Bad Bank | 06 Jun 2020

This article is based on “Bad bank: Should India have one?” which was published in The Financial Express on 04/06/2020. It talks about the pros and cons of a Bad bank for resolution of Non-Performing Assets (NPAs).

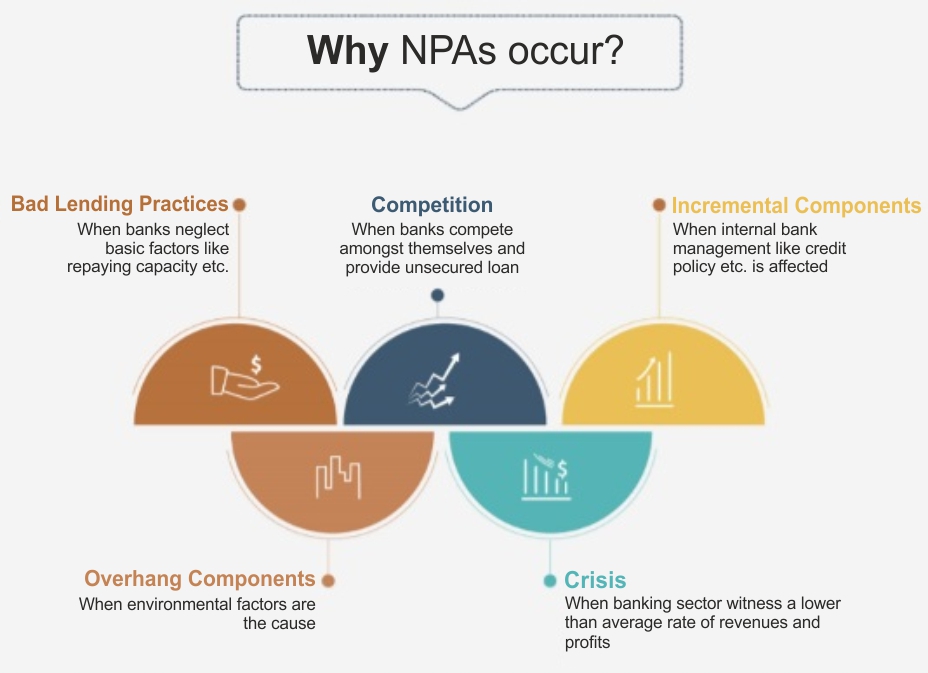

In the wake of the slowdown in economic activities due to the lockdown imposed, banks are set to witness a hike in Non-performing assets (NPAs). Before the lockdown, the gross NPAs fell below Rs 10 lakh crore, but as per rating firm Crisil, it is now expected to cross Rs 11 lakh crore by the end of this fiscal year.

In this context, the Indian Banks Association (IBA), have refloated an old idea of creating a ‘bad bank’. The Economic Survey 2017, suggested Public Sector Asset Rehabilitation Agency or PARA, to buy out the NPAs of high value from Indian banks.

A bad bank is technically an asset reconstruction company that buys bad loans(NPAs) from the commercial banks at a discount and tries to recover the money from the defaulter by providing a systematic solution over a period of time.

The idea of a bad bank seeks to reduce the NPAs in the banking sector and then revive lending and credit growth. However, the feasibility of such a bank is highly debated among various economists.

Rationale of Bad Bank

- Easing Provisioning Requirement: High level of non-performing assets (NPAs) makes the lending difficult for banks, as they have to keep supplementary capital (provisioning requirement) under the Basel Accord. This reduces its capital base and the resulting losses erode depositor confidence — the lifeblood of any bank.

- Bad bank by way of absorbing NPAs, will ease the provisioning requirement by the banks and help them to get on with business as usual.

- Re-assuring Trust: Moreover, the creation of a bad bank allows the segregation of a bank’s good assets from its bad assets. This allows investors to assess its financial health with greater clarity and for banks to grow financially.

- Aside from this, a government-led initiative may perhaps make it more palatable or even an attractive opportunity for investors to invest their money- both domestic and foreign.

- International Precedent: The 2007-2010 financial crises led to the creation of bad banks in many countries.

- In the US, as part of the Emergency Economic Stabilisation Act of 2008, a bad bank was suggested to address the subprime mortgage crisis (real estate loans default).

- In Ireland, the National Asset Management Agency was established in 2009 to respond to the financial crisis.

- Concerns About IBC Code: Many lenders are concerned over huge haircuts they have to endure after a resolution through the Insolvency and bankruptcy code.

- Also, NPAs in the power sector can't be resolved through the IBC system as factors like the lack of coal linkages and the absence of purchase power agreements make them unfit for a resolution through the IBC.

- The bad bank structure could help banks park their money to separate agencies to find a solution in a long time.

- Moreover, banks feel the assets having future demand-supply issues face liquidation under the IBC, a problem that can be solved under the bad bank.

- Thus, a bad bank may save a defaulting firm from liquidation and closure.

Associated Challenges

- Mobilising Capital: Finding buyers for bad assets in a pandemic hit economy will be a challenge, especially when governments are facing the issue of containing the fiscal deficit.

- Not Addressing the Underlying Issue: Without governance reforms, the Public sector banks (accounted for 86%, of the total NPAs) may go on doing business the way they have been doing in the past and may end up piling-up of bad debts again.

- Also, the bad bank idea is like shifting loans from one government pocket (the public sector banks) to another (the bad bank).

- Provisioning Issue Tackled Through Recapitalization: Union Government, in the last few years, has infused nearly Rs 2.6 lakh crore in banks through recapitalisation.

- Those who oppose the concept of bad banks hold that the government has on its part recapitalised the banks to compensate for the write-offs and hence, there is no need for a bad bank.

- Market-related Issues: The price at which bad assets are transferred from commercial banks to the bad bank will not be market-determined and price discovery will not happen.

- Moral Hazard: Former RBI Governor Raghuram Rajan had said that a bad bank may create a moral hazard and enable banks to continue reckless lending practices, without any commitment to reduce NPAs.

Conclusion

So long as Public sector banks managements remain beholden to politicians and bureaucrats, their deficit in professionalism will remain and subsequently, prudential norms in lending will continue to suffer. Therefore, the debate regarding setting up a bad bank must be preceded by proper implementation of holistic reforms in the banking sector, as envisaged under the IndraDhanush plan.

|

Drishti Mains Question Discuss how the concept of the bad bank can tackle the NPA crisis and revive lending in Indian Banking industry. |

This editorial is based on “Killing Gajah” which was published in The Hindu on June 5th, 2020. Now watch this on our Youtube channel.