MSME Innovative Scheme | 11 Mar 2022

For Prelims: MSME Innovative Scheme, Definition of MSMEs.

For Mains: Government Policies and Interventions, Industrial Policy, MSME sector

Why in News?

Recently, the Ministry of MSME (Medium, Small and Micro Enterprises) has launched the MSME Innovative Scheme (Incubation, Design and IPR) along with the MSME IDEA HACKATHON 2022.

What are the Key Points?

- About:

- It is the combination of existing sub-schemes around incubation, design, and Intellectual Property Rights (IPR) for MSMEs.

- The government also announced equity support of up to Rs 1 crore for commercialisation of ideas, designs and patents across all three sub-schemes and also to help MSMEs further scale up to raise subsequent funding.

- For this, a separate corpus will be created and managed by SIDBI (Small Industries Development Bank of India) as the fund manager.

- SIDBI set up on 2nd April 1990 under an Act of Indian Parliament, acts as the Principal Financial Institution for Promotion, Financing and Development of the MSME sector as well as for co-ordination of functions of institutions engaged in similar activities.

- The new scheme will ensure support through guidance, financial support, technical support, and more to MSMEs to scale up.

- The new scheme would act as a hub for innovation activities facilitating and guiding the development of ideas into viable business propositions that can benefit society directly and can be marketed successfully.

- It is the combination of existing sub-schemes around incubation, design, and Intellectual Property Rights (IPR) for MSMEs.

- Components:

- Incubation: The primary objective of the scheme is to promote and support untapped creativity and to promote adoption of latest technologies in MSMEs that seek the validation of their ideas at the proof-of-concept level.

- As part of the incubation scheme, the government announced the launch of an MSME Idea Hackathon to invite ideas from MSMEs, innovators and students through host institutes.

- Financial assistance up to Rs. 15 lakh per idea and up to Rs. 1.00 crore for relevant plants and machines will be provided.

- Design: The objective of this component is to bring the Indian manufacturing sector and Design expertise/ Design fraternity on to a common platform.

- It aims to provide expert advice and cost-effective solutions on real time design problems for new product development, its continuous improvement and value addition in existing/new products.

- IPR (Intellectual Property Rights): The objective of the scheme is to improve the IP culture in India with a view to enhance the awareness of Intellectual Property Rights (IPRs) amongst the MSMEs and to encourage creative intellectual endeavor in the Indian economy.

- It also aims to take suitable measures for the protection of ideas, technological innovation and knowledge-driven business strategies developed by the MSMEs for their commercialization and effective utilization of IPR tools through IP Facilitation Centre.

- Financial assistance upto Rs. 5 lakh for Foreign Patent, Rs. 1.00 lakh Domestic Patent, Rs. 2.00 lakh for GI (Geographical Indication) Registration, Rs. 15,000/- for Design Registration, Rs.10,000/- for Trademark in the form of reimbursement.

- Incubation: The primary objective of the scheme is to promote and support untapped creativity and to promote adoption of latest technologies in MSMEs that seek the validation of their ideas at the proof-of-concept level.

What are the other Schemes Related to MSME?

- The Ministry of Micro, Small & Medium Enterprises (M/o MSME) envisions a vibrant MSME sector by promoting growth and development of the MSME Sector, including Khadi, Village and Coir Industries.

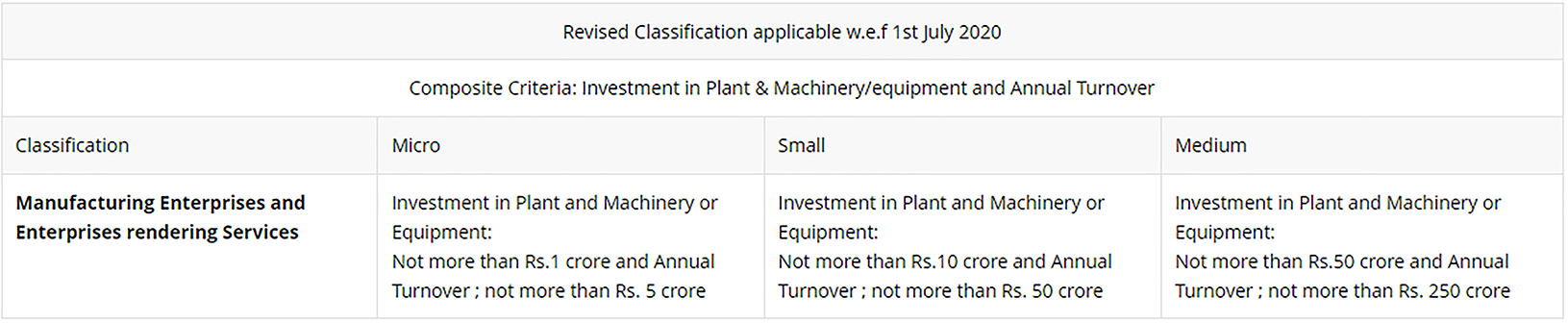

- The Micro Small and Medium Enterprises Development (MSMED) Act was notified in 2006 to address policy issues affecting MSMEs as well as the coverage and investment ceiling of the sector.

- Prime Minister’s Employment Generation programme (PMEGP): It is a credit linked subsidy scheme, for setting up of new micro-enterprises and to generate employment opportunities in rural as well as urban areas of the country.

- Scheme of Fund for Regeneration of Traditional Industries (SFURTI): It aims to properly organize the artisans and the traditional industries into clusters and thus provide financial assistance to make them competitive in today's market scenario.

- A Scheme for Promoting Innovation, Rural Industry & Entrepreneurship (ASPIRE): The scheme promotes innovation & rural entrepreneurship through rural Livelihood Business Incubator (LBI), Technology Business Incubator (TBI) and Fund of Funds for start-up creation in the agro-based industry.

- Interest Subvention Scheme for Incremental Credit to MSMEs: It was introduced by the Reserve Bank of India wherein relief is provided upto 2% of interest to all the legal MSMEs on their outstanding fresh/incremental term loan/working capital during the period of its validity.

- Credit Guarantee Scheme for Micro and Small Enterprises: Launched to facilitate easy flow of credit, guarantee cover is provided for collateral free credit extended to MSMEs.

- Micro and Small Enterprises Cluster Development Programme (MSE-CDP): It aims to enhance the productivity and competitiveness as well as capacity building of MSEs.

- CHAMPIONS portal: It aims to assist Indian MSMEs march into the big league as National and Global CHAMPIONS by solving their grievances and encouraging, supporting, helping and hand holding them.

- MSME Samadhan: It enables them to directly register their cases about delayed payments by Central Ministries/Departments/CPSEs/State Governments.

- Udyam Registrations Portal: This new portal assists the government in aggregating the data on the number of MSMEs in the country.

- MSME SAMBANDH: It is a Public Procurement Portal. It was launched to monitor the implementation of the Public Procurement from MSEs by Central Public Sector Enterprises.