering, Prevention of Money-Laundering Act (PMLA) and its objectives, Impact of money laundering on the economy.

Why in News?

India has undertaken changes in the money laundering law, the Prevention of Money-Laundering Act (PMLA),2002, as part of a series of changes to plug loopholes ahead of the country’s proposed assessment later in 2023 under the Financial Action Task Force (FATF).

What are the Changes Made Under the PMLA?

- More disclosures for non-governmental organizations by reporting entities like financial institutions, banking companies or intermediaries.

- Defining "politically exposed persons" (PEPs) as individuals who have been entrusted with prominent public functions by a foreign country, bringing uniformity with a 2008 Reserve Bank of India (RBI) circular for Know Your Customer (KYC) norms and anti-money laundering standards for banks and financial institutions.

- Bringing in practicing chartered accountants, company secretaries, and cost and works accountants carrying out financial transactions on behalf of their clients into the ambit of the money laundering law.

- Financial Transactions Include:

- Buying and selling of any immovable property.

- Managing client money, securities, or other assets.

- Management of bank, savings, or securities accounts.

- Organization of contributions for the creation, operation, or management of companies.

- Creation, operation, or management of companies, limited liability partnerships, or trusts.

- Buying and selling of business entities.

- Financial Transactions Include:

- The government widened the list of non-banking reporting entities to allow 22 financial entities like Amazon Pay (India) Pvt. Ltd, Aditya Birla Housing Finance Ltd, and IIFL Finance Ltd. to verify the identity of their customers via Aadhaar under the ambit of the money laundering law.

What are the Concerns Regarding the Changes?

- The changes require reporting entities to maintain records of all transactions and conduct KYC before each specified transaction. Failure to comply could result in penalties and action from investigative agencies.

- Low conviction rate under the PMLA but an extremely difficult process to go through.

- The exclusion of lawyers and legal professionals in the new definition of entities covered under the PMLA has been criticized by some professionals.

- Some also argue that these newly incorporated professionals are already regulated by professional bodies set up under various acts of Parliament, making these measures unnecessary.

What is the PMLA, 2002?

- Background:

- The PMLA was enacted in response to India’s global commitment (Vienna Convention) to combat the menace of money laundering. These include:

- United Nations Convention Against Illicit Traffic in Narcotic Drugs and Psychotropic Substances 1988

- Basle Statement of Principles, 1989

- Forty Recommendations of the Financial Action Task Force on Money Laundering, 1990

- Political Declaration and Global Program of Action adopted by the United Nations General Assembly in 1990.

- The PMLA was enacted in response to India’s global commitment (Vienna Convention) to combat the menace of money laundering. These include:

- About:

- It is a criminal law enacted to prevent money laundering and to provide for confiscation of property derived from, or involved in, money-laundering and related matters.

- It forms the core of the legal framework put in place by India to combat Money Laundering.

- The provisions of this act are applicable to all financial institutions, banks (Including RBI), mutual funds, insurance companies, and their financial intermediaries.

- Objectives:

- Confiscate and seize proceeds of crime that are laundered, generated or acquired through criminal activities.

- Establish a legal framework for the prevention of money laundering and terrorist financing.

- Strengthen and improve the mechanism for investigation and prosecution of money laundering offences.

- Enhance international cooperation in the fight against money laundering and related crimes.

- Regulating Authorities:

- Directorate of Enforcement (ED): The ED is responsible for enforcing the provisions of the PMLA and investigating money laundering cases.

What is FATF?

- About:

- The FATF is an intergovernmental organization established in 1989.

- It is a global standard-setter for combating money laundering, terrorist financing, and other related threats to the integrity of the international financial system.

- FATF operates as a policy-making body that promotes the implementation of legal, regulatory, and operational measures to combat financial crimes.

- Objective:

- FATF's primary objective is to set international standards and promote the effective implementation of measures to combat money laundering, terrorist financing, and the proliferation of weapons of mass destruction.

- Formation:

- FATF was formed at the initiative of the G7 countries in response to growing concerns about money laundering and its impact on the global economy.

- It initially focused on developing recommendations and best practices to combat money laundering.

- Over the years, its mandate expanded to include countering terrorist financing and addressing new emerging threats.

- Grey List and Black List:

- FATF maintains two key lists: the "grey list" and the "black list."

- The grey list includes jurisdictions that have strategic deficiencies in their anti-money laundering and counter-terrorist financing frameworks.

- Placement on the grey list signifies a need for improvement and subjects the jurisdiction to increased monitoring by FATF.

- The black list, officially known as the "Call for Action," comprises countries with severe deficiencies in their anti-money laundering and counter-terrorist financing efforts.

- Inclusion on the black list may result in international sanctions and restrictions.

- Member Countries:

- There are currently 39 members of the FATF; 37 jurisdictions and 2 regional organizations (the Gulf Cooperation Council and the European Commission).

- FATF also works closely with other international organizations, such as the United Nations, to strengthen global cooperation in combating financial crimes.

- India and FATF:

- India became a member of FATF in 2010.

UPSC Civil Services Examination, Previous Year Questions (PYQs)

Q. Discuss how emerging technologies and globalisation contribute to money laundering. Elaborate measures to tackle the problem of money laundering both at national and international levels. (2021)

Sugarcane Production in India

For Prelims: FRP, SAP, CACP, Rangarajan Committee, WTO, Sugarcane Industry, EBP Program.

For Mains: Sugarcane Production in India, its Potential and Challenges.

Why in News?

Recently, Madras High court in its judgment observed that Fair and Remunerative Price (FRP) of Sugarcane is not the fair market price and that Marginal farmers can survive only if the State governments paid them the much higher State Advised Price (SAP).

How are the Prices of Sugarcane Determined?

- The Prices of Sugarcane are Determined by the Central Government and the State Governments.

- Central Government: Fair and Remunerative Price (FRP)

- The Central Government announces FRP which are determined on the recommendation of the Commission for Agricultural Costs and Prices (CACP) and announced by the Cabinet Committee on Economic Affairs (CCEA).

- CCEA is chaired by the Prime Minister of India.

- The FRP is based on the Rangarajan Committee report on reorganising the sugarcane industry.

- The Central Government announces FRP which are determined on the recommendation of the Commission for Agricultural Costs and Prices (CACP) and announced by the Cabinet Committee on Economic Affairs (CCEA).

- State Government: State Advised Prices (SAP)

- The SAP is announced by the Governments of key sugarcane producing states.

- SAP is generally higher than FRP.

- The price is calculated by the experts, who calculate the entire economics of the crop by taking input cost and then suggest to the government, which may agree or not.

What are the Advantages of Increasing Sugar Production?

- Sugar production generates several by-products, such as molasses, bagasse, and press mud, which can be used for the production of other products such as ethanol, paper, and Bio-Fertilizers.

- Sugar mills can divert excess sugarcane to ethanol, which is blended with petrol, which not only serves as a green fuel but also saves foreign exchange on account of crude oil import.

- The government of India has fixed a target of 10% blending of fuel grade ethanol with petrol by 2022 & 20% blending by 2025.

- India achieved its target of an average of 10% blending across the country five months ahead of the targeted timelines of November 2022.

- The government of India has fixed a target of 10% blending of fuel grade ethanol with petrol by 2022 & 20% blending by 2025.

- Cultivating sugarcane provides farmers with an opportunity to diversify their agricultural activities and increase their income.

- Sugarcane cultivation can be integrated with other crops such as vegetables, fruits, and spices to promote crop diversification. This can lead to better soil health, reduced pest and disease pressure, and improved crop yields.

What are the Challenges Associated with Growing Sugarcane?

- Longer Duration to Harvest:

- Sugarcane takes a long time to grow and be ready for harvest (around 10 to 12 months). Growing sugarcane is not an easy task as it requires the farmer to plant and harvest two more crops before they can finally harvest sugarcane.

- This means that growing sugarcane demands a lot of hard work over a period of about three years.

- Higher Investment:

- Growing sugarcane requires farmers to invest more money because they have to prepare the fields properly before planting. This involves tilling the soil to a greater depth, followed by harrowing and leveling it to make it suitable for sugarcane.

- Moreover, buying sugarcane seedlings is expensive, and before planting, farmers need to add manure and fertilizers to the soil, which also comes at a high cost.

- High Labor Cost:

- The labour for cutting sugarcane costs huge and if the cutting season is dry without rains, it gravely affects the total weight of the cane and if it rains, there will be slush on the path resulting in lorries/trucks not being able to come near the field.

- Farmers have to spend a lot to transport the sugarcane from their fields to the main road by employing labour.

- Unviability Sugar Exports:

- India is finding it difficult to export sugar as the cost of producing it is higher compared to the international market price, mainly due to the high cost of sugarcane.

- To help bridge this gap, the government has been providing export subsidies, but other countries have raised objections with the World Trade Organization (WTO).

- Although India is currently allowed to continue with these subsidies until December 2023, there is uncertainty about what will happen after that.

- Problem with India’s Ethanol Programme:

- Blending ethanol with petrol to use as auto fuel was first announced in 2003, but this initiative has not been very successful due to several challenges. One of the key challenges is the poor pricing of ethanol supplied for blending.

- Since the price of ethanol is often higher than the price of petrol, blending ethanol with petrol becomes less economically viable. This can discourage ethanol producers from supplying ethanol for blending.

What is the Status of India’s Sugarcane Sector?

- About:

- Sugar industry is an important agro-based industry that impacts the rural livelihood of about 50 million sugarcane farmers and around 5 lakh workers directly employed in sugar mills.

- The sugar industry is the second largest agro-based industry in India after cotton.

- Sugar industry is an important agro-based industry that impacts the rural livelihood of about 50 million sugarcane farmers and around 5 lakh workers directly employed in sugar mills.

- Geographical Conditions for the Growth of Sugar:

- Temperature: Between 21-27°C with hot and humid climate.

- Rainfall: Around 75-100 cm.

- Soil Type: Deep rich loamy soil.

- Top Sugarcane Producing States: Maharashtra>Uttar Pradesh > Karnataka

- Status of Sugarcane Sector:

- India is the world's top Producer, User, and Second-largest Exporter of sugar.

- According to the Indian Sugar Mills Association (ISMA), the sugar production of India rose by 3.69% to 12.07 million tonnes during the October-December quarter of 2022.

- In the same period last year, it stood at 11.64 million tonnes.

- Total sugar production, after diversion for ethanol manufacturing, has increased to 193.5 lakh tonnes till January 2023 from 187.1 lakh tonnes in the year-ago period.

- Schemes:

- Scheme for Extending Financial Assistance to Sugar Undertakings (SEFASU)

- National Policy on Biofuels

- Ethanol Blending with Petrol (EBP) Programme

Way Forward

- Sugar mills should not only be dependent on making and selling sugar but make other products too.

- To make sugar mills profitable which can pay remunerative price to the farmers, and earn profit to the mills, it is very important to produce power by setting up cogeneration plants, ethanol, which is a renewal biofuel, by setting up its plants in mills which have raw material available for it.

- The Rangarajan Committee has suggested a Revenue Sharing Formula to fix cane price factoring in the price of sugar and other by-products.

- Further, in case the cane price, arrived at by the formula, drops below what the government considers as a reasonable payment, it can bridge the gap from a dedicated fund created for the purpose and a cess can be levied to build up the fund.

UPSC Civil Services Examination, Previous Year Questions (PYQs)

Q.1 The Fair and Remunerative Price (FRP) of sugarcane is approved by the (2015)

(a) Cabinet Committee on Economic Affairs

(b) Commission for Agricultural Costs and Prices

(c) Directorate of Marketing and Inspection, Ministry of Agriculture

(d) Agricultural Produce Market Committee

Ans: (a)

Q.2 With reference to the current trends in the cultivation of sugarcane in India, consider the following statements: (2020)

- A substantial saving in seed material is made when ‘bud chip settlings’ are raised in a nurse, and transplanted in the main field.

- When direct planting of setts is done, the germination percentage is better with single budded setts as compared to setts with many buds.

- If bad weather conditions prevail when setts are directly planted, single-budded setts have better survival as compared to large setts

- Sugarcane can be cultivated using settlings prepared from tissue culture.

Which of the statements given above is/are correct?

(a) 1 and 2 only

(b) 3 only

(c) 1 and 4 only

(d) 2, 3 and 4 only

Ans: (c)

Exp:

- Tissue Culture Technology

- Tissue culture is a technique in which fragments of plants are cultured and grown in a laboratory.

- It provides a new way to rapidly produce and supply disease-free seed cane of existing commercial varieties.

- It uses meristem to clone the mother plant.

- It also preserves genetic identity.

- The tissue culture technique, owing to its cumbersome outfit and physical limitation, is turning out to be uneconomical.

- Bud Chip Technology

- As a viable alternative of tissue culture, it reduces the mass and enables quick multiplication of seeds.

- This method has proved to be more economical and convenient than the traditional method of planting two to three bud setts.

- The returns are relatively better, with substantial savings on the seed material used for planting. Hence, statement 1 is correct.

- The researchers have found that the setts having two buds are giving germination about 65 to 70% with better yield. Hence, statement 2 is not correct.

- Large setts have better survival under bad weather but single budded setts also give 70% germination if protected with chemical treatment. Hence, statement 3 is not correct.

- Tissue culture can be used to germinate and grow sugarcane settlings which can be transplanted later in the field. Hence, statement 4 is correct. Therefore, option (c) is the correct answer.

UN Report on Maternal and Infant Health

For Prelims: United Nations (UN), Maternal mortality ratio, Hemorrhage, Janani Shishu Suraksha Karyakram(JSSK), LaQshya

For Mains: Major Reasons Behind Maternal and Infant Deaths, Government Initiatives Related to Maternal and Infant Health.

Why in News?

A new report from the United Nations (UN) has found that progress in reducing the number of women and babies who die every year during pregnancy, childbirth, or the first weeks after birth has stopped since 2015.

What are the Key Findings of the Report?

- Global Maternal and Neonatal Health Challenges:

- The report highlights that India is at the forefront of the global burden of maternal deaths, stillbirths, and newborn deaths, representing 17% of the total.

- Following India, countries with the highest number of absolute maternal and neonatal deaths and stillbirths in 2020 are Nigeria, Pakistan, Democratic Republic of Congo, Ethiopia, Bangladesh, China, Indonesia, Afghanistan and Tanzania.

- The key findings of the report revealed how gains made between 2000 and 2010 were faster than they have been in the years since 2010 and how it should be in the next decade to meet global targets.

- The report highlights that India is at the forefront of the global burden of maternal deaths, stillbirths, and newborn deaths, representing 17% of the total.

- Trends:

- Maternal Mortality Ratio (MMR):

- MMR observed an annual reduction rate of 2.8% between 2000 and 2009, which decreased to 1.3% between 2010 and 2020.

- Maternal mortality ratio refers to the number of maternal deaths per 1,000 live births in a given population or region.

- It is a crucial indicator of the health and well-being of women during pregnancy, childbirth, and the postnatal period.

- An improvement of reducing this indicator by 11.9% is required in the next decade to meet global targets of an MMR equivalent to 70 deaths per 1,000 live births.

- MMR observed an annual reduction rate of 2.8% between 2000 and 2009, which decreased to 1.3% between 2010 and 2020.

- Stillbirth Rate (SBR):

- Between 2000 and 2009, the SBR was reduced by 2.3% and by 1.8% between 2010 and 2021.

- The SBR is defined as the number of babies born with no signs of life at 28 weeks or more of gestation, per 1,000 total births.

- A 5.2% reduction is required between 2022 and 2030 to meet global targets of less than 12 stillbirths per 1,000 live births.

- Between 2000 and 2009, the SBR was reduced by 2.3% and by 1.8% between 2010 and 2021.

- Neonatal Mortality Rate (NMR):

- NMR records a similar trend; a 3.2% reduction between 2000 and 2009, 2.2% reduction between 2010 and 2021.

- Neonatal mortality rate refers to the number of deaths of infants within the first 28 days of life per 1,000 live births.

- NMR needs to be reduced by another 7.2% between 2022 and 2030 to meet the global target of ending newborn mortality.

- NMR records a similar trend; a 3.2% reduction between 2000 and 2009, 2.2% reduction between 2010 and 2021.

- Maternal Mortality Ratio (MMR):

- Measures Suggested:

- Maternal and infant health can be improved by increasing essential health services. Three measures are used to assess availability: at least four antenatal care contacts, skilled attendants at birth, and postnatal care within the first two days after birth.

- Antenatal care coverage has improved from 61% in 2010 to 68% in 2022, with a projected increase to only 69% by 2025.

- Skilled attendant at birth coverage has increased from 75% to 86% between 2010 and 2022, and is expected to reach 88% by 2025.

- Postnatal care coverage has shown the highest improvement, from 54% to 66% between 2010 and 2022, projected to reach 69% by 2025.

- Maternal and infant health can be improved by increasing essential health services. Three measures are used to assess availability: at least four antenatal care contacts, skilled attendants at birth, and postnatal care within the first two days after birth.

What are the Major Reasons Behind Maternal and Infant Deaths?

- Maternal Deaths:

- Severe Bleeding (hemorrhage): This is the leading cause of maternal mortality, often occurring during childbirth or in the immediate postpartum period.

- High Blood Pressure Disorders (pre-eclampsia and eclampsia): These conditions can result in complications such as organ failure, seizures, and even lead to maternal death.

- Unsafe Abortions: In areas where access to safe and legal abortions is limited, women may resort to unsafe procedures, leading to complications and maternal deaths.

- Other Factors: Roughly a third of women do not have even four of a recommended eight antenatal checks or receive essential postnatal care, while some 270 million women lack access to modern family planning methods.

- Infant Deaths:

- Prematurity and Low Birth Weight: Babies born too early (preterm) or with a low birth weight are more vulnerable to various health complications and have a higher risk of mortality.

- Birth Asphyxia: When a baby does not receive enough oxygen during childbirth, it can result in birth asphyxia, leading to brain damage or death if resuscitation is not performed promptly.

- Sudden Infant Death Syndrome (SIDS): SIDS refers to the sudden, unexplained death of an infant under one year of age, usually during sleep.

What are the Government Initiatives Related to Maternal and Infant Health?

- Janani Shishu Suraksha Karyakram(JSSK): Government of India has launched this scheme on 1st June, 2011, which entitles all pregnant women delivering in public health institutions to absolutely free and no expense delivery including Cesarean section.

- The initiative stipulates free drugs, diagnostics, blood and diet, besides free transport from home to institution, between facilities in case of a referral and drop back home. In 2013, this was expanded to sick infants and antenatal and postnatal complications.

- Similar entitlements have been put in place for all sick new-born accessing public health institutions for treatment till 30 days after birth.

- Pradhan Mantri Surakshit Matritva Abhiyan (PMSMA): It was launched in 2016 to ensure quality antenatal care and high risk pregnancy detection in pregnant women on 9th of every month.

- LaQshya: In order to further accelerate the decline in MMR in the coming years, the government has launched 'LaQshya - Labour room Quality improvement Initiative.

- LaQshya program is a focused and targeted approach to strengthen key processes related to the labour rooms and maternity operation theatres which aims at improving quality of care around birth and ensuring Respectful Maternity Care.

What are the Ways to Improve Maternal and Infant Health?

- Addressing Socioeconomic Factors: There is a need to recognize and address the social determinants of health, such as poverty, education, and gender inequality, which significantly impact maternal and infant health.

- Creating a Garbh Raksha Helpline: To enhance the provision of quality and timely healthcare for mothers and infants, especially in underserved regions, it is imperative to establish district-level task forces in collaboration with medical personnel.

- These task forces would work towards improving healthcare delivery and outcomes at the local level. This can include Garbh Raksha helpline number and Ambulance and mobile health units.

- For instance in Delhi, Pink ambulances driven by women and managed by women for women patients were started during Covid-19 pandemic.

- Nutrition and Food Security: Implement innovative approaches to improve maternal and infant nutrition, such as community gardens, fortified food programs, and mobile applications that provide personalized dietary recommendations. Addressing food insecurity through initiatives like food banks and voucher systems can also contribute to better health outcomes.

- Health Education and Awareness: There is a need to create innovative educational programs that target mothers, families, and communities to raise awareness about maternal and infant health.

- Utilizing digital platforms, mobile applications, and interactive media to deliver engaging and culturally sensitive health information will also be fruitful.

- Also there is a need to incorporate mental health screenings into routine prenatal and postnatal care.

UPSC Civil Services Examination, Previous Year Question (PYQ)

Q. In order to enhance the prospects of social development, sound and adequate health care policies are needed particularly in the fields of geriatric and maternal health care. Discuss. (2020)

Gallantry Awards

Why in News?

Recently, President of India presented gallantry awards to 37 personnel of the armed forces, paramilitary, and police forces for their bravery and valour in the line of duty. Eight personnel were conferred with the Kirti Chakra, and 29 personnel received the Shaurya Chakra.

What are the Gallantry Awards in India?

- Post-Independence, the first three gallantry awards namely Param Vir Chakra, Maha Vir Chakra, and Vir Chakra were instituted by the government of India on 26th January 1950 and were deemed to have effect from 15th August 1947.

- Thereafter, three other gallantry awards — the Ashoka Chakra Class-I, the Ashoka Chakra Class-II, and the Ashoka Chakra Class-III — were instituted in 1952 and were deemed to have effect from 15th August 1947.

- These awards were renamed Ashoka Chakra, Kirti Chakra, and Shaurya Chakra respectively in January 1967.

- Order of precedence of these awards is the Param Vir Chakra, the Ashoka Chakra, the Mahavir Chakra, the Kirti Chakra, the Vir Chakra, and the Shaurya Chakra.

- The gallantry awards are announced twice in a year — first on the occasion of the Republic Day and then on the occasion of the Independence Day.

What is Kirti Chakra?

- About:

- It is the peacetime equivalent of the Maha Vir Chakra, the second-highest peacetime gallantry award.

- Awarded for displaying conspicuous gallantry, indomitable courage, and extreme devotion to duty. or self-sacrifice away from the field of battle.

- Eligibility and Design:

- Open to civilians as well as military personnel, including posthumous awards.

- A circular silver medal with a lotus flower in the center and a chakra around it, suspended from a green ribbon with two orange stripes.

What is Shaurya Chakra?

- About:

- An Indian military decoration awarded for gallantry, courageous action, or self-sacrifice while not engaged in direct action with the enemy.

- Represents the spirit of bravery, valor, and devotion to duty in peacetime.

- Eligibility and Design:

- Open to civilians as well as military personnel, including posthumous awards.

- Circular bronze medal with a replica of the Ashoka Chakra, the national emblem of India, in the center.

- Features a lotus wreath around the Ashoka Chakra symbol.

- Suspended from a green ribbon with three vertical lines.

UPSC Civil Services Examination, Previous Year Questions (PYQs)

Q. Consider the following statements in respect of Bharat Ratna and Padma Awards: (2021)

- Bharat Ratna and Padma Awards are titles under the Article 18(1) of the Constitution of India.

- Padma Awards, which were instituted in the year 1954, were suspended only once.

- The number of Bharat Ratna Awards is restricted to a maximum of five in a particular year.

Which of the above statements are not correct?

(a) 1 and 2 only

(b) 2 and 3 only

(c) 1 and 3 only

(d) 1, 2 and 3

Ans: (d)

Exp:

- The Padma Awards are announced annually on Republic Day. It was instituted in 1954 and is one of the highest civilian honours of India. The awards are given in three categories:

- Padma Vibhushan (for exceptional and distinguished service)

- Padma Bhushan (distinguished service of higher order)

- Padma Shri (distinguished service)

- Article 18(1) prohibits the State to confer titles on anybody whether a citizen or a non-citizen. Military and academic distinctions are, however, exempted from the prohibition. Bharat Ratna and Padma Awards are not titles under the Article 18(1). Hence, statement 1 is not correct.

- Padma Vibhushan is highest in the hierarchy of Padma Awards followed by Padma Bhushan and Padma Shri.

- The Padma Awards were suspended during the years 1978, 1979 and 1993 to 1997. Hence, statement 2 is not correct.

- Bharat Ratna is the highest civilian award of the country. It is awarded in recognition of exceptional service/performance of the highest order in any field of human endeavour.

- The recommendations for Bharat Ratna are made by the Prime Minister to the President of India. The number of Bharat Ratna Awards is restricted to a maximum of three in a particular year. Hence, statement 3 is not correct.

- Therefore, option (d) is the correct answer.

Rapid Fire Current Affairs

Santiniketan

Santiniketan, initially built by Debendranath Tagore in 1863 and later expanded by his son, Nobel laureate Rabindra Nath Tagore which is also the location of Visva-Bharti University, has been recommended for inclusion in UNESCO's World Heritage List. The recommendation was made by the International Council on Monuments and Sites (ICOMOS), based on a file submitted by the Indian government. ICOMOS, an international cultural body headquartered in France, is dedicated to the preservation and promotion of global architectural and landscape heritage. This recommendation comes as great news for India on the occasion of Rabindranath Tagore's 162nd birth anniversary (9th May 2023). The formal announcement of the nomination will take place at the World Heritage Committee meeting in Riyadh, Saudi Arabia, in September 2023. If Santiniketan’s nomination is accepted, it will become India’s 41st world heritage site and Bengal’s third after Darjeeling Himalayan Railways(1999) and Sundarbans National Park (1987).

Read more: Rabindra Nath Tagore

April 2023: Fourth Warmest April Globally

According to a recent analysis by the European Union's Earth observation program Copernicus Climate Change Service (C3S), April 2023 ranked as the fourth warmest April globally. The month exhibited a temperature deviation of 0.32 degrees Celsius above the 1991-2020 average, showcasing a notable contrast in European air temperatures. C3S highlighted that above-average temperatures were observed in the equatorial eastern Pacific, indicating a potential shift towards El Nino conditions, which typically contribute to warmer global temperatures. Although April 2023 was slightly cooler than the record-breaking April 2016, it closely resembled the temperatures observed in April 2017 and 2018. The analysis also revealed regional variations, with certain areas experiencing colder-than-average conditions while others faced abnormal dryness or increased rainfall. Spain and Portugal encountered their highest April temperatures, while parts of Europe, the United States, and southeastern Asia exhibited dry conditions.

The majority of the ocean surface also witnessed above-average temperatures, particularly notable in areas like the Weddell Sea, the northern Pacific, and the Humboldt Current in the equatorial eastern Pacific. The data from C3S serves as a crucial foundation for informed decision-making regarding climate change mitigation and adaptation strategies on a global scale.

Read more: World Likely to See 2°C Warming by 2050

Swachh Bharat Mission Grameen Phase II

India celebrates a major milestone in its Swachh Bharat Mission Gramin (SBM-G) as 50% of the country's villages have achieved ODF Plus status in phase II of the mission. ODF Plus villages sustain their Open Defecation Free (ODF) status while implementing solid or liquid waste management systems. Over 2.96 lakh villages have declared themselves ODF Plus, a significant step towards achieving the SBM-G phase II goals by 2024-25. Leading states in terms of ODF Plus villages include Telangana, Karnataka, Tamil Nadu, and Uttar Pradesh among the big states, and Goa and Sikkim among the small states.

Under the SBM-G, various initiatives have been undertaken to address waste management and improve sanitation practices. Plastic Waste Management Units and waste collection sheds have been established, promoting the recycling of plastic waste for road construction and fuel usage. Bio-gas/CBG plants and community compost pits have been set up to manage organic waste effectively, contributing to the circular economy and creating clean and green villages. The GOBARdhan initiative focuses on converting waste into resources such as biogas and bio-slurry, fostering entrepreneurship, and promoting green energy investment. Grey water management has been addressed through the construction of soak pits and leach pits, while faecal sludge management involves the desludging of sanitation systems and the establishment of treatment units. These comprehensive efforts have resulted in improved sanitation, reduced environmental impact, and economic benefits for the local community.

Read more: Swachh Bharat Mission Grameen Phase-II

Persona Non Grata

Diplomatic tensions between Canada and China escalated as reciprocal expulsions of diplomats took place, with Canada expelling a Chinese diplomat and China declaring a Canadian diplomat persona non grata.

The concept of persona non grata finds its roots in the Vienna Convention on Diplomatic Relations, a treaty signed in 1961 that governs diplomatic relations between countries. According to Article 9 of the convention, a country has the right to declare any member of a diplomatic staff persona non grata "at any time and without having to explain its decision." This designation carries diplomatic significance and signifies that the person is an unwelcome individual whose presence in the country is prohibited.

The use of persona non grata is not limited to diplomats alone. It can also be applied to foreign individuals who are not part of diplomatic missions but whose entry or presence in a country is deemed undesirable. The Vienna Convention allows countries to exercise this right as a means to express their discontent with the actions of other nations. While the convention does not establish specific criteria for declaring someone persona non grata, historically, it has been used as a form of diplomatic sanction or retaliation.

During the Cold War, it was often used as a "tit-for-tat" measure between the United States and the Soviet Union, with both sides expelling each other's diplomats in response to perceived provocations. Even outside the realm of diplomacy, individuals from the entertainment industry, such as Hollywood actor Brad Pitt, have faced this designation in certain countries due to their involvement in projects deemed politically sensitive.

Read more: Vienna Convention