Innovation in Pharma Sector | 08 Sep 2021

This article is based on the Pharma industry must turn more innovative which was published in The Hindu BusinessLine on 07/09/2021. It talks about the prospects of the Indian pharma sector and the need for innovation in the sector away from the generic sector.

India enjoys an important position in the global pharmaceuticals sector. If the right choices are made and if nurtured right, India can grow to be leaders in the global pharmaceutical market. The next story of the Indian pharma industry has to be one centred around innovation.

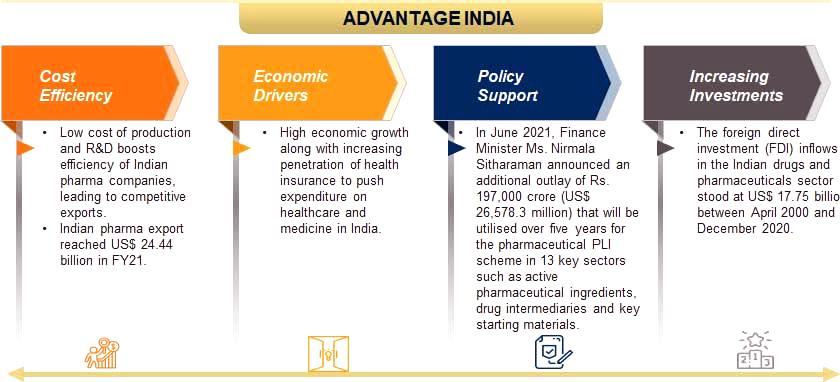

However, to go beyond generics and bring innovation, the pharma industry will need policy support by way of R&D tax breaks, patent law tweaks and research talent.

State of Indian Pharma Sector

- India is the largest provider of generic drugs globally. It supplies over 50% of global demand for various vaccines, 40% of generic demand in the US and 25% of all medicine in the UK.

- The Indian pharmaceutical market is estimated at USD 40 billion and pharma companies export another USD 20 billion.

- However, this is a miniscule portion of the USD 1.27-trillion global pharmaceutical market.

- Globally, India ranks 3rd in terms of pharmaceutical production by volume and 14th by value.

- India has more than 30% share in the global generic market but less than 1% share in the new molecular entity space.

- According to the Economic Survey 2021, the domestic market is expected to grow three times in the next decade.

- India’s domestic pharmaceutical market is estimated at USD 42 billion in 2021 and likely to reach USD 65 billion by 2024 and further expand to reach ~USD 120-130 billion by 2030.

Issues With Indian Pharma Sector

- Lack of Capabilities in Innovation Space: India is rich in its manpower and talent but still lags in innovation infrastructure. The government needs to invest in research initiatives and talent to grow India’s innovation.

- The government should support the clinical trials and subjectivity in certain regulatory decision-making.

- Effect of External Markets: Reports comments that India is heavily dependent on other countries for active pharmaceutical ingredients (API) and other intermediates. 80% of the APIs are imported from China.

- So India is, therefore, at the mercy of supply disruptions and unpredictable price fluctuations. Implementation of infrastructure improvement in the field of internal facilities is necessary to stabilize supply.

- Quality compliance inquiry: India has undergone the highest number of Food and Drug Administration (FDA) inspections since 2009; therefore, continuous investment for upgrading quality standards will distract the capital away from other areas of development and growth is reduced.

- Lack of Stable Pricing and Policy Environment: The challenge created by unexpected and frequent domestic pricing policy changes in India. It has created a vague environment for investments and innovations.

Need of the Innovation in Pharma Sector

- Changing perspective and increasing the use of technology were the need of the hour. But now it is essential that innovation is at the core of business, and there is a dire need to embrace it if India wants to continue to be of relevance in the global pharmaceutical space.

- India playing at scale in the innovation space will not just help the country but will create a source of sustainable revenues, bringing new solutions to unmet healthcare needs.

- In India, this would lead to reduction in disease burden (development of drugs for India-specific concerns like tuberculosis and leprosy does not get global attention), creation of new high-skilled jobs, and probably around USD 10 billion of additional exports from 2030.

- Countries like China have already leapfrogged ahead, skipping the generic medicine based development.

Challenges in Achieving Innovation

- For innovation to thrive in India, multiple challenges must be overcome:

- Complex and protracted approval processes (nod for development of new drugs in India takes 33-63 months versus 11-18 months in developed countries).

- Lack of robust process guidelines (Indian websites list 24 guidelines compared to over 600 at the USFDA).

- Lack of transparency (the US has an established pre-submission process and a time bound stage-gate process).

- Inadequate capacity/capability (there are considerable enhancements needed across regulatory bodies in India).

- Limited governance (Indian authorities currently only track the number of applications and approvals).

- A limited innovation mindset (India is risk averse compared to most global bodies, for example in the approval of clinical trials).

Way Forward

- Robust Regulation: An enabling regulatory structure with simplified processes, robust guidelines, predictability, increased capacity and strong governance.

- India needs a 60% reduction in the approval timeline to be competitive.

- Robust Funding Support with government aid for industry investment through policies/incentives, direct government investment, and significant private investment.

- India offers an attractive set of benefits — weighted R&D deduction, additional patent box benefits, and progressive policies to increase innovation funding which can attract more investment.

- Industry-Academia Linkages: Strong linkages between academia and industry with high quality academic talent and infrastructure, industry-oriented research, and strong governance.

- The US created the Bayh-Dole Act encouraging academics to set up independent companies.

- India needs world-class centres of excellence to attract global talent and support cutting-edge research.

- Coherent Policies Across Sector: A favourable policy landscape through coherent policies across research, technology commercialisation and Intellectual Property(IP).

- Innovation Hubs to Accelerate Collaboration: There is a need for several at-scale innovation hubs co-locating academia, public R&D centres, industry, start-ups and incubators.

- Invest in Other Modern Sectors: India should look up to and invest in biotechnology. India’s biotechnology industry, comprising biopharmaceuticals, bio-services, bio agriculture, bio-industry and bioinformatics is expected to grow at an average rate of around 30% a year and reach USD 100 billion by 2025.

|

Drishti Mains Question India needs innovation in the pharma sector in order to grow to be leaders in the global pharmaceutical market. Comment. |