Boosting Exports From MSMEs | 06 Apr 2024

For Prelims: NITI Aayog, Micro, Small, and Medium Enterprises, Goods and Services Tax, Reserve Bank of India, RoDTEP Scheme, Export Credit Guarantee Corporation (ECGC), Market Access Initiative, Micro & Small Enterprises Cluster Development Programme, Credit Guarantee Scheme for MSME, Gross Domestic Product

For Mains: Boosting Exports from MSMEs: NITI Aayog, Indian Economy and issues relating to planning, mobilisation of resources, growth, development and employment, Role of digitalization and technology adoption in MSMEs, Role of MSMEs in rural development

Introduction

Recently, the NITI Aayog (National Institution for Transforming India) has released a report titled Boosting Exports from MSMEs focusing on improving exports from Micro, Small, and Medium Enterprises (MSMEs) in India.

- The report emphasizes the significant role MSMEs play in the Indian economy, contributing to employment, exports, and economic growth.

What is the Overview of the MSME Sector in India?

- Changing Definition of MSMEs:

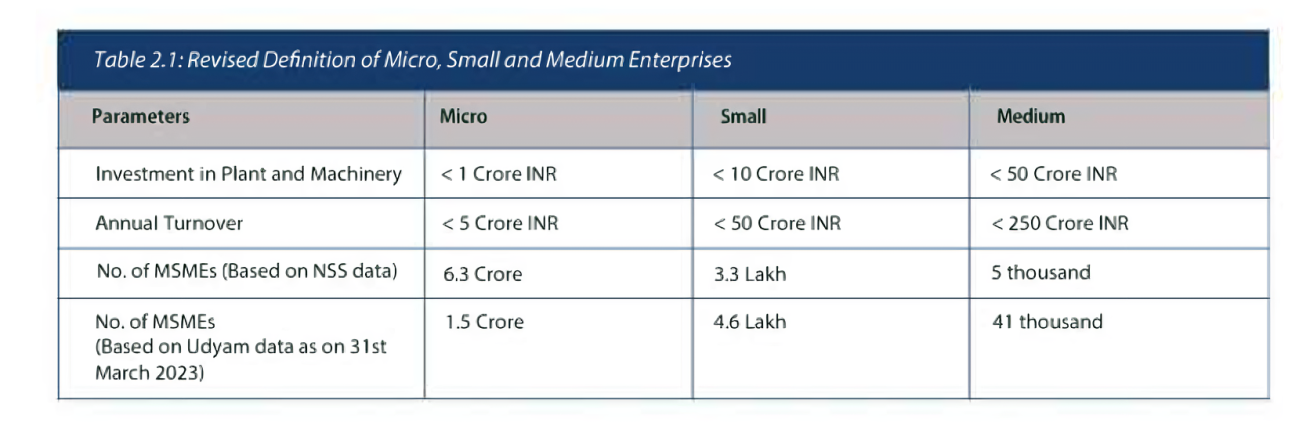

- The MSME Development Act, 2006 was revised in 2020, increasing the investment and turnover limits for micro, small, and medium enterprises.

- The revision aimed to prevent the loss of benefits by raising the low threshold limit and incorporating turnover as a defining measure.

- The revision aimed to prevent the loss of benefits by raising the low threshold limit and incorporating turnover as a defining measure.

- Growth Trends in the MSME Sector:

- Between FY 2019 and FY 2021, India witnessed a steep rise in establishing new MSME units, with around 40 lakh new units.

- An increase in new micro-enterprises primarily drove the growth.

- The share of MSME units engaged in manufacturing witnessed a 7% growth over the past eight years, with 38% of the total 54 lakh MSME units now involved in manufacturing activities.

- Between FY 2019 and FY 2021, India witnessed a steep rise in establishing new MSME units, with around 40 lakh new units.

- Distribution and Concentration:

- The majority of manufacturing activity suitable for export is concentrated among small and medium enterprises within the MSME sector.

- According to the 2020-21 Annual Report of the Ministry of MSMEs, the top five states with the highest concentration of manufacturing MSMEs are Uttar Pradesh, Maharashtra, Tamil Nadu, Karnataka, and Gujarat.

- Formal Regulation:

- The MSME sector in India comprises approximately 6.34 crore enterprises, with the majority (approximately 6.3 crore) being microenterprises with less than 20 workers, placing them outside of most formal regulations.

- Only around 12.8 lakh enterprises exceed the 20-worker threshold and are considered part of the formal system.

- Among the 13 lakh enterprises registered in the Provident Fund database, approximately 70,000 have revenues exceeding 5 crores, moving them from the micro to the small category.

- The remaining 9.3 lakh enterprises, despite having more than 20 workers, still fall under the micro-segment in terms of revenue definition.

- The MSME sector in India comprises approximately 6.34 crore enterprises, with the majority (approximately 6.3 crore) being microenterprises with less than 20 workers, placing them outside of most formal regulations.

- Policy Landscape and Challenges:

- The current policy landscape in India and economic packages primarily benefit small businesses but inadvertently discourage them from surpassing certain thresholds and expanding operations.

- For example, the Industrial Disputes Act of 1947 only requires government permission for employee retrenchment in companies with over 100 employees, allowing smaller firms to dismiss employees

- This restriction inadvertently incentivizes MSMEs to remain small, hindering their ability to reap the benefits of economies of scale, and access to larger markets and resources, as well as attracting investments for innovation and expansion.without this restriction.

- For example, the Industrial Disputes Act of 1947 only requires government permission for employee retrenchment in companies with over 100 employees, allowing smaller firms to dismiss employees

- Despite being beneficiaries of various support initiatives, many MSMEs face challenges in capitalizing on economies of scale, limiting their growth potential.

- The current policy landscape in India and economic packages primarily benefit small businesses but inadvertently discourage them from surpassing certain thresholds and expanding operations.

- Export Potential and Underperformance:

- Despite India's large population, a substantial portion of it remains economically disadvantaged, leading to limited purchasing power. As a result, the effective size of the Indian market is smaller than expected.

- The combination of high competition and a small market size creates a challenging growth environment for manufacturing MSMEs.

- Therefore, exporting is crucial for Indian MSMEs to overcome size limitations and unlock growth potential.

- Exporting can benefit 54 lakh manufacturing MSMEs by expanding their customer base, increasing revenue and profit, diversifying their customer base, and enhancing their reputation as a global player.

- Despite the opportunity, only a small percentage (0.95%) of MSMEs engage in exporting.

- Out of 1.58 crore registered MSMEs, only around 1.5 lakh units claim to export their goods and services.

- Despite India's large population, a substantial portion of it remains economically disadvantaged, leading to limited purchasing power. As a result, the effective size of the Indian market is smaller than expected.

- Estimating MSME Exports:

- There is a discrepancy between MSME exports and total exports in India. The estimation of exports originating from MSMEs is currently based on an outdated list known as the 'List of Items Reserved for Purchase from Small Scale Industries.'

- This list mandated by the Government of India required certain products to be procured exclusively from MSMEs.

- Nullification of the protected goods category necessitates revision of the estimation procedure, highlighting the need for updating methodology to reflect current market dynamics.

- Discrepancies between self-reported data (Udyam) and the government's official estimates result in inflated figures for MSME exports, leading to inaccuracies.

- There is a discrepancy between MSME exports and total exports in India. The estimation of exports originating from MSMEs is currently based on an outdated list known as the 'List of Items Reserved for Purchase from Small Scale Industries.'

What are the Opportunities For MSME Exports?

- Skill-Intensive Nature of Exports:

- Both manufacturing and services exports are skill-intensive.

- India's specialization has shifted towards more skilled-intensive exports like auto parts, electronics, machinery, and pharmaceuticals.

- Underutilization of Low-Skill Manufacturing Potential:

- India has not fully exploited the Lewis curve for low-skill manufacturing exports.

- Lewis assumed that the labour market in the modern sector is perfectly competitive, in which case the marginal product curves are the actual demand curve for labour.

- India has a competitive advantage in exporting low-skilled exports such as apparel, textiles, leather, and footwear but has consistently underperformed in this area.

- Despite having a large working-age population and significant employment in manufacturing MSMEs, India's share of global exports of low-skilled manufacturing products is only 5%.

- India lags behind Vietnam, Bangladesh, and China in the proportion of low-skilled goods exports relative to the size of the working-age population.

- Low-skilled exports increase merchandise export share without competing for resources from skilled manufacturing, benefiting the country. This also allows MSMEs to leverage their strengths and grow sustainably.

- India has not fully exploited the Lewis curve for low-skill manufacturing exports.

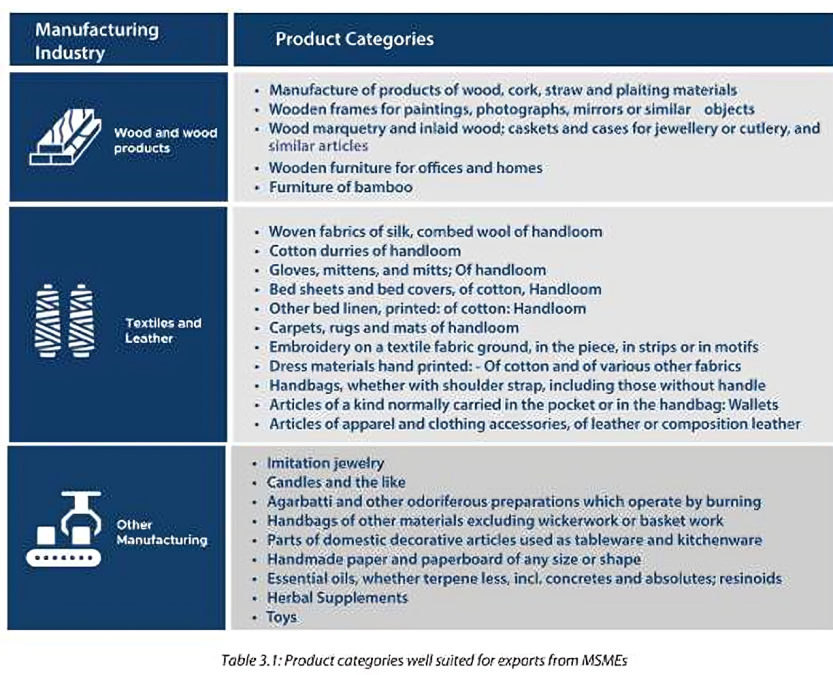

- Natural Fit Industries:

- Certain industries like wood products manufacturing, ayurveda and herbal supplements, handloom textiles, handicrafts, leather products, and jewellery are well-suited for MSME exports.

- They possess a unique aesthetic appealing to consumers abroad, providing Indian manufacturers a competitive edge over products from other countries.

- They utilize traditional manufacturing techniques and craftsmanship, are labour-intensive, require low investment, and benefit from product customization and India's heritage value in international markets.

- Certain industries like wood products manufacturing, ayurveda and herbal supplements, handloom textiles, handicrafts, leather products, and jewellery are well-suited for MSME exports.

- Utilizing E-commerce for Export Growth:

- MSMEs need to operate at a sufficiently large scale to maintain sustainable profit margins in exports.

- Majority of Indian exporters generate modest revenues, making channels like e-commerce more feasible.

- India's cross-border e-commerce trade represents a modest USD 2 billion, accounting for only 0.5% of total merchandise exports and 0.25% of global business-to-consumer (B2C) e-commerce exports.

- Projections suggest that by the end of the decade, e-commerce exports from India could reach USD 350 billion, comprising one-third of its total exports.

- Globally, the B2C e-commerce market is expected to reach USD 8 trillion, indicating significant growth opportunities for India in this sector.

- Lack of awareness, understanding, and regulatory support hinders India's presence in the global B2C e-commerce market.

What are the Challenges in Boosting Exports From MSMEs?

- Business Environment:

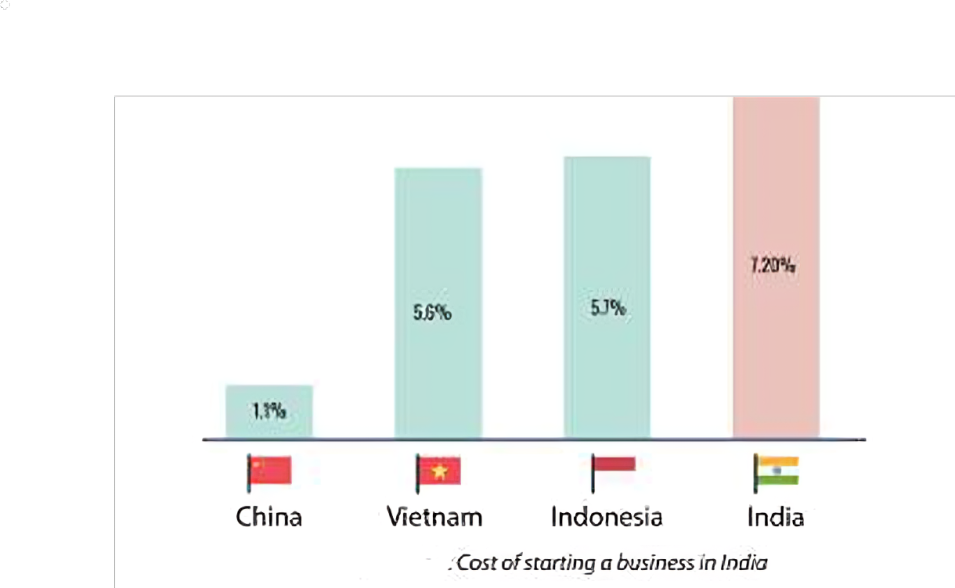

- Heavy Regulatory Burden:

- Manufacturers in India face extensive regulatory requirements including business registration, taxation, environmental regulations, labor laws, and intellectual property rights.

- Compliance is resource-intensive and time-consuming, with potential financial costs and personal liability for non-compliance.

- Compliance mistakes can result in financial costs for the company and personal liability for the promoters.

- The cost of starting a business in India is high, requiring numerous procedures and approvals.

- Heavy Regulatory Burden:

- Dissonance between Policies and Implementation:

- Lack of harmonization between policies and practical implementation creates hurdles during the export process.

- Different interpretations of policies increase compliance burdens, leading to delays and complications, such as unnecessary document requests by banks.

- For example, despite the Income Tax Law of India not requiring Form 15CA or 15CB for payments made for purchase of goods from foreign vendors, banks often request these forms, causing delays in payment processing and impacting vendor payments and delivery to customers.

- Testing and Certification Challenges:

- Limited availability of specialized labs results in delays in product testing and certification, hindering timely shipments.

- Obtaining certifications is time-consuming and costly, particularly for MSMEs, limiting their access to international markets and competitiveness.

- Limited availability of specialized labs results in delays in product testing and certification, hindering timely shipments.

- Import Duties on Samples:

- Customs authorities impose high duties and taxes on imported samples, creating working capital blockages for importers.

- Inadequate exemptions under Customs Law exacerbate the financial burden on importers.

- Customs authorities impose high duties and taxes on imported samples, creating working capital blockages for importers.

- Export Incentives for E-commerce:

- Existing export incentives primarily favour cargo shipping, disadvantaging e-commerce exporters using courier mode.

- This creates a barrier for e-commerce exporters, limiting their access to programs like the Remission of Duties and Taxes on Exported Products (RoDTEP) scheme and Advance Authorisation, and hindering their ability to benefit from government support.

- Taxing Merchandise Export Procedure:

- Fragmented Coordination:

- Exporters must coordinate with five different government authorities: DGFT (Directorate General of Foreign Trade), Customs, GST (Goods and Services Tax), Banks, and later the RBI (Reserve Bank of India).

- This fragmented process requires repeated filing of similar documents and details to each authority, increasing resource burden and time wastage.

- Exporters must coordinate with five different government authorities: DGFT (Directorate General of Foreign Trade), Customs, GST (Goods and Services Tax), Banks, and later the RBI (Reserve Bank of India).

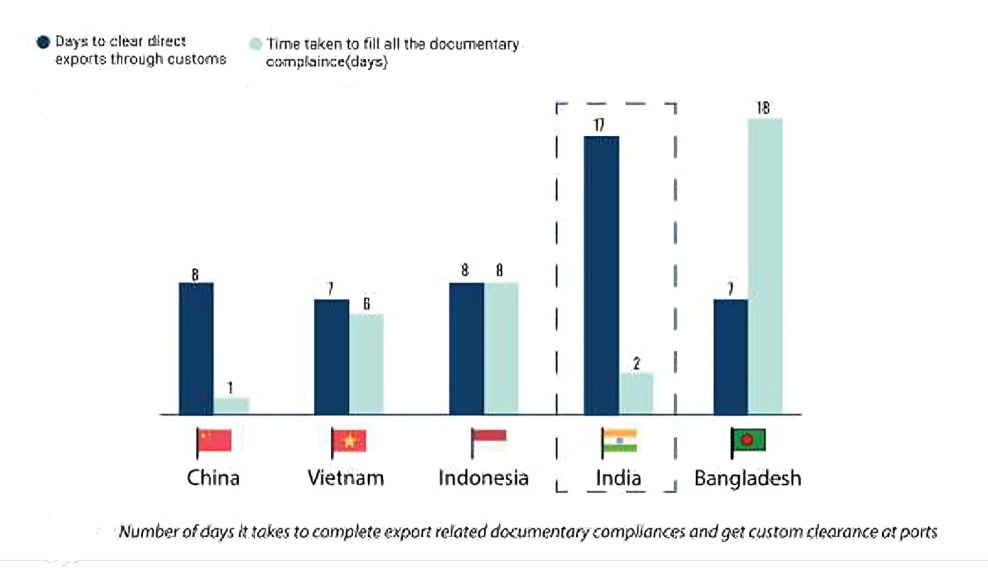

- High Volume of Paperwork:

- Extensive documentation requirements, including export licenses, invoices, and packing lists, pose a challenge.

- Pre-shipment and post-shipment documentation processes are time-consuming and complex, especially for inexperienced exporters.

- India takes on average 17 days to clear exports through customs, despite exporters taking only 2 days to fill documentary compliances.

- Fragmented Coordination:

- Delays Due to Customs Sampling:

- Random sampling of shipments by customs for quality verification can cause shipment delays.

- Sampling, examination, and clearance processes extend shipping timelines, impacting timely delivery and causing logistical challenges.

- Tedious Payment Reconciliation:

- The Payment reconciliation process for imports and exports remains a major pain point.

- Stringent criteria for settling shipping bills against export proceeds, a resource-intensive process with no room for error.

- Failure in reconciliation results in fines and lengthy correction processes, adding to operational challenges.

- Accessing Finance for MSMEs:

- Limited Access to Formal Finance:

- Only 16% of the total credit demand of the MSME sector in India is fulfilled by commercial banks, NBFCs, and FinTech.

- Access to capital is crucial for sustaining daily operations and driving business growth.

- Avendus Capital Private Limited estimates the total finance demand for MSMEs to be USD 1,955 billion, with a significant portion remaining unaddressable.

- Only 16% of the total credit demand of the MSME sector in India is fulfilled by commercial banks, NBFCs, and FinTech.

- Trade Finance Gap:

- The entire MSME finance gap is estimated to be close to USD 5 trillion, hindering their growth.

- The trade finance gap alone is estimated at over USD 1.5 trillion, with a rejection rate of 45% for MSME proposals.

- Reasons for the gap include a higher risk profile, lack of collateral, complex documentation, and high costs of services.

- The entire MSME finance gap is estimated to be close to USD 5 trillion, hindering their growth.

- Micro-enterprises Facing Credit Deficit:

- Lack of collateral and high-risk perception by lenders lead to loan denials, with 40% of micro-enterprises being denied loans due to lack of collateral.

- Accessing Working Capital:

- Nearly 70% of the SME sector's debt demand comprises working capital demand.

- Lack of access to working capital credit negatively impacts the growth of small manufacturers, as working capital is essential for every step of production.

- Nearly 70% of the SME sector's debt demand comprises working capital demand.

- Limited Access to Formal Finance:

- Limited Market Access:

- Lack of Exposure:

- MSMEs often lack exposure to global markets, resulting in limited awareness of demand and quality standards.

- Absence of market intelligence leads to a limited understanding of consumer preferences, trends, and competitors.

- Conducting market research and effective marketing is challenging due to resource constraints.

- Difficulty Finding Buyers:

- New exporters struggle to locate buyers in international markets due to lack of networks and market familiarity.

- Identifying potential buyers and accessing distribution channels poses challenges for first-time promoters.

- Awareness of distribution channels like trade fairs and e-commerce platforms is limited, hindering outreach efforts.

- New exporters struggle to locate buyers in international markets due to lack of networks and market familiarity.

- Non-Tariff Barriers:

- MSMEs face non-tariff barriers such as technical regulations and certification requirements abroad.

- Compliance is complex and costly, especially for small businesses with limited resources.

- Lack of Exposure:

- Accessing Export Information:

- Lack of Consolidated Information:

- Indian MSME exporters struggle to access basic information on merchandise exports and market research.

- There is a lack of a verified and consolidated source of information on the entire export value chain, making it difficult for exporters to find information on export procedures.

- The information is scattered across different government department websites, and the complex presentation and technical terms used further complicate the process.

- Limited Market Research Resources:

- Indian businesses lack tools or channels for conducting product and country-specific market research, which discourages aspiring MSMEs from exploring export opportunities.

- Obscurity of Post-Shipment Procedures:

- Lack of accessible information on post-shipment procedures leads to delays and financial setbacks.

- Fragmented Government Support Schemes:

- Government support details are scattered across various sources, making it challenging for exporters to access them.

- Lack of Consolidated Information:

- Policy Landscape:

- Commentary on Existing Initiatives:

- Lack of Clear Information:

- Absence of a consolidated list of government incentives for exporters.

- Information on export promotion schemes scattered across various government sources.

- Scheme-related documents often lack clarity and clear descriptions of covered activities.

- Outdated information on government websites adds to the confusion.

- Eligibility Design Hurdles:

- Schemes with upfront eligibility criteria require significant effort and resources.

- Lack of clarity in eligibility criteria complicates the application process.

- Overlaps in benefits and mandates among different schemes create confusion for MSMEs.

- Schemes with upfront eligibility criteria require significant effort and resources.

- Lack of Clear Information:

- Gaps in the Policy Ecosystem:

- Integration into Global Value Chains:

- Lack of policies providing incentives for MSMEs to upgrade to international quality standards.

- Need for initiatives supporting the establishment of testing and certification labs and assisting MSMEs in obtaining certifications.

- E-commerce Policy:

- Absence of a comprehensive e-commerce policy tailored to address challenges faced by e-commerce exporters.

- Support for New Exporters:

- Initiatives required to alleviate compliance burden for new exporters, including waiver of non-compliance fines for initial shipments.

- Integration into Global Value Chains:

- Commentary on Existing Initiatives:

What are the Recommendations for Boosting Exports From MSMEs?

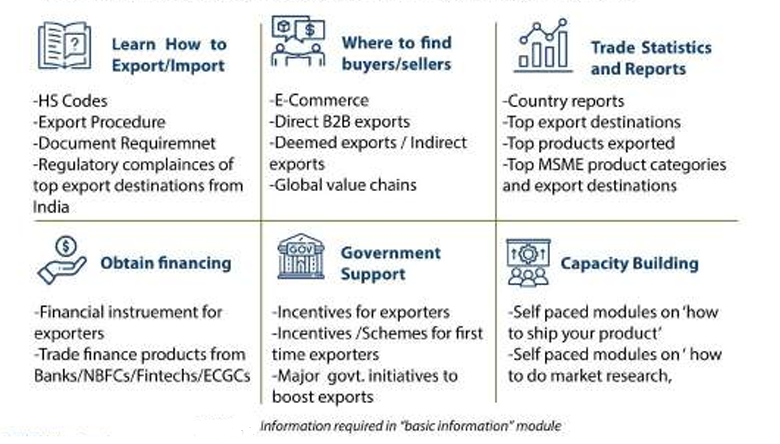

- Create One Stop Information Channel for Exporters:

- The current landscape of Indian MSME exports shows that only a small fraction of MSMEs have the capabilities for direct exports, accounting for less than 1% of all MSME units.

- Existing exporters have the necessary products, resources, and technology. However, they face challenges in accessing information on export procedures, compliances, and market regulations.

- There is a need for a comprehensive and regularly updated platform for exporters, similar to the United States International Trade Administration (US ITA) portal.

- The proposal is to introduce an intelligence portal with Generative AI capabilities, including a chatbot to provide information on export regulations, compliance, finance, market access, and government initiatives.

- The portal will have modules for basic information and market research, with enhanced features. It will offer comprehensive resources, a user-friendly interface, and up-to-date information, similar to the US ITA portal.

- The current landscape of Indian MSME exports shows that only a small fraction of MSMEs have the capabilities for direct exports, accounting for less than 1% of all MSME units.

- Introduction of National Trade Network (NTN):

- Exporters currently face the challenge of navigating multiple portals for approvals, licenses, certifications, and payment receipt.

- The process involves cumbersome navigation through various interfaces, including the physical submission of documents.

- Establishing an end-to-end National Trade Portal (NTN) can streamline the entire export process.

- The NTN will offer a seamless experience for exporters, providing assistance with queries and resolving paperwork gaps.

- Implementation of NTN will reduce process burden and delays for MSME exporters, enabling them to compete effectively.

- The NTN streamlines customs by using big data for intelligent inspection selection, automating entry tax deductions with Radio-Frequency Identification (RFID) tags, and enabling real-time container tracking.

- It ensures seamless document flow, automatic payments, and direct deposit of duty drawbacks, minimizing the need for physical bank visits unless fraud issues occur.

- Overall, NTN ensures a smoother, automated, and transparent export process.

- The Ministry of Commerce can lead the initiative by forming a task force to review previous efforts like the Society for Worldwide Interbank Financial Telecommunication (SWIFT) messaging system and devise a timebound program for NTN implementation.

- The goal is to create a national trade network on par with global standards, enhancing efficiency and competitiveness in international trade.

- Promote E-commerce Exports:

- Access to markets is a significant obstacle for MSME exports, but e-commerce offers a solution.

- China's MSME e-commerce exports surpass USD 200 billion, while India's stands at only USD 2 billion.

- Cumbersome compliance processes, especially payment reconciliation, hinder e-commerce export growth.

- Methods to Boost E-commerce Exports:

- Currently, Indian export regulations dictate that the exporter must be the owner of the product, and export proceeds must be received in the exporter's name.

- This poses challenges for MSMEs and solo entrepreneurs in cross-border e-commerce sales, as they must act as both the product owner (Seller on Record - SOR) and the exporter (Exporter on Record - EOR). This dual role increases the burden of meeting export compliance requirements and handling payment reconciliation processes, particularly as sales volumes grow.

- Distinguishing between SOR and EOR would allow sellers to focus more efficiently on manufacturing while leaving selling and compliance tasks to specialist players, thereby freeing up time and resources for business growth.

- Allow reduction in invoice value without a percentage ceiling for all e-commerce exports.

- Introduce an annual financial reconciliation process for e-commerce exporters to streamline operations.

- Exempt import duties on rejects/returns to reduce financial burden on exporters.

- Consider exemption on reconciliation requirements for shipments up to USD 1000 until NTN is implemented.

- Establish a green channel clearance for e-commerce exports to expedite customs procedures.

- Currently, Indian export regulations dictate that the exporter must be the owner of the product, and export proceeds must be received in the exporter's name.

- Access to markets is a significant obstacle for MSME exports, but e-commerce offers a solution.

- Promote Ease of Merchandise Exports:

- Ease of Doing Business initiatives should extend to export processes, especially focusing on MSME exporters.

- MSMEs can be granted relaxation from certain compliance requirements initially to facilitate their entry into export markets.

- Forgiveness on errors should be considered as MSMEs learn and adapt to the requirements of export markets, promoting a supportive environment.

- A streamlined process should be established for the time-bound disbursement of incentives to MSMEs to ensure that their working capital is not blocked.

- Timely disbursement of incentives is crucial for MSMEs to maintain liquidity and sustain their export operations effectively.

- These measures will not only reduce the burden on MSME exporters but also encourage their participation in international trade, contributing to economic growth.

- Allow reasonable variations in duty-free imports under advance authorization by permitting the duty-free import of components/goods for export under the scheme.

- Current regulations penalize slight variations between license and actual export, leading to litigation.

- Proposal: Allow 2-5% deviation to accommodate reasonable explanations such as loss, damage, or defects, reducing persecution in genuine cases.

- Improve Access to Export Finance:

- Access to finance is a major challenge for MSMEs. Promoting Export Credit Guarantee can improve working capital for MSMEs.

- Currently, only 10% of MSMEs are using Export Credit Guarantee Corporation (ECGC) schemes.

- The primary objective of ECGC, India's apex export credit guarantee institution, is to protect Indian exporters against the risks of non-payment by foreign buyers due to commercial or political reasons.

- In FY22, ECGC insured all exports from India, totalling USD 75 billion. However, this figure is significantly lower compared to Sinosure, China's state-owned enterprise, which insured approximately 25% of all Chinese exports, totalling USD 900 billion in FY22.

- There's an opportunity to increase awareness of the ECGC scheme among exporting SMEs and enhance its attractiveness by including interest rate subvention as part of the package.

- The government should introduce incentives to create a single marketplace for export credit providers, similar to higher education loans, which can lower costs for MSMEs.

- These measures aim to reduce financial constraints on MSMEs, enabling them to engage in international trade and support economic growth.

- Access to finance is a major challenge for MSMEs. Promoting Export Credit Guarantee can improve working capital for MSMEs.

- Ensure Accurate Measurement:

- Insufficient reliable data hinders accurate measurement of MSME exports.

- Current estimates are likely inflated due to outdated reserved sector lists.

- Accurate measurement and consistent tracking are crucial for initiating improvements.

- Proposed integration of Directorate General of Foreign Trade trade data with GST and income tax data using PAN numbers as a common identifier.

- By mapping MSME exports using existing departmental data, such as GST returns and income tax filings, firms' annual turnover and investment in plant and machinery can be determined.

- This enables classification into Micro, Small, and Medium enterprises based on turnover and investment criteria, as per MSME classifications.

- Reluctance to share information across government departments is a challenge. Suggest forming a committee with representatives from DGFT, the finance ministry, and the MSME ministry create a mechanism for sharing necessary information without compromising confidentiality.

- This collaborative approach aims to ensure accurate depiction of MSME exports for informed policymaking and interventions.

- The Trade Statistics of Small and Medium-sized Enterprises (TSSME) in Japan, offers detailed statistics on export and import activities of SMEs. Updated annually, it includes data on the number of SMEs engaged, export destinations, and exported product types.

- Utilizing data from GSTN registrations and income tax records, a portal akin to TSSME can be developed to publish periodic reports on merchandise exports from MSMEs. These reports would highlight exporter numbers, top products, destination countries, and export types, facilitating informed decision-making and trend analysis.

- Insufficient reliable data hinders accurate measurement of MSME exports.

What are the Government Initiatives Related to MSMEs?

|

Initiatives to Support Access to Finance |

|

|

|

|

Export Credit Re-Financing (ECR) |

|

|

Credit Guarantee Scheme for Subordinate Debt |

|

|

Initiatives to Support Market Access |

|

|

Market Access Initiative (MAI) |

|

|

|

|

Procurement and Marketing Support (PMS) |

|

|

Initiatives to Create a Favorable Business Environment |

|

|

|

|

Micro & Small Enterprises Cluster Development Programme (MSE-CDP) |

|

|

One District One Product (ODOP) / District Export Cluster

|

|

|

Schemes that Reduce the Cost of Serving the International Markets |

|

|

Export Promotion Capital Goods Scheme (EPCG) |

|

|

Remission of Duties and Taxes on Exported Products (RoDTEP) Scheme |

|

|

Initiatives to Simplify and Fast Track Certain Aspects of Export Procedure |

|

|---|---|

|

Liberalized Indian AEO (Authorized Economic Operator) Program for MSMEs |

|

|

Status Holder Certification |

|

|

|

|

Conclusion

The MSME sector plays a crucial role in India's economy, contributing significantly to employment, GDP, and manufacturing output. Despite employing over 11 crore people and constituting around 27.0% of the Gross Domestic Product (GDP), MSMEs face challenges in accessing export opportunities. The report proposes a strategic roadmap with six key recommendations, including the creation of comprehensive trade portals and the promotion of e-commerce exports, to unlock the immense export potential of MSMEs. By addressing these barriers and enhancing access to export finance, India can harness the transformative power of MSMEs, leading to substantial export growth and fostering a more resilient and competitive economic landscape.