NPAs in SHG loans | 02 Sep 2020

Why in News

The Union Ministry of Rural Development (MoRD) has asked states to monitor the status of Non Performing Assets (NPAs) district-wise and take corrective measures to recover overdue/outstanding dues from Self-Help Groups (SHGs).

- The issue was raised in the review meeting of the Deendayal Antyodaya Yojana-National Rural Livelihoods Mission.

- A Non Performing Asset (NPA) is a loan or advance for which the principal or interest payment remained overdue for a period of 90 days.

Deendayal Antyodaya Yojana - National Livelihoods Mission

- It was launched by the Ministry of Rural Development (MoRD), Government of India in 2011.

- NRLM set out with an agenda to cover 7 Crore rural poor households, across 600 districts, 6000 blocks, 2.5 lakh Gram Panchayats and 6 lakh villages in the country through SHGs and federated institutions and support them for livelihoods collectives in a period of 8-10 years.

- The Mission aims at creating efficient and effective institutional platforms for the rural poor enabling them to increase household income through sustainable livelihood enhancements and improved access to financial services.

Key Points

- SHG Loans as NPAs:

- About Rs. 91,130 crore have been given to about 54.57 lakh SHGs across the country by the end of March 2020 as loans.

- Around 2.37% or Rs. 2,168 crore of this total outstanding bank loans turned out to be NPAs.

- The proportion of NPAs in bank loans given to SHGs has significantly increased over the last decade from 2.90% in 2008 to 6.12% in 2018.

- There has been a rise of 0.19% in overall NPAs in SHG loans in 2019-20 compared to financial year 2018-19.

- About Rs. 91,130 crore have been given to about 54.57 lakh SHGs across the country by the end of March 2020 as loans.

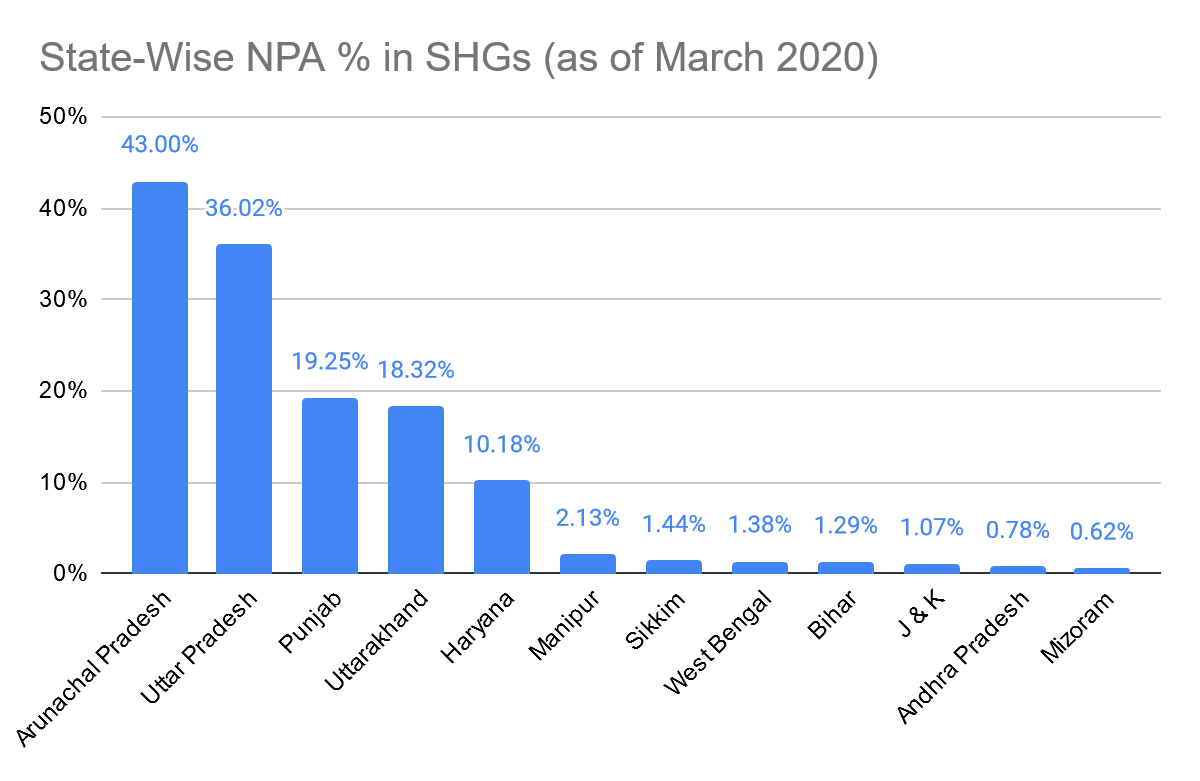

- State Wise Distribution:

- Uttar Pradesh, which has 71,907 SHGs, reported that 36.02% of the loans taken by the groups were NPAs at the end of March 2020, as compared to 22.16% in 2018-19.

- In Arunachal Pradesh, the NPA proportion stood at an alarming 43%, though the number of SHGs there is just 209.

- Directions: The State Rural Livelihood Missions (SRLMs) were directed by the MoRD to monitor the status of NPA district wise and take immediate corrective actions wherever instances of NPA or overdues were found.

- A mechanism under which representatives drawn from SHGs monitored loans had proved critical in ensuring timely repayment and therefore, it should be institutionalised in all bank branches.

- Reasons: In 2019, the National Institute of Rural Development and Panchayati Raj (NIRDPR) has conducted a research study on NPAs by SHGs.

- It found that poor economic conditions, non-cooperation, lack-of training, expenses towards marriages and social ceremonies, and medical emergencies are the main reasons for non-payment of loans by SHGs.

- Expectations of loan waiver from the government was also found to be a major reason for the poor financial health of SHGs.

- The role played by banks in handholding, timely opening accounts, monitoring and follow-up was not as per the expectation.

Initiatives by Central Government to promote SHGs

- Agriculture Infrastructure Fund

- PM Formalization of Micro Food Processing Enterprises (PM FME) Scheme

- Pradhan Mantri Matsya Sampada Yojana (PMMSY)

- Ambedkar Hastshilp Vikas Yojana (AHVY)

- North East Rural Livelihood Project

- Economic Stimulus-III

National Institute of Rural Development and Panchayati Raj

- It is an autonomous organisation under the Union Ministry of Rural Development.

- It is a premier national centre of excellence in rural development and Panchayati Raj.

- It has been recognized internationally as one of the UN-ESCAP Centres of Excellence.

- It builds capacities of rural development functionaries, elected representatives of Panchayati Raj Institutions, bankers, Non-Governmental Organizations and other stakeholders through interrelated activities of training, research and consultancy.

- The Institute is located in Hyderabad (Telangana).

Suggestions

- Training SHGs and providing them market linkages for the products/services so that they use the funds for income generating activity and have no problem in paying back the loan amount should be done by the government. In addition, providing group health and life insurance clubbed with loans at low cost will help as members spend a significant portion of the loan on events like ill-health, ceremonies etc.

- It needs to be ensured that grading of SHGs needs to be done properly and loans should be issued only if it is found suitable for lending. Follow-ups and constant monitoring is a must.

- Quantum of loan should be high as it is a major limiting factor, one-time lending not only impedes the process of business expansion but also wastes the money lent so far. Banks need to be sensitized to lend multiple doses of credit, for well performing SHGs.

Way Forward

- Though NPAs by SHGs are a major concern, it must not deter the government from supporting SHGs. Post lockdown, there is an imperative need for economic revival and reconstruction. Each SHG loan sanctioned or enhanced, will either facilitate spending or investment- the twin engines for driving an economy.

- Women members of SHGs across the country from NRLM have also contributed to contain the spread of Covid-19.